Global Soybean Oil Market - Key Trends and Drivers Summarized

What Makes Soybean Oil a Critical Player in the Global Edible Oil Market?

Soybean oil, extracted from the seeds of the soybean plant, is one of the most widely consumed edible oils in the world, accounting for a significant share of the global vegetable oil market. Its prominence can be attributed to its versatile nature, mild flavor, and high nutritional value. Soybean oil is rich in polyunsaturated fatty acids, including omega-6 linoleic acid and omega-3 alpha-linolenic acid, which are essential for heart health and overall wellness. Additionally, its balanced profile of saturated and unsaturated fats makes it a preferred choice for consumers seeking healthier cooking oil options. Beyond its nutritional benefits, soybean oil is highly versatile in culinary applications, used for frying, baking, sautéing, and as a base for salad dressings and margarine. Its neutral taste allows it to blend seamlessly into a variety of cuisines without overpowering other flavors, enhancing its appeal in the food processing industry. With the rise of health-conscious eating and the increasing demand for plant-based ingredients, soybean oil's position in the edible oil market has strengthened, making it a staple in both household kitchens and commercial food production.How Are Consumer Trends and Dietary Preferences Impacting the Demand for Soybean Oil?

The growing trend towards healthier eating and the increased adoption of plant-based diets are significantly impacting the demand for soybean oil worldwide. As consumers become more aware of the health implications of their dietary choices, they are opting for oils that offer a favorable fatty acid profile, low trans fat content, and additional health benefits. Soybean oil, being naturally free of trans fats and rich in essential fatty acids, aligns well with these preferences. This trend is particularly strong in North America and Europe, where the push for cleaner labels and non-GMO ingredients has further propelled the demand for high-quality soybean oil. The food industry has responded by introducing a variety of value-added soybean oil products, such as organic, cold-pressed, and high-oleic variants, which cater to niche consumer segments looking for enhanced nutritional profiles. Meanwhile, in emerging markets like Asia-Pacific and Latin America, where soybean oil is already a dietary staple, rising disposable incomes and a shift towards healthier cooking oils are driving increased consumption. Additionally, the global popularity of plant-based diets and the growing interest in vegan and vegetarian foods have positioned soybean oil as a key ingredient in the formulation of plant-based products, from dairy alternatives to meat substitutes, further expanding its reach and applications in the food industry.What Innovations and Trends Are Shaping the Soybean Oil Industry?

The soybean oil industry is undergoing transformative changes driven by innovations in production, processing, and product development. One of the most notable trends is the development of high-oleic soybean oil, which is engineered to have a higher content of monounsaturated fats and improved oxidative stability. This innovation addresses a key challenge in the food industry, where the stability of cooking oils is crucial for maintaining the quality and shelf life of processed foods. High-oleic soybean oil's resistance to oxidation makes it ideal for frying and high-heat applications, thereby extending its use in commercial kitchens and packaged foods. Additionally, advances in soybean breeding have led to the creation of non-GMO and low-linolenic soybean varieties, which produce oils with enhanced health benefits and minimal trans fats, catering to the growing demand for healthier, non-genetically modified oils. Another significant trend is the increased focus on sustainability and traceability in soybean oil production. Companies are investing in sustainable farming practices, such as no-till farming and crop rotation, to reduce the environmental footprint of soybean cultivation. Digital technologies, including blockchain and IoT, are also being implemented to ensure supply chain transparency, allowing consumers and manufacturers to trace the origin of the oil and verify compliance with environmental standards. Furthermore, the development of novel processing techniques, such as enzymatic interesterification and supercritical CO2 extraction, is enhancing the quality and purity of soybean oil, making it suitable for use in high-end food products and nutraceuticals.What Factors Are Driving the Rapid Growth in the Soybean Oil Market?

The growth in the global soybean oil market is driven by several factors, including increasing demand from the food and beverage industry, advancements in oil extraction technology, and the expanding scope of soybean oil applications beyond traditional uses. One of the primary drivers is the growing use of soybean oil in processed foods and foodservice applications, where its versatility, stability, and neutral flavor make it a preferred choice among manufacturers. The rise of convenience foods, ready-to-eat meals, and snack products has further fueled the demand for soybean oil as a key ingredient in formulations that require a balance of functionality and nutrition. Another major growth driver is the increasing adoption of soybean oil in non-food sectors, such as biodiesel production, where it serves as a renewable and environmentally friendly alternative to conventional petroleum-based fuels. Government policies promoting the use of biofuels in response to climate change concerns are boosting the demand for soybean oil as a feedstock for biodiesel, particularly in countries like the United States and Brazil. Technological advancements, such as the development of new oilseed processing technologies and genetically modified soybean varieties, have also contributed to increased production efficiency and higher yields, ensuring a steady supply of high-quality soybean oil to meet rising global demand. Additionally, the growing popularity of sustainable and responsibly sourced oils is prompting companies to adopt certification schemes such as the Roundtable on Sustainable Soy (RTRS) and other eco-labels, thereby enhancing the appeal of their soybean oil products among environmentally conscious consumers. These combined factors, along with increasing investments in R&D and the expansion of soybean cultivation in key regions, are driving the rapid growth of the soybean oil market and positioning it as a critical component in both the global food supply chain and the biofuel industry.Report Scope

The report analyzes the Soybean Oil market, presented in terms of market value (US$ Thousand). The analysis covers the key segments and geographic regions outlined below.- Segments: Application (Biodiesel, Plastic & Polymers, Food & Beverage, Cosmetics, Paper & Pulp, Other End-Uses).

- Geographic Regions/Countries:World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Biodiesel Application segment, which is expected to reach US$6.9 Billion by 2030 with a CAGR of a 9.9%. The Plastic & Polymers Application segment is also set to grow at 7.7% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $2.9 Billion in 2024, and China, forecasted to grow at an impressive 12.4% CAGR to reach $4.5 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Soybean Oil Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Soybean Oil Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Soybean Oil Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as ADM, Arkema SA, Bunge, Cargill, Chemical Company and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 43 companies featured in this Soybean Oil market report include:

- ADM

- Arkema SA

- Bunge

- Cargill

- Chemical Company

- Ferro Corporation

- Galata Chemicals

- Hairma chemicals (GZ) Ltd.

- Louis Dreyfus

- Shandong Longkou Longda Chemical Industry Co., Ltd.

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- ADM

- Arkema SA

- Bunge

- Cargill

- Chemical Company

- Ferro Corporation

- Galata Chemicals

- Hairma chemicals (GZ) Ltd.

- Louis Dreyfus

- Shandong Longkou Longda Chemical Industry Co., Ltd.

Table Information

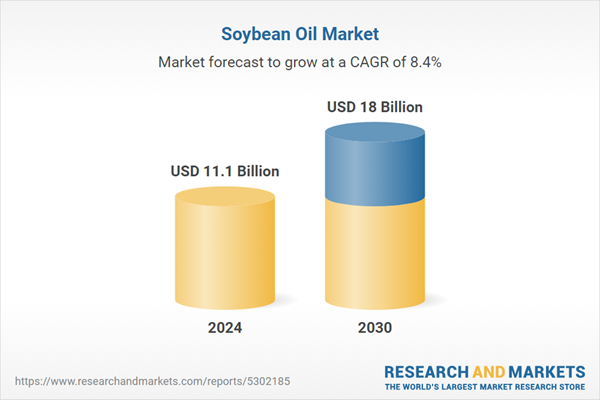

| Report Attribute | Details |

|---|---|

| No. of Pages | 193 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 11.1 Billion |

| Forecasted Market Value ( USD | $ 18 Billion |

| Compound Annual Growth Rate | 8.4% |

| Regions Covered | Global |