Global Nephrology and Urology Devices Market - Key Trends & Drivers Summarized

What Are Nephrology and Urology Devices, and Why Are They So Crucial in Modern Healthcare?

Nephrology and urology devices encompass a broad range of medical equipment designed to diagnose, treat, and manage conditions affecting the kidneys, urinary tract, bladder, and associated organs. These devices are used to address a variety of disorders, including chronic kidney disease, urinary incontinence, kidney stones, benign prostatic hyperplasia, and cancers of the urinary system. Examples include dialysis machines, catheters, ureteroscopes, lithotripters, urinary stents, and nephrostomy devices, among others. These devices play a crucial role in improving patient outcomes, providing minimally invasive treatment options, and supporting long-term management of both acute and chronic conditions.The importance of nephrology and urology devices lies in their ability to enhance the quality of life for patients by enabling effective disease management, faster recovery, and less invasive procedures. For patients with chronic kidney disease or end-stage renal disease, dialysis machines are essential for maintaining kidney function and prolonging life. In cases of urological disorders, devices like stents, catheters, and laser systems allow for effective management of obstructions, infections, and other complications. As the prevalence of kidney-related and urological conditions continues to rise globally - due to aging populations, lifestyle factors, and comorbidities like diabetes and hypertension - these devices have become vital components of modern healthcare delivery.

How Are Technological Advancements Shaping the Nephrology and Urology Devices Market?

Technological advancements have significantly enhanced the precision, efficiency, and patient outcomes associated with nephrology and urology devices, driving innovation across the healthcare sector. One of the major developments is the rise of minimally invasive technologies, which have transformed surgical and therapeutic interventions in both nephrology and urology. Devices such as flexible ureteroscopes, laser lithotripters, and robotic-assisted systems allow for precise treatment of kidney stones, tumors, and other obstructions with reduced recovery times, minimal complications, and lower healthcare costs. Robotic surgery, for instance, enables enhanced visualization, better control, and smaller incisions, making it particularly effective in procedures like prostatectomy and partial nephrectomy.Advancements in dialysis technology have improved the treatment of chronic kidney disease and end-stage renal disease. Modern dialysis machines feature improved filtration systems, better monitoring capabilities, and more user-friendly interfaces, making treatments safer, more efficient, and less burdensome for patients. The development of portable and wearable dialysis devices has further expanded the options for home-based care, allowing patients greater mobility and flexibility in managing their condition. Additionally, ongoing research into implantable artificial kidneys holds the potential to revolutionize renal replacement therapy, offering more permanent and less restrictive solutions for kidney failure patients.

The development of digital health tools and remote monitoring solutions has also enhanced the management of nephrology and urology conditions. Telemedicine, wearable sensors, and mobile health apps are now used to track patient health metrics, such as fluid levels, blood pressure, and urine output, providing healthcare professionals with real-time data to optimize treatment plans. For example, continuous monitoring of patients undergoing dialysis or treatment for urinary retention can help detect complications early, enabling timely interventions and reducing hospital readmissions. These technological innovations not only expand the capabilities of nephrology and urology devices but also align with broader trends toward personalized, data-driven, and patient-centric care in modern healthcare.

What Are the Emerging Applications of Nephrology and Urology Devices Across Different Patient Groups?

Nephrology and urology devices are finding expanding applications across diverse patient groups, driven by increasing prevalence of kidney and urological disorders and the need for more effective, less invasive treatment options. In the treatment of kidney stones, for example, ureteroscopes, lithotripters, and stents are widely used to facilitate stone removal or fragmentation. These devices are commonly employed across adult and pediatric populations, offering effective solutions for acute management and long-term prevention of recurrence. The use of extracorporeal shock wave lithotripsy (ESWL), which breaks down stones non-invasively, has become a preferred treatment method due to its minimal complications and faster recovery times.For patients with chronic kidney disease or end-stage renal disease, dialysis machines are essential for maintaining kidney function. Hemodialysis and peritoneal dialysis devices serve different patient needs, with hemodialysis being more common in clinical settings and peritoneal dialysis offering greater flexibility for home-based care. Recent advancements have focused on improving patient comfort, reducing treatment duration, and enhancing efficiency. Portable dialysis machines, for instance, allow patients to receive dialysis at home or while traveling, providing more autonomy and a better quality of life.

In the management of benign prostatic hyperplasia (BPH), devices like prostatic stents, transurethral resection of the prostate (TURP) equipment, and laser systems have become standard treatment options, particularly among older male patients. These devices provide effective relief from urinary obstruction and improve urine flow, offering minimally invasive solutions with shorter hospital stays and reduced risks of complications. In addition, urinary incontinence devices, such as catheters, slings, and sacral neuromodulation implants, offer targeted solutions for different types of incontinence, addressing the needs of both male and female patients across a wide age range.

In cancer treatment, nephrology and urology devices are used for biopsy, tumor ablation, and surgical interventions. Devices like laparoscopic nephrectomy tools, cystoscopes, and laser ablation systems allow for precise removal or treatment of cancerous tissues while preserving healthy structures. The use of advanced imaging technologies in conjunction with these devices has improved early detection, diagnosis, and targeted treatment of cancers like renal cell carcinoma and bladder cancer. The expanding applications of nephrology and urology devices across these patient groups highlight their critical role in enhancing patient outcomes, improving quality of life, and supporting comprehensive care for kidney and urological disorders.

What Drives Growth in the Nephrology and Urology Devices Market?

The growth in the nephrology and urology devices market is driven by several factors, including increasing prevalence of kidney and urological disorders, rising demand for minimally invasive treatments, and advancements in medical technology. One of the primary growth drivers is the global rise in chronic kidney disease and end-stage renal disease, largely due to aging populations, lifestyle changes, and higher rates of diabetes and hypertension. As more patients require long-term management and renal replacement therapy, the demand for dialysis machines, catheters, and other related devices has increased, supporting market expansion.The growing preference for minimally invasive surgical techniques has also fueled demand for advanced urology devices. Patients and healthcare providers are increasingly opting for treatments that offer quicker recovery, reduced pain, and fewer complications. Minimally invasive technologies, such as laser lithotripsy for kidney stones and robotic-assisted surgery for prostate and kidney tumors, have become popular choices, driving demand for ureteroscopes, lasers, and robotic systems. This shift toward less invasive interventions has supported the adoption of innovative devices that offer better precision, safety, and effectiveness in treating kidney and urological disorders.

Advancements in medical technology, including digital health tools and portable devices, have contributed to market growth by improving access to care and patient outcomes. Innovations like wearable sensors, remote monitoring devices, and mobile health applications allow for continuous monitoring of patients with chronic conditions, supporting better disease management and timely interventions. For instance, home-based dialysis machines enable more patients to receive treatment outside traditional clinical settings, enhancing convenience and reducing healthcare costs. These advancements align with broader healthcare trends toward personalized, patient-centric care and integrated digital solutions.

Government initiatives and healthcare infrastructure development have also played a key role in driving the nephrology and urology devices market. Increased healthcare spending, improved insurance coverage, and public awareness campaigns about kidney and urological health have boosted the adoption of medical devices in both developed and developing regions. Regulatory support for new device approvals and reimbursement policies has further facilitated access to advanced treatment options, ensuring broader availability of nephrology and urology devices in global markets.

With ongoing innovations in medical devices, telehealth, and minimally invasive techniques, the nephrology and urology devices market is poised for continued growth. These trends, combined with increasing demand for effective disease management, improved patient outcomes, and advanced treatment options, make nephrology and urology devices vital components of modern healthcare strategies across diverse patient populations.

Report Scope

The report analyzes the Nephrology And Urology Devices market, presented in terms of market value (US$ Thousand). The analysis covers the key segments and geographic regions outlined below.- Segments: Type (Dialysis Devices, Endoscopy Devices, Benign Prostatic Hyperplasia (BPH) Treatment Devices, Urinary Incontinence and Pelvic Organ Prolapse Treatment Devices, Urinary Stone Treatment Devices, Other Types).

- Geographic Regions/Countries:World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Dialysis Devices segment, which is expected to reach US$28.9 Billion by 2030 with a CAGR of a 6.2%. The Endoscopy devices segment is also set to grow at 5.4% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $7.3 Billion in 2024, and China, forecasted to grow at an impressive 8.9% CAGR to reach $9.1 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Nephrology And Urology Devices Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Nephrology And Urology Devices Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Nephrology And Urology Devices Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Asahi Kasei Corp, B. Braun Group, Boston Scientific Corporation, Siemens Healthineers, Cardinal Health Inc. and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 41 companies featured in this Nephrology And Urology Devices market report include:

- Asahi Kasei Corp

- B. Braun Group

- Boston Scientific Corporation

- Siemens Healthineers

- Cardinal Health Inc.

- Cook Group Incorporated

- Dornier Medtech

- Medtronic plc

- Olympus Europa SE & Co. KG

- Teleflex Inc.

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Asahi Kasei Corp

- B. Braun Group

- Boston Scientific Corporation

- Siemens Healthineers

- Cardinal Health Inc.

- Cook Group Incorporated

- Dornier Medtech

- Medtronic plc

- Olympus Europa SE & Co. KG

- Teleflex Inc.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 194 |

| Published | January 2026 |

| Forecast Period | 2024 - 2030 |

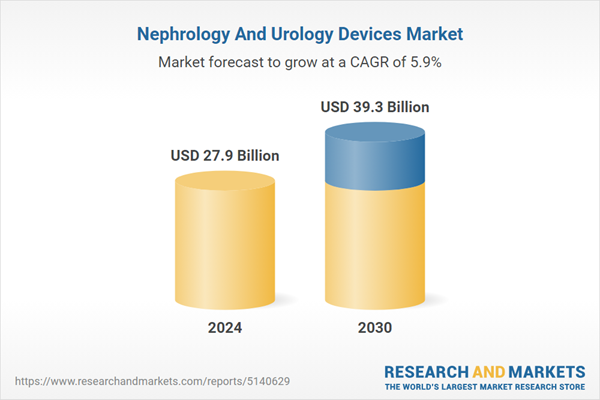

| Estimated Market Value ( USD | $ 27.9 Billion |

| Forecasted Market Value ( USD | $ 39.3 Billion |

| Compound Annual Growth Rate | 5.9% |

| Regions Covered | Global |