An Unnamed Ariel Vehicle, i.e. UAV, or a drone indispensably carries extra weight which is not included in the weight of the drone itself. This weight includes extra cameras, sensors or packages for delivery. Payloads which are required for business drones mainly include GPS, additional data telemetry, LiDAR etc. With the advancement in technology, military sectors, as well as commercial users, are increasingly utilising drones to enhance their services and outputs. The size and weight of the payloads is decided by the weight of the drone. A heavier drone can carry big payloads. The demand of payload subsystems is increasing in parallel with the increasing popularity of drones.

Drivers of Global UAV Payload and Subsystems Market:

- Both developed as well as the developing nations are seeking the utility of drones for various tasks such as to improve the surveillance and communication systems, make rescue operations more efficient, and the collection and management of data. A wide range of payloads including sensors, communication systems and electronics, etc., are required for performing all the aforementioned tasks.

- There are numerous improvements made in persistent surveillance systems, electronic counter-measures and communications. Along with this, there has been a rise in the use of UAVs for the purpose of search and rescue operations.

- UAVs are being increasingly deployed in military and defence activities. The military industry has increased its spending on the payload subsystems for surveillance, intelligence and imaging, detection of mapping as well as for carrying the weaponries.

- The UAV payload subsystems market has seen a noticeable boost accrediting to the frequent utilisations of UAVs in the agriculture, retail, media and entertainment sectors. Commercial users enhance their photography outputs by using the UAVs.

Key Market Segmentation:

The research provides an analysis of the key trends in each sub-segment of the global UAV payload and subsystems market report, along with forecasts at the global and regional level from 2025-2033. Our report has categorized the market based on type, subsystems and application.Breakup by Type:

- Camera and Sensors

- Weaponry

- Radar and Communications

- Others

Breakup by Subsystems:

- Ground Control Station System

- Signal Transmission System

- Propulsion System

Breakup by Application:

- Military

- Civil

Breakup by Region:

- North America

- Asia Pacific

- Europe

- Middle East and Africa

- Latin America

Competitive Landscape:

The competitive landscape of the market has also been examined with some of the key players being AeroVironment, Boeing, Elbit Systems, BAE Systems, Northrop Grumman Corporation, Harris Corporation, CACI International, Rheinmetall AG, ThalesRaytheonSystems, Lockheed Martin Corporation, Israel Aerospace Industries, General Dynamics Corporation, GA-ASI, Raytheon and Textron Systems.This report provides a deep insight into the global UAV payload and subsystems market covering all its essential aspects. This ranges from macro overview of the market to micro details of the industry performance, recent trends, key market drivers and challenges, SWOT analysis, Porter’s five forces analysis, value chain analysis, etc. This report is a must-read for entrepreneurs, investors, researchers, consultants, business strategists, and all those who have any kind of stake or are planning to foray into the UAV payload and subsystems industry in any manner.

Key Questions Answered in This Report:

- How has the global UAV payload and subsystems market performed so far and how will it perform in the coming years ?

- What has been the impact of COVID-19 on the global UAV payload and subsystems market ?

- What are the key regions in the global UAV payload and subsystems market ?

- What are the major types in the global UAV payload and subsystems market ?

- What are the major types of subsystems in the global UAV payload and subsystems market ?

- What are the major application areas in the global UAV payload and subsystems market ?

- What are the various stages in the value chain of the global UAV payload and subsystems industry ?

- What are the key driving factors and challenges in the global UAV payload and subsystems industry ?

- What is the structure of the global UAV payload and subsystems industry and who are the key players ?

- What is the degree of competition in the global UAV payload and subsystems industry ?

Table of Contents

Companies Mentioned

- AeroVironment

- Boeing

- Elbit Systems

- BAE Systems

- Northrop Grumman Corporation

- Harris Corporation

- CACI International

- Rheinmetall AG

- ThalesRaytheonSystems

- Lockheed Martin Corporation

- Israel Aerospace Industries

- General Dynamics Corporation

- GA-ASI

- Raytheon

- Textron Systems

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 146 |

| Published | June 2025 |

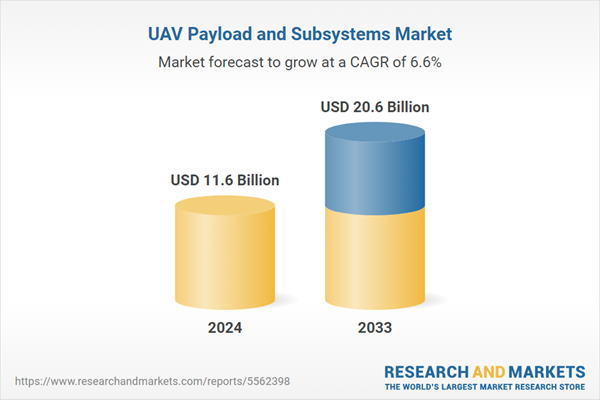

| Forecast Period | 2024 - 2033 |

| Estimated Market Value ( USD | $ 11.6 Billion |

| Forecasted Market Value ( USD | $ 20.6 Billion |

| Compound Annual Growth Rate | 6.6% |

| Regions Covered | Global |

| No. of Companies Mentioned | 15 |