Global UAV Payload and Subsystems Market - Key Trends & Drivers Summarized

What Are UAV Payloads and Subsystems?

Unmanned Aerial Vehicles (UAVs), commonly known as drones, have revolutionized various sectors by providing unparalleled capabilities for a wide range of applications. UAV payloads and subsystems refer to the additional equipment and components integrated into drones to enhance their functionality. These payloads include cameras, sensors, communication devices, weapons systems, and other specialized equipment, while subsystems comprise essential components like power systems, navigation units, and propulsion mechanisms. The integration of advanced payloads and subsystems enables UAVs to perform complex tasks such as surveillance, reconnaissance, cargo delivery, and environmental monitoring, thereby expanding their utility across military, commercial, and civilian domains.How Are Technological Innovations Shaping the UAV Payload and Subsystems Market?

Technological advancements have significantly impacted the development of UAV payloads and subsystems, leading to more sophisticated and efficient systems. Innovations in miniaturization have allowed for the creation of lightweight yet highly capable sensors and cameras, enhancing the operational range and endurance of UAVs. The advent of artificial intelligence (AI) and machine learning (ML) technologies has further propelled the capabilities of UAVs, enabling autonomous operations and real-time data analysis. Additionally, advancements in communication technologies, such as 5G and satellite communications, have improved the connectivity and data transmission rates, facilitating more effective remote operations. These technological breakthroughs not only enhance the performance and reliability of UAVs but also open up new possibilities for their application in various fields.Why Is There a Surge in Adoption Across Various Sectors?

The adoption of UAV payloads and subsystems is witnessing a significant surge across multiple sectors, driven by their versatility and efficiency. In the military sector, UAVs equipped with advanced payloads are extensively used for intelligence, surveillance, and reconnaissance (ISR) missions, as well as for precision strikes. The commercial sector is leveraging UAVs for applications such as agriculture monitoring, infrastructure inspection, and logistics, benefiting from their ability to access hard-to-reach areas and provide real-time data. In the healthcare sector, UAVs are being utilized for medical supply deliveries in remote regions. Environmental agencies employ UAVs for wildlife monitoring and disaster management, capitalizing on their capability to cover large areas quickly. This growing utilization across diverse industries highlights the expanding role of UAVs in enhancing operational efficiency and achieving cost-effective solutions.What Is Driving the Growth in the UAV Payload and Subsystems Market?

The growth in the UAV payload and subsystems market is driven by several factors. The increasing demand for UAVs in military applications for ISR and combat operations is a primary driver. Technological advancements in sensor and communication technologies are enhancing the capabilities of UAVs, making them more effective and versatile. The rise of commercial applications, such as precision agriculture, infrastructure inspection, and logistics, is significantly contributing to market growth. Additionally, the increasing use of UAVs in disaster management and environmental monitoring is driving demand for advanced payloads. Regulatory frameworks that support the integration of UAVs into national airspace and commercial operations are further propelling market expansion. Moreover, investments in research and development are fostering innovation, leading to the development of more advanced and cost-effective UAV payloads and subsystems, thereby boosting market growth.Report Scope

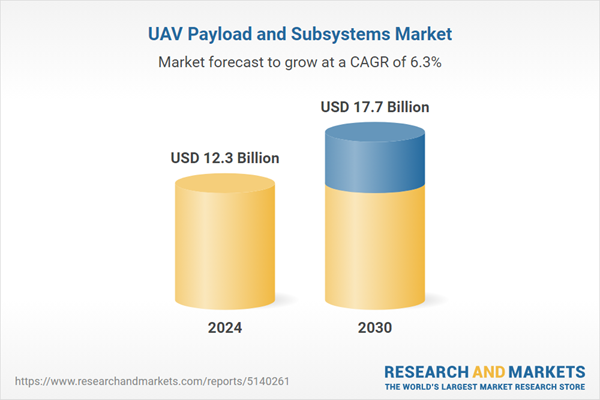

The report analyzes the UAV Payload and Subsystems market, presented in terms of market value (US$ Thousand). The analysis covers the key segments and geographic regions outlined below.- Segments: Segment (UAV Cameras & Sensors, UAV Weaponry, UAV Radars & Communication Systems, Other Segments).

- Geographic Regions/Countries:World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; and Rest of Europe); Asia-Pacific; Rest of World.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the UAV Cameras & Sensors segment, which is expected to reach US$7.9 Billion by 2030 with a CAGR of a 6.7%. The UAV Weaponry segment is also set to grow at 5.7% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $3.4 Billion in 2024, and China, forecasted to grow at an impressive 5.8% CAGR to reach $2.8 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global UAV Payload and Subsystems Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global UAV Payload and Subsystems Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global UAV Payload and Subsystems Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as AeroVironment, Inc., BAE Systems PLC, Boeing Company, The, Elbit Systems Ltd., Israel Aerospace Industries (IAI) and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 41 companies featured in this UAV Payload and Subsystems market report include:

- AeroVironment, Inc.

- BAE Systems PLC

- Boeing Company, The

- Elbit Systems Ltd.

- Israel Aerospace Industries (IAI)

- Lockheed Martin Corporation

- Northrop Grumman Corporation

- Raytheon Company

- Textron Systems Corporation

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- AeroVironment, Inc.

- BAE Systems PLC

- Boeing Company, The

- Elbit Systems Ltd.

- Israel Aerospace Industries (IAI)

- Lockheed Martin Corporation

- Northrop Grumman Corporation

- Raytheon Company

- Textron Systems Corporation

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 244 |

| Published | January 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 12.3 Billion |

| Forecasted Market Value ( USD | $ 17.7 Billion |

| Compound Annual Growth Rate | 6.3% |

| Regions Covered | Global |