Global Analytics and Risk Compliance Solutions for Banking Market - Key Trends and Drivers Summarized

How Are Analytics Transforming Risk Management in Banking?

In the ever-evolving landscape of banking, analytics have become indispensable in transforming risk management practices. Banks are leveraging advanced analytics to identify, assess, and mitigate risks more effectively than ever before. Through the integration of big data, machine learning, and artificial intelligence, financial institutions can now analyze vast amounts of data in real-time to detect anomalies, predict potential risks, and make informed decisions. This proactive approach not only enhances the accuracy of risk assessments but also enables banks to respond swiftly to emerging threats. For instance, predictive analytics can foresee credit risks by analyzing customer behavior and transaction patterns, thereby reducing the likelihood of loan defaults. Furthermore, the use of sophisticated algorithms helps in identifying fraudulent activities, ensuring regulatory compliance, and maintaining the integrity of financial systems.Why Is Compliance a Critical Focus for Banks?

Compliance with regulatory requirements is a critical focus for banks, driven by the need to maintain trust, avoid hefty fines, and safeguard their reputations. The financial crisis of 2008 and subsequent regulatory reforms, such as the Dodd-Frank Act and the Basel III framework, have significantly heightened the importance of compliance in the banking sector. Analytics and risk compliance solutions play a pivotal role in this context by automating compliance processes, monitoring transactions, and ensuring adherence to regulatory standards. These solutions help banks to stay ahead of regulatory changes and avoid costly penalties associated with non-compliance. For example, anti-money laundering (AML) regulations require banks to implement stringent monitoring and reporting mechanisms. Analytics tools can efficiently sift through transaction data to flag suspicious activities and generate reports that meet regulatory requirements. This not only streamlines compliance workflows but also reduces operational costs and enhances the overall efficiency of compliance management.What Trends Are Shaping the Adoption of Risk Compliance Solutions?

Several key trends are shaping the adoption of analytics and risk compliance solutions in the banking industry. One notable trend is the growing reliance on cloud-based solutions, which offer scalability, flexibility, and cost-effectiveness. Cloud platforms enable banks to process and analyze large datasets without the need for significant infrastructure investments. Another trend is the increasing use of artificial intelligence and machine learning to enhance the predictive capabilities of risk management systems. These technologies enable more accurate risk modeling and scenario analysis, allowing banks to prepare for potential adverse events. Additionally, the integration of blockchain technology is emerging as a transformative trend, providing enhanced security, transparency, and immutability in transaction monitoring and reporting. The adoption of these advanced technologies not only improves the robustness of risk compliance solutions but also fosters innovation in the banking sector.What Drives the Growth in the Analytics and Risk Compliance Market?

The growth in the analytics and risk compliance solutions market is driven by several factors. Technological advancements, such as the development of artificial intelligence, machine learning, and blockchain, are propelling the demand for sophisticated risk management tools. The increasing complexity of regulatory requirements and the need for real-time compliance monitoring are also significant drivers. Banks are investing in advanced analytics solutions to enhance their compliance capabilities and mitigate risks associated with financial crimes and regulatory breaches. Furthermore, the rise in cyber threats and data breaches has heightened the need for robust risk management frameworks, driving the adoption of analytics and risk compliance solutions. The growing emphasis on customer-centric banking and personalized financial services is another factor, as banks leverage analytics to gain deeper insights into customer behavior and preferences. Additionally, the proliferation of digital banking and fintech innovations necessitates advanced risk management solutions to address emerging risks and ensure regulatory compliance. As banks continue to navigate the complexities of the modern financial landscape, the demand for analytics and risk compliance solutions is expected to witness sustained growth.Report Scope

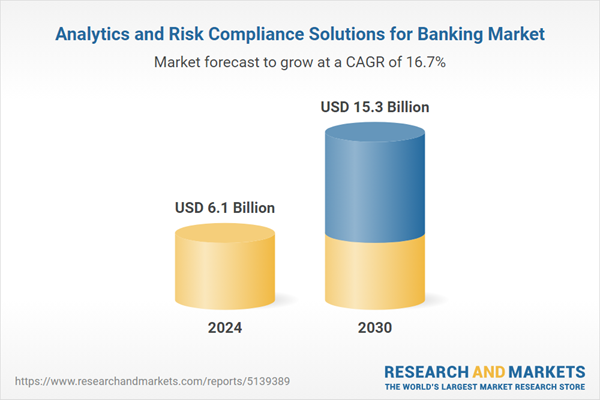

The report analyzes the Analytics and Risk Compliance Solutions for Banking market, presented in terms of market value (USD). The analysis covers the key segments and geographic regions outlined below.- Segments: Segment (Analytics and Risk Compliance Solutions for Banking).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; and Rest of Europe); Asia-Pacific; Rest of World.

Regional Analysis

Gain insights into the U.S. market, valued at $1.7 Billion in 2024, and China, forecasted to grow at an impressive 15.7% CAGR to reach $2.3 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Analytics and Risk Compliance Solutions for Banking Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Analytics and Risk Compliance Solutions for Banking Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Analytics and Risk Compliance Solutions for Banking Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Check Point Software Technologies Ltd., EMC Corporation, IBM Corporation, LogicManager, Inc., MEGA International and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 11 companies featured in this Analytics and Risk Compliance Solutions for Banking market report include:

- Check Point Software Technologies Ltd.

- EMC Corporation

- IBM Corporation

- LogicManager, Inc.

- MEGA International

- MetricStream Inc.

- Nasdaq

- NAVEX Global, Inc.

- Oracle Corporation

- Protiviti Inc.

- Rsam

- SAI Global Ltd.

- SAP SE

- SAS Institute, Inc.

- Software AG

- Thomson Reuters

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Check Point Software Technologies Ltd.

- EMC Corporation

- IBM Corporation

- LogicManager, Inc.

- MEGA International

- MetricStream Inc.

- Nasdaq

- NAVEX Global, Inc.

- Oracle Corporation

- Protiviti Inc.

- Rsam

- SAI Global Ltd.

- SAP SE

- SAS Institute, Inc.

- Software AG

- Thomson Reuters

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 158 |

| Published | January 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 6.1 Billion |

| Forecasted Market Value ( USD | $ 15.3 Billion |

| Compound Annual Growth Rate | 16.7% |

| Regions Covered | Global |