Global Medical Packaging Market - Key Trends and Drivers Summarized

Why Is Medical Packaging Becoming Essential for Ensuring Product Safety, Maintaining Sterility, and Enhancing Healthcare Efficiency?

Medical packaging has become essential for ensuring product safety, maintaining sterility, and enhancing healthcare efficiency across the industry. But why is medical packaging so critical today? In healthcare, where patient safety and the integrity of medical devices, drugs, and equipment are paramount, medical packaging plays a vital role in protecting products from contamination, physical damage, and environmental conditions. It ensures that sterile products such as surgical instruments, medications, and implants remain uncontaminated from the time they are packaged to the point of use. Any compromise in packaging can lead to severe health risks, such as infections or compromised treatment effectiveness, making packaging a crucial element in the medical supply chain.Sterility is one of the most important functions of medical packaging. Whether it's packaging for single-use medical devices, pharmaceuticals, or diagnostic tools, the packaging must meet strict standards for sterility. Advanced materials and technologies are now used to create barrier packaging that protects against bacteria, moisture, and particulate contamination, ensuring that medical products remain sterile and safe until opened in controlled environments, like operating rooms or pharmacies.

Moreover, medical packaging improves healthcare efficiency by enabling easy handling, storage, and transportation. Packaging designs that support efficient storage, such as stackable or space-saving formats, and easy-opening features contribute to better workflow management in hospitals and clinics. Labeling is also crucial, as it provides vital information such as usage instructions, expiration dates, and batch numbers, helping healthcare professionals manage inventory and avoid potential errors.

How Are Technological Advancements and Innovations Improving the Functionality, Safety, and Sustainability of Medical Packaging?

Technological advancements and innovations are significantly improving the functionality, safety, and sustainability of medical packaging, making it more effective in protecting products and supporting healthcare needs. One of the most important innovations is the development of smart packaging solutions that incorporate digital technologies, such as sensors and RFID (radio-frequency identification) tags, which allow real-time tracking of medical products. These smart packaging solutions provide valuable data on the location, temperature, humidity, and handling conditions of medical supplies during storage and transport. This is particularly important for temperature-sensitive products, such as vaccines and biologics, where maintaining the cold chain is critical to preserving efficacy. If there is a deviation in required conditions, healthcare providers can act quickly, preventing the use of compromised products.Nanotechnology is also being integrated into medical packaging to enhance safety and barrier properties. For instance, nano-coatings are used to create ultra-thin layers that offer better protection against microbial contamination, oxygen, and moisture, while keeping the packaging lightweight and easy to handle. These nanomaterials can also have antimicrobial properties, adding an extra layer of protection by inhibiting the growth of bacteria and other pathogens on the surface of the packaging. This is particularly valuable in hospital settings, where infection control is a top priority.

Sustainability is another major area of innovation in medical packaging. As environmental concerns grow, the healthcare industry is seeking ways to reduce waste, particularly the large amounts of plastic used in single-use packaging. Biodegradable and recyclable materials are being developed to create eco-friendly packaging that meets the high safety and sterility standards required in healthcare. Plant-based plastics, compostable materials, and recyclable paper-based packaging are being introduced to reduce the environmental footprint of medical packaging. Additionally, manufacturers are designing packaging that minimizes material use without compromising protection, reducing the overall volume of waste generated by the healthcare sector.

Another key advancement is the development of tamper-evident and child-resistant packaging, which is especially important in pharmaceuticals. Tamper-evident seals ensure that products have not been opened or contaminated before reaching the patient, providing an extra layer of security. Child-resistant packaging prevents accidental ingestion of medications, significantly improving safety in home healthcare settings. These features are now widely implemented across the medical packaging sector, ensuring that both professionals and patients can trust the integrity of the products they use.

Medical packaging is also becoming more personalized with the rise of 3D printing technology. Custom-designed packaging can be created for specific medical devices or pharmaceutical products, ensuring a perfect fit and optimal protection during transportation and storage. This is particularly useful for complex devices or implants that need tailored packaging solutions to prevent damage. The use of 3D printing reduces waste and speeds up production processes, contributing to more efficient packaging development.

Why Is Medical Packaging Critical for Reducing Contamination, Extending Product Shelf Life, and Enhancing Patient Safety?

Medical packaging is critical for reducing contamination, extending product shelf life, and enhancing patient safety because it provides a protective barrier that shields medical products from harmful external factors. One of the primary reasons medical packaging is so valuable is its ability to maintain sterility and prevent contamination, which is essential for ensuring the safety and efficacy of medical products. In healthcare settings, where even minor contamination can lead to infections or compromised treatments, medical packaging serves as the first line of defense. Whether it's for surgical instruments, sterile gloves, or injectable drugs, proper packaging ensures that these products remain safe to use until they are opened in a controlled environment.Extending product shelf life is another key benefit of medical packaging. Pharmaceuticals, biologics, and medical devices can degrade over time when exposed to air, moisture, or light. Packaging solutions with advanced barrier properties help to protect these products from environmental factors, preserving their effectiveness for longer periods. This is particularly important for products like vaccines or complex biologics, where maintaining their integrity throughout the supply chain is essential to ensuring that patients receive effective treatments. By extending shelf life, medical packaging also reduces waste and helps healthcare providers better manage inventory, ensuring that products are available when needed.

Medical packaging plays a crucial role in enhancing patient safety by providing clear labeling and usage instructions. Accurate labeling ensures that healthcare professionals have the information they need to administer medications correctly and handle devices properly. For example, blister packaging for pharmaceuticals includes information on dosage and expiration dates, helping to prevent medication errors. Tamper-evident packaging further enhances patient safety by ensuring that products have not been compromised before reaching the patient. If a seal is broken or damaged, healthcare providers know that the product should not be used, preventing potential harm.

Medical packaging also supports the safe transport and storage of critical healthcare supplies. In global healthcare systems, medical products often need to travel long distances and pass through various environments before reaching their final destination. Packaging that provides robust protection against physical shocks, temperature changes, and moisture ensures that these products arrive intact and ready for use. This is particularly important for fragile devices or temperature-sensitive medications that require strict handling protocols. Without proper packaging, these products could be damaged during transit, leading to costly losses and putting patient care at risk.

In the context of home healthcare, medical packaging contributes to patient safety by making it easier for patients and caregivers to use products correctly. Packaging designed with clear instructions, easy-open features, and child-resistant mechanisms ensures that patients can safely access their medications and medical supplies without confusion or risk. This is particularly important for elderly patients or those with limited dexterity, who may struggle with traditional packaging designs. By improving accessibility and safety, medical packaging plays a critical role in supporting patient adherence to treatment plans and reducing the risk of medication errors.

What Factors Are Driving the Growth of the Medical Packaging Market?

Several key factors are driving the rapid growth of the medical packaging market, including the increasing demand for medical supplies, the growth of the pharmaceutical industry, advancements in packaging technology, and the rising focus on sustainability. One of the primary drivers is the growing demand for medical supplies and devices, driven by the expanding global healthcare sector and the increasing prevalence of chronic diseases. As more medical devices and pharmaceuticals are developed to address these health challenges, there is a corresponding need for packaging that can protect these products, ensure sterility, and maintain their integrity throughout the supply chain.The growth of the pharmaceutical industry is another major factor fueling the expansion of the medical packaging market. The rise of biologics, specialty drugs, and personalized medicine has created new demands for packaging that can safely store and transport these complex products. Biologics, in particular, are highly sensitive to environmental conditions and require advanced packaging solutions that can maintain strict temperature control. As the pharmaceutical industry continues to develop innovative therapies, the need for specialized packaging that meets the unique requirements of these drugs is driving market growth.

Advancements in packaging technology are also contributing to the growth of the medical packaging market. Innovations such as smart packaging, which incorporates sensors and RFID tags for real-time tracking, are becoming more widely adopted, particularly for high-value medical products that require constant monitoring. These technologies improve supply chain transparency and help healthcare providers ensure that products are handled correctly from manufacturing to patient delivery. The development of tamper-evident and child-resistant packaging is also expanding the market, as regulatory agencies increasingly require these features for consumer safety.

The rising focus on sustainability is another significant driver of the medical packaging market. With growing awareness of the environmental impact of plastic waste and the healthcare sector's reliance on single-use materials, there is increasing pressure to develop eco-friendly packaging alternatives. Manufacturers are investing in biodegradable, recyclable, and reusable packaging materials that can meet the strict safety and sterility standards of medical packaging while reducing environmental harm. Governments and regulatory bodies are also encouraging the adoption of sustainable practices, further driving the demand for environmentally friendly packaging solutions.

The COVID-19 pandemic has also played a role in accelerating the growth of the medical packaging market. The pandemic has increased the global demand for medical supplies, such as personal protective equipment (PPE), vaccines, and diagnostic kits, all of which require specialized packaging to ensure their safety and effectiveness. The surge in vaccination campaigns, in particular, has underscored the importance of reliable and sterile packaging for the distribution of temperature-sensitive products like vaccines. The need to rapidly scale up the production and distribution of medical supplies has highlighted the critical role of medical packaging in the healthcare supply chain.

Report Scope

The report analyzes the Medical Packaging market, presented in terms of market value (USD). The analysis covers the key segments and geographic regions outlined below.- Segments: Packing Type (Primary Packaging, Secondary Packaging, Tertiary Packaging); Application (Medical Tools & Equipment, Medical Devices, In-Vitro Diagnostic Products, Implants).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Medical Tools & Equipment Application segment, which is expected to reach US$27 Billion by 2030 with a CAGR of 3.9%. The Medical Devices Application segment is also set to grow at 4.8% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $14.6 Billion in 2024, and China, forecasted to grow at an impressive 8.2% CAGR to reach $17 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Medical Packaging Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Medical Packaging Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Medical Packaging Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Amcor Ltd., American Health Packaging, AptarGroup, Inc., Baxter International, Inc., Becton, Dickinson and Company and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 41 companies featured in this Medical Packaging market report include:

- Amcor Ltd.

- American Health Packaging

- AptarGroup, Inc.

- Baxter International, Inc.

- Becton, Dickinson and Company

- Bemis Co., Inc.

- Cardinal Health, Inc.

- Catalent Pharma Solutions, Inc.

- CCL Industries, Inc.

- Clondalkin Group Holdings BV

- Constantia Flexibles Group GmbH

- Datwyler Holding, Inc.

- Euromedex France SA

- Gerresheimer AG

- Intrapac International Corporation

- Klockner Pentaplast GmbH & Co. KG

- Korber AG

- Nampak Ltd.

- RPC Bramlage GmbH

- SCHOTT AG

- SteriPack Group

- Vitro S.A.B. de C.V.

- Winpak Ltd.

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Amcor Ltd.

- American Health Packaging

- AptarGroup, Inc.

- Baxter International, Inc.

- Becton, Dickinson and Company

- Bemis Co., Inc.

- Cardinal Health, Inc.

- Catalent Pharma Solutions, Inc.

- CCL Industries, Inc.

- Clondalkin Group Holdings BV

- Constantia Flexibles Group GmbH

- Datwyler Holding, Inc.

- Euromedex France SA

- Gerresheimer AG

- Intrapac International Corporation

- Klockner Pentaplast GmbH & Co. KG

- Korber AG

- Nampak Ltd.

- RPC Bramlage GmbH

- SCHOTT AG

- SteriPack Group

- Vitro S.A.B. de C.V.

- Winpak Ltd.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 273 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

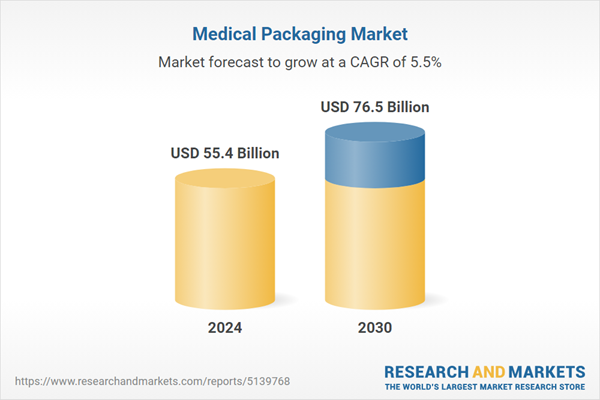

| Estimated Market Value ( USD | $ 55.4 Billion |

| Forecasted Market Value ( USD | $ 76.5 Billion |

| Compound Annual Growth Rate | 5.5% |

| Regions Covered | Global |