Global Internet of Things (IoT) Insurance Market - Key Trends and Drivers Summarized

How Is the Internet of Things (IoT) Reshaping the Insurance Industry?

The Internet of Things (IoT) is transforming the insurance industry by enabling more accurate risk assessments, improving customer engagement, and streamlining claims processing. IoT devices such as connected vehicles, wearable health monitors, and smart home systems provide insurers with real-time data on policyholders' behaviors and environments, allowing for more personalized and dynamic risk pricing. For example, telematics devices in vehicles track driving behavior, helping insurers offer usage-based insurance (UBI) policies that reward safe driving. In health insurance, wearables monitor physical activity and vital signs, enabling insurers to offer wellness incentives and preventative care plans. IoT solutions are also being used to automate claims processing, detect fraud, and improve customer service through real-time data collection and analysis.How Are Technological Advancements Shaping IoT in Insurance?

Technological advancements in IoT sensors, AI, and data analytics are driving the adoption of IoT in the insurance sector. IoT sensors embedded in vehicles, homes, and wearable devices are becoming more accurate and energy-efficient, enabling continuous data collection on policyholder behavior and environmental conditions. AI-powered analytics platforms are being integrated with IoT systems to analyze vast amounts of data, providing insurers with predictive insights that help improve risk assessments, prevent fraud, and offer personalized policies. Blockchain technology is also emerging as a key innovation, offering secure, transparent data sharing between insurers and policyholders, enhancing trust and reducing fraud risks. These advancements are making IoT solutions more accessible and effective for insurers looking to improve their offerings and reduce operational costs.How Do Market Segments Define the Growth of IoT in Insurance?

Applications include automotive insurance, health insurance, property insurance, and life insurance, with automotive insurance leading the market due to the widespread adoption of telematics and usage-based insurance policies. Components include hardware such as sensors and connected devices, software platforms for data management and analytics, and services such as system integration and support. Geographically, North America and Europe dominate the market, driven by early adoption of telematics and IoT-enabled insurance solutions, while Asia-Pacific is expected to see significant growth as insurers in the region embrace digital transformation and connected technologies.What Factors Are Driving the Growth in the IoT Insurance Market?

The growth in the IoT insurance market is driven by several factors, including the increasing demand for personalized insurance policies, advancements in connected devices, and the need for more accurate risk assessment. As consumers seek more flexible and customized insurance options, insurers are adopting IoT solutions to offer usage-based policies that align with individual behaviors and preferences. Technological innovations in telematics, wearables, and AI-driven analytics are also fueling growth by enabling insurers to collect and analyze real-time data on policyholder behavior, improving risk assessments and preventing fraud. Additionally, the rising focus on digital transformation and the need to streamline claims processing and customer service are driving investments in IoT-enabled insurance solutions.Report Scope

The report analyzes the Internet of Things (IoT) Insurance market, presented in terms of market value (US$ Thousand). The analysis covers the key segments and geographic regions outlined below.- Segments: Application (Automotive & Transportation, Life & Health, Home & Commercial Buildings, Business & Enterprise, Other Applications).

- Geographic Regions/Countries:World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; and Rest of Europe); Asia-Pacific; Rest of World.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Automotive & Transportation Application segment, which is expected to reach US$169.6 Billion by 2030 with a CAGR of a 38%. The Life & Health Application segment is also set to grow at 40.1% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $19.2 Billion in 2024, and China, forecasted to grow at an impressive 34.2% CAGR to reach $63.5 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Internet of Things (IoT) Insurance Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Internet of Things (IoT) Insurance Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Internet of Things (IoT) Insurance Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Accenture, Capgemini, Cognizant, Hippo Insurance, IBM Corporation and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 37 companies featured in this Internet of Things (IoT) Insurance market report include:

- Accenture

- Capgemini

- Cognizant

- Hippo Insurance

- IBM Corporation

- Lemonade Inc

- LexisNexis

- Oracle Corporation

- SAP SE

- Zonoff Inc

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Accenture

- Capgemini

- Cognizant

- Hippo Insurance

- IBM Corporation

- Lemonade Inc

- LexisNexis

- Oracle Corporation

- SAP SE

- Zonoff Inc

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 109 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

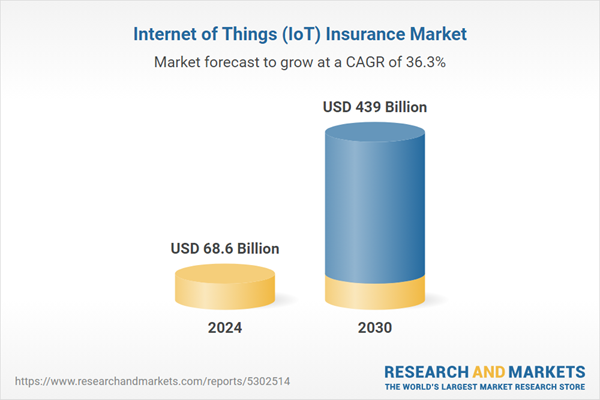

| Estimated Market Value ( USD | $ 68.6 Billion |

| Forecasted Market Value ( USD | $ 439 Billion |

| Compound Annual Growth Rate | 36.3% |

| Regions Covered | Global |