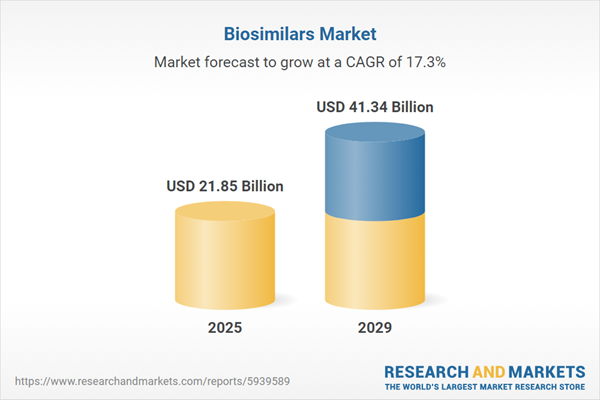

The biosimilars market size is expected to see rapid growth in the next few years. It will grow to $41.34 billion in 2029 at a compound annual growth rate (CAGR) of 17.3%. The growth in the forecast period can be attributed to the increasing prevalence of cancer, increasing demand for prophylaxis with granulocyte colony-stimulating factor (G-CSF), a rise in healthcare expenditure, high potential of emerging economies, technology advances, high penetration of biological drugs, aging population and an increase in healthcare access will drive the growth. Major trends in the forecast period include a focus on robust R&D activities for the development of effective and innovative drugs, on focus on M&A growth strategies, a focus on establishing strategic partnerships, a focus on increasing investments, and a focus on artificial intelligence.

The forecast of 17.3% growth over the next five years reflects a modest reduction of 0.4% from the previous estimate for this market. This reduction is primarily due to the impact of tariffs between the US and other countries. Trade tensions could hinder U.S. healthcare systems by inflating prices of biosimilars manufactured in Ireland and Singapore, resulting in restricted formulary options and higher overall pharmaceutical expenditures. The effect will also be felt more widely due to reciprocal tariffs and the negative effect on the global economy and trade due to increased trade tensions and restrictions.

The biosimilars market is anticipated to witness significant growth due to the escalating prevalence of chronic diseases such as arthritis, asthma, and cancer. Factors such as prolonged work hours, limited physical activity, and unhealthy lifestyle choices contribute to the increased occurrence of these conditions, for which biosimilars are increasingly becoming a preferred treatment option. Biosimilars play a crucial role in stimulating the immune system response against cancer cells, aiding in their elimination from the body. As per a United Nations projection, by 2030, chronic diseases are estimated to account for around 70% of global deaths, with the global burden of chronic disease expected to reach approximately 60%. Consequently, this upsurge in chronic disease prevalence is set to drive the demand for biosimilars, consequently propelling the biosimilars market.

The rise in healthcare expenditures is anticipated to drive the growth of the biosimilars market in the future. Healthcare expenditures refer to the overall spending on healthcare goods and services within a specific population or healthcare system. The biosimilars market contributes to reducing healthcare expenditures by providing more affordable alternatives to costly biologic drugs, which helps lower treatment costs for patients and healthcare systems. For example, in March 2024, the Health Foundation, a UK-based independent charity and think tank, reported that total health expenditures in England reached £182 billion ($196.78 billion) in the last confirmed year of spending data, 2022/23. Although planned health spending is projected to increase to £192 billion ($207.59 billion) in 2024/25, inflation is expected to result in only a modest real-term increase of 0.6% compared to the fiscal year 2023/24. Thus, the growing healthcare expenditures are fueling the expansion of the biosimilars market.

Key players in the biosimilars market are heavily invested in pioneering innovative products to establish a competitive edge. Notably, AMJEVITA marks a significant milestone as the inaugural U.S. biosimilar to Humira, a medication relied upon by over a million patients managing severe inflammatory conditions. In January 2023, Amgen Inc., a prominent biotechnology company, introduced AMJEVITA (adalimumab-atto) into the U.S. market. This biosimilar, available at 55% and 5% below the list price of Humira, offers patients a more cost-effective option.

Major companies within the biosimilars domain persist in crafting novel solutions. FYLNETRA represents a leap forward as a leukocyte growth factor designed to lower infection incidence, particularly febrile neutropenia, in patients with non-myeloid malignancies undergoing myelosuppressive anti-cancer treatments. In May 2023, Amneal Pharmaceuticals Inc., a distinguished pharmaceutical entity, launched the commercial debut of FYLNETRA (pegfilgrastim-pbbk), a Neulasta-referenced biosimilar delivered in a pre-filled single-dose syringe. FYLNETRA aims to address neutropenia, commonly experienced by chemotherapy patients, presenting a significant advancement in biosimilar-based treatments.

In November 2022, Biocon Biologics Ltd., an Indian biopharmaceutical company, announced the acquisition of Viatris Inc.'s biosimilars business for $3 billion. This strategic move aims to enhance Biocon Biologics' proximity to patients, customers, and payors by providing direct commercial capabilities and supporting infrastructure in advanced countries and various emerging regions. The merger combines Viatris' acquired global biosimilars business with Biocon Biologics' existing capabilities in research and development, global-scale manufacturing, and commercialization. Viatris Inc. is a US-based pharmaceutical company specializing in the development, licensing, manufacturing, marketing, and distribution of generic and branded medicines.

Major companies operating in the biosimilars market include Amgen, Novartis AG, Samsung Bioepis Co., Ltd., Viatris, Celltrion, Inc., Coherus Biosciences, Eli Lilly and Company, Dr. Reddy's Laboratories, Roche India Pvt Ltd, Abbott India Limited, bioMérieux India, Becton Dickinson Private Limited, Danaher Corporation, Wuxi biologics, shanghai Henlius biotech, Innovent Biologics, Hisun Pharma, 3SBio, Beijing ShuangLu Pharmaceuticals, Qilu Pharmaceutical, Kyowa Hakko Kirin, Takeda, Mitsubishi Tanabe, AGC Biologics, Bio-Thera, Sandoz Pty Ltd, Apotex Pty Ltd, Cadila Pharmaceuticals, BiosanaPharma, GlaxoSmithKline, AstraZeneca, Bayer, Merck, Boehringer Ingelheim, Sanofi, Fresenius Kabi, Napp Pharmaceuticals, Mundipharma Deutschland GmbH & Co. KG, Geropharm, Valenta, NovaMedica, SynBio, Rani Therapeutics, Johnson & Johnson, Biogen Inc., Aché, Eurofarma, Teva Pharmaceuticals, Oramed Pharmaceuticals, Entera Bio, Julphar, Hikma Pharmaceuticals, BIOPHARMA-MEA, NeoTX, AID Genomics Limited, Altis Biologics, Cipla Medpro South Africa, Next Biosciences, Viome, Inqaba Biotechnical Industries (Pty)

North America was the largest region in the global biosimilars market in 2024. Middle East is expected to be the fastest-growing region in the forecast period. The regions covered in the biosimilars market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, Africa. The countries covered in the biosimilars market report are Australia, Brazil, China, France, Germany, India, Indonesia, Japan, Russia, South Korea, UK, USA, Italy, Canada, Spain.

Note that the outlook for this market is being affected by rapid changes in trade relations and tariffs globally. The report will be updated prior to delivery to reflect the latest status, including revised forecasts and quantified impact analysis. The report’s Recommendations and Conclusions sections will be updated to give strategies for entities dealing with the fast-moving international environment.

The sudden escalation of U.S. tariffs and the resulting trade tensions in spring 2025 are having a significant impact on the pharmaceutical sector. Companies are grappling with higher costs on imported active pharmaceutical ingredients (APIs), glass vials, and laboratory equipment - many of which have limited alternative sources. Generic drug manufacturers, already operating with minimal profit margins, are particularly affected, with some scaling back production of low-margin medications. Biotech firms are also experiencing delays in clinical trials due to shortages of specialized reagents linked to tariffs. In response, the industry is shifting API production to regions like India and Europe, building up inventory reserves, and advocating for tariff exemptions on essential medicines.

The biosimilars market research report is one of a series of new reports that provides biosimilars market statistics, including biosimilars industry global market size, regional shares, competitors with a biosimilars market share, detailed biosimilars market segments, market trends, and opportunities, and any further data you may need to thrive in the biosimilars industry. This biosimilars market research report delivers a complete perspective of everything you need, with an in-depth analysis of the current and future scenarios of the industry.

Biosimilars are medications made from living things, though they can be made in a variety of ways and with slightly different materials. Due to the intricacy and high cost of their creation, as well as their molecular size and structure, biosimilars are fundamentally distinct from generic drugs.

The main types of biosimilars are human growth hormone, erythropoietin, monoclonal antibodies, insulin, interferon, granulocyte-colony stimulating factor, and others. Erythropoietin is a hormone produced by the kidneys to stimulate the production and maintenance of vital red blood cells. The various products include recombinant non-glycosylated proteins and recombinant glycosylated proteins that are used for the treatment of oncology, chronic and autoimmune diseases, growth hormone deficiency, infectious diseases, and others.

The biosimilars market consists of sales of binocrit, epoetin alfa hexal, and abseamed. Values in this market are factory gate values, that is the value of goods sold by the manufacturers or creators of the goods, whether to other entities (including downstream manufacturers, wholesalers, distributors, and retailers) or directly to end customers. The value of goods in this market includes related services sold by the creators of the goods.

The market value is defined as the revenues that enterprises gain from the sale of goods and/or services within the specified market and geography through sales, grants, or donations in terms of the currency (in USD, unless otherwise specified).

The revenues for a specified geography are consumption values that are revenues generated by organizations in the specified geography within the market, irrespective of where they are produced. It does not include revenues from resales along the supply chain, either further along the supply chain or as part of other products.

This product will be delivered within 1-3 business days.

Table of Contents

Executive Summary

Biosimilars Global Market Report 2025 provides strategists, marketers and senior management with the critical information they need to assess the market.This report focuses on biosimilars market which is experiencing strong growth. The report gives a guide to the trends which will be shaping the market over the next ten years and beyond.

Reasons to Purchase:

- Gain a truly global perspective with the most comprehensive report available on this market covering 15 geographies.

- Assess the impact of key macro factors such as geopolitical conflicts, trade policies and tariffs, post-pandemic supply chain realignment, inflation and interest rate fluctuations, and evolving regulatory landscapes.

- Create regional and country strategies on the basis of local data and analysis.

- Identify growth segments for investment.

- Outperform competitors using forecast data and the drivers and trends shaping the market.

- Understand customers based on the latest market shares.

- Benchmark performance against key competitors.

- Suitable for supporting your internal and external presentations with reliable high quality data and analysis

- Report will be updated with the latest data and delivered to you along with an Excel data sheet for easy data extraction and analysis.

- All data from the report will also be delivered in an excel dashboard format.

Description

Where is the largest and fastest growing market for biosimilars? How does the market relate to the overall economy, demography and other similar markets? What forces will shape the market going forward, including technological disruption, regulatory shifts, and changing consumer preferences? The biosimilars market global report answers all these questions and many more.The report covers market characteristics, size and growth, segmentation, regional and country breakdowns, competitive landscape, market shares, trends and strategies for this market. It traces the market’s historic and forecast market growth by geography.

- The market characteristics section of the report defines and explains the market.

- The market size section gives the market size ($b) covering both the historic growth of the market, and forecasting its development.

- The forecasts are made after considering the major factors currently impacting the market. These include: the technological advancements such as AI and automation, Russia-Ukraine war, trade tariffs (government-imposed import/export duties), elevated inflation and interest rates.

- Market segmentations break down the market into sub markets.

- The regional and country breakdowns section gives an analysis of the market in each geography and the size of the market by geography and compares their historic and forecast growth.

- The competitive landscape chapter gives a description of the competitive nature of the market, market shares, and a description of the leading companies. Key financial deals which have shaped the market in recent years are identified.

- The trends and strategies section analyses the shape of the market as it emerges from the crisis and suggests how companies can grow as the market recovers.

Scope

Markets Covered:

1) By Type: Monoclonal Antibodies, Insulin, Erythropoietin, Granulocyte-Colony Stimulating Factor, Other Hormones, Others2) By Product: Recombinant Non-glycosylated Proteins, Recombinant Glycosylated Proteins

3) By Application: Oncology, Chronic and Autoimmune Diseases, Growth Hormone Deficiency, Infectious Diseases, Other Applications

Subsegments:

1) By Monoclonal Antibodies: IgG Biosimilars; Non-IgG Biosimilars2) By Insulin: Rapid-Acting Insulin Biosimilars; Long-Acting Insulin Biosimilars; Premixed Insulin Biosimilars

3) By Erythropoietin: Epoetin Alfa Biosimilars; Darbepoetin Alfa Biosimilars

4) By Granulocyte-Colony Stimulating Factor (G-CSF): Filgrastim Biosimilars; Pegfilgrastim Biosimilars

5) By Other Hormones: Growth Hormones; Hormonal Replacement Therapy Biosimilars

6) By Others: Enzyme Biosimilars; Vaccines; Other Biologics

Companies Mentioned: Amgen; Novartis AG; Samsung Bioepis Co., Ltd.; Viatris; Celltrion, Inc.; Coherus Biosciences; Eli Lilly and Company; Dr. Reddy's Laboratories; Roche India Pvt Ltd; Abbott India Limited; bioMérieux India; Becton Dickinson Private Limited; Danaher Corporation; Wuxi biologics; shanghai Henlius biotech; Innovent Biologics; Hisun Pharma; 3SBio; Beijing ShuangLu Pharmaceuticals; Qilu Pharmaceutical; Kyowa Hakko Kirin; Takeda; Mitsubishi Tanabe; AGC Biologics; Bio-Thera; Sandoz Pty Ltd; Apotex Pty Ltd; Cadila Pharmaceuticals; BiosanaPharma; GlaxoSmithKline; AstraZeneca; Bayer; Merck; Boehringer Ingelheim; Sanofi; Fresenius Kabi; Napp Pharmaceuticals; Mundipharma Deutschland GmbH & Co. KG; Geropharm; Valenta; NovaMedica; SynBio; Rani Therapeutics; Johnson & Johnson; Biogen Inc.; Aché; Eurofarma; Teva Pharmaceuticals; Oramed Pharmaceuticals; Entera Bio; Julphar; Hikma Pharmaceuticals; BIOPHARMA-MEA; NeoTX; AID Genomics Limited; Altis Biologics; Cipla Medpro South Africa; Next Biosciences; Viome; Inqaba Biotechnical Industries (Pty)

Countries: Australia; Brazil; China; France; Germany; India; Indonesia; Japan; Russia; South Korea; UK; USA; Canada; Italy; Spain

Regions: Asia-Pacific; Western Europe; Eastern Europe; North America; South America; Middle East; Africa

Time Series: Five years historic and ten years forecast.

Data: Ratios of market size and growth to related markets, GDP proportions, expenditure per capita.

Data Segmentation: Country and regional historic and forecast data, market share of competitors, market segments.

Sourcing and Referencing: Data and analysis throughout the report is sourced using end notes.

Delivery Format: PDF, Word and Excel Data Dashboard.

Companies Mentioned

The companies featured in this Biosimilars market report include:- Amgen

- Novartis AG

- Samsung Bioepis Co., Ltd.

- Viatris

- Celltrion, Inc.

- Coherus Biosciences

- Eli Lilly and Company

- Dr. Reddy's Laboratories

- Roche India Pvt Ltd

- Abbott India Limited

- bioMérieux India

- Becton Dickinson Private Limited

- Danaher Corporation

- Wuxi biologics

- shanghai Henlius biotech

- Innovent Biologics

- Hisun Pharma

- 3SBio

- Beijing ShuangLu Pharmaceuticals

- Qilu Pharmaceutical

- Kyowa Hakko Kirin

- Takeda

- Mitsubishi Tanabe

- AGC Biologics

- Bio-Thera

- Sandoz Pty Ltd

- Apotex Pty Ltd

- Cadila Pharmaceuticals

- BiosanaPharma

- GlaxoSmithKline

- AstraZeneca

- Bayer

- Merck

- Boehringer Ingelheim

- Sanofi

- Fresenius Kabi

- Napp Pharmaceuticals

- Mundipharma Deutschland GmbH & Co. KG

- Geropharm

- Valenta

- NovaMedica

- SynBio

- Rani Therapeutics

- Johnson & Johnson

- Biogen Inc.

- Aché

- Eurofarma

- Teva Pharmaceuticals

- Oramed Pharmaceuticals

- Entera Bio

- Julphar

- Hikma Pharmaceuticals

- BIOPHARMA-MEA

- NeoTX

- AID Genomics Limited

- Altis Biologics

- Cipla Medpro South Africa

- Next Biosciences

- Viome

- Inqaba Biotechnical Industries (Pty)

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 250 |

| Published | September 2025 |

| Forecast Period | 2025 - 2029 |

| Estimated Market Value ( USD | $ 21.85 Billion |

| Forecasted Market Value ( USD | $ 41.34 Billion |

| Compound Annual Growth Rate | 17.3% |

| Regions Covered | Global |

| No. of Companies Mentioned | 61 |