Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

However, the market faces a substantial hurdle regarding Size, Weight, and Power (SWaP) constraints. As the functionality of wearable devices expands, their power requirements increase, necessitating the use of heavy battery packs. This added weight burdens the soldier, negatively impacting endurance and mobility during prolonged field missions, which in turn impedes the widespread expansion of the market.

Market Drivers

Increasing government funding for soldier modernization programs is fundamentally transforming the sector as nations aim to equip infantry with enhanced lethality and survivability. Defense departments are dedicating significant budgets to shift from analog gear to integrated digital soldier systems, accelerating the acquisition of smart textiles and body-worn electronics while enabling manufacturers to manage the high research and development costs of next-generation ruggedized equipment. For example, Rheinmetall announced in a February 2025 press release titled 'Rheinmetall awarded framework contract for soldier systems' that it secured a record €3.1 billion framework contract to update the Infantry Soldier of the Future system for the German Bundeswehr. These allocations occur within a broader financial context where, according to the Stockholm International Peace Research Institute, global military expenditure reached a historic peak of $2.72 trillion in 2024, providing a solid capital base for such advanced technological acquisitions.Furthermore, the critical need for superior C4ISR capabilities and situational awareness drives the adoption of tactical computing devices and wearable displays. Modern combat requires dismounted soldiers to act as connected nodes within the Internet of Military Things (IoMT), sharing navigation intelligence and target data in real time. This operational imperative compels manufacturers to create low-latency solutions that integrate seamlessly with battle management networks, boosting the market for sophisticated tactical processors. Illustrating this trend, GovCon Wire reported in February 2025 in the article 'ACI Secures $276M Army Contract for Nett Warrior Support' that the U.S. Army awarded a $276 million contract to Augustine Consulting Inc. to support the Nett Warrior program, a pivotal system for delivering precise battlefield information to ground unit leaders.

Market Challenges

The limitations associated with Size, Weight, and Power (SWaP) represent a primary technical barrier restricting the growth of the global military wearables market. As reliance on network-centric capabilities increases, the energy density required for continuous sensor operation and data transmission necessitates heavy battery packs. This increased weight burden directly impairs the physical agility and endurance of soldiers, creating a detrimental trade-off between technological capability and combat effectiveness. Consequently, defense agencies are forced to limit the procurement scale of power-intensive wearable systems to avoid compromising the mobility of dismounted units during operations.This operational constraint persists despite a historic rise in available defense capital. The Stockholm International Peace Research Institute reported in April 2024 that global military expenditure reached a record high of USD 2.44 trillion. While this figure indicates a robust financial environment for acquiring advanced defense tools, the physical restrictions imposed by current battery technologies prevent the market from fully absorbing these funds. As a result, the adoption rate of comprehensive wearable suits remains capped by the physiological limits of the human operator rather than by budget availability.

Market Trends

The deployment of Integrated Visual Augmentation Systems (IVAS) signifies a fundamental shift in soldier lethality, evolving from traditional night vision to heads-up displays that overlay tactical data directly into the operator's view. This technology merges thermal imaging, navigation, and platoon-level connectivity into a single visor, allowing infantry to engage targets with greater precision while maintaining situational awareness without checking handheld devices. The scale of this transition is reflected in federal procurement priorities; according to DefenseScoop's March 2024 article 'Army seeks $255M to procure more than 3,000 IVAS augmented reality systems in fiscal 2025', the U.S. Army requested $255 million to acquire 3,162 units of the IVAS 1.2 variant, emphasizing the strategic goal of equipping dismounted units with fighter-pilot-like capabilities.Simultaneously, the proliferation of soft robotic exosuits is emerging as a practical solution to musculoskeletal injuries caused by increasing equipment loads. Unlike rigid industrial exoskeletons, these systems employ cable-driven actuators and powered textiles to synchronize with human gait, effectively reducing the metabolic energy cost of carrying heavy rucksacks over rough terrain. This focus on physiological augmentation is driving specific research funding to validate efficacy before widespread fielding; for instance, the U.S. Department of Defense announced in its 'Contracts for May 8, 2024' release that it awarded a $9.3 million contract to the Jackson Foundation to support exoskeleton research services, highlighting the commitment to integrating these technologies into standard infantry operations.

Key Players Profiled in the Military Wearables Market

- ABB Ltd.

- Aeris Technologies, Inc.

- Atmos International Limited

- Physical Sciences Inc.

- Schneider Electric S.E

- Siemens Energy AG

- Teledyne FLIR LLC

- L3Harris Technologies, Inc.

- Northrop Grumman Corporation

- BAE Systems PLC

Report Scope

In this report, the Global Military Wearables Market has been segmented into the following categories:Military Wearables Market, by Product Type:

- Eyewear

- Headwear

- Wristwear

- Bodywear

- Others

Military Wearables Market, by End User:

- Airborne Forces

- Land Forces

- Naval Forces

Military Wearables Market, by Region:

- North America

- Europe

- Asia-Pacific

- South America

- Middle East & Africa

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Global Military Wearables Market.Available Customization

The analyst offers customization according to your specific needs. The following customization options are available for the report:- Detailed analysis and profiling of additional market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

The key players profiled in this Military Wearables market report include:- ABB Ltd.

- Aeris Technologies, Inc.

- Atmos International Limited

- Physical Sciences Inc.

- Schneider Electric S.E

- Siemens Energy AG

- Teledyne FLIR LLC

- L3Harris Technologies, Inc

- Northrop Grumman Corporation

- BAE Systems PLC

Table Information

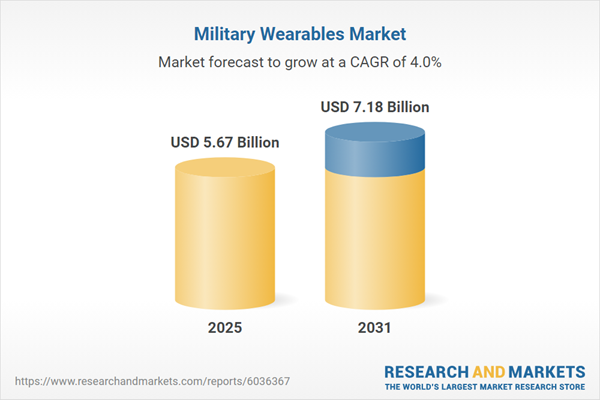

| Report Attribute | Details |

|---|---|

| No. of Pages | 185 |

| Published | January 2026 |

| Forecast Period | 2025 - 2031 |

| Estimated Market Value ( USD | $ 5.67 Billion |

| Forecasted Market Value ( USD | $ 7.18 Billion |

| Compound Annual Growth Rate | 4.0% |

| Regions Covered | Global |

| No. of Companies Mentioned | 11 |