Global Flour Market - Key Trends and Drivers Summarized

Why Is Flour Such a Fundamental Ingredient in Global Food Production?

Flour is a staple in kitchens and industries worldwide, but why is it such a fundamental ingredient in global food production? Flour, which is made by grinding grains, seeds, or roots into a fine powder, serves as the base for countless products in the food industry. The most common type of flour is wheat flour, but other varieties like rice, corn, almond, and coconut flour are also widely used. From bread and pasta to cakes and sauces, flour is a critical component in creating texture, structure, and flavor in a wide range of foods. Its versatility and ability to act as a thickening or binding agent make it indispensable in both commercial and home kitchens.One of the key reasons flour is so essential in food production is its role in creating structure, particularly in baked goods. When flour is mixed with water, the proteins in wheat flour form gluten, a network that gives dough its elasticity and allows it to rise during baking. This process creates the chewy texture of bread and the soft crumb of cakes and pastries. Flour also acts as a thickening agent in sauces, gravies, and soups, helping to create smooth, cohesive mixtures. In addition, it's used as a coating for fried foods, giving them a crispy exterior. As food production becomes more industrialized and diverse, flour remains a cornerstone ingredient in feeding the world.

How Is Flour Made, and What Makes It So Versatile?

Flour comes in many forms, but how is it made, and what gives it such versatility in food production? The process of making flour typically involves grinding raw grains, legumes, or other plant-based materials into a fine powder. The most common source is wheat, but other grains like corn, rice, rye, and barley, as well as non-grains like almonds or coconut, are used to create different types of flour. Wheat flour production begins with milling, where the grains are cleaned, tempered (soaked to soften the outer bran), and then ground between rollers. The flour is then sifted to separate the bran, germ, and endosperm, the latter being the main component of white flour. Whole wheat flour, on the other hand, retains more of the bran and germ, giving it a coarser texture and richer nutritional profile.What makes flour so versatile is its ability to serve multiple functions in various foods. Wheat flour, for example, contains proteins that, when mixed with water, form gluten - a structure that traps air and allows dough to rise, making it ideal for bread, pizza, and pastries. Other types of flour, like corn or rice flour, are gluten-free, making them popular in gluten-free baking and cooking. Almond and coconut flours, rich in fats and fiber, are used in low-carb or paleo diets, offering unique flavors and textures to baked goods. Flour's thickening properties also make it indispensable in sauces, soups, and gravies, where it helps to create a smooth, consistent texture.

Additionally, flour's role in different cuisines and food traditions contributes to its versatility. In Italian cooking, flour is the base for pasta and pizza dough; in Asian cuisine, rice flour is a key ingredient in noodles and steamed buns. Flour also serves as a binding agent in foods like meatballs and coatings for fried dishes. Its adaptability across a wide range of culinary applications is why it remains a universal ingredient, central to global food production.

How Is Flour Shaping the Future of Food Innovation and Dietary Trends?

Flour is not just a traditional ingredient - it's also shaping the future of food innovation and dietary trends. One of the most significant ways flour is driving change is through the rise of alternative flours. As more consumers adopt gluten-free, low-carb, or plant-based diets, the demand for non-traditional flours has surged. Almond, coconut, chickpea, and other gluten-free flours are increasingly being used to create baked goods, snacks, and meal options that cater to specific dietary needs. These alternative flours not only provide a solution for people with gluten intolerance but also offer new textures and flavors, expanding the possibilities for culinary creativity.Sustainability is another area where flour is making an impact. The production of traditional wheat flour is resource-intensive, requiring significant amounts of water, land, and energy. In response, there has been growing interest in using more sustainable sources for flour production, such as legumes, pulses, and even insects. These alternatives are not only nutritionally dense but also have a lower environmental impact, supporting the global push toward more sustainable food systems. Additionally, whole grain and minimally processed flours are gaining popularity due to their higher nutritional content and health benefits, as consumers seek out foods that are both nutritious and environmentally friendly.

Flour is also playing a key role in the growing demand for plant-based and functional foods. As consumers become more health-conscious, there is an increased focus on foods that offer additional nutritional benefits. Flours made from seeds, legumes, and ancient grains like quinoa or amaranth are rich in protein, fiber, and micronutrients, making them popular choices in functional food products designed to promote health and wellness. As food innovation continues to evolve, the use of alternative and enriched flours is likely to expand, driving new trends in healthier, more sustainable eating.

What Factors Are Driving the Growth of the Flour Market?

Several key factors are driving the rapid growth of the flour market, reflecting broader trends in global food production, dietary preferences, and sustainability. One of the primary drivers is the increasing demand for gluten-free and specialty flours. As more people are diagnosed with celiac disease or choose to follow gluten-free diets for health reasons, the demand for flours made from alternative sources like rice, almonds, chickpeas, and coconut has surged. These gluten-free flours enable bakers and manufacturers to create high-quality products that cater to a growing segment of the market, contributing to the expansion of the flour industry.Another significant factor contributing to the growth of the flour market is the rising demand for convenience and processed foods. Flour is a key ingredient in a wide range of packaged foods, from bread and pasta to snacks and baked goods. As urbanization and busy lifestyles lead to greater reliance on convenient food products, the demand for flour-based products continues to rise. Flour's versatility allows manufacturers to create a broad range of processed foods that meet consumer needs for quick and easy meal solutions, driving the market's growth.

The trend toward healthier eating is also fueling the flour market. Consumers are increasingly seeking out whole grain, organic, and fortified flours that offer higher nutritional value than traditional refined flour. Whole grain flours, in particular, have become more popular as they retain the bran and germ, providing more fiber, vitamins, and minerals. Additionally, fortification with nutrients like iron and folic acid is helping to combat nutritional deficiencies, especially in developing regions. This shift toward health-conscious eating is driving the adoption of flours that support a more balanced and nutritious diet.

Lastly, sustainability and food security are becoming critical factors in the growth of the flour market. As the global population grows and resources become more limited, there is a growing need for sustainable agricultural practices and food production systems. Alternative flours made from legumes, pulses, or even insects offer a more sustainable option compared to traditional wheat flour, as they require fewer resources to produce. Moreover, the use of locally sourced grains and seeds for flour production helps reduce the carbon footprint associated with transportation. Together, these factors are driving the expansion of the flour market, positioning it as a key ingredient in the future of global food production, dietary innovation, and sustainability.

Report Scope

The report analyzes the Flour market, presented in terms of market value (USD). The analysis covers the key segments and geographic regions outlined below.- Segments: Segment (Wheat, Maize, Rice, Other Segments); End-Use (Bread & Bakery, Noodles & Pasta, Wafers, Crackers & Biscuits, Animal Feed, Other End-Uses).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Wheat Flour segment, which is expected to reach US$332.8 Billion by 2030 with a CAGR of 4.7%. The Maize Flour segment is also set to grow at 5.5% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $80.7 Billion in 2024, and China, forecasted to grow at an impressive 7.2% CAGR to reach $89.4 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Flour Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Flour Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Flour Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as ABF Ingredients Ltd., Archer Daniels Midland Company, Ardent Mills, Associated British Foods plc, Conagra Brands, Inc. and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 279 companies featured in this Flour market report include:

- ABF Ingredients Ltd.

- Archer Daniels Midland Company

- Ardent Mills

- Associated British Foods plc

- Conagra Brands, Inc.

- General Mills Inc.

- Hodgson Mill, Inc.

- ITC Limited

- Wilmar International Ltd.

- Grain Craft, Inc.

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- ABF Ingredients Ltd.

- Archer Daniels Midland Company

- Ardent Mills

- Associated British Foods plc

- Conagra Brands, Inc.

- General Mills Inc.

- Hodgson Mill, Inc.

- ITC Limited

- Wilmar International Ltd.

- Grain Craft, Inc.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 442 |

| Published | January 2026 |

| Forecast Period | 2024 - 2030 |

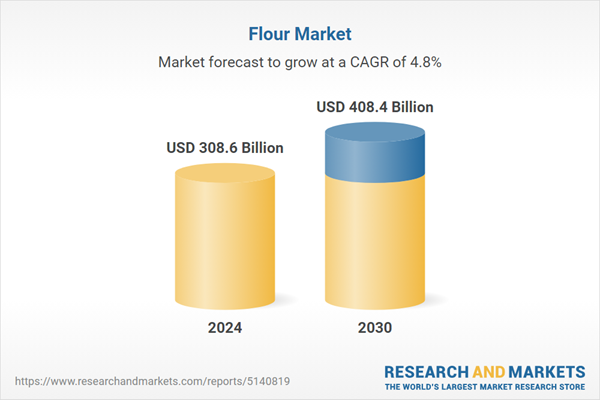

| Estimated Market Value ( USD | $ 308.6 Billion |

| Forecasted Market Value ( USD | $ 408.4 Billion |

| Compound Annual Growth Rate | 4.8% |

| Regions Covered | Global |