Global Gas Purifiers Market - Key Trends and Drivers Summarized

What Are Gas Purifiers and Why Are They Indispensable for Critical Operations?

Gas purifiers are specialized devices used to remove contaminants and impurities from gases, ensuring that the gas supplied to sensitive processes meets stringent purity requirements. These devices are crucial in industries like semiconductor manufacturing, pharmaceuticals, chemical processing, and research laboratories, where even trace amounts of impurities can lead to costly defects, compromised product quality, or inaccurate experimental results. Gas purifiers are typically integrated into gas delivery systems and use a variety of purification techniques, including chemical absorption, catalytic conversion, adsorption on molecular sieves, and cryogenic trapping, depending on the specific contaminants and desired purity levels. For example, semiconductor fabrication requires ultra-high purity gases, such as hydrogen and nitrogen, that are free from oxygen, moisture, and hydrocarbons to prevent damage to delicate wafers during deposition and etching processes. In other industries, such as healthcare and pharmaceuticals, gas purifiers are used to ensure the integrity of medical gases, removing any potential contaminants that could affect patient safety or drug synthesis. Given the critical nature of their applications, gas purifiers are engineered to operate with high reliability, precision, and efficiency, often equipped with real-time monitoring systems that provide continuous verification of gas quality.How Are Gas Purifiers Adapting to Meet the Complex Demands of Modern Industry?

The design and functionality of gas purifiers have evolved significantly to keep pace with the increasing complexity and precision required in modern industrial applications. One of the key trends is the development of compact and modular gas purification systems, which provide greater flexibility and scalability for industries with varying gas purity needs. These modular systems allow users to configure and expand their purification setups as requirements change, making them ideal for research laboratories, pilot plants, and production facilities that need to adapt quickly to new processes or production scales. Another major advancement is the integration of smart technology, such as digital controllers and IoT connectivity, which enables real-time monitoring of gas purity, flow rates, and pressure levels. This digital integration allows for remote control, predictive maintenance, and automated performance optimization, reducing the risk of system failures and ensuring consistent gas quality. Additionally, manufacturers are focusing on the development of purifiers capable of removing a broader range of contaminants, including volatile organic compounds (VOCs), sulfur compounds, and particulates, using advanced filtration and catalytic materials. The demand for high-efficiency purifiers that minimize energy consumption and operational costs is also driving innovations in materials and design. For instance, new purification media, such as high-capacity sorbents and enhanced molecular sieves, are being developed to increase the lifespan of purification cartridges and reduce the frequency of maintenance. Furthermore, sustainability is becoming a critical consideration, with manufacturers exploring eco-friendly materials and designing purifiers that minimize waste and environmental impact.What Technological Innovations Are Defining the Future of Gas Purifiers?

The future of gas purifiers is being shaped by a series of cutting-edge technological advancements aimed at improving their efficiency, selectivity, and environmental sustainability. One of the most notable innovations is the development of advanced catalytic materials and sorbents that offer higher adsorption capacities and faster reaction times. These materials, such as nanostructured catalysts and metal-organic frameworks (MOFs), provide a larger surface area for contaminant capture, allowing purifiers to achieve ultra-high purity levels with greater efficiency. Another key breakthrough is the use of regenerative purification systems that can automatically restore the adsorbent media without requiring manual replacement. This technology is particularly beneficial for industries with continuous gas flow requirements, such as semiconductor manufacturing and industrial gas production, where system downtime can be extremely costly. Additionally, advancements in gas sensing and monitoring technologies are enabling real-time analysis of gas purity with unprecedented accuracy. Miniaturized sensors and laser-based analyzers can detect trace contaminants down to parts per billion (ppb) levels, providing early warning of contamination and enabling immediate corrective actions. The integration of AI and machine learning algorithms is further enhancing the functionality of gas purifiers by optimizing operating conditions, predicting the need for media replacement, and fine-tuning purification parameters to maximize efficiency. Moreover, the rise of hybrid purification systems, which combine multiple purification methods - such as cryogenic trapping, catalytic conversion, and pressure swing adsorption - is expanding the range of applications for gas purifiers, enabling them to handle complex gas mixtures with diverse contaminants.What Are the Key Drivers of Growth in the Gas Purifier Market?

The growth in the gas purifier market is driven by several key factors, including the rising demand for ultra-high purity gases in semiconductor manufacturing, the expanding applications in pharmaceuticals and healthcare, and the increasing focus on environmental and operational safety across industries. One of the primary drivers is the semiconductor industry's relentless pursuit of smaller, faster, and more powerful chips, which requires ultra-high purity gases to avoid defects in the fabrication process. Gas purifiers play a critical role in ensuring that the gases used in deposition, etching, and doping are free from moisture, oxygen, and other contaminants that could compromise the delicate structures of semiconductor wafers. Another significant driver is the pharmaceutical and biotechnology sectors, where high-purity gases are essential for drug synthesis, sterile environments, and laboratory research. As the global demand for biopharmaceuticals and advanced therapeutics grows, so does the need for reliable gas purification systems that can maintain stringent quality standards. Additionally, the trend toward stricter environmental regulations and safety standards is supporting market growth, as industries seek to minimize emissions, ensure workplace safety, and comply with new guidelines for gas purity and handling. This is particularly relevant in sectors like chemical processing and food and beverage, where gas purifiers are used to remove hazardous impurities and maintain product quality. Furthermore, the push for sustainability and efficiency is creating opportunities for advanced gas purification technologies that reduce waste, energy consumption, and environmental impact. With these factors converging, the gas purifier market is poised for significant growth, driven by the dual imperatives of achieving high purity and maintaining safe, sustainable operations across a wide range of high-tech industries.Report Scope

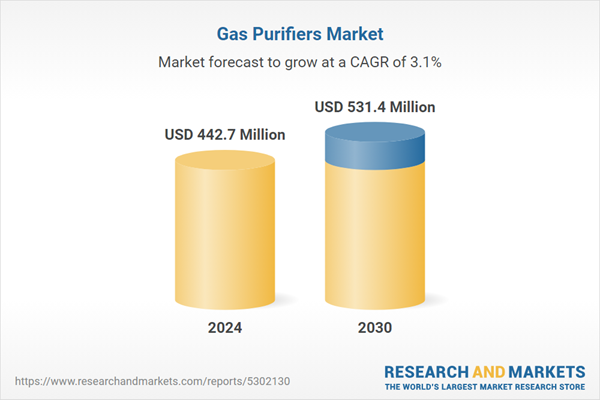

The report analyzes the Gas Purifiers market, presented in terms of market value (US$ Thousand). The analysis covers the key segments and geographic regions outlined below.- Segments: Purifier Type (Single Column, Double Column, Multi-Column, Other Purifier Types); Application (Semiconductor, Research, Other Applications).

- Geographic Regions/Countries:World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Single Column Purifiers segment, which is expected to reach US$185.2 Million by 2030 with a CAGR of a 3.8%. The Double Column Purifiers segment is also set to grow at 2.9% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $117.9 Million in 2024, and China, forecasted to grow at an impressive 4.9% CAGR to reach $108.1 Million by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Gas Purifiers Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Gas Purifiers Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Gas Purifiers Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Agilent Technologies, Inc., Air Liquide, ENTEGRIS, INC., Japan Pionics Co., Ltd., Matheson Tri-Gas, Inc. and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 34 companies featured in this Gas Purifiers market report include:

- Agilent Technologies, Inc.

- Air Liquide

- ENTEGRIS, INC.

- Japan Pionics Co., Ltd.

- Matheson Tri-Gas, Inc.

- Merck KGaA

- PARKER HANNIFIN CORP

- Praxair Technology, Inc.

- SAES Pure Gas, Inc.

- Thermo Fisher

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Agilent Technologies, Inc.

- Air Liquide

- ENTEGRIS, INC.

- Japan Pionics Co., Ltd.

- Matheson Tri-Gas, Inc.

- Merck KGaA

- PARKER HANNIFIN CORP

- Praxair Technology, Inc.

- SAES Pure Gas, Inc.

- Thermo Fisher

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 274 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 442.7 Million |

| Forecasted Market Value ( USD | $ 531.4 Million |

| Compound Annual Growth Rate | 3.1% |

| Regions Covered | Global |