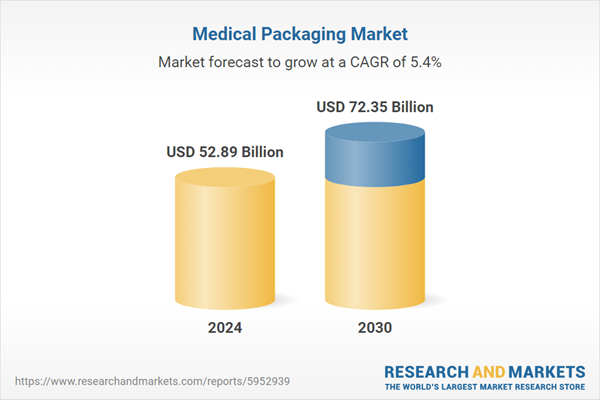

Medical Tools & Equipment is the fastest growing segment, North America is the largest regional market

Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

Market growth is fueled by stringent global safety and sterilization regulations, the expanding global healthcare sector, aging populations, and increasing demand for sterile and single-use medical products. In the United States alone, the flexible packaging industry recorded USD 6.1 billion in sales from the medical and pharmaceutical sectors in 2023, accounting for a 14% market share. However, rising raw material costs and the complexity of meeting diverse global regulatory standards present substantial challenges for manufacturers, potentially slowing market expansion.

Key Market Drivers

The escalating demand for pharmaceutical and medical devices significantly drives the global medical packaging market

Rising global demand for pharmaceuticals and medical devices remains a major driver of the medical packaging market. West Pharmaceutical Services Inc. reported a 7.7% increase in sales in 2023, reaching USD 2.94 billion, illustrating the rising need for advanced containment and delivery systems for injectable medicines. As innovation accelerates across drug development and medical device manufacturing, requirements for sterile, protective, and user-friendly packaging increase accordingly. This trend is reinforced by the growth of the European pharmaceutical market, which expanded by 6.2% in 2023 to reach EUR 288 billion, according to EFPIA.Key Market Challenges

The escalating costs associated with procuring raw materials and ensuring adherence to increasingly complex global regulatory compliance frameworks

Rising raw material costs and intensifying regulatory demands represent major obstacles for the global medical packaging market. Higher prices for essential materials directly elevate production costs for packaging used to protect medical devices and pharmaceuticals, making it more difficult for healthcare providers and manufacturers to manage costs.Regulatory compliance adds further financial strain, requiring investments in rigorous testing, validation, and documentation to meet international standards. According to the European Flexible Packaging Federation, raw material and logistics cost increases in Q2 2024 pushed prices for materials such as 60gsm one-sided coated paper up by nearly 10% from the previous quarter. These combined pressures reduce profit margins, slow innovation - particularly among smaller companies - and raise barriers to market entry, ultimately constraining the sector’s ability to expand.

Key Market Trends

Sustainable Packaging Material Advancement

Growing emphasis on environmental responsibility is shaping innovation in medical packaging materials. Manufacturers are increasingly adopting recyclable, mono-material, and reduced-plastic designs to minimize environmental impact. A 2025 Medical Product Outsourcing survey found that all healthcare stakeholders planned to use recyclable materials in 2024, with 75% listing plastic reduction as a top priority. Reflecting this trend, SCHOTT Pharma and Alliance to Zero introduced a blister-free syringe concept in October 2024 that lowers CO2 emissions by up to 58% across its value chain.Key Market Players Profiled:

- Bemis Company Inc.

- Berry Plastics Corporation

- 3M Company

- Westrock Company

- Toppan Printing Co., Ltd.

- Thomas Packaging LLC.

- Wipak Group

- Uhlmann Pac-Systeme GmbH & Co. Kg

- Oliver Healthcare Packaging

- CCL Industries Inc.

Report Scope:

In this report, the Global Medical Packaging Market has been segmented into the following categories:By Material:

- Polymer

- Paper & Paperboard

- Non-Woven Fabric

- Others

By Packaging Type:

- Trays

- Boxes

- Bags & Pouches

- Others

By Packing Type:

- Primary

- Secondary

- Tertiary

By Application:

- Medical Tools & Equipment

- In-Vitro Diagnostic Products

- Medical Devices

- Others

By Region:

- North America

- Europe

- Asia-Pacific

- South America

- Middle East & Africa

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Global Medical Packaging Market.Available Customizations:

With the given market data, the publisher offers customizations according to a company's specific needs. The following customization options are available for the report.Company Information

- Detailed analysis and profiling of additional market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

The companies profiled in this Medical Packaging market report include:- Bemis Company Inc.

- Berry Plastics Corporation

- 3M Company

- Westrock Company

- Toppan Printing Co., Ltd.

- Thomas Packaging LLC.

- Wipak Group

- Uhlmann Pac-Systeme GmbH & Co. Kg

- Oliver Healthcare Packaging

- CCL Industries Inc.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 183 |

| Published | November 2025 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 52.89 Billion |

| Forecasted Market Value ( USD | $ 72.35 Billion |

| Compound Annual Growth Rate | 5.3% |

| Regions Covered | Global |

| No. of Companies Mentioned | 11 |