Global Cellular Glass Market - Key Trends & Drivers Summarized

What Is Cellular Glass, and Why Is It Gaining Prominence in Construction and Insulation?

Cellular glass, also known as foam glass, is a high-performance insulation material made from crushed glass that is heated and expanded to form a rigid, lightweight structure filled with closed cells. This unique structure gives cellular glass excellent thermal insulation properties, resistance to moisture, fire, and pests, as well as high compressive strength. As a result, it is widely used in construction, industrial applications, and specialized infrastructure projects, particularly for insulating pipes, tanks, roofs, and foundations. Its non-combustible nature, combined with its ability to maintain insulation performance in extreme temperatures, makes it an ideal material for environments where safety, durability, and energy efficiency are paramount. The growing focus on sustainability in construction is also pushing cellular glass into the spotlight. Manufactured primarily from recycled glass, cellular glass offers eco-friendly insulation solutions that align with the industry's movement towards greener materials. It is chemically stable, non-toxic, and fully recyclable at the end of its lifecycle, adding to its appeal as a sustainable choice for both residential and industrial applications. Its use in critical sectors, such as oil and gas, chemical processing, and cold storage, further demonstrates its versatility and importance in modern building and insulation practices.How Are Technological Innovations Enhancing the Cellular Glass Market?

Technological advancements are playing a critical role in expanding the applications and improving the performance of cellular glass products. One of the most important innovations in this area is the refinement of production processes to increase the efficiency of cellular glass manufacturing. Improved heating techniques, better control of raw material inputs, and advancements in molding technologies are helping manufacturers produce cellular glass with more uniform properties, enhanced thermal insulation, and reduced production costs. These innovations are essential as demand for high-quality, cost-effective insulation solutions continues to rise across industries.In addition to process improvements, there have been significant developments in the modification of cellular glass to meet specific project requirements. This includes adjustments in density and cell structure to optimize the material for different applications, from high-load-bearing foundations to lightweight roofing insulation. Some manufacturers are integrating new additives or coatings to further enhance the water resistance, strength, and durability of cellular glass, making it suitable for more demanding environments like chemical plants and cryogenic systems. These technological innovations not only improve the material's versatility but also enable its adoption in more specialized and high-stakes applications where performance and safety are critical.

What Industry and Market Trends Are Driving the Growing Demand for Cellular Glass?

Several industry trends are driving the rising demand for cellular glass, especially the push for energy-efficient and sustainable building materials. As governments and industries worldwide enforce stricter regulations on building energy consumption and thermal efficiency, the demand for high-performance insulation materials like cellular glass is increasing. In cold storage facilities, oil and gas pipelines, and other industrial sectors, cellular glass offers superior insulation that helps reduce energy loss, maintain temperature control, and lower operating costs. Its resistance to moisture, fire, and chemicals makes it particularly valuable in harsh environments where traditional insulation materials may fail.Another major trend driving demand is the growing focus on sustainability and eco-friendly construction practices. With its high recycled content and fully recyclable nature, cellular glass is viewed as a sustainable material that aligns with green building certifications and eco-conscious construction trends. This appeal is particularly strong in regions like Europe and North America, where green building standards such as LEED (Leadership in Energy and Environmental Design) are gaining widespread acceptance. In addition, the non-toxic and inert nature of cellular glass makes it a preferred choice for industries concerned with environmental impact and long-term sustainability. The increasing need for disaster-resilient infrastructure is also boosting demand for cellular glass. Its non-combustible properties and resistance to extreme temperatures make it a critical material for constructing fireproof and resilient structures. This is particularly relevant in regions prone to wildfires or extreme heat, where building materials must be able to withstand harsh conditions without compromising performance. The construction of industrial facilities and infrastructure in these areas is increasingly turning to cellular glass for its reliability and safety features.

Growth in the Cellular Glass Market Is Driven by Several Factors

Growth in the cellular glass market is driven by several factors, including technological advancements, the rising demand for sustainable construction materials, and increasing regulatory requirements for energy efficiency. One of the key drivers is the growing emphasis on reducing energy consumption in both residential and industrial sectors. As energy costs continue to rise, more companies and builders are looking for materials that can provide long-lasting, reliable insulation to reduce heating and cooling expenses. Cellular glass's superior thermal insulation capabilities make it an attractive solution in these energy-conscious markets, particularly for applications that require long-term durability, such as oil refineries, cold storage facilities, and chemical plants. Technological innovations are also accelerating market growth, with improved manufacturing techniques lowering production costs and enabling the production of cellular glass with more precise and consistent properties. These advancements have expanded the material's range of applications, making it suitable for everything from light-duty residential insulation to heavy-duty industrial infrastructure. The versatility and adaptability of cellular glass are attracting new industries and increasing its adoption across various sectors.Another significant factor driving growth is the increasing stringency of building codes and environmental regulations, which prioritize the use of sustainable and fire-resistant materials. Cellular glass meets the needs of both safety and sustainability, offering a fully recyclable, non-toxic, and fireproof solution that aligns with modern construction trends. As governments and industries push for greener building practices and enhanced fire safety measures, the demand for cellular glass continues to rise, positioning it as a key material in the global construction and insulation market.

Report Scope

The report analyzes the Cellular Glass market, presented in terms of market value (US$ Thousand). The analysis covers the key segments and geographic regions outlined below.- Segments: Product Type (Blocks & Shells, Foam Glass Gravels); Application (Construction, Industrial, Other Applications).

- Geographic Regions/Countries:World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Blocks & Shells segment, which is expected to reach US$586.3 Million by 2030 with a CAGR of a 4.4%. The Foam Glass Gravels segment is also set to grow at 4.5% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $161.8 Million in 2024, and China, forecasted to grow at an impressive 6.5% CAGR to reach $166.1 Million by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Cellular Glass Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Cellular Glass Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Cellular Glass Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

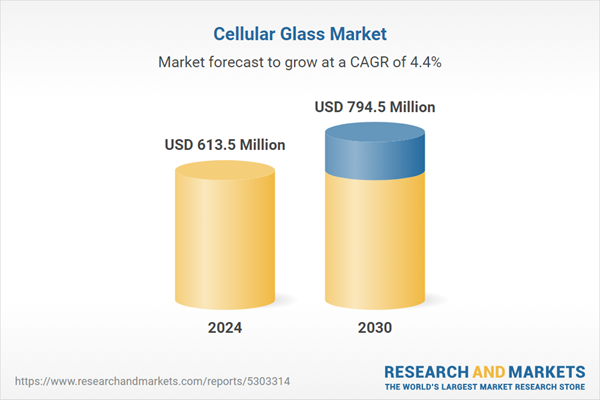

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Aeroaggregates of North America,LLC, Anhui Huichang New Material Co., Ltd., Benarx, Earthstone International LLC, Geocell Schaumglas GmbH and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 47 companies featured in this Cellular Glass market report include:

- Aeroaggregates of North America,LLC

- Anhui Huichang New Material Co., Ltd.

- Benarx

- Earthstone International LLC

- Geocell Schaumglas GmbH

- German Geo Construction GmbH

- Glapor Werk Mitterteich GmbH

- Glavel, Inc.

- Jahan Ayegh Pars Company

- Langfang Chaochen Thermal Insulation Material Co., Ltd.

- Liaver Gmbh & Co. KG

- Misapor AG

- Ningbo Yoyo Foam Glass Co., Ltd.

- Owens Corning

- Pinosklo Cellular Glass

- Polydros, S.A.

- Refaglass S.R.O.

- Steinbach Schaumglas Gmbh & Co. KG

- Stes-Vladimir

- Stikloporas

- Uusioaines Oy

- Veriso GmbH

- Zhejiang Dehe Insulation Technology Co., Ltd.

- Zhejiang Yahong Industrial Co., Ltd.

- Zhejiang Zhenshen Thermal Technology Co. Ltd.

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Aeroaggregates of North America,LLC

- Anhui Huichang New Material Co., Ltd.

- Benarx

- Earthstone International LLC

- Geocell Schaumglas GmbH

- German Geo Construction GmbH

- Glapor Werk Mitterteich GmbH

- Glavel, Inc.

- Jahan Ayegh Pars Company

- Langfang Chaochen Thermal Insulation Material Co., Ltd.

- Liaver Gmbh & Co. KG

- Misapor AG

- Ningbo Yoyo Foam Glass Co., Ltd.

- Owens Corning

- Pinosklo Cellular Glass

- Polydros, S.A.

- Refaglass S.R.O.

- Steinbach Schaumglas Gmbh & Co. KG

- Stes-Vladimir

- Stikloporas

- Uusioaines Oy

- Veriso GmbH

- Zhejiang Dehe Insulation Technology Co., Ltd.

- Zhejiang Yahong Industrial Co., Ltd.

- Zhejiang Zhenshen Thermal Technology Co. Ltd.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 281 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 613.5 Million |

| Forecasted Market Value ( USD | $ 794.5 Million |

| Compound Annual Growth Rate | 4.4% |

| Regions Covered | Global |