Global Commercial Satellite Imaging Market - Key Trends and Drivers Summarized

How Are Commercial Routers Transforming Business Connectivity?

Commercial routers are at the heart of modern business connectivity, providing the backbone for secure, reliable, and high-speed internet access across a range of industries. These powerful devices enable businesses to connect multiple locations, manage high volumes of traffic, and support a variety of applications essential for daily operations. Unlike consumer-grade routers, which are limited in capacity and functionality, commercial routers are designed to handle the demands of large-scale networks, offering superior performance, scalability, and advanced security features. They facilitate seamless communication between internal and external networks, ensuring smooth operations in environments where connectivity is crucial, such as corporate offices, retail chains, healthcare facilities, and manufacturing plants. As businesses adopt more cloud-based applications, commercial routers play an increasingly pivotal role in supporting data-heavy operations like cloud computing, video conferencing, and remote access. Furthermore, with the growing trend toward smart devices and IoT systems, routers are now required to support not just computers and phones, but a wide array of connected devices, from industrial sensors to smart appliances. This shift has made robust, feature-rich routers indispensable for maintaining operational efficiency and ensuring business continuity in today's digital-first world.What Technological Innovations Are Shaping the Future of Commercial Routers?

The commercial router market is undergoing rapid transformation, driven by significant technological advancements that are reshaping the way businesses manage their networks. One of the most influential innovations is the widespread adoption of Wi-Fi 6 technology, which offers faster speeds, higher bandwidth, and improved performance in environments with a large number of connected devices. This is particularly important in enterprise settings where dozens, or even hundreds, of devices are accessing the network simultaneously, such as in offices, hotels, and airports. Wi-Fi 6 enhances network capacity, reduces congestion, and provides lower latency, which is critical for supporting high-performance applications like video streaming, cloud computing, and real-time data analytics. Another major development is the rise of mesh networking, which allows multiple routers to work together to cover larger areas with consistent and uninterrupted connectivity. This is a boon for sprawling commercial spaces like warehouses, factories, and large office buildings, where traditional routers may struggle to provide uniform coverage. Additionally, advancements in IoT integration mean that commercial routers now need to handle a much greater variety of devices, from security cameras to automated manufacturing equipment. To meet this challenge, routers are becoming more intelligent, incorporating AI and machine learning algorithms that optimize network traffic, allocate bandwidth more efficiently, and predict potential issues before they cause disruptions.What Challenges and Trends Are Driving Commercial Router Adoption?

As businesses evolve, so too do the challenges and trends driving the adoption of commercial routers. One of the most significant challenges is the shift toward cloud computing and the need for routers that can support large-scale data transfers between on-premise systems and cloud-based platforms. In a world where businesses increasingly rely on software-as-a-service (SaaS) solutions and remote data storage, routers must offer high-speed, low-latency connections to ensure smooth access to these critical resources. This trend has led to a surge in demand for routers capable of handling heavy data loads without compromising speed or security. The growing prevalence of remote work is another driver, as organizations need to provide secure and reliable connections for employees accessing corporate networks from various locations. Commercial routers equipped with advanced security features such as VPN support, firewalls, and intrusion detection systems have become essential tools for safeguarding sensitive data and preventing cyberattacks. Furthermore, the proliferation of IoT devices in industries ranging from healthcare to logistics presents both a challenge and an opportunity. While the sheer number of devices can strain traditional network infrastructure, it also creates demand for more advanced routers that can manage these devices effectively, ensuring uninterrupted connectivity and data flow. The integration of smart technologies, which allow for real-time monitoring and diagnostics, is becoming increasingly critical as businesses seek to minimize downtime and optimize network performance.What's Driving Growth in the Commercial Router Market?

The growth in the commercial router market is driven by several factors tied to technological advancements, evolving business needs, and increasing reliance on digital infrastructure. A key driver is the rapid adoption of cloud-based services, which require robust, high-performance routers capable of handling large data transfers and ensuring reliable access to cloud platforms. As businesses continue to migrate their operations to the cloud, the need for routers that can provide low-latency, high-bandwidth connections has surged. Additionally, the rise of remote and hybrid work environments has increased the demand for secure commercial routers that offer advanced features like VPNs and encrypted communications, allowing employees to safely access corporate networks from remote locations. Another significant factor is the proliferation of IoT devices across industries such as manufacturing, healthcare, and retail. These devices require routers that can manage a high density of connected devices while maintaining stable, secure connections. The growing emphasis on network security, driven by the increasing frequency and sophistication of cyberattacks, is also propelling the market, with businesses investing in routers that offer built-in firewalls, intrusion detection systems, and real-time threat monitoring. Lastly, the development of energy-efficient and environmentally sustainable routers is gaining traction, as businesses seek to reduce operational costs and meet environmental goals without compromising performance. These technological and operational factors are contributing to the sustained expansion of the commercial router market, as businesses continue to prioritize connectivity, security, and efficiency in their digital infrastructure.Report Scope

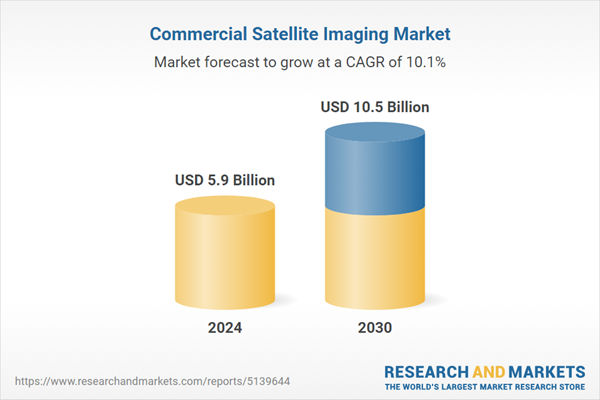

The report analyzes the Commercial Satellite Imaging market, presented in terms of market value (USD). The analysis covers the key segments and geographic regions outlined below.- Segments: Application (Geospatial Data Acquisition & Mapping, Energy & Natural Resource Management, Urban Planning & Development, Surveillance & Security, Disaster Management, Defense & Intelligence, Other Applications); End-Use (Government, Military & Defense, Forestry & Agriculture, Civil Engineering & Archaeology, Energy, Transportation & Logistics, Other End-Uses).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; and Rest of Europe); Asia-Pacific; Rest of World.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Geospatial Data Acquisition & Mapping Application segment, which is expected to reach US$3.3 Billion by 2030 with a CAGR of 10.7%. The Energy & Natural Resource Management Application segment is also set to grow at 11.2% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $1.7 Billion in 2024, and China, forecasted to grow at an impressive 9.4% CAGR to reach $1.6 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Commercial Satellite Imaging Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Commercial Satellite Imaging Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Commercial Satellite Imaging Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as BlackSky Global LLC, DigitalGlobe, Inc., European Space Imaging, Galileo Group, Inc., Harris Corporation and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 46 companies featured in this Commercial Satellite Imaging market report include:

- BlackSky Global LLC

- DigitalGlobe, Inc.

- European Space Imaging

- Galileo Group, Inc.

- Harris Corporation

- ImageSat International NV

- Planet Labs, Inc.

- SkyLab Analytics

- SpaceKnow, Inc.

- UrtheCast Corporation

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- BlackSky Global LLC

- DigitalGlobe, Inc.

- European Space Imaging

- Galileo Group, Inc.

- Harris Corporation

- ImageSat International NV

- Planet Labs, Inc.

- SkyLab Analytics

- SpaceKnow, Inc.

- UrtheCast Corporation

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 246 |

| Published | January 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 5.9 Billion |

| Forecasted Market Value ( USD | $ 10.5 Billion |

| Compound Annual Growth Rate | 10.1% |

| Regions Covered | Global |