A catalyst refers to a substance that improves the rate of a chemical reaction without undergoing any physical or chemical change. It enhances chemical processes and minimizes waste, production time, energy consumption, and operational cost. It assists in enhancing the air quality by controlling emissions, mitigating volatile organic compounds (VOCs), formulating improved oil fractions, including natural gas, biodiesel, and propane, and synthesizing active compounds and intermediates. As a result, industrial catalysts are widely used in petroleum refining, petrochemical production, environment protection reactions, organic synthesis, polymer processing, and bulk chemical synthesis.

Industrial Catalyst Industry Trends

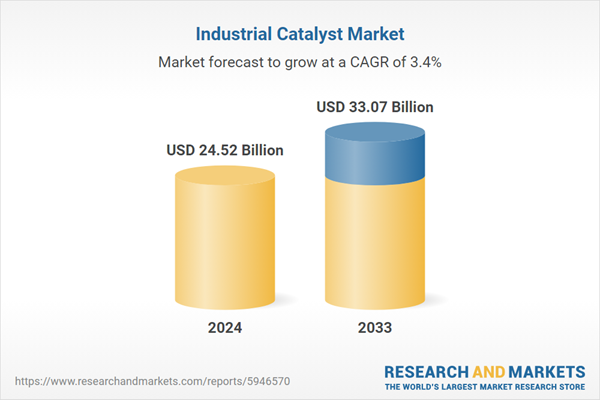

The growing expansion of the petroleum industry is resulting in the rising establishment of petrol refining capacities and the need for various chemical products and eco-friendly fuels. This, in turn, is positively influencing the market. In addition, the escalating demand for petroleum-based products from power generation plants is expanding the applications of industrial catalysts in petroleum refining and petrochemical plants for a convenient, quicker, safer, and more efficient production process. Apart from this, the rising use of catalytic converters in automobile manufacturing emission control systems is offering lucrative growth opportunities to industry investors. This can also be attributed to increasing environmental concerns and the implementation of stringent government regulations for controlling emission levels. Furthermore, the development of nano-catalysts that assist in enhancing catalytic procedures in the pharmaceutical and food and beverage (F&B) industries are creating a positive market outlook. Moreover, strategic collaborations amongst leading industry players to expand their global market reach, along with increasing investments in research and development (R&D) activities to enhance catalysts efficiency while minimizing operational costs, are impelling the market growth.Market Segmentation

This report provides an analysis of the key trends in each sub-segment of the global industrial catalyst market report, along with forecasts at the global and regional level from 2025-2033. The report has categorized the market based on type, raw material and application.Breakup by Type

- Heterogeneous Catalysts

- Homogeneous Catalysts

- Biocatalysts

Breakup by Raw Material

- Mixed

- Oxide

- Metallic

- Sulfide

- Organometallic

Breakup by Application

- Petroleum Refinery

- Chemical Synthesis

- Petrochemicals

- Others

- Asia Pacific

- North America

- Europe

- Middle East and Africa

- Latin America

Competitive Landscape

The competitive landscape of the market has been analyzed in the report, along with the detailed profiles of the major players operating in the industry. Some of these players are Albemarle Corporation, Arkema S.A., BASF SE, Clariant AG, Evonik Industries AG, Exxon Mobil Chemical Co, Akzo Nobel N.V., Chevron Phillips Chemical Company, LLC, and The DOW Chemical Company.Key Questions Answered in This Report

1. What is an industrial catalyst?2. How big is the industrial catalyst market?

3. What is the expected growth rate of the global/regional industrial catalyst market during 2025-2033?

4. What are the key factors driving the global/regional industrial catalyst market?

5. What is the leading segment of the global/regional industrial catalyst market based on type?

6. What is the leading segment of the global industrial catalyst market based on material?

7. What is the leading segment of the global industrial catalyst market based on application?

8. What are the key regions in the global industrial catalyst market?

9. Who are the key players/companies in the global industrial catalyst market?

Table of Contents

Companies Mentioned

- Albemarle Corporation

- Arkema S.A.

- BASF Corporation

- Clariant AG

- Evonik Industries AG

- Exxon Mobil Chemical Corporation

- Akzo Nobel N.V.

- Chevron Phillips Chemical Company

- The DOW Chemical Company

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 137 |

| Published | February 2025 |

| Forecast Period | 2024 - 2033 |

| Estimated Market Value ( USD | $ 24.52 Billion |

| Forecasted Market Value ( USD | $ 33.07 Billion |

| Compound Annual Growth Rate | 3.4% |

| Regions Covered | Global |

| No. of Companies Mentioned | 9 |