Global Home Pregnancy Tests (HPT) Market - Key Trends and Drivers Summarized

What Is a Home Pregnancy Test and How Does It Work?

Home pregnancy tests (HPTs) have fundamentally changed the way people confirm pregnancies, allowing women to test in the privacy and convenience of their homes. But how exactly do these tests function? At the core of HPTs is their ability to detect human chorionic gonadotropin (hCG), a hormone that the body produces after a fertilized egg attaches to the uterine lining. This hormone first appears in the urine within days of implantation and increases rapidly as pregnancy progresses. Home pregnancy tests typically consist of absorbent tips that come into contact with urine, where they react with chemicals designed to detect the presence of hCG. The results are usually displayed in various forms - simple lines, plus or minus signs, or digital messages such as 'pregnant' or 'not pregnant.' Modern tests have become so advanced that they can detect pregnancy several days before a missed period, with sensitivity levels ranging from 20 to 50 milli-international units per milliliter (mIU/mL). This early detection capability, combined with the speed and accuracy of the results, makes HPTs a reliable first step in pregnancy detection for millions of people worldwide.How Reliable Are Home Pregnancy Tests, and What Could Affect Their Accuracy?

When it comes to reliability, home pregnancy tests are generally very accurate, but several factors can influence their effectiveness. Most HPTs boast an accuracy rate of up to 99% when used correctly, but the timing of the test is critical. For instance, taking a test too early - before hCG levels have risen sufficiently - can result in a false negative, even if conception has occurred. Additionally, factors such as consuming large amounts of liquids before taking the test can dilute urine and lower the concentration of hCG, making detection more difficult. False positives, though rarer, can occur due to certain medical conditions like ovarian cysts or medications containing hCG. In some cases, a recent miscarriage or birth can leave residual hCG in the body, which might also lead to a misleading result. However, technological advances in testing have mitigated many of these risks. Digital HPTs equipped with smart sensors provide more accurate readings by interpreting results automatically, eliminating the subjectivity of reading faint lines. These innovations, coupled with better user instructions, have made modern HPTs highly dependable for home use, reducing the need for repeated testing or medical confirmation.Why Are Home Pregnancy Tests Becoming the Go-To Option for Consumers?

Why do more people choose home pregnancy tests over clinical alternatives? Convenience and privacy play significant roles in this shift. Home pregnancy tests enable individuals to confirm a pregnancy in the comfort of their own homes, bypassing the need for doctor visits, lab appointments, or waiting for results from a clinic. This is particularly appealing for those seeking immediate answers without the added stress of scheduling medical appointments. Moreover, HPTs are widely available and relatively inexpensive, making them accessible to a broad demographic. From pharmacy shelves to online platforms, they can be purchased easily, ensuring that anyone can perform the test at their convenience. The affordability of these tests compared to the cost of a clinical pregnancy test further drives their popularity. This ease of access is supported by the ongoing societal shift towards more personal control over healthcare decisions. As individuals become more proactive about their reproductive health, they seek products that give them autonomy over their bodies without unnecessary medical intervention. In addition, the availability of different types of HPTs, from basic manual tests to high-tech digital versions that provide clearer, more definitive results, means that consumers can choose products based on their personal preferences and needs.What Is Driving the Growth of the Home Pregnancy Test Market?

The growth in the home pregnancy test market is driven by several factors that reflect technological advancements, shifting consumer expectations, and expanding access to healthcare products. One of the primary drivers is the continuous innovation in digital pregnancy tests, which offer increased sensitivity and precision. These tests not only detect pregnancy earlier than ever before but also present results in a user-friendly digital format, reducing the possibility of misinterpretation that often arises with traditional line-based tests. Another significant factor is the growing demand for more personalized and private healthcare solutions. Consumers today are more inclined to take charge of their health, preferring at-home solutions that allow them to manage their reproductive health independently. This trend towards privacy and convenience has led to a surge in HPT sales, especially as awareness around family planning and reproductive health increases globally. Furthermore, the rise of e-commerce has dramatically expanded the availability of home pregnancy tests, particularly in regions where access to healthcare facilities is limited. Online retail platforms make it easy for consumers to discreetly purchase HPTs, further driving market growth. The increasing awareness of environmentally sustainable products has also spurred the development of eco-friendly and reusable HPTs, appealing to environmentally-conscious consumers and contributing to market expansion. Overall, the home pregnancy test market is set for continued growth, propelled by these advancements in technology, changing consumer behavior, and improved access to health products across diverse populations.Report Scope

The report analyzes the Home Pregnancy Tests (HPT) market, presented in terms of market value (US$ Thousand). The analysis covers the key segments and geographic regions outlined below.- Segments: Type (Digital Devices, Strips / Dip Sticks & Cards, Line Indicators, Other Types); Distribution Channel (Pharmacies, Drug Stores, Online, Other Distribution Channels).

- Geographic Regions/Countries:World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Digital Devices segment, which is expected to reach US$597.6 Million by 2030 with a CAGR of a 7.1%. The Strips / Dip Sticks & Cards segment is also set to grow at 6% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $307.7 Million in 2024, and China, forecasted to grow at an impressive 9.8% CAGR to reach $348.3 Million by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Home Pregnancy Tests (HPT) Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Home Pregnancy Tests (HPT) Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Home Pregnancy Tests (HPT) Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

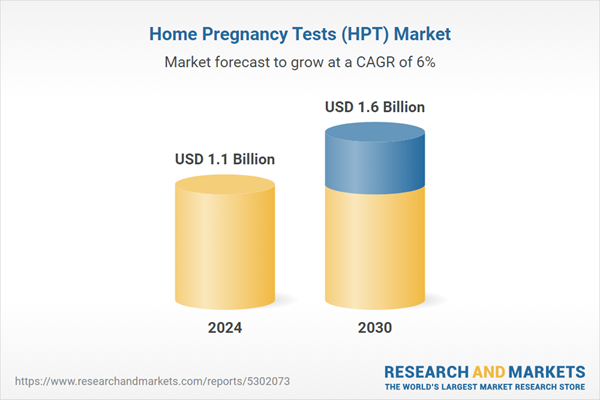

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Alere Inc., Cardinal Health, Confirm Biosciences, Piramal Enterprises, Prestige Brands Holdings, Inc. and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 42 companies featured in this Home Pregnancy Tests (HPT) market report include:

- Alere Inc.

- Cardinal Health

- Confirm Biosciences

- Piramal Enterprises

- Prestige Brands Holdings, Inc.

- Procter & Gamble Co.

- Quidel Corporation

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Alere Inc.

- Cardinal Health

- Confirm Biosciences

- Piramal Enterprises

- Prestige Brands Holdings, Inc.

- Procter & Gamble Co.

- Quidel Corporation

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 285 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 1.1 Billion |

| Forecasted Market Value ( USD | $ 1.6 Billion |

| Compound Annual Growth Rate | 6.0% |

| Regions Covered | Global |