Global Cardiac Mapping Market - Key Trends & Drivers Summarized

What Is Cardiac Mapping and Why Is It Essential in Modern Cardiology?

Cardiac mapping is an advanced medical technique used to visualize the electrical activity of the heart to identify and treat arrhythmias, such as atrial fibrillation, ventricular tachycardia, and other abnormal heart rhythms. This technique allows cardiologists to create detailed, three-dimensional maps of the heart's electrical conduction system, offering precise information about the source of abnormal electrical signals. By pinpointing the locations responsible for arrhythmias, cardiac mapping helps guide therapeutic interventions such as catheter ablation, making it an essential tool in modern electrophysiology.With the rising prevalence of cardiovascular diseases (CVDs) globally, particularly arrhythmias, the need for effective diagnosis and treatment tools like cardiac mapping is growing. The precision that cardiac mapping provides allows for more accurate diagnoses, reducing the risk of ineffective treatments and minimizing the invasiveness of procedures. Additionally, cardiac mapping is increasingly used in complex cases where traditional diagnostic methods may not be sufficient to determine the root cause of the arrhythmia. This growing reliance on sophisticated diagnostics is making cardiac mapping an indispensable part of cardiac care.

How Are Technological Advancements Shaping the Cardiac Mapping Market?

Technological advancements are revolutionizing the cardiac mapping market, leading to the development of more sophisticated, accurate, and user-friendly systems. The introduction of three-dimensional (3D) electroanatomical mapping systems has significantly enhanced the ability of physicians to visualize the heart's electrical pathways in real-time. These systems integrate data from various sources, such as catheters, sensors, and imaging modalities, to generate highly detailed maps that guide interventions with remarkable precision. For example, systems like the CARTO 3 system and the EnSite Precision system have transformed the way complex arrhythmias are diagnosed and treated.Moreover, advancements in non-invasive mapping technologies, such as body surface mapping (BSM), are gaining traction as they allow for detailed cardiac mapping without the need for invasive catheterization. This not only improves patient comfort but also broadens the application of mapping in early diagnosis and follow-up care. The rise of artificial intelligence (AI) and machine learning algorithms is further enhancing the capabilities of cardiac mapping by improving the accuracy of signal interpretation, enabling faster and more accurate diagnoses. These technological innovations are making cardiac mapping more efficient, accessible, and valuable in clinical practice, driving its adoption in hospitals and specialized cardiac centers worldwide.

What Patient and Healthcare Trends Are Driving the Demand for Cardiac Mapping?

Several patient and healthcare trends are influencing the demand for cardiac mapping technologies. The increasing incidence of cardiovascular diseases, particularly arrhythmias, is one of the primary drivers. With an aging global population and rising risk factors such as hypertension, obesity, and sedentary lifestyles, the prevalence of heart rhythm disorders is on the rise. As more patients are diagnosed with conditions like atrial fibrillation and ventricular tachycardia, the need for advanced diagnostic tools that offer precise and effective treatment options is growing, leading to greater reliance on cardiac mapping systems.Another key trend is the growing emphasis on personalized medicine. Patients today expect more tailored treatments that cater to their specific medical conditions. Cardiac mapping enables cardiologists to deliver customized therapies by accurately identifying the source of arrhythmias and targeting specific areas of the heart for treatment. Additionally, there is an increasing demand for minimally invasive procedures, driven by patients' preferences for shorter recovery times, reduced pain, and fewer complications. Cardiac mapping, particularly in guiding catheter ablation, aligns with this trend by offering a minimally invasive yet highly effective solution for treating arrhythmias. As patient expectations and healthcare delivery evolve, the demand for precision diagnostics like cardiac mapping continues to grow.

Growth in the Cardiac Mapping Market Is Driven by Several Factors

Growth in the cardiac mapping market is driven by several factors, including the increasing prevalence of cardiovascular diseases, advancements in electrophysiology technologies, and the rising demand for minimally invasive procedures. One of the key drivers is the growing number of patients diagnosed with arrhythmias and other heart rhythm disorders. As arrhythmia cases rise globally, particularly due to lifestyle factors and aging populations, there is an increasing need for effective diagnostic tools that enable cardiologists to accurately map the heart's electrical activity and guide precise treatments.Technological advancements in cardiac mapping systems are also fueling market growth. The development of 3D electroanatomical mapping systems, non-invasive body surface mapping, and AI-powered diagnostic tools is improving the accuracy and efficiency of arrhythmia diagnosis and treatment. These innovations are making cardiac mapping systems more accessible to hospitals and specialized centers, further expanding the market. Additionally, the increasing adoption of catheter ablation, a minimally invasive procedure used to treat arrhythmias, is boosting demand for cardiac mapping technologies that assist in guiding these procedures with high precision.

Another key factor driving market growth is the rising focus on personalized and precision medicine. Cardiac mapping allows for tailored treatment strategies based on the specific characteristics of each patient's heart condition, improving outcomes and reducing the need for repeat procedures. Furthermore, as healthcare systems worldwide focus on improving patient care and reducing the burden of cardiovascular diseases, cardiac mapping is becoming a crucial tool in providing more effective and personalized cardiac care. These trends are expected to continue fueling the growth of the cardiac mapping market in the coming years.

Report Scope

The report analyzes the Cardiac Mapping market, presented in terms of market value (US$ Thousand). The analysis covers the key segments and geographic regions outlined below.- Segments: Indication (Atrial Fibrillation, Atrial Flutter, AVNRT, Other Arrhythmias); Product (Contact Cardiac Mapping Systems, Non-Contact Cardiac Mapping Systems).

- Geographic Regions/Countries:World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Atrial Fibrillation Indication segment, which is expected to reach US$1.2 Billion by 2030 with a CAGR of a 7.2%. The Atrial Flutter Indication segment is also set to grow at 8.6% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $610.1 Million in 2024, and China, forecasted to grow at an impressive 11.6% CAGR to reach $909.8 Million by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Cardiac Mapping Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Cardiac Mapping Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Cardiac Mapping Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Abbott Laboratories, Acutus Medical, Angiodynamics, APN Health, LLC, Biosense Webster, Inc. (A Johnson & Johnson Company) and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 42 companies featured in this Cardiac Mapping market report include:

- Abbott Laboratories

- Acutus Medical

- Angiodynamics

- APN Health, LLC

- Biosense Webster, Inc. (A Johnson & Johnson Company)

- Biosig Technologies, Inc.

- Biotronik

- Boston Scientific Corporation

- Catheter Precision, Inc.

- Coremap

- EP Solutions Sa

- Epmap-System

- Kardium, Inc.

- Koninklijke Philips N.V.

- Lepu Medical

- Medtronic Plc

- Microport Scientific Corporation

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Abbott Laboratories

- Acutus Medical

- Angiodynamics

- APN Health, LLC

- Biosense Webster, Inc. (A Johnson & Johnson Company)

- Biosig Technologies, Inc.

- Biotronik

- Boston Scientific Corporation

- Catheter Precision, Inc.

- Coremap

- EP Solutions Sa

- Epmap-System

- Kardium, Inc.

- Koninklijke Philips N.V.

- Lepu Medical

- Medtronic Plc

- Microport Scientific Corporation

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 279 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

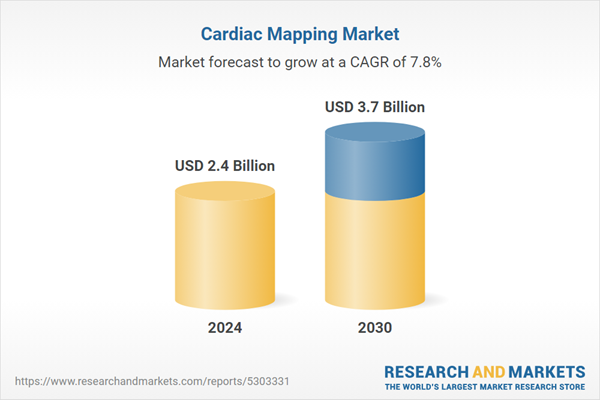

| Estimated Market Value ( USD | $ 2.4 Billion |

| Forecasted Market Value ( USD | $ 3.7 Billion |

| Compound Annual Growth Rate | 7.8% |

| Regions Covered | Global |