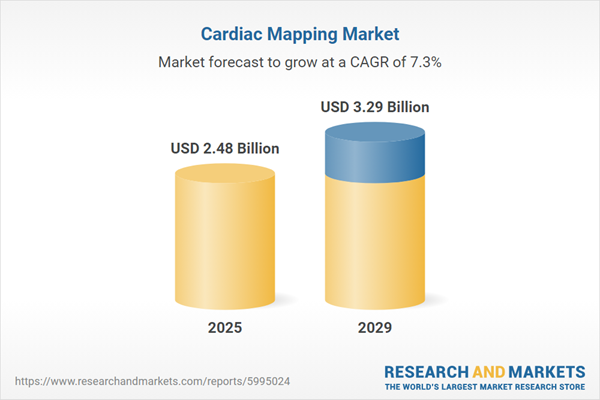

The cardiac mapping market size has grown strongly in recent years. It will grow from $2.3 billion in 2024 to $2.48 billion in 2025 at a compound annual growth rate (CAGR) of 7.6%. The growth in the historic period can be attributed to the introduction of catheter ablation, development of 3D mapping systems, improvements in imaging technologies, rise in the prevalence of cardiac arrhythmias, and growth in minimally invasive procedures.

The cardiac mapping market size is expected to see strong growth in the next few years. It will grow to $3.29 billion in 2029 at a compound annual growth rate (CAGR) of 7.3%. The growth in the forecast period can be attributed to the increasing prevalence of cardiovascular diseases, growing aging population, rising awareness and screening programs, improved healthcare infrastructure, and rising prevalence of health issues. Major trends in the forecast period include integration with artificial intelligence (AI), real-time 3D mapping systems, improved catheter technologies, cloud-based data analysis, and enhanced electrophysiology software.

The cardiac mapping market is poised for growth due to increasing prevalence of heart ailments, which encompass various conditions affecting the heart's structure and function, leading to complications such as arrhythmias, heart attacks, and heart failure. Sedentary lifestyles, poor dietary habits, and aging populations contribute to the rising incidence of these ailments. Cardiac mapping plays a crucial role in diagnosing and treating heart conditions by precisely identifying electrical abnormalities in the heart's rhythm. For example, the British Heart Foundation reported in January 2024 that over one million individuals in the UK suffer from heart failure, with approximately 200,000 new cases diagnosed annually and around 730,000 people included in GP heart failure registers. This underscores how the prevalence of heart ailments is fueling growth in the cardiac mapping market.

Leading companies in the cardiac mapping market are focusing on developing advanced solutions such as cardiac mapping platforms to improve diagnostic precision and treatment effectiveness. These platforms employ sophisticated technologies to visualize and analyze electrical activity within the heart, aiding in the diagnosis and treatment of cardiac arrhythmias and other conditions. For instance, Abbott Laboratories, a US-based healthcare company, received FDA 510(k) clearance in January 2022 for its EnSite X EP system. This platform helps physicians pinpoint origins of abnormal heart rhythms by generating detailed 3D maps that offer a comprehensive 360-degree view, regardless of catheter orientation. The system utilizes Abbott's proprietary EnSite omnipolar technology (OT) and advisor HD grid catheter to capture accurate electrograms from any catheter angle.

In August 2022, Medtronic Plc, a US-based medical technology firm, acquired Affera Inc. for $925 million. This acquisition expands Medtronic's cardiac ablation portfolio to include Affera's advanced cardiac mapping and navigation platform, alongside its diagnostic and therapeutic catheters. Affera Inc., based in the US, specializes in developing systems for cardiac mapping and ablation.

Major companies operating in the cardiac mapping market are Johnson & Johnson, Abbott Laboratories, Medtronic plc, Koninklijke Philips N.V., GE Healthcare Technologies, Boston Scientific Corporation, Epmap-System, APN Health LLC, BIOTRONIK SE & Co. KG, Lepu Medical Technology Co. Ltd., MicroPort Scientific Corporation, Biosense Webster Inc., BioSig Technologies Inc., CardioFocus Inc., Kardium Inc., Acutus Medical Inc., Navix Medical Ltd., EP Solutions SA, CoreMap Inc., Catheter Precision Inc.

North America was the largest region in the cardiac mapping market in 2024. Asia-Pacific is expected to be the fastest-growing region in the forecast period. The regions covered in the cardiac mapping market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, Africa. The countries covered in the cardiac mapping market report are Australia, Brazil, China, France, Germany, India, Indonesia, Japan, Russia, South Korea, UK, USA, Canada, Italy, Spain.

Cardiac mapping involves creating a detailed representation of the heart's electrical activity to pinpoint abnormal rhythms (arrhythmias) by mapping the location and patterns of electrical impulses. This data is essential for diagnosing and treating various cardiac conditions and guiding procedures such as ablation therapy to correct irregular heartbeats.

The primary types of cardiac mapping systems are contact cardiac mapping and non-contact cardiac mapping. Contact cardiac mapping systems utilize electrodes in direct contact with heart tissue to precisely identify and map electrical activity. They are used for diagnosing and treating conditions such as atrial fibrillation, atrial flutter, and atrioventricular nodal reentrant tachycardia (AVNRT). These systems are employed by hospitals, clinics, diagnostic centers, and other healthcare facilities.

The cardiac mapping research report is one of a series of new reports that provides cardiac mapping market statistics, including the cardiac mapping industry's global market size, regional shares, competitors with a cardiac mapping market share, detailed cardiac mapping market segments, market trends and opportunities, and any further data you may need to thrive in the cardiac mapping industry. This cardiac mapping market research report delivers a complete perspective of everything you need, with an in-depth analysis of the current and future scenarios of the industry.

The cardiac mapping market consists of revenues earned by entities by providing services such as monitoring and follow-up, diagnostic mapping, and ablation guidance. The market value includes the value of related goods sold by the service provider or included within the service offering. The cardiac mapping market also includes sales of electrophysiology mapping systems, mapping software, navigation systems, and ablation catheters. Values in this market are ‘factory gate’ values, that is the value of goods sold by the manufacturers or creators of the goods, whether to other entities (including downstream manufacturers, wholesalers, distributors and retailers) or directly to end customers. The value of goods in this market includes related services sold by the creators of the goods.

The market value is defined as the revenues that enterprises gain from the sale of goods and/or services within the specified market and geography through sales, grants, or donations in terms of the currency (in USD, unless otherwise specified).

The revenues for a specified geography are consumption values that are revenues generated by organizations in the specified geography within the market, irrespective of where they are produced. It does not include revenues from resales along the supply chain, either further along the supply chain or as part of other products.

This product will be delivered within 3-5 business days.

Table of Contents

Executive Summary

Cardiac Mapping Global Market Report 2025 provides strategists, marketers and senior management with the critical information they need to assess the market.This report focuses on cardiac mapping market which is experiencing strong growth. The report gives a guide to the trends which will be shaping the market over the next ten years and beyond.

Reasons to Purchase:

- Gain a truly global perspective with the most comprehensive report available on this market covering 15 geographies.

- Assess the impact of key macro factors such as conflict, pandemic and recovery, inflation and interest rate environment and the 2nd Trump presidency.

- Create regional and country strategies on the basis of local data and analysis.

- Identify growth segments for investment.

- Outperform competitors using forecast data and the drivers and trends shaping the market.

- Understand customers based on the latest market shares.

- Benchmark performance against key competitors.

- Suitable for supporting your internal and external presentations with reliable high quality data and analysis

- Report will be updated with the latest data and delivered to you along with an Excel data sheet for easy data extraction and analysis.

- All data from the report will also be delivered in an excel dashboard format.

Description

Where is the largest and fastest growing market for cardiac mapping ? How does the market relate to the overall economy, demography and other similar markets? What forces will shape the market going forward? The cardiac mapping market global report answers all these questions and many more.The report covers market characteristics, size and growth, segmentation, regional and country breakdowns, competitive landscape, market shares, trends and strategies for this market. It traces the market’s historic and forecast market growth by geography.

- The market characteristics section of the report defines and explains the market.

- The market size section gives the market size ($b) covering both the historic growth of the market, and forecasting its development.

- The forecasts are made after considering the major factors currently impacting the market. These include: the Russia-Ukraine war, rising inflation, higher interest rates, and the legacy of the COVID-19 pandemic.

- Market segmentations break down the market into sub markets.

- The regional and country breakdowns section gives an analysis of the market in each geography and the size of the market by geography and compares their historic and forecast growth. It covers the growth trajectory of COVID-19 for all regions, key developed countries and major emerging markets.

- The competitive landscape chapter gives a description of the competitive nature of the market, market shares, and a description of the leading companies. Key financial deals which have shaped the market in recent years are identified.

- The trends and strategies section analyses the shape of the market as it emerges from the crisis and suggests how companies can grow as the market recovers.

Scope

Markets Covered:

1) By Type: Contact Cardiac Mapping Systems; Non-Contact Cardiac Mapping Systems2) By Indications: Atrial Fibrillation; Atrial Flutter; Atrioventricular Nodal Reentrant Tachycardia (AVNRT); Other Indications

3) By End-User: Hospitals and Clinics; Diagnostic Centers; Other End-Users

Subsegments:

1) By Contact Cardiac Mapping Systems: Electrode-Based Mapping Systems; Catheter-Based Mapping Systems; Integrated Mapping and Ablation Systems; 3D Mapping Systems2) By Non-Contact Cardiac Mapping Systems: Non-Contact Voltage Mapping Systems; Electrocardiographic Mapping Systems; Optical Mapping Systems; Magnetic Field Mapping Systems

Key Companies Mentioned: Johnson & Johnson; Abbott Laboratories; Medtronic plc; Koninklijke Philips N.V.; GE Healthcare Technologies

Countries: Australia; Brazil; China; France; Germany; India; Indonesia; Japan; Russia; South Korea; UK; USA; Canada; Italy; Spain

Regions: Asia-Pacific; Western Europe; Eastern Europe; North America; South America; Middle East; Africa

Time Series: Five years historic and ten years forecast.

Data: Ratios of market size and growth to related markets, GDP proportions, expenditure per capita.

Data Segmentation: Country and regional historic and forecast data, market share of competitors, market segments.

Sourcing and Referencing: Data and analysis throughout the report is sourced using end notes.

Delivery Format: PDF, Word and Excel Data Dashboard.

Companies Mentioned

The major companies featured in this Cardiac Mapping market report include:- Johnson & Johnson

- Abbott Laboratories

- Medtronic plc

- Koninklijke Philips N.V.

- GE Healthcare Technologies

- Boston Scientific Corporation

- Epmap-System

- APN Health LLC

- BIOTRONIK SE & Co. KG

- Lepu Medical Technology Co. Ltd.

- MicroPort Scientific Corporation

- Biosense Webster Inc.

- BioSig Technologies Inc.

- CardioFocus Inc.

- Kardium Inc.

- Acutus Medical Inc.

- Navix Medical Ltd.

- EP Solutions SA

- CoreMap Inc.

- Catheter Precision Inc.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 200 |

| Published | April 2025 |

| Forecast Period | 2025 - 2029 |

| Estimated Market Value ( USD | $ 2.48 Billion |

| Forecasted Market Value ( USD | $ 3.29 Billion |

| Compound Annual Growth Rate | 7.3% |

| Regions Covered | Global |

| No. of Companies Mentioned | 21 |