Global Military Wearable Sensors Market - Key Trends & Drivers Summarized

What Are Military Wearable Sensors and How Are They Transforming Modern Warfare?

Military wearable sensors are integral components in the transformation of modern combat, providing critical capabilities that enhance soldier safety and operational effectiveness. These devices monitor health metrics like heart rate, stress levels, and fatigue, while also detecting environmental threats such as chemical and biological agents. Embedded within uniforms and gear, these sensors facilitate real-time data transmission to command centers, allowing for instant strategic decisions and rapid response to changing conditions on the battlefield. This seamless integration of technology not only optimizes soldier performance but also significantly increases the tactical execution capabilities of military units, thereby transforming standard military operations into highly efficient, technology-driven maneuvers.How Are Technological Innovations Shaping the Development of Military Wearable Sensors?

Technological innovations are crucial in the development of military wearable sensors, driving significant advancements in their functionality and reliability. The miniaturization of electronic components and breakthroughs in flexible materials have allowed sensors to be integrated directly into the fabric of military uniforms. This integration provides soldiers with unobtrusive and continuous health and environmental monitoring without impacting mobility. Wireless communications and IoT technology enable these sensors to deliver real-time data to military strategists, who can monitor troop health and performance from afar. Energy-efficient designs and enhanced battery life ensure these sensors can operate over extended periods, which is essential for prolonged missions. Each innovation not only extends the capabilities of these sensors but also broadens their potential applications across various military operations.What Strategic Advantages Do Wearable Sensors Offer to Military Operations?

Wearable sensors offer a suite of strategic advantages that are pivotal in modern military operations. By equipping soldiers with health monitoring technologies, military forces can proactively manage potential medical issues, reducing downtime and improving troop resilience. Navigation and motion sensors embedded in military gear help optimize patrol routes and tactical movements, ensuring units move efficiently and securely. Environmental sensors play a crucial role in detecting hazards such as explosive devices or toxic substances, providing early warnings that can save lives. These capabilities ensure that military operations are not only executed with precision but are also adaptable to dynamic combat environments, where real-time data and situational awareness are key to mission success.What Drives the Growth in the Military Wearable Sensors Market?

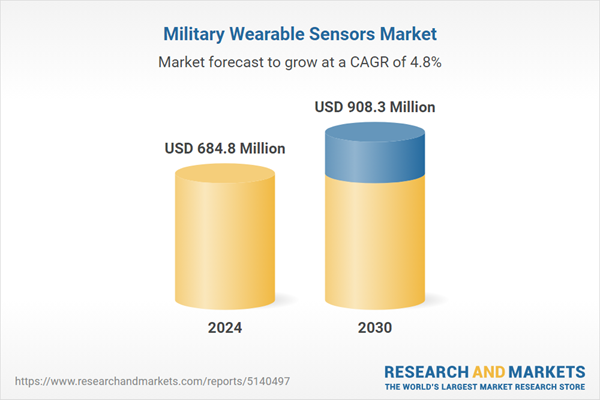

The growth in the military wearable sensors market is driven by several factors, including the increasing reliance on advanced technological solutions to enhance combat readiness and soldier safety. The shift towards network-centric military operations necessitates the use of interconnected devices that can generate and share data across platforms, making wearable sensors indispensable. Additionally, ongoing global security challenges and the need for armed forces to operate in diverse and unpredictable environments amplify the demand for equipment that can provide tactical advantages. The drive for innovation in military technology, supported by substantial defense budgets dedicated to modernizing and equipping forces with the latest tools, further accelerates the development and deployment of wearable sensor technologies. As the nature of threats evolves, so does the need for sophisticated, reliable, and versatile military equipment, underscoring the sustained growth and expansion of this market.Report Scope

The report analyzes the Military Wearable Sensors market, presented in terms of market value (USD). The analysis covers the key segments and geographic regions outlined below.- Segments: Type (Military Device-Based Sensors, Military Clothing-Based Sensors).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; and Rest of Europe); Asia-Pacific; Rest of World.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Military Device-Based Sensors segment, which is expected to reach US$741.9 Million by 2030 with a CAGR of 4.9%. The Military Clothing-Based Sensors segment is also set to grow at 4.3% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $187.5 Million in 2024, and China, forecasted to grow at an impressive 4.6% CAGR to reach $143 Million by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Military Wearable Sensors Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Military Wearable Sensors Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Military Wearable Sensors Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Arralis Ltd., Boeing Company, Leidos, Inc., Lockheed Martin Corporation, Q-Track Corporation and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 34 companies featured in this Military Wearable Sensors market report include:

- Arralis Ltd.

- Boeing Company

- Leidos, Inc.

- Lockheed Martin Corporation

- Q-Track Corporation

- Rheinmetall AG

- Safran Group

- TT Electronics PLC

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Arralis Ltd.

- Boeing Company

- Leidos, Inc.

- Lockheed Martin Corporation

- Q-Track Corporation

- Rheinmetall AG

- Safran Group

- TT Electronics PLC

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 242 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 684.8 Million |

| Forecasted Market Value ( USD | $ 908.3 Million |

| Compound Annual Growth Rate | 4.8% |

| Regions Covered | Global |