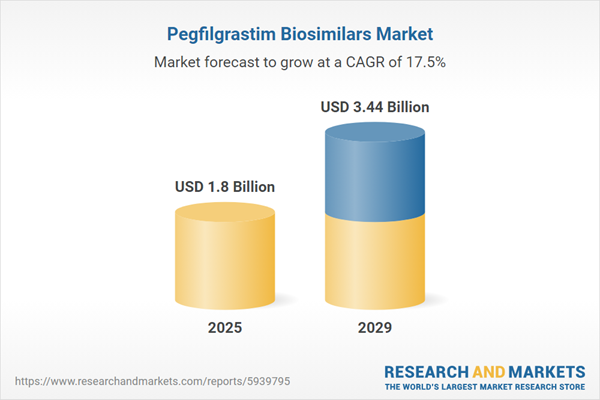

The pegfilgrastim biosimilars market size is expected to see rapid growth in the next few years. It will grow to $3.44 billion in 2029 at a compound annual growth rate (CAGR) of 17.5%. The growth in the forecast period can be attributed to increasing prevalence of cancer, aging population, increasing number of approvals, and targets and incentives. Major trends in the forecast period include taking advantage of the less stringent regulations to develop new and improved biosimilars, investing extensively in R&D activities for the development of effective and innovative biologics, focusing on establishing strategic partnerships with the large players to expand their research and developments activities in new drug developments and increasing their focus on M&A growth strategies to expand the customer base and their geographic markets, and increasing focus towards the production of biosimilars for neutropenia treatment to improve revenues and product offerings.

Government initiatives aimed at promoting the development of biosimilars are anticipated to be a driving force behind the pegfilgrastim biosimilars market. Governments on a global scale are prioritizing biosimilar development due to its cost-effectiveness. Initiatives such as the Biosimilar Action Plan launched by the US Food and Drug Administration (FDA) to expand treatment options and the commitment of the Australian government to the Biosimilar Awareness Initiative through a $5 million grant to support biosimilar education and activities highlight the concerted efforts to enhance awareness and production of biosimilars. These endeavors contribute to the overall growth of the pegfilgrastim biosimilars market.

The rising incidence of cancer is anticipated to drive the growth of the pegfilgrastim biosimilars market in the coming years. Cancer encompasses a range of diseases characterized by the uncontrolled proliferation and spread of abnormal cells. Pegfilgrastim biosimilars play a crucial role in mitigating the risk of infection among cancer patients undergoing chemotherapy by promoting white blood cell production. For example, in February 2024, the World Health Organization (WHO), a Switzerland-based intergovernmental organization, projected that by 2050, more than 35 million new cancer cases are expected, representing a 77% increase from the estimated 20 million cases reported in 2022. Thus, the increasing incidence of cancer is a key driver for the pegfilgrastim biosimilars market.

Companies operating in the pegfilgrastim biosimilar market are enhancing their product innovation through strategic collaborations. To thrive in the increasingly competitive market, these companies are not only developing innovative products but also leveraging partnerships to share skills and expertise. While collaborations with academic and research institutions have been a common practice, this trend has gained momentum in recent years. For example, in May 2023, Amneal Pharmaceuticals, a US-based generics and specialty pharmaceutical company, joined forces with Kashiv Biosciences, a US-based integrated biosciences company, to collaboratively develop and introduce Fylnetra (pegfilgrastim-pbbk), a biosimilar pegfilgrastim. Fylnetra is a preservative-free, clear solution provided in a 6 mg/0.6 mL single-dose prefilled syringe, aiming to reduce infection risks, specifically febrile neutropenia, in patients with non-myeloid cancers undergoing certain myelosuppressive anti-cancer treatments.

Major companies in the pegfilgrastim biosimilars market are introducing high-quality products such as Stimufend to offer improved alternatives. Stimufend, launched by Fresenius Kabi, a Germany-based healthcare company, in February 2023, is a therapeutic drug designed to assist cancer patients in addressing neutropenia. Available as a 6 mg/0.6 mL solution in a single-use pre-filled syringe with a built-in needle guard, Stimufend marks the company's entry into the U.S. biosimilars market for cancer care, providing healthcare professionals with a high-quality treatment alternative.

In February 2022, Biocon Biologics Ltd., an India-based fully integrated biopharmaceutical company, completed the acquisition of Viatris' biosimilar business for $3.34 billion. This strategic move enables Biocon Biologics to direct-market more of its existing and upcoming biosimilars. As part of the acquisition, Viatris, a US-based pharmaceutical and healthcare corporation, is expected to provide commercial and other transition services to ensure a smooth transition and maintain customer service for an anticipated two-year term.

Major companies operating in the pegfilgrastim biosimilars market include Amgen, Mylan N.V., Sandoz (a Novartis division), Teva Pharmaceutical Industries Ltd., Biocon, Pfizer, Celltrion Healthcare, Coherus BioSciences, Gedeon Richter, Fresenius Kabi, Hetero Labs, Intas Pharmaceuticals, LG Chem, Merck KGaA, Zydus Cadila, Aurobindo Pharma, Apotex Inc., Dr. Reddy's Laboratories, Stada Arzneimittel AG, Reddy's Laboratories, Shanghai Henlius Biotech, Alvotech, EirGenix, Bharat Biotech, Kye Pharmaceuticals, CinnaGen, Boryung Pharmaceutical, Sinopharm.

North America was the largest region in the pegfilgrastim biosimilars market in 2024. Middle East is expected to be the fastest growing region in the global pegfilgrastim biosimilars market share during the forecast period. The regions covered in the pegfilgrastim biosimilars market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, Africa. The countries covered in the pegfilgrastim biosimilars market report are Australia, Brazil, China, France, Germany, India, Indonesia, Japan, Russia, South Korea, UK, USA, Italy, Canada, Spain.

Pegfilgrastim biosimilars are biosimilar products designed to be used in conjunction with supportive care for individuals with non-myeloid cancer. These biosimilars aid in preventing or treating infections resulting from myelosuppressive chemotherapy by stimulating the production of specific white blood cells.

The diverse applications of pegfilgrastim biosimilars include their use in chemotherapy treatment, transplantation, and other medical scenarios. Chemotherapy is a cancer treatment method that involves the administration of one or more anti-cancer medications following a specified protocol. These biosimilars are made available through various distribution channels, including hospital pharmacies, retail pharmacies, and mail-order pharmacies.

The pegfilgrastim biosimilars market research report is one of a series of new reports that provides pegfilgrastim biosimilars market statistics, including pegfilgrastim biosimilars industry global market size, regional shares, competitors with a pegfilgrastim biosimilars market share, detailed pegfilgrastim biosimilars market segments, market trends and opportunities, and any further data you may need to thrive in the pegfilgrastim biosimilars industry. This pegfilgrastim biosimilars market research report delivers a complete perspective of everything you need, with an in-depth analysis of the current and future scenarios of the industry.

The pegfilgrastim biosimilars market consists of sales of fulphila, pelgraz, pelmeg, udenyca, ziextenzo, grasustek, fylnetra, and stimufend. Values in this market are 'factory gate values,' that is the value of goods sold by the manufacturers or creators of the goods, whether to other entities (including downstream manufacturers, wholesalers, distributors, and retailers) or directly to end customers. The value of goods in this market includes related services sold by the creators of the goods.

The market value is defined as the revenues that enterprises gain from the sale of goods and/or services within the specified market and geography through sales, grants, or donations in terms of the currency (in USD, unless otherwise specified).

The revenues for a specified geography are consumption values that are revenues generated by organizations in the specified geography within the market, irrespective of where they are produced. It does not include revenues from resales along the supply chain, either further along the supply chain or as part of other products.

This product will be delivered within 3-5 business days.

Table of Contents

Executive Summary

Pegfilgrastim Biosimilars Global Market Report 2025 provides strategists, marketers and senior management with the critical information they need to assess the market.This report focuses on pegfilgrastim biosimilars market which is experiencing strong growth. The report gives a guide to the trends which will be shaping the market over the next ten years and beyond.

Reasons to Purchase:

- Gain a truly global perspective with the most comprehensive report available on this market covering 15 geographies.

- Assess the impact of key macro factors such as conflict, pandemic and recovery, inflation and interest rate environment and the 2nd Trump presidency.

- Create regional and country strategies on the basis of local data and analysis.

- Identify growth segments for investment.

- Outperform competitors using forecast data and the drivers and trends shaping the market.

- Understand customers based on the latest market shares.

- Benchmark performance against key competitors.

- Suitable for supporting your internal and external presentations with reliable high quality data and analysis

- Report will be updated with the latest data and delivered to you along with an Excel data sheet for easy data extraction and analysis.

- All data from the report will also be delivered in an excel dashboard format.

Description

Where is the largest and fastest growing market for pegfilgrastim biosimilars? How does the market relate to the overall economy, demography and other similar markets? What forces will shape the market going forward? The pegfilgrastim biosimilars market global report answers all these questions and many more.The report covers market characteristics, size and growth, segmentation, regional and country breakdowns, competitive landscape, market shares, trends and strategies for this market. It traces the market’s historic and forecast market growth by geography.

- The market characteristics section of the report defines and explains the market.

- The market size section gives the market size ($b) covering both the historic growth of the market, and forecasting its development.

- The forecasts are made after considering the major factors currently impacting the market. These include:

- The forecasts are made after considering the major factors currently impacting the market. These include the Russia-Ukraine war, rising inflation, higher interest rates, and the legacy of the COVID-19 pandemic.

- Market segmentations break down the market into sub markets.

- The regional and country breakdowns section gives an analysis of the market in each geography and the size of the market by geography and compares their historic and forecast growth. It covers the growth trajectory of COVID-19 for all regions, key developed countries and major emerging markets.

- The competitive landscape chapter gives a description of the competitive nature of the market, market shares, and a description of the leading companies. Key financial deals which have shaped the market in recent years are identified.

- The trends and strategies section analyses the shape of the market as it emerges from the crisis and suggests how companies can grow as the market recovers.

Scope

Markets Covered:

1) By Application: Chemotherapy Treatment, Transplantation, Other Applications2) By Distribution Channel: Hospital Pharmacies, Retail Pharmacies, Mail-Order Pharmacies

Subsegments:

1) By Chemotherapy Treatment: Supportive Care for Cancer Patients; Reduction of Chemotherapy-Induced Neutropenia2) By Transplantation: Hematopoietic Stem Cell Transplantation; Peripheral Blood Stem Cell Transplantation

3) By Other Applications: Treatment of Chronic Neutropenia; Treatment of Severe Congenital Neutropenia; Other Supportive Therapies in Oncology

Key Companies Mentioned: Amgen; Mylan N.V.; Sandoz (a Novartis division); Teva Pharmaceutical Industries Ltd.; Biocon

Countries: Australia; Brazil; China; France; Germany; India; Indonesia; Japan; Russia; South Korea; UK; USA; Canada; Italy; Spain

Regions: Asia-Pacific; Western Europe; Eastern Europe; North America; South America; Middle East; Africa

Time Series: Five years historic and ten years forecast.

Data: Ratios of market size and growth to related markets, GDP proportions, expenditure per capita.

Data Segmentation: Country and regional historic and forecast data, market share of competitors, market segments.

Sourcing and Referencing: Data and analysis throughout the report is sourced using end notes.

Delivery Format: PDF, Word and Excel Data Dashboard.

Companies Mentioned

- Amgen

- Mylan N.V.

- Sandoz (a Novartis division)

- Teva Pharmaceutical Industries Ltd.

- Biocon

- Pfizer

- Celltrion Healthcare

- Coherus BioSciences

- Gedeon Richter

- Fresenius Kabi

- Hetero Labs

- Intas Pharmaceuticals

- LG Chem

- Merck KGaA

- Zydus Cadila

- Aurobindo Pharma

- Apotex Inc.

- Dr. Reddy's Laboratories

- Stada Arzneimittel AG

- Reddy's Laboratories

- Shanghai Henlius Biotech

- Alvotech

- EirGenix

- Bharat Biotech

- Kye Pharmaceuticals

- CinnaGen

- Boryung Pharmaceutical

- Sinopharm

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 250 |

| Published | March 2025 |

| Forecast Period | 2025 - 2029 |

| Estimated Market Value ( USD | $ 1.8 Billion |

| Forecasted Market Value ( USD | $ 3.44 Billion |

| Compound Annual Growth Rate | 17.5% |

| Regions Covered | Global |

| No. of Companies Mentioned | 28 |