Global Industrial Catalysts Market - Key Trends & Drivers Summarized

Why Are Industrial Catalysts Becoming Integral to Modern Chemical and Manufacturing Processes?

Industrial catalysts are becoming integral to modern chemical and manufacturing processes due to their ability to accelerate chemical reactions, increase process efficiency, and optimize the production of essential chemicals and materials. Catalysts are substances that enhance the rate of a chemical reaction without being consumed in the process, making them crucial in industries such as petrochemicals, chemicals, refining, pharmaceuticals, and automotive. Their primary role is to lower the energy barrier required for reactions, enabling processes to occur under milder conditions, such as lower temperatures and pressures, while achieving higher conversion rates and selectivity. This leads to reduced energy consumption, lower production costs, and minimized environmental impact, making catalysts indispensable for industrial processes.Moreover, industrial catalysts are used in a wide range of applications, from cracking hydrocarbons in petroleum refining to synthesizing ammonia for fertilizers and producing polymers for plastic manufacturing. In refining and petrochemicals, for example, catalysts are used in processes like fluid catalytic cracking (FCC) and hydrocracking to convert heavy crude oil into valuable products like gasoline, diesel, and jet fuel. In the automotive sector, catalysts are used in catalytic converters to reduce harmful emissions from vehicles, contributing to environmental sustainability and regulatory compliance. The versatility and efficiency of industrial catalysts in facilitating complex chemical transformations are driving their widespread adoption in industries that prioritize operational efficiency, product quality, and sustainability.

How Are Technological Advancements Transforming the Industrial Catalysts Market?

Technological advancements are transforming the industrial catalysts market by enabling the development of more efficient, selective, and environmentally friendly catalysts. One of the most significant innovations in this space is the use of nanotechnology to create nanoscale catalysts with enhanced surface area, reactivity, and stability. Nanoscale catalysts offer superior performance due to their higher surface-to-volume ratio, which provides more active sites for chemical reactions. This results in increased reaction rates and improved selectivity, making these catalysts ideal for applications such as fine chemicals production, pharmaceuticals synthesis, and renewable energy conversion. Additionally, the development of nanostructured catalysts is helping to reduce the use of precious metals like platinum and palladium, lowering costs and promoting the sustainability of catalytic processes.Another transformative trend is the shift towards sustainable and green catalysts that minimize the environmental impact of chemical processes. Research into bio-based catalysts, such as enzymes and bio-catalysts, is gaining momentum, as these materials offer high selectivity and operate under mild conditions, reducing the need for harsh chemicals and extreme processing conditions. The use of solid acid catalysts in place of liquid acids in petrochemical processes is another example of how catalyst technology is evolving to reduce waste and pollution. Furthermore, advancements in computational chemistry and machine learning are enabling the design and optimization of catalysts at the molecular level. These technologies allow researchers to model and predict catalyst behavior, accelerating the development of next-generation catalysts that offer higher efficiency and longer lifespans.

The integration of digital technologies, such as artificial intelligence (AI) and the Industrial Internet of Things (IIoT), is also playing a crucial role in optimizing catalyst performance. AI-driven models can analyze vast datasets from catalytic processes to identify optimal operating conditions, predict catalyst deactivation, and suggest regeneration strategies. IIoT-enabled sensors provide real-time data on catalyst performance, enabling proactive maintenance and reducing unplanned downtime. As these technologies continue to evolve, they are making industrial catalysts more effective, reliable, and adaptable to the specific needs of modern chemical and manufacturing processes.

What Role Do Sustainability and Environmental Regulations Play in Driving the Adoption of Advanced Industrial Catalysts?

Sustainability and environmental regulations are playing a pivotal role in driving the adoption of advanced industrial catalysts, as industries face increasing pressure to reduce their environmental footprint and comply with stringent emission standards. Catalysts are essential for minimizing emissions, enhancing process efficiency, and promoting the use of cleaner feedstocks and renewable resources. For example, in the refining and petrochemical industries, catalysts are used to remove sulfur and other impurities from fuels, ensuring compliance with environmental regulations such as the International Maritime Organization's (IMO) 2020 sulfur cap and the U.S. Environmental Protection Agency's (EPA) Tier 3 gasoline sulfur standards. These regulations mandate the use of low-sulfur fuels to reduce air pollution and improve air quality, making advanced catalysts a key component in achieving compliance.The drive towards sustainability is also prompting companies to adopt catalysts that enable the use of alternative and renewable feedstocks. For instance, catalysts are being developed to facilitate the conversion of biomass into biofuels, bioplastics, and other value-added chemicals, supporting the transition to a circular economy. In the chemical industry, green catalysts are being used to promote the use of carbon dioxide (CO2) as a feedstock for chemical synthesis, reducing greenhouse gas emissions and creating new pathways for sustainable production. Additionally, the use of catalysts in waste-to-energy processes, such as converting plastic waste into fuels or chemicals, is gaining traction as industries look for innovative ways to tackle environmental challenges.

The automotive sector is another area where environmental regulations are driving demand for advanced catalysts. With the implementation of stringent emission standards, such as the Euro 6 and China VI regulations, automotive manufacturers are required to reduce emissions of nitrogen oxides (NOx), carbon monoxide (CO), and hydrocarbons (HC). This has led to the widespread adoption of advanced catalytic converters that use platinum-group metals (PGMs) to achieve high conversion rates of pollutants. As governments and regulatory bodies continue to tighten environmental standards and promote sustainable practices, the demand for industrial catalysts that enable cleaner, more efficient processes is expected to increase significantly.

What Factors Are Driving the Growth of the Global Industrial Catalysts Market?

The growth in the global industrial catalysts market is driven by several factors, including the expanding chemical and petrochemical industries, the rising demand for cleaner energy and environmental sustainability, and the ongoing innovation in catalyst technologies. One of the primary growth drivers is the increasing production of chemicals and petrochemicals, particularly in regions like Asia-Pacific and the Middle East. As global demand for plastics, fertilizers, and specialty chemicals continues to rise, the need for catalysts that enable efficient and cost-effective production is growing. Catalysts are used in a wide range of chemical processes, including polymerization, hydrogenation, oxidation, and hydrocracking, making them essential for the production of a broad spectrum of chemical products. The expansion of petrochemical facilities and the development of new production capacities are further boosting the demand for catalysts in this sector.The rising demand for cleaner energy and environmental sustainability is another key factor driving the market. As industries strive to reduce their carbon footprint and transition to cleaner energy sources, the use of catalysts in processes such as hydrogen production, fuel cell technology, and biofuel synthesis is gaining momentum. For example, catalysts are used in steam methane reforming (SMR) and water-gas shift (WGS) reactions to produce hydrogen, which is a key component in clean energy technologies. The use of catalysts in carbon capture and utilization (CCU) processes is also supporting the development of sustainable energy solutions by converting captured CO2 into valuable chemicals and fuels. As the world moves towards a low-carbon economy, the demand for catalysts that enable cleaner energy production and emissions reduction is expected to grow.

The ongoing innovation in catalyst technologies is further contributing to market growth. Companies are investing in research and development (R&D) to create catalysts that offer higher activity, selectivity, and stability, reducing the amount of catalyst required and extending their operational lifespan. The development of multi-functional catalysts that can perform multiple reactions in a single step is enhancing process efficiency and reducing production costs. Additionally, the use of advanced characterization techniques, such as in-situ spectroscopy and high-throughput screening, is accelerating the discovery and optimization of new catalysts. These innovations are helping companies address challenges related to catalyst deactivation, regeneration, and recycling, making industrial processes more sustainable and cost-effective.

Moreover, the increasing focus on renewable chemicals and bio-based products is creating new opportunities for the industrial catalysts market. As industries shift towards using renewable feedstocks and developing green chemical processes, catalysts are playing a crucial role in enabling these transformations. The development of catalysts for biomass conversion, green hydrogen production, and sustainable plastic manufacturing is supporting the growth of bio-based industries. Additionally, the rise of circular economy initiatives, where waste materials are converted into valuable products using catalytic processes, is driving demand for innovative catalysts that can support these new production paradigms.

Furthermore, the expansion of the automotive industry and the shift towards electric vehicles (EVs) are influencing the industrial catalysts market. While the demand for traditional automotive catalysts used in internal combustion engine (ICE) vehicles may decline in the long term, the growing adoption of fuel cell vehicles (FCVs) and the use of catalysts in battery recycling and production are creating new growth avenues. As these factors converge, the global industrial catalysts market is poised for robust expansion, supported by technological advancements, evolving energy needs, and the increasing emphasis on sustainability and environmental compliance across various sectors.

Report Scope

The report analyzes the Industrial Catalysts market, presented in terms of market value (USD). The analysis covers the key segments and geographic regions outlined below.- Segments: Type (Heterogeneous, Homogeneous); Material (Metals, Chemicals, Zeolites, Organometallic Materials); Application (Petroleum Refining, Chemical Synthesis, Petrochemicals, Other Applications).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Heterogeneous Catalysts segment, which is expected to reach US$22.1 Billion by 2030 with a CAGR of 4.9%. The Homogeneous Catalysts segment is also set to grow at 4.1% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $7.1 Billion in 2024, and China, forecasted to grow at an impressive 7.3% CAGR to reach $7.8 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Industrial Catalysts Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Industrial Catalysts Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Industrial Catalysts Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Akzo Nobel NV, Albemarle Corporation, Arkema Group, BASF SE, Chevron Phillips Chemical Company LLC and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 47 companies featured in this Industrial Catalysts market report include:

- Akzo Nobel NV

- Albemarle Corporation

- Arkema Group

- BASF SE

- Chevron Phillips Chemical Company LLC

- Clariant AG

- Dow, Inc.

- DuPont de Nemours, Inc.

- Evonik Industries AG

- ExxonMobil Chemical Company

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Akzo Nobel NV

- Albemarle Corporation

- Arkema Group

- BASF SE

- Chevron Phillips Chemical Company LLC

- Clariant AG

- Dow, Inc.

- DuPont de Nemours, Inc.

- Evonik Industries AG

- ExxonMobil Chemical Company

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 197 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

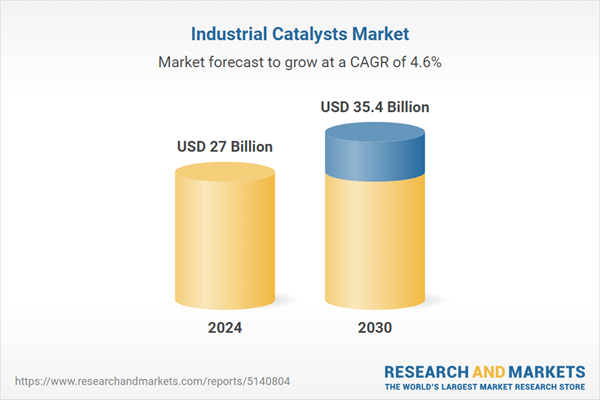

| Estimated Market Value ( USD | $ 27 Billion |

| Forecasted Market Value ( USD | $ 35.4 Billion |

| Compound Annual Growth Rate | 4.6% |

| Regions Covered | Global |