Global Biopsy Needles Market - Key Trends and Drivers Summarized

Why Are Biopsy Needles Becoming Critical Tools in Early Disease Diagnosis?

Biopsy needles are essential instruments in the field of medical diagnostics, playing a crucial role in the early detection and diagnosis of various diseases, particularly cancer. These needles are designed to extract tissue samples from specific areas of the body, which are then analyzed by pathologists to identify abnormalities at the cellular level. The precision and effectiveness of biopsy needles have made them indispensable for diagnosing cancers of the breast, prostate, liver, lung, and other organs. Early and accurate diagnosis is critical for the successful treatment of these conditions, and biopsy needles provide a minimally invasive way to collect the necessary tissue samples without requiring major surgery. Moreover, as the global burden of cancer and chronic diseases continues to rise, the demand for efficient and reliable diagnostic tools like biopsy needles is increasing. The use of biopsy needles allows physicians to target specific areas with minimal patient discomfort, reducing recovery time and improving the overall patient experience in comparison to more invasive diagnostic procedures.How Are Technological Advancements Improving Biopsy Needle Performance?

Technological advancements are significantly enhancing the performance, safety, and precision of biopsy needles, leading to more accurate diagnostic outcomes and better patient care. One of the most notable innovations in this field is the development of image-guided biopsy techniques. These techniques, which use ultrasound, CT scans, or MRI to guide the needle to the precise location of the suspicious tissue, have dramatically increased the accuracy of biopsies, ensuring that the correct tissue sample is collected with minimal invasiveness. This not only improves diagnostic accuracy but also reduces the need for repeat procedures, thus reducing patient stress and healthcare costs. Additionally, advancements in needle design have led to the creation of specialized biopsy needles that are tailored for specific types of tissue and organs. For example, core biopsy needles are designed to remove small cylinders of tissue, while fine-needle aspiration (FNA) needles are used for collecting cells from fluid-filled cysts or soft tissues. Another key innovation is the development of vacuum-assisted biopsy (VAB) needles, which use suction to collect larger samples of tissue, providing a more comprehensive analysis in a single procedure. This technology is particularly valuable in diagnosing complex conditions like breast cancer, where larger tissue samples can provide more detailed information about the nature of the tumor. Furthermore, the advent of disposable biopsy needles has improved patient safety by eliminating the risk of cross-contamination between procedures.Where Are Biopsy Needles Seeing Increasing Adoption and Use?

Biopsy needles are witnessing increasing adoption across a wide range of medical specialties, driven by their versatility and efficacy in diagnosing a variety of conditions. In oncology, biopsy needles are indispensable for diagnosing cancers at early stages, allowing for timely and targeted treatments. Breast cancer screening programs, in particular, rely heavily on biopsy needles for confirming abnormal findings from mammograms or ultrasounds. Similarly, prostate cancer diagnosis often involves the use of transrectal ultrasound-guided biopsy needles, which enable urologists to take tissue samples with high precision. Beyond oncology, biopsy needles are used extensively in hepatology for diagnosing liver diseases, such as hepatitis, cirrhosis, and liver cancer. These procedures help determine the extent of liver damage or the presence of malignant cells, guiding treatment plans accordingly. The use of biopsy needles is also increasing in the diagnosis of lung diseases. With the rise of respiratory illnesses, including lung cancer and chronic obstructive pulmonary disease (COPD), pulmonologists often rely on needle biopsies to obtain tissue samples from the lungs, pleura, or lymph nodes for further examination. In addition to these areas, biopsy needles are used in the assessment of kidney diseases, thyroid conditions, and autoimmune disorders, demonstrating their broad application across the medical field. Hospitals, outpatient clinics, and diagnostic imaging centers are expanding their use of biopsy needles to meet the growing demand for early, accurate diagnosis.What Is Driving the Growth of the Biopsy Needles Market?

The growth in the biopsy needles market is driven by several key factors, including rising incidences of cancer and chronic diseases, technological advancements, and an increasing focus on early and accurate diagnosis. One of the primary drivers of market growth is the global increase in cancer rates, with breast, lung, prostate, and liver cancers being some of the most common forms diagnosed. The growing prevalence of these diseases has fueled the demand for reliable diagnostic tools, with biopsy needles playing a critical role in providing tissue samples for analysis. Early detection remains a cornerstone of effective cancer treatment, and the use of biopsy needles allows for timely diagnosis, improving patient outcomes and survival rates. Another significant driver is the technological advancements in biopsy procedures, such as the adoption of image-guided biopsy techniques and vacuum-assisted biopsy systems, which have improved the precision and safety of tissue sampling. The development of disposable and single-use biopsy needles has further contributed to market growth by reducing the risk of infection and cross-contamination, especially in high-volume clinical settings. The increasing awareness among patients and healthcare professionals regarding the importance of early diagnosis is also driving market expansion. Additionally, the rising demand for minimally invasive procedures is further boosting the market, as patients increasingly prefer biopsy techniques that minimize discomfort and recovery time. Finally, the growing availability of healthcare services in emerging markets, coupled with government initiatives aimed at improving cancer care infrastructure, is broadening the reach of biopsy needle technologies. These factors - rising cancer prevalence, technological innovation, growing patient awareness, and expanded access to healthcare - are collectively driving the rapid growth of the biopsy needles market.Report Scope

The report analyzes the Biopsy Needles market, presented in terms of market value (US$ Thousand). The analysis covers the key segments and geographic regions outlined below.- Segments: Product Type (Vacuum-Assisted, Core Needle); Application (Breast, Kidney, Colorectal, Lungs, Bone Marrow, Other Applications).

- Geographic Regions/Countries:World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Vacuum-Assisted Needles segment, which is expected to reach US$971.8 Million by 2030 with a CAGR of a 6.1%. The Core Needle segment is also set to grow at 5.1% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $316.1 Million in 2024, and China, forecasted to grow at an impressive 8.8% CAGR to reach $389.7 Million by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Biopsy Needles Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Biopsy Needles Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Biopsy Needles Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Angiotech, Argon Medical devices, C.R. Bard, Inc., Cardinal Health, Inc., Carefusion Corporation and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 42 companies featured in this Biopsy Needles market report include:

- Angiotech

- Argon Medical devices

- C.R. Bard, Inc.

- Cardinal Health, Inc.

- Carefusion Corporation

- Creganna Medica

- DTR Medical

- Hologic, Inc.

- INRAD, Inc.

- Medax Medical Devices

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Angiotech

- Argon Medical devices

- C.R. Bard, Inc.

- Cardinal Health, Inc.

- Carefusion Corporation

- Creganna Medica

- DTR Medical

- Hologic, Inc.

- INRAD, Inc.

- Medax Medical Devices

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 285 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

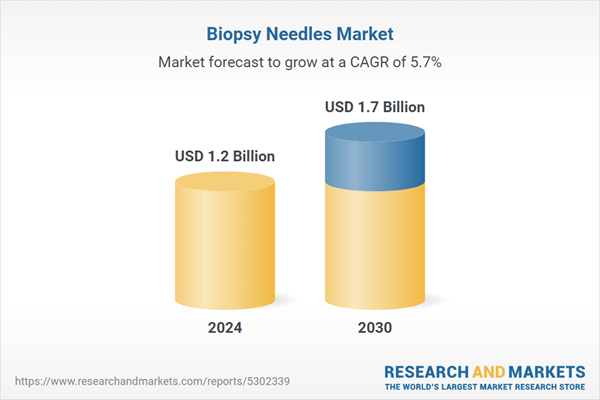

| Estimated Market Value ( USD | $ 1.2 Billion |

| Forecasted Market Value ( USD | $ 1.7 Billion |

| Compound Annual Growth Rate | 5.7% |

| Regions Covered | Global |