Global Hot Chocolate Market - Key Trends and Drivers Summarized

Why Is Hot Chocolate Gaining Popularity as a Comfort Beverage?

Hot chocolate has long been a beloved comfort beverage, enjoyed by consumers worldwide for its rich flavor and warming qualities. Traditionally made with cocoa powder, milk, and sugar, hot chocolate is a staple in cafes and homes, especially during colder months. However, the market for hot chocolate has expanded significantly, with premium versions that feature high-quality dark chocolate, organic ingredients, and innovative flavors such as salted caramel or spiced chili. The beverage's versatility, from being a quick instant drink to a gourmet indulgence, has broadened its appeal. Hot chocolate is not only a favorite among children but also adults who seek indulgence, nostalgia, or relaxation through its comforting taste.How Are Innovations Shaping the Hot Chocolate Market?

The hot chocolate market has experienced growth due to innovations in product formulation and packaging. Manufacturers are introducing healthier versions of hot chocolate, featuring organic, vegan, and sugar-free options to cater to health-conscious consumers. Additionally, gourmet hot chocolate mixes made from high-quality cocoa beans are being marketed as premium products, offering a richer, more authentic chocolate experience. Instant hot chocolate products have also seen advancements in convenience, with single-serve pods and sachets that simplify preparation without compromising taste. The rising popularity of plant-based milk alternatives has opened new opportunities for the hot chocolate market, as more consumers experiment with almond, oat, and coconut milk versions of the beverage.How Do Market Segments Define the Growth of the Hot Chocolate Market?

Product types include instant mixes, powdered hot chocolate, and ready-to-drink (RTD) options, with instant mixes leading the market due to their convenience and affordability. Premium powdered and gourmet options are also gaining traction, especially in urban markets where consumers are willing to pay more for higher-quality ingredients. Distribution channels include supermarkets, specialty stores, online platforms, and cafes, with online sales experiencing significant growth due to the rise of e-commerce. Regionally, North America and Europe dominate the market, driven by the strong cultural affinity for hot beverages, while emerging markets in Asia-Pacific are seeing increased interest in premium and health-conscious variants.What Factors Are Driving the Growth in the Hot Chocolate Market?

The growth in the hot chocolate market is driven by several factors, including increasing consumer demand for indulgent beverages, innovations in product formulations, and the rise of premium chocolate trends. The growing trend of “cocooning,” where consumers seek comfort and indulgence at home, has boosted the demand for hot chocolate as a cozy, feel-good drink. Health-conscious consumers are also driving demand for low-sugar, organic, and plant-based hot chocolate options. Additionally, the expansion of the premium chocolate segment, which emphasizes high-quality, ethically sourced cocoa, has elevated hot chocolate into a luxury indulgence, appealing to a more discerning customer base. The rise of online retail and the growing café culture worldwide have also contributed to the global growth of the hot chocolate market.Report Scope

The report analyzes the Hot Chocolate market, presented in terms of market value (US$ Thousand). The analysis covers the key segments and geographic regions outlined below.- Segments: Distribution Channel (Offline, Online); Type (Original Taste, Flavor Taste).

- Geographic Regions/Countries:World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Offline Distribution Channel segment, which is expected to reach US$4.7 Billion by 2030 with a CAGR of a 4.4%. The Online Distribution Channel segment is also set to grow at 7.8% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $1.1 Billion in 2024, and China, forecasted to grow at an impressive 7.2% CAGR to reach $1.2 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Hot Chocolate Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Hot Chocolate Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Hot Chocolate Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Chocoladefabriken Lindt & Sprungli AG, Cocosutra, H. Schoppe& Schultz GmbH & Co., KG, Haribo of America, Inc., Hershey Company and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 53 companies featured in this Hot Chocolate market report include:

- Chocoladefabriken Lindt & Sprungli AG

- Cocosutra

- H. Schoppe& Schultz GmbH & Co., KG

- Haribo of America, Inc.

- Hershey Company

- LUIGI LAVAZZA SPA

- Mars, Inc.

- Mondelez International

- Nestle

- Sprüngli AG

- Starbucks Corporation

- Twinins (Associated

- UelzenaeG

- Unilever

- Xucker GmbH

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Chocoladefabriken Lindt & Sprungli AG

- Cocosutra

- H. Schoppe& Schultz GmbH & Co., KG

- Haribo of America, Inc.

- Hershey Company

- LUIGI LAVAZZA SPA

- Mars, Inc.

- Mondelez International

- Nestle

- Sprüngli AG

- Starbucks Corporation

- Twinins (Associated

- UelzenaeG

- Unilever

- Xucker GmbH

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 284 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

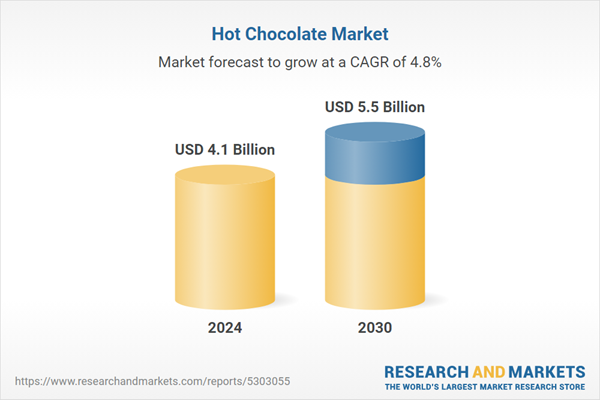

| Estimated Market Value ( USD | $ 4.1 Billion |

| Forecasted Market Value ( USD | $ 5.5 Billion |

| Compound Annual Growth Rate | 4.8% |

| Regions Covered | Global |