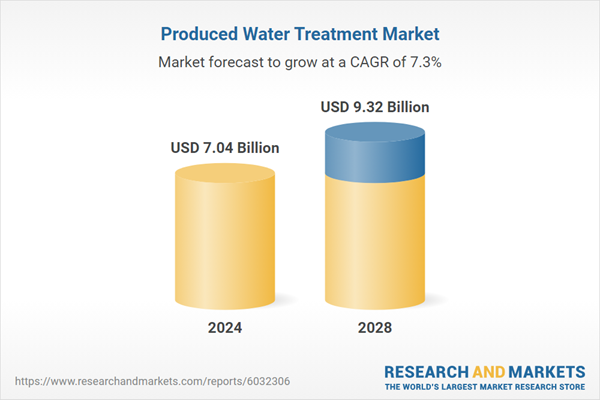

The produced water treatment market size is expected to see strong growth in the next few years. It will grow to $9.32 billion in 2028 at a compound annual growth rate (CAGR) of 7.3%. The anticipated growth during the forecast period can be attributed to several key factors, including a growing emphasis on solutions to water scarcity, increasing global energy demand, heightened investments in sustainable infrastructure, the expansion of unconventional oil and gas exploration, rising public awareness of environmental issues, and an increasing need for efficient treatment solutions. Major trends expected to shape this period include the growing adoption of advanced technologies such as membrane filtration and electrochemical processes, a heightened focus on zero-liquid discharge systems, increased integration of automation and digital monitoring, expanded use of chemical treatment solutions, rising investments in research and development for more efficient treatment methods, and a greater emphasis on regulatory compliance and sustainable practices.

The increasing global production of oil and gas is expected to drive growth in the produced water treatment market in the coming years. This rise in production is fueled by the growing demand for energy and advancements in extraction technologies, such as fracking and deep-water drilling. Produced water treatment plays a critical role in oil and gas operations by facilitating safe disposal, recycling, and compliance with environmental regulations, thereby ensuring the sustainability of operations. For example, in September 2023, HM Revenue and Customs, a UK-based non-ministerial government department, reported that total government revenues from UK oil and gas production rose to $1.84 billion (£1.4 billion) in the 2021-2022 tax year, up from $0.39 billion (£0.3 billion) the previous year, representing an increase of $1.45 billion (£1.1 billion). Consequently, the growth in global oil and gas production is driving the expansion of the produced water treatment market.

Key companies in the produced water treatment sector are innovating with technologies such as microbubble technology to enhance the efficiency and effectiveness of contaminant removal and water recycling processes. Microbubble technology employs tiny gas bubbles, typically ranging from 10 to 100 micrometers in size, to improve contaminant removal processes. In water treatment applications, these small bubbles facilitate the separation of pollutants by attaching to them, making extraction easier. For instance, in January 2024, Adaptive Process Solutions (APS), a US-based water and wastewater treatment technology company, launched the Microbubble Infusion Unit (MiFU), a state-of-the-art system designed to optimize contaminant removal in produced water. This unit utilizes microbubble technology to generate extremely fine gas bubbles that effectively adhere to pollutants, enhancing their separation and extraction. The MiFU aims to significantly improve the efficiency and effectiveness of water recycling processes, contributing to more sustainable and cost-effective water management solutions.

In October 2022, Aris Water Solutions Inc., a US-based company specializing in water management and treatment, acquired the intellectual property rights and related proprietary treatment technologies and assets from Water Standard Management Inc. for an undisclosed amount. This acquisition is intended to enhance Aris's capabilities in produced water treatment and expand its portfolio of sustainable water management solutions within the oil and gas industry. Water Standard is a US-based water treatment and management firm that specializes in solutions for various industrial applications, including the oil and gas sector.

Major companies operating in the produced water treatment market are Dow Inc., Veolia Group, Schlumberger Ltd., Baker Hughes Company, Halliburton Company, Emerson Electric Co., DuPont Inc., SUEZ Group, National Oilwell Varco Inc., TechnipFMC plc., Pall Corporation, Mineral Technologies Inc., Tetra Technologies Inc., GE Water & Process Technologies, Aquatech International, Ovivo, Alderley plc, IDE Technologies Ltd., Samco Technologies Inc., DAS Environmental Expert GMBH, Enviro-Tech Systems, Dryden Aqua Ltd., Condorchem Envitech SL, Microvi Biotech Inc.

North America was the largest region in the produced water treatment market in 2023. Asia-Pacific is expected to be the fastest-growing region in the forecast period. The regions covered in the produced water treatment market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, Africa.

The countries covered in the produced water treatment market report are Australia, Brazil, China, France, Germany, India, Indonesia, Japan, Russia, South Korea, UK, USA, Canada, Italy, Spain.

Produced water treatment refers to the process of treating water that is a byproduct of oil and gas extraction. This water typically contains hydrocarbons, salts, and other contaminants that must be removed before the water can be disposed of, reused, or safely released into the environment. Treatment methods encompass physical, chemical, and biological processes.

The primary types of produced water treatment include chemical treatment, reverse osmosis or membrane treatment, biological treatment, physical treatment, combined systems, and others. Chemical treatment involves the addition of chemicals to eliminate contaminants and enhance water quality. This process may include coagulation, flocculation, and the use of various chemical agents to neutralize or precipitate impurities. The production sources for produced water include crude oil and natural gas, and treatment applications span both onshore and offshore environments. Different end users, such as oil and gas companies, industrial facilities, power generation entities, and others, utilize these treatment methods.

The produced water treatment market research report is one of a series of new reports that provides produced water treatment market statistics, including the produced water treatment industry's global market size, regional shares, competitors with a produced water treatment market share, detailed produced water treatment market segments, market trends and opportunities, and any further data you may need to thrive in the produced water treatment industry. This produced water treatment market research report delivers a complete perspective of everything you need, with an in-depth analysis of the current and future scenarios of the industry.

The produced water treatment market includes revenues earned by entities by providing services such as filtration, flotation, precipitation, and oxidation. The market value includes the value of related goods sold by the service provider or included within the service offering. Only goods and services traded between entities or sold to end consumers are included.

The market value is defined as the revenues that enterprises gain from the sale of goods and/or services within the specified market and geography through sales, grants, or donations in terms of the currency (in USD, unless otherwise specified).

The revenues for a specified geography are consumption values that are revenues generated by organizations in the specified geography within the market, irrespective of where they are produced. It does not include revenues from resales along the supply chain, either further along the supply chain or as part of other products.

This product will be delivered within 3-5 business days.

Table of Contents

Executive Summary

Produced Water Treatment Global Market Report 2024 provides strategists, marketers and senior management with the critical information they need to assess the market.This report focuses on produced water treatment market which is experiencing strong growth. The report gives a guide to the trends which will be shaping the market over the next ten years and beyond.

Reasons to Purchase:

- Gain a truly global perspective with the most comprehensive report available on this market covering 50+ geographies.

- Understand how the market has been affected by the COVID-19 and how it is responding as the impact of the virus abates.

- Assess the Russia - Ukraine war’s impact on agriculture, energy and mineral commodity supply and its direct and indirect impact on the market.

- Measure the impact of high global inflation on market growth.

- Create regional and country strategies on the basis of local data and analysis.

- Identify growth segments for investment.

- Outperform competitors using forecast data and the drivers and trends shaping the market.

- Understand customers based on the latest market shares.

- Benchmark performance against key competitors.

- Suitable for supporting your internal and external presentations with reliable high quality data and analysis

- Report will be updated with the latest data and delivered to you along with an Excel data sheet for easy data extraction and analysis.

- All data from the report will also be delivered in an excel dashboard format.

Description

Where is the largest and fastest growing market for produced water treatment? How does the market relate to the overall economy, demography and other similar markets? What forces will shape the market going forward? The produced water treatment market global report answers all these questions and many more.The report covers market characteristics, size and growth, segmentation, regional and country breakdowns, competitive landscape, market shares, trends and strategies for this market. It traces the market’s historic and forecast market growth by geography.

- The market characteristics section of the report defines and explains the market.

- The market size section gives the market size ($b) covering both the historic growth of the market, and forecasting its development.

- The forecasts are made after considering the major factors currently impacting the market. These include:

- The impact of sanctions, supply chain disruptions, and altered demand for goods and services due to the Russian Ukraine war, impacting various macro-economic factors and parameters in the Eastern European region and its subsequent effect on global markets.

- The impact of higher inflation in many countries and the resulting spike in interest rates.

- The continued but declining impact of COVID-19 on supply chains and consumption patterns.

- Market segmentations break down the market into sub markets.

- The regional and country breakdowns section gives an analysis of the market in each geography and the size of the market by geography and compares their historic and forecast growth. It covers the growth trajectory of COVID-19 for all regions, key developed countries and major emerging markets.

- The competitive landscape chapter gives a description of the competitive nature of the market, market shares, and a description of the leading companies. Key financial deals which have shaped the market in recent years are identified.

- The trends and strategies section analyses the shape of the market as it emerges from the crisis and suggests how companies can grow as the market recovers.

Scope

Markets Covered:

1) By Treatment: Chemical Treatment; Reverse Osmosis Or Membrane Treatment; Biological Treatment; Physical Treatment; Combined Systems; Other Treatments2) By Production Source: Crude Oil; Natural Gas

3) By Application: Onshore; Offshore

4) By End User: Oil And Gas; Industrial; Power Generation; Other End Users

Key Companies Mentioned: Dow Inc.; Veolia Group; Schlumberger Ltd.; Baker Hughes Company; Halliburton Company

Countries: Australia; Brazil; China; France; Germany; India; Indonesia; Japan; Russia; South Korea; UK; USA; Canada; Italy; Spain

Regions: Asia-Pacific; Western Europe; Eastern Europe; North America; South America; Middle East; Africa

Time Series: Five years historic and ten years forecast.

Data: Ratios of market size and growth to related markets, GDP proportions, expenditure per capita.

Data Segmentation: Country and regional historic and forecast data, market share of competitors, market segments.

Sourcing and Referencing: Data and analysis throughout the report is sourced using end notes.

Delivery Format: PDF, Word and Excel Data Dashboard.

Companies Mentioned

Some of the major companies profiled in this Produced Water Treatment market report include:- Dow Inc.

- Veolia Group

- Schlumberger Ltd.

- Baker Hughes Company

- Halliburton Company

- Emerson Electric Co.

- DuPont Inc.

- SUEZ Group

- National Oilwell Varco Inc.

- TechnipFMC plc.

- Pall Corporation

- Mineral Technologies Inc.

- Tetra Technologies Inc.

- GE Water & Process Technologies

- Aquatech International

- Ovivo

- Alderley plc

- IDE Technologies Ltd.

- Samco Technologies Inc.

- DAS Environmental Expert GMBH

- Enviro-Tech Systems

- Dryden Aqua Ltd.

- Condorchem Envitech SL

- Microvi Biotech Inc.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 175 |

| Published | December 2024 |

| Forecast Period | 2024 - 2028 |

| Estimated Market Value ( USD | $ 7.04 Billion |

| Forecasted Market Value ( USD | $ 9.32 Billion |

| Compound Annual Growth Rate | 7.3% |

| Regions Covered | Global |

| No. of Companies Mentioned | 25 |