Global Radiofrequency Ablation Devices for Pain Management Market - Key Trends & Drivers Summarized

What Are Radiofrequency Ablation Devices and How Are They Changing Pain Management?

Radiofrequency Ablation (RFA) devices are minimally invasive medical tools designed to alleviate chronic pain by targeting and disrupting specific nerve fibers that transmit pain signals to the brain. The procedure involves using a specialized probe to deliver targeted radiofrequency energy to nerve tissues, creating heat that alters or damages the nerve's ability to conduct pain signals. RFA has emerged as a highly effective option for patients suffering from chronic pain conditions such as osteoarthritis, facet joint pain, and neuropathic pain. Traditionally, these patients had limited choices, often relying on long-term medication or invasive surgical procedures. With the advent of RFA devices, healthcare providers can offer a more precise, less risky, and highly effective treatment option that can provide significant pain relief with minimal recovery time. Over the years, the technique has gained widespread acceptance due to its ability to deliver lasting pain relief - often up to a year or more - without the need for more radical interventions.In addition to treating musculoskeletal pain, RFA devices are increasingly being used to manage pain associated with complex conditions like cancer and trigeminal neuralgia. The versatility of these devices lies in their ability to target nerves with great precision, minimizing collateral damage to surrounding tissues and reducing the risk of complications. This has made RFA a preferred choice in interventional pain management clinics and hospital pain management programs. As the demand for non-opioid pain relief options continues to rise, RFA devices are playing a pivotal role in reshaping the landscape of pain management. The growing body of clinical evidence supporting the safety and efficacy of these devices is driving their adoption among healthcare providers and boosting patient confidence in the procedure. Furthermore, advancements in RFA technology, such as the development of cooled radiofrequency systems and novel probe designs, have expanded the scope of treatment to previously challenging pain conditions, establishing RFA devices as a cornerstone in modern pain management strategies.

How Are Technological Innovations Transforming The Landscape Of Radiofrequency Ablation Devices?

Technological innovations are fundamentally transforming the capabilities and effectiveness of Radiofrequency Ablation devices, opening up new possibilities for treating a wider range of chronic pain conditions. One of the most notable advancements is the development of cooled radiofrequency (CRF) technology. Unlike traditional RFA devices, which can generate high temperatures at the target site, CRF uses an internal cooling mechanism to regulate temperature and create larger, more uniform lesions. This allows for more precise targeting of nerve tissues while minimizing the risk of thermal damage to surrounding structures. CRF has shown particular promise in treating sacroiliac joint pain and complex nerve conditions that were previously challenging to manage with standard RFA techniques. Additionally, the introduction of advanced probe designs, including multi-tined and curved needles, has enhanced the ability of practitioners to access difficult-to-reach nerve structures, improving the overall success rates of RFA procedures.Another significant technological advancement is the integration of imaging and navigation systems with RFA devices. These systems, which often include fluoroscopy, ultrasound, or MRI guidance, allow for real-time visualization of the target nerves and surrounding anatomy, enabling more accurate probe placement and reducing the risk of complications. This integration has made RFA procedures safer and more effective, particularly in sensitive areas like the spine or craniofacial region. Furthermore, the emergence of bipolar and pulsed radiofrequency technologies is offering new treatment options for patients. Bipolar RFA allows for simultaneous treatment of larger nerve areas, while pulsed RFA delivers short bursts of energy that modulate nerve function without causing permanent damage, making it suitable for patients who require temporary nerve modulation. As these innovations continue to evolve, they are broadening the therapeutic applications of RFA devices and solidifying their role as a go-to solution in interventional pain management.

What Factors Are Driving The Adoption Of Radiofrequency Ablation Devices Across The Pain Management Market?

The adoption of Radiofrequency Ablation devices in pain management is being driven by a variety of factors, including the growing prevalence of chronic pain conditions, rising demand for minimally invasive procedures, and increasing awareness of non-opioid treatment options. Chronic pain affects millions of people globally, with conditions such as lower back pain, osteoarthritis, and neuropathic pain becoming more prevalent due to aging populations and sedentary lifestyles. Traditional pain management strategies often rely heavily on pharmacological interventions, including opioids, which come with risks of addiction and adverse side effects. As healthcare providers and patients seek safer alternatives, RFA devices have gained traction as an effective, long-lasting solution that addresses pain at its source without the need for medication. This shift towards non-pharmacological treatments is also being reinforced by regulatory bodies and public health agencies, which are advocating for reduced opioid use in pain management.The rising demand for minimally invasive procedures is another key driver of RFA adoption. Unlike surgical interventions, RFA offers a minimally invasive approach with shorter recovery times, reduced risk of infection, and minimal scarring. These benefits make it an attractive option for patients who are either not candidates for surgery or prefer less invasive solutions. Additionally, the widespread availability of RFA devices in outpatient settings and specialized pain clinics has made the procedure more accessible, further boosting its adoption. Another critical factor contributing to the growth of the RFA market is the increasing coverage of RFA procedures by health insurance providers, recognizing the cost-effectiveness and clinical efficacy of the treatment. This financial support is encouraging more patients to consider RFA as a viable option for managing chronic pain, leading to increased utilization across various healthcare settings.

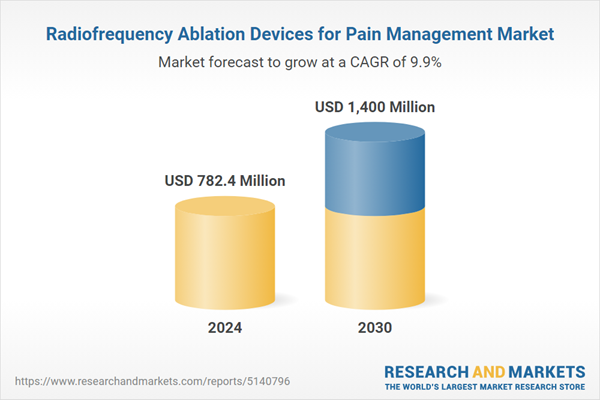

What Is Driving The Growth Of The Global Radiofrequency Ablation Devices Market For Pain Management?

The growth in the global Radiofrequency Ablation devices market for pain management is driven by several factors, including advancements in technology, changing treatment paradigms, and the growing focus on non-opioid pain relief solutions. One of the primary growth drivers is the continuous innovation in RFA technology, with newer devices offering enhanced safety features, better precision, and expanded treatment capabilities. These technological improvements have broadened the range of conditions that can be treated using RFA, from chronic musculoskeletal pain to complex nerve pain syndromes. Additionally, the development of portable, easy-to-use RFA systems is making it possible for a wider range of healthcare providers to offer the procedure, increasing its availability in diverse clinical settings. Another significant factor driving market growth is the rising awareness and acceptance of RFA as a long-term pain management solution. As clinical studies continue to demonstrate the effectiveness and safety of RFA, both patients and practitioners are gaining confidence in its use, leading to higher adoption rates.Moreover, the shift in treatment paradigms towards personalized and patient-centered care is also fueling market growth. With RFA, practitioners can tailor treatments to the specific pain profiles of individual patients, offering a level of customization that is not possible with traditional pain management methods. This has made RFA particularly appealing for patients with unique or refractory pain conditions. Additionally, the rising emphasis on non-opioid pain relief solutions is driving the demand for RFA devices. The ongoing opioid crisis has spurred healthcare systems and providers to explore alternative pain management options, with RFA emerging as one of the most promising solutions. Furthermore, supportive government policies and increased funding for pain research are expected to further accelerate the adoption of RFA devices. As the global population ages and the demand for effective pain management solutions grows, the RFA market is poised for robust growth, driven by a combination of technological advancements, evolving treatment practices, and a heightened focus on patient safety and quality of life.

Report Scope

The report analyzes the Radiofrequency Ablation Devices for Pain Management market, presented in terms of market value (US$ Thousand). The analysis covers the key segments and geographic regions outlined below.- Segments: Segment (Disposable Products, RF Generators, Reusable Products); End-Use (Hospitals, Ambulatory Surgery Centers, Specialty Clinics).

- Geographic Regions/Countries:World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Disposable Products segment, which is expected to reach US$649.8 Million by 2030 with a CAGR of a 9.9%. The RF Generators segment is also set to grow at 10.8% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $206.9 Million in 2024, and China, forecasted to grow at an impressive 13.5% CAGR to reach $307.7 Million by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Radiofrequency Ablation Devices for Pain Management Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Radiofrequency Ablation Devices for Pain Management Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Radiofrequency Ablation Devices for Pain Management Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Accuray, Inc., AngioDynamics, Inc., AtriCure, Inc., Avanos Medical, Inc., Biosense Webster, Inc. and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 46 companies featured in this Radiofrequency Ablation Devices for Pain Management market report include:

- Accuray, Inc.

- AngioDynamics, Inc.

- AtriCure, Inc.

- Avanos Medical, Inc.

- Biosense Webster, Inc.

- Boston Scientific Corporation

- Diros Technology

- Hologic, Inc.

- Medtronic PLC

- Stryker Corporation

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Accuray, Inc.

- AngioDynamics, Inc.

- AtriCure, Inc.

- Avanos Medical, Inc.

- Biosense Webster, Inc.

- Boston Scientific Corporation

- Diros Technology

- Hologic, Inc.

- Medtronic PLC

- Stryker Corporation

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 196 |

| Published | January 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 782.4 Million |

| Forecasted Market Value ( USD | $ 1400 Million |

| Compound Annual Growth Rate | 9.9% |

| Regions Covered | Global |