Global Agricultural Fumigants Market - Key Trends and Drivers Summarized

Why Are Agricultural Fumigants Crucial for Modern Farming?

Agricultural fumigants are indispensable in modern farming as they provide an effective means to control pests, diseases, and soil-borne pathogens, which can severely reduce crop yields and compromise the quality of agricultural products. Fumigants are primarily used in two key phases: pre-harvest, where they are applied to the soil to eliminate pests before planting, and post-harvest, where they ensure the preservation of stored products like grains, fruits, and vegetables. These chemicals work by penetrating deep into the soil or enclosed storage spaces, targeting a wide range of insects, nematodes, fungi, and bacteria that conventional pesticides might not reach. Fumigants such as methyl bromide, phosphine, and chloropicrin are particularly valued for their ability to control large infestations in a short period, without requiring direct contact with the pests. In high-value crops such as nuts, grapes, and grains, where pest infestations can lead to significant economic losses, fumigation ensures that the produce remains free from contamination and safe for human consumption. Moreover, in international trade, agricultural fumigants are critical for meeting the stringent phytosanitary requirements imposed by importing countries, as untreated goods may be refused entry due to pest contamination. Thus, fumigants have become a cornerstone of both domestic farming and global agricultural commerce.What Are the Main Concerns Surrounding the Use of Fumigants?

Despite their widespread use and effectiveness, agricultural fumigants pose several significant concerns, particularly regarding environmental safety and human health. The toxicity of many fumigants means that improper application or handling can have severe consequences. Chemicals such as methyl bromide, once widely used, have been phased out due to their adverse effects on the ozone layer. Its replacement by other fumigants like sulfuryl fluoride and phosphine, while less harmful to the environment, still raises concerns because of their high toxicity and volatility. Inhalation of fumigant vapors can cause respiratory issues, neurological damage, and in extreme cases, fatalities, especially for farm workers and communities living near treated areas. Moreover, fumigants can contribute to soil and groundwater contamination, as residual chemicals leach into the environment, potentially affecting wildlife and ecosystems. To mitigate these risks, governments and regulatory bodies have implemented strict guidelines for the use of fumigants, including the mandatory use of protective equipment, buffer zones around treated areas, and restrictions on their application during certain weather conditions to minimize drift. Additionally, growing consumer awareness regarding food safety and environmental sustainability has intensified the demand for safer and more eco-friendly pest control alternatives, pressuring the agricultural sector to seek out less hazardous options.How Is Technology Shaping the Future of Agricultural Fumigation?

Technological advancements are playing a transformative role in the evolution of agricultural fumigation, making the process more precise, efficient, and environmentally responsible. One of the most significant technological developments in recent years is the advent of precision fumigation techniques. These methods allow for the targeted application of fumigants in controlled environments, significantly reducing waste and the risk of unintended environmental exposure. Fumigation tunnels and controlled-release systems are examples of such innovations, as they ensure that chemicals are applied only where needed, minimizing the quantity used while maximizing effectiveness. In addition, modern monitoring systems that utilize sensors and automation technology can track the fumigation process in real-time, adjusting the dosage and environmental conditions to ensure optimal results. These systems not only improve safety by reducing human exposure but also enhance the efficacy of the fumigation process by maintaining consistent conditions. Another area of progress is the development of bio-based and biodegradable fumigants, which are derived from natural materials and are less harmful to the environment. These innovations are gaining traction, particularly in organic farming, where synthetic chemicals are prohibited. Additionally, advancements in drone and robotic technologies are enabling the application of fumigants in previously inaccessible areas, enhancing pest control in large or complex terrains. These technological shifts highlight a broader industry trend toward integrating sustainability with the need for effective pest management solutions.What Is Driving Growth in the Agricultural Fumigants Market?

The growth in the agricultural fumigants market is driven by several factors, including evolving technological advancements, shifts in consumer behavior, and the increasing scale of agricultural operations. One of the primary drivers is the rising global demand for high-quality, pest-free agricultural produce. As international trade expands, particularly in developing regions, the need for phytosanitary measures that meet the regulatory standards of importing countries has intensified. This has led to a surge in the use of fumigants to ensure that crops remain free of pests and diseases throughout their storage and transport. Furthermore, the trend toward longer storage periods, necessitated by global supply chains and fluctuating market demands, has increased the need for reliable post-harvest pest control solutions, further boosting the demand for fumigants. Technological innovations, such as the development of safer, more environmentally friendly fumigants and precision application technologies, are also fueling market growth by addressing safety and sustainability concerns. These advancements have made fumigation more accessible to a broader range of farmers, particularly in regions where environmental regulations are becoming stricter. Additionally, the rise of organic and eco-conscious farming practices has opened up new avenues for bio-based fumigants, which appeal to farmers looking to meet consumer demands for sustainably produced food. Lastly, global concerns about food security, exacerbated by climate change and population growth, are driving governments and agricultural sectors to invest in more effective pest control measures, ensuring that crops can be stored and transported without loss, ultimately contributing to the growing demand for agricultural fumigants.Report Scope

The report analyzes the Agricultural Fumigants market, presented in terms of market value (US$ Thousand). The analysis covers the key segments and geographic regions outlined below.- Segments: Product (Phosphine, Chloropicrin, Metam Sodium, 1,3 Dichloropropene, Metam Potassium, Dimethyl Disulfide, Methyl Bromide, Other Products); Application (Warehouse, Soil).

- Geographic Regions/Countries:World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Phosphine segment, which is expected to reach US$990.2 Million by 2030 with a CAGR of a 5.9%. The Chloropicrin segment is also set to grow at 4.1% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $677.3 Million in 2024, and China, forecasted to grow at an impressive 7.4% CAGR to reach $763.2 Million by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Agricultural Fumigants Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Agricultural Fumigants Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Agricultural Fumigants Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

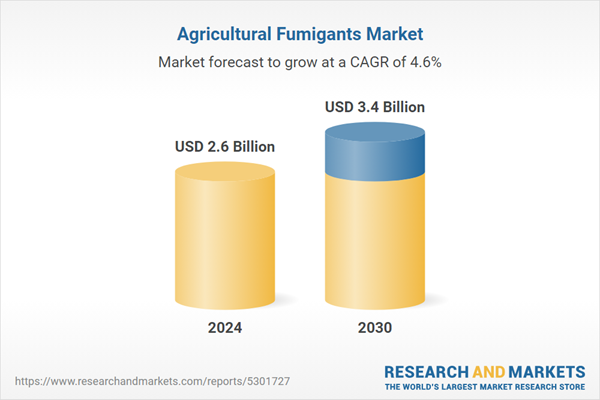

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as ADAMA, AMVAC Chemical Corporation, Arkema, Arysta LifeScience Limited, BASF SE and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 37 companies featured in this Agricultural Fumigants market report include:

- ADAMA

- AMVAC Chemical Corporation

- Arkema

- Arysta LifeScience Limited

- BASF SE

- Bayer CropScience AG

- Chemtura Corporation

- FMC

- Great Lakes Solutions

- Novozymes

- Nufarm

- Syngenta AG

- The Dow Chemical Company

- Trinity Manufacturing, Inc.

- UPL

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- ADAMA

- AMVAC Chemical Corporation

- Arkema

- Arysta LifeScience Limited

- BASF SE

- Bayer CropScience AG

- Chemtura Corporation

- FMC

- Great Lakes Solutions

- Novozymes

- Nufarm

- Syngenta AG

- The Dow Chemical Company

- Trinity Manufacturing, Inc.

- UPL

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 286 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 2.6 Billion |

| Forecasted Market Value ( USD | $ 3.4 Billion |

| Compound Annual Growth Rate | 4.6% |

| Regions Covered | Global |