Global Protein Hydrolysis Enzymes Market - Key Trends and Drivers Summarized

What Role Do Protein Hydrolysis Enzymes Play in Various Industries?

Protein hydrolysis enzymes are pivotal in numerous industries, particularly in food processing, animal feed, detergent, textile, pharmaceuticals, and biotechnology. These enzymes catalyze the breakdown of proteins into smaller peptides and amino acids, a process known as hydrolysis. In the food industry, these enzymes are essential for producing protein hydrolysates, which are used to create products with improved digestibility, enhanced flavor, and better nutritional profiles. For instance, hydrolyzed proteins are commonly found in infant formulas, sports nutrition products, and specialty foods designed for people with dietary restrictions. In the animal feed industry, protein hydrolysis enzymes improve the nutritional quality of feed, making nutrients more accessible to livestock, thereby enhancing growth and productivity. The pharmaceutical industry uses these enzymes to produce bioactive peptides with therapeutic properties, while biotechnology applications include producing amino acids for use in various biochemical processes.How Are Innovations in Enzyme Engineering and Production Impacting the Market?

Technological advancements in enzyme engineering and production have significantly impacted the protein hydrolysis enzymes market. Innovations in recombinant DNA technology and protein engineering have enabled the development of enzymes with improved specificity, stability, and efficiency. These engineered enzymes can operate under a broader range of conditions, such as varying pH levels and temperatures, making them more versatile for industrial applications. Additionally, advancements in fermentation and downstream processing technologies have increased the scalability of enzyme production, reducing costs and improving the accessibility of these enzymes to smaller companies and startups. The development of immobilized enzymes, which can be reused in multiple cycles of hydrolysis, has also enhanced the efficiency and cost-effectiveness of the process. These technological innovations are driving the adoption of protein hydrolysis enzymes across various industries.What Are the Emerging Applications of Protein Hydrolysis Enzymes?

Emerging applications of protein hydrolysis enzymes are expanding their market potential beyond traditional uses. In the cosmetics industry, these enzymes are used to produce bioactive peptides that can promote skin health and combat aging, leading to the development of high-value cosmeceuticals. The growing demand for plant-based and allergen-free protein products has also spurred the use of these enzymes to create hypoallergenic protein hydrolysates from alternative protein sources, such as soy, pea, and rice. Additionally, the environmental sector is exploring the use of protein hydrolysis enzymes in waste management, where they can break down protein-rich waste into useful by-products, contributing to sustainable waste processing solutions. These emerging applications are broadening the scope of the protein hydrolysis enzymes market, making it an increasingly important component of various industries.What Are the Key Growth Drivers in the Market?

The growth in the protein hydrolysis enzymes market is driven by several factors. The increasing demand for protein hydrolysates in food and beverage products, particularly in infant nutrition and sports nutrition, is a major driver. Technological advancements in enzyme engineering and production have improved the efficiency and cost-effectiveness of these enzymes, encouraging their adoption in various industries. The rising consumer preference for plant-based and hypoallergenic protein products has also spurred the demand for protein hydrolysis enzymes capable of processing alternative protein sources. Additionally, the expansion of applications in the cosmetics and environmental sectors is further propelling market growth. The growing awareness of the benefits of enzyme-based processes, such as reduced environmental impact and improved product quality, is also contributing to the increased adoption of protein hydrolysis enzymes.Report Scope

The report analyzes the Protein Hydrolysis Enzymes market, presented in terms of market value (USD). The analysis covers the key segments and geographic regions outlined below.- Segments: Source (Microorganisms, Plants, Animals); End-Use (Detergents & Cleaning, Food & Beverage, Animal Feed, Textile, Other End-Uses).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; and Rest of Europe); Asia-Pacific; Rest of World.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Microorganisms Source segment, which is expected to reach US$1.5 Billion by 2030 with a CAGR of 3.9%. The Plants Source segment is also set to grow at 4.5% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $676.3 Million in 2024, and China, forecasted to grow at an impressive 3.7% CAGR to reach $502.1 Million by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Protein Hydrolysis Enzymes Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Protein Hydrolysis Enzymes Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

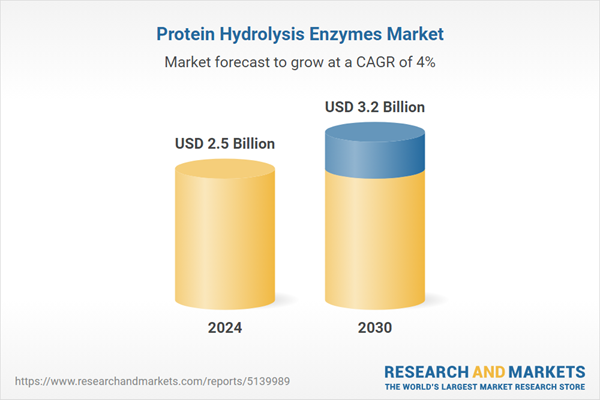

- How is the Global Protein Hydrolysis Enzymes Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as AB Enzymes GmbH, Dyadic International, Inc., Koninklijke DSM NV, Novozymes A/S, Solvay S.A and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 56 companies featured in this Protein Hydrolysis Enzymes market report include:

- AB Enzymes GmbH

- Dyadic International, Inc.

- Koninklijke DSM NV

- Novozymes A/S

- Solvay S.A

- Specialty Enzymes & Biotechnologies Co.

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- AB Enzymes GmbH

- Dyadic International, Inc.

- Koninklijke DSM NV

- Novozymes A/S

- Solvay S.A

- Specialty Enzymes & Biotechnologies Co.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 332 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 2.5 Billion |

| Forecasted Market Value ( USD | $ 3.2 Billion |

| Compound Annual Growth Rate | 4.0% |

| Regions Covered | Global |