Global Foam Glass Market - Key Trends & Drivers Summarized

Why Is Foam Glass Gaining Popularity in Construction and Industrial Applications?

Foam glass is becoming increasingly popular in construction and industrial applications due to its unique combination of thermal insulation, lightweight structure, and resistance to moisture, chemicals, and fire. Foam glass is made from recycled glass that is heated and foamed to produce a porous, cellular material that is ideal for insulation and other purposes. In construction, foam glass is commonly used as an insulating material for building envelopes, foundations, and roofs, providing excellent thermal insulation while being impervious to water and resistant to rot, mold, and vermin. It is particularly valuable in projects where moisture control and energy efficiency are critical. The industrial sector also benefits from foam glass, especially in applications requiring high thermal resistance and durability, such as petrochemical plants, cryogenic systems, and piping insulation. Its non-combustible nature makes it ideal for fire protection in industrial facilities, while its chemical resistance makes it suitable for environments where exposure to aggressive chemicals is common. Additionally, foam glass is an environmentally friendly material, as it is made from recycled glass and can be fully recycled at the end of its life cycle, aligning with the growing focus on sustainable building practices. This combination of properties makes foam glass an increasingly attractive option for both construction and industrial applications.What Technological Advancements Are Driving the Foam Glass Market?

Technological advancements in the production and application of foam glass are enhancing its performance and expanding its range of uses. One key innovation is the development of advanced manufacturing processes that allow for greater control over the porosity, density, and thermal conductivity of foam glass, enabling manufacturers to tailor the material to specific applications. For instance, high-density foam glass with low porosity is ideal for heavy load-bearing applications, while low-density foam glass with high porosity is preferred for lightweight thermal insulation. These advancements are improving the versatility of foam glass, making it suitable for a wider array of construction and industrial projects. Another important advancement is the development of foam glass products with enhanced mechanical properties, such as increased compressive strength and impact resistance. These improvements are making foam glass more competitive with other traditional building materials, such as mineral wool and polystyrene, while maintaining its inherent advantages like non-combustibility and chemical resistance. Additionally, research into more sustainable production methods is leading to the creation of foam glass products that are even more environmentally friendly, such as those made using renewable energy or reducing the carbon footprint of the manufacturing process. These technological advancements are helping to boost the appeal of foam glass in both traditional and emerging markets.Why Is Sustainability a Key Factor Driving the Demand for Foam Glass?

Sustainability is a major factor driving the demand for foam glass, particularly in the construction industry, where energy efficiency and environmentally friendly materials are becoming increasingly important. Foam glass is made from recycled glass, which helps reduce the demand for raw materials and lowers the environmental impact of production. Additionally, its long lifespan and recyclability at the end of its use make it a circular building material that contributes to reducing construction waste. With increasing pressure from governments and consumers to adopt sustainable building practices, foam glass is gaining traction as a green alternative to traditional insulation materials.Moreover, the superior thermal insulation properties of foam glass contribute to improving the energy efficiency of buildings, reducing heating and cooling demands and lowering carbon emissions. In industrial applications, foam glass is used to insulate cryogenic and high-temperature systems, minimizing energy losses and improving overall process efficiency. Its non-toxic and chemically inert properties make it a safer choice for both the environment and human health. As regulations around energy efficiency and sustainable construction materials tighten globally, foam glass is becoming a preferred material for environmentally conscious building and industrial projects.

What Are the Key Growth Drivers for the Foam Glass Market?

The growth of the foam glass market is driven by several factors, including the increasing focus on energy-efficient construction, the rising demand for sustainable building materials, and the expansion of industrial applications that require high-performance insulation. In the construction industry, foam glass is being increasingly adopted in both residential and commercial projects as governments and consumers prioritize energy efficiency and environmental sustainability. Its excellent thermal insulation properties and recyclability make it an attractive choice for green building initiatives and energy-efficient building standards like LEED (Leadership in Energy and Environmental Design). The industrial sector is another major growth driver, as foam glass is widely used for insulating piping, tanks, and equipment in industries such as petrochemicals, oil and gas, and cryogenics, where thermal stability and resistance to harsh conditions are essential. Additionally, the non-combustible and fire-resistant nature of foam glass is driving its use in industrial facilities requiring high levels of fire protection. The increasing adoption of foam glass in industrial settings, combined with its growing popularity as a sustainable construction material, is expected to fuel steady market growth in the coming years.Report Scope

The report analyzes the Foam Glass market, presented in terms of market value (US$ Thousand). The analysis covers the key segments and geographic regions outlined below.- Segments: Type (Closed Cell, Open Cell); Application (Building & Construction, Industrial, Other End-Uses).

- Geographic Regions/Countries:World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Closed Cell Foam Glass segment, which is expected to reach 1.3 Million Tons by 2030 with a CAGR of a 4.7%. The Open Cell Foam Glass segment is also set to grow at 3.1% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at 488.5 Thousand Tons in 2024, and China, forecasted to grow at an impressive 7.5% CAGR to reach 465.2 Thousand Tons by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Foam Glass Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Foam Glass Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Foam Glass Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as AeroAggregates, Anhui Huichang New Material Co., Ltd., Beijing ShouBang New Materials Co., Ltd., Earthstone international, Geocell and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 34 companies featured in this Foam Glass market report include:

- AeroAggregates

- Anhui Huichang New Material Co., Ltd.

- Beijing ShouBang New Materials Co., Ltd.

- Earthstone international

- Geocell

- Glapor

- MISAPOR

- Ningbo Yoyo Foam Glass Co., Ltd

- Owens Corning

- Pinosklo

- Polydros S.A.

- Refaglass

- UUSIOAINES OY

- Zhejiang Dehe Insulation Technology Co., Ltd.

- Zhejiang Zhenshen Insulation Technology Corp.

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- AeroAggregates

- Anhui Huichang New Material Co., Ltd.

- Beijing ShouBang New Materials Co., Ltd.

- Earthstone international

- Geocell

- Glapor

- MISAPOR

- Ningbo Yoyo Foam Glass Co., Ltd

- Owens Corning

- Pinosklo

- Polydros S.A.

- Refaglass

- UUSIOAINES OY

- Zhejiang Dehe Insulation Technology Co., Ltd.

- Zhejiang Zhenshen Insulation Technology Corp.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 268 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

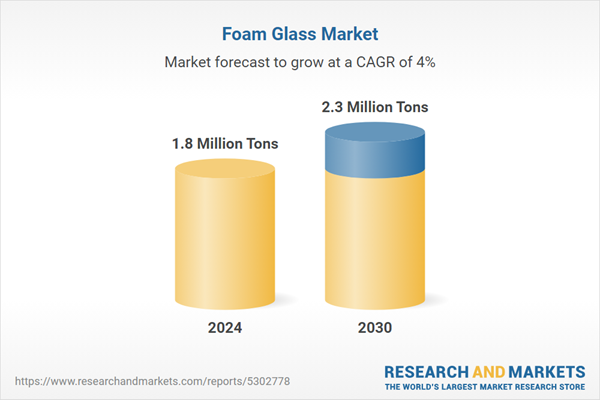

| Estimated Market Value in 2024 | 1.8 Million Tons |

| Forecasted Market Value by 2030 | 2.3 Million Tons |

| Compound Annual Growth Rate | 4.0% |

| Regions Covered | Global |