Global Produced Water Treatment Market - Key Trends & Drivers Summarized

What is Produced Water Treatment, and Why is it Essential?

Produced water treatment refers to the processes used to manage and treat water generated during oil and gas production. When oil and gas are extracted from underground reservoirs, they are often accompanied by large volumes of water, which contain various impurities, including hydrocarbons, heavy metals, and dissolved salts. This produced water poses environmental challenges and requires careful treatment before it can be safely disposed of, reused, or discharged. The treatment process helps to separate these contaminants and reduce the ecological impact, ensuring regulatory compliance and protecting local ecosystems. Given the significant environmental concerns around water pollution and the limited availability of freshwater resources, produced water treatment has become an essential part of sustainable oil and gas operations.In addition to environmental benefits, produced water treatment can generate economic value for oil and gas companies. Treated water can be reused in enhanced oil recovery, drilling operations, or other industrial applications, reducing the need for fresh water and lowering operational costs. With global water scarcity on the rise, repurposing treated produced water is gaining traction as a sustainable practice, particularly in water-stressed regions. By treating produced water for reuse, companies can achieve a more circular approach to water management, reducing their freshwater footprint while simultaneously meeting regulatory requirements. This dual focus on compliance and resource optimization highlights the strategic importance of produced water treatment in modern energy production.

What Technologies Are Transforming the Produced Water Treatment Market?

The produced water treatment market has seen rapid advancements in technology, particularly in filtration, separation, and desalination methods, enabling more efficient and cost-effective treatment solutions. Membrane filtration, such as reverse osmosis and nanofiltration, has become popular for removing dissolved salts and contaminants, creating high-quality treated water suitable for reuse or safe disposal. Advances in membrane durability and anti-fouling coatings have improved the efficiency of these systems, making them more resilient to the harsh conditions typically present in produced water. Additionally, hydrocyclones and flotation techniques are used to separate oil and suspended solids from water, providing an efficient solution for primary treatment, particularly in offshore and remote environments. These technologies are adaptable, with compact designs that meet the spatial constraints of various oil and gas facilities.Electrochemical treatment methods, such as electrocoagulation and advanced oxidation, have also gained traction as they offer effective removal of contaminants with lower chemical usage and minimal sludge production. With the integration of digital monitoring and automation, companies can now optimize treatment processes in real time, adjusting parameters to maintain optimal efficiency and reduce costs. Data analytics and predictive maintenance tools further support operational efficiency by minimizing downtime and extending equipment life. Additionally, decentralized modular systems allow companies to set up customized water treatment processes tailored to specific site conditions, supporting operational flexibility. As environmental regulations tighten and sustainable practices become prioritized, these advanced treatment solutions are crucial for enhancing produced water management in the oil and gas industry.

Why Are Oil and Gas Companies Embracing Produced Water Treatment?

Oil and gas companies are increasingly adopting produced water treatment to meet stringent environmental regulations and reduce their environmental footprint. With regulations around water disposal and discharge becoming more comprehensive, particularly in regions like North America and Europe, companies are under pressure to ensure that produced water meets high standards before release. Non-compliance can lead to significant financial penalties and reputational damage, making effective water treatment a priority for regulatory adherence. Produced water treatment also helps companies meet sustainability goals by minimizing the impact on local water sources and reducing the reliance on fresh water. As public scrutiny over environmental practices grows, adopting advanced water treatment systems demonstrates a commitment to responsible resource management and environmental stewardship, aligning oil and gas companies with broader corporate social responsibility (CSR) objectives.The rising cost and scarcity of freshwater resources are also motivating companies to treat and reuse produced water for various applications. Reusing treated produced water not only conserves fresh water but also reduces operational expenses, as companies can utilize this treated water for hydraulic fracturing, drilling operations, and secondary recovery processes. Furthermore, reusing water in operations can provide companies with a competitive advantage in regions with limited water availability, as it enables more sustainable and uninterrupted production. The potential to repurpose treated water across various industrial applications is compelling companies to embrace produced water treatment as a cost-effective, environmentally responsible solution. By improving their water management practices, oil and gas companies can enhance operational efficiency, meet regulatory standards, and foster long-term sustainability.

What Factors Drive Growth in the Produced Water Treatment Market?

The growth in the produced water treatment market is driven by several critical factors, including regulatory compliance, environmental concerns, and technological advancements. Stringent environmental regulations across the globe mandate that oil and gas companies treat produced water to meet specific quality standards before disposal or discharge, significantly impacting market demand for treatment solutions. Regulatory bodies, especially in North America and Europe, are continuously updating their guidelines to address water pollution and promote sustainable practices in energy production, driving companies to invest in advanced treatment systems. Additionally, environmental concerns about the disposal of untreated produced water, particularly in water-scarce regions, are compelling companies to adopt more responsible water management practices. The emphasis on sustainability and the reduction of environmental impact is further accelerating market growth as companies seek to align with global sustainability standards.Technological innovation is another strong growth driver in the produced water treatment market. Advancements in treatment technologies, such as membrane filtration, electrocoagulation, and desalination, have made it easier and more cost-effective for companies to treat and repurpose produced water. Additionally, the integration of digital solutions, such as real-time monitoring, data analytics, and predictive maintenance, is helping companies optimize their water treatment processes, lowering operational costs and enhancing system performance. Finally, the global push toward circular economy practices is encouraging oil and gas companies to treat and recycle produced water for internal or industrial use, reducing dependency on limited freshwater resources. Together, these factors create a favorable environment for the growth of the produced water treatment market, underscoring its essential role in the future of sustainable energy production.

Report Scope

The report analyzes the Produced Water Treatment market, presented in terms of market value (USD). The analysis covers the key segments and geographic regions outlined below.- Segments: Treatment (Primary Treatment, Secondary Treatment, Tertiary Treatment, Other Treatments); Source (Conventional Source, Unconventional Source); Application (Onshore Application, Offshore Application).

- Geographic Regions/Countries: World; USA; Canada; China; Europe; UK; Russia; Kazakhstan; Norway; Rest of Europe; Asia-Pacific; India; Indonesia; Rest of Asia-Pacific; Latin America; Brazil; Mexico; Rest of Latin America; Middle East; Iran; Saudi Arabia; UAE; Rest of Middle East; Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Primary Treatment segment, which is expected to reach US$6.1 Billion by 2030 with a CAGR of 6%. The Secondary Treatment segment is also set to grow at 7.1% CAGR over the analysis period.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Produced Water Treatment Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Produced Water Treatment Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Produced Water Treatment Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

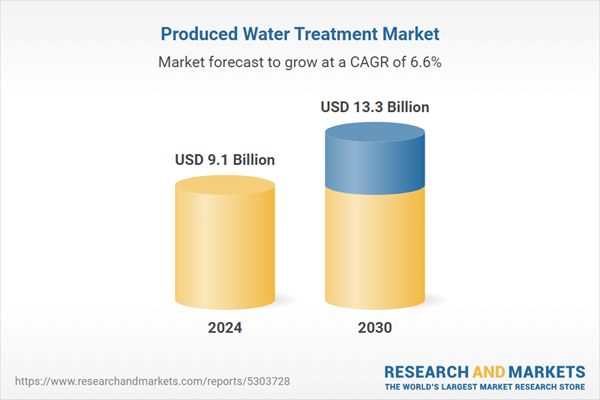

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Alderley plc, Aquatech International LLC, Baker Hughes Company, Cannon Artes S.P.A., Diva Envitec Pvt. Ltd. and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 55 companies featured in this Produced Water Treatment market report include:

- Alderley plc

- Aquatech International LLC

- Baker Hughes Company

- Cannon Artes S.P.A.

- Diva Envitec Pvt. Ltd.

- Enhydra Ltd.

- Enviro-Tech Systems

- Filtra Systems Company

- Genesis water technologies, Inc.

- Industrie de nora S.P.A

- Integrated Sustainability consultants Ltd.

- NOV, Inc.

- Ovivo water Ltd.

- Schlumberger Limited

- TechnipFMC Plc

- Tetra Technologies, Inc.

- Veolia Water Technologies

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Alderley plc

- Aquatech International LLC

- Baker Hughes Company

- Cannon Artes S.P.A.

- Diva Envitec Pvt. Ltd.

- Enhydra Ltd.

- Enviro-Tech Systems

- Filtra Systems Company

- Genesis water technologies, Inc.

- Industrie de nora S.P.A

- Integrated Sustainability consultants Ltd.

- NOV, Inc.

- Ovivo water Ltd.

- Schlumberger Limited

- TechnipFMC Plc

- Tetra Technologies, Inc.

- Veolia Water Technologies

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 331 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 9.1 Billion |

| Forecasted Market Value ( USD | $ 13.3 Billion |

| Compound Annual Growth Rate | 6.6% |

| Regions Covered | Global |