Global Vegan Cosmetics Market - Key Trends & Drivers Summarized

What Are Vegan Cosmetics, and Why Are They So Crucial in Modern Beauty Trends?

Vegan Cosmetics are beauty and personal care products made without any animal-derived ingredients or by-products, including common components like beeswax, lanolin, collagen, carmine, and gelatin. Instead, these products rely on plant-based and synthetic ingredients, adhering to ethical standards that support cruelty-free and sustainable manufacturing practices. Vegan cosmetics cover a wide range of products, including skincare, haircare, makeup, and body care, and are often labeled as cruelty-free, indicating that they were not tested on animals during development.The importance of vegan cosmetics lies in their alignment with increasing consumer demand for ethical, sustainable, and clean beauty options. As awareness of animal welfare, environmental sustainability, and ingredient transparency grows, more consumers are seeking products that align with their ethical values and lifestyle choices. Vegan cosmetics provide a solution that not only meets these demands but also caters to sensitive skin by avoiding common animal-derived allergens. This shift toward vegan and cruelty-free products reflects a broader movement in the beauty industry toward cleaner formulations, sustainable sourcing, and ethical branding, making vegan cosmetics a vital part of the modern beauty landscape.

How Are Technological Advancements Shaping the Vegan Cosmetics Market?

Technological advancements have significantly enhanced the formulation, performance, and appeal of Vegan Cosmetics, driving innovation across various beauty segments. One of the major developments is the rise of plant-based alternatives to traditional animal-derived ingredients. For example, plant-based squalane, extracted from sugarcane or olives, has replaced animal-derived squalene in moisturizers and serums, offering similar hydration benefits with a sustainable sourcing profile. Similarly, advancements in biotechnology have enabled the production of lab-grown ingredients like collagen and silk proteins, which mimic the benefits of their animal-derived counterparts while maintaining vegan credentials.The use of natural preservatives, emulsifiers, and colorants has improved the stability, safety, and effectiveness of vegan cosmetics. Natural preservatives, such as radish root ferment filtrate and rosemary extract, help maintain product freshness while avoiding synthetic or animal-derived preservatives. Innovations in pigment extraction from plant sources, such as beetroot, turmeric, and spirulina, have expanded the color palette for vegan makeup, offering vibrant shades without the use of carmine or other animal-based dyes. Additionally, the development of cruelty-free testing methods, such as in-vitro testing and AI-driven skin simulations, has enabled vegan brands to ensure product safety and efficacy without resorting to animal testing.

The rise of sustainable packaging solutions has also contributed to the growth of the vegan cosmetics market. Brands are increasingly using eco-friendly materials like biodegradable plastics, recycled glass, and refillable packaging to reduce environmental impact, further aligning with the ethical and sustainable values of vegan beauty consumers. Digitalization has enhanced transparency and traceability, allowing consumers to access ingredient information, sourcing practices, and ethical certifications through apps, QR codes, and websites. These technological innovations not only expand the options available in vegan cosmetics but also strengthen consumer trust and brand loyalty in an industry driven by ethical choices and clean beauty trends.

What Are the Emerging Applications of Vegan Cosmetics Across Different Beauty Categories?

Vegan Cosmetics are finding expanding applications across a wide range of beauty categories, driven by the need for clean, ethical, and high-performance products. In skincare, vegan formulations are used in moisturizers, serums, cleansers, and face masks, offering benefits like hydration, anti-aging, and brightening while using plant-based ingredients like hyaluronic acid (derived from biofermentation), botanical oils, and plant extracts. Products like vegan retinol, derived from bakuchiol, offer anti-aging properties similar to traditional retinol, making them suitable for sensitive skin and those seeking natural alternatives.In the makeup category, vegan cosmetics encompass foundations, lipsticks, eyeshadows, and mascaras, all formulated without animal-derived ingredients. The development of plant-based waxes, such as candelilla and carnauba wax, has enabled the production of vegan lipsticks and mascaras with long-lasting effects. Vegan makeup also focuses on achieving high pigmentation, blendability, and skin benefits, using ingredients like mica, minerals, and natural colorants sourced from fruits and vegetables. Vegan haircare products, including shampoos, conditioners, and styling products, use plant-based proteins, oils, and botanical extracts to promote hair health, offering options that avoid animal-derived keratin, honey, or silk proteins.

Body care and personal hygiene products, such as body lotions, deodorants, and body washes, have also embraced vegan formulations, using natural butters, oils, and plant-based surfactants to provide gentle cleansing and moisturizing benefits. The men's grooming segment, which includes vegan beard oils, shaving creams, and hair styling products, is witnessing growth as more men opt for ethical and clean grooming options. The expanding applications of vegan cosmetics across these categories reflect the growing consumer preference for holistic, cruelty-free, and sustainable beauty solutions, demonstrating the versatility and effectiveness of vegan formulations.

What Drives Growth in the Vegan Cosmetics Market?

The growth in the Vegan Cosmetics market is driven by several factors, including increasing consumer awareness of ethical and sustainable beauty, rising demand for clean and transparent ingredients, and growing regulatory support for cruelty-free products. One of the primary growth drivers is the shift in consumer preferences toward ethical consumption. Modern consumers, particularly Millennials and Gen Z, prioritize sustainability, animal welfare, and ingredient transparency, leading to increased demand for vegan beauty products. Social media and influencer marketing have amplified the appeal of vegan cosmetics, as ethical beauty brands leverage digital platforms to educate consumers and promote cruelty-free lifestyles.The clean beauty movement, which emphasizes non-toxic, natural, and safe ingredients, has also fueled demand for vegan cosmetics. Consumers are seeking products that are free from synthetic chemicals, parabens, sulfates, and animal-derived ingredients, pushing brands to innovate with plant-based alternatives. The rise of certifications like Leaping Bunny, Vegan Society, and PETA's cruelty-free badge has strengthened consumer trust, making it easier for shoppers to identify genuine vegan products. This alignment with clean beauty trends has made vegan cosmetics a preferred choice for health-conscious and environmentally aware consumers.

Regulatory changes and government support for cruelty-free beauty practices have further driven the adoption of vegan cosmetics. Many countries, including the European Union, India, and Australia, have banned animal testing for cosmetics, encouraging brands to develop vegan and cruelty-free formulations. The rise of direct-to-consumer (DTC) brands and e-commerce has made it easier for niche vegan brands to reach wider audiences, driving market growth. Continuous innovations in formulation, sustainable packaging, and digital transparency are expected to sustain the growth of the vegan cosmetics market, as consumers increasingly seek ethical, effective, and eco-friendly beauty products.

Report Scope

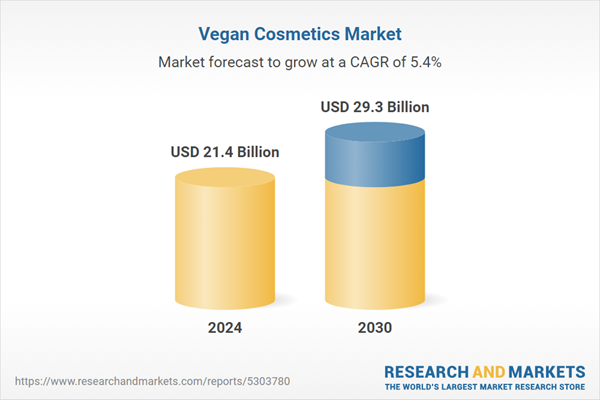

The report analyzes the Vegan Cosmetics market, presented in terms of market value (US$ Thousand). The analysis covers the key segments and geographic regions outlined below.- Segments: Product (Skin Care, Hair Care, Makeup, Other Products); Distribution Channel (Hypermarkets / Supermarkets, eCommerce, Specialty Stores, Departmental Stores, Other Distribution Channels).

- Geographic Regions/Countries:World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Skin Care Cosmetics segment, which is expected to reach US$10.9 Billion by 2030 with a CAGR of a 5.9%. The Hair Care Cosmetics segment is also set to grow at 5.4% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $5.6 Billion in 2024, and China, forecasted to grow at an impressive 8.1% CAGR to reach $6.6 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Vegan Cosmetics Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Vegan Cosmetics Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Vegan Cosmetics Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Arbonne, Bare Blossom, Beauty Without Cruelty (BWC), Billy Jealousy, Ecco Bella and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 42 companies featured in this Vegan Cosmetics market report include:

- Arbonne

- Bare Blossom

- Beauty Without Cruelty (BWC)

- Billy Jealousy

- Ecco Bella

- Emma Jean Cosmetics

- Modern Minerals Makeup

- MuLondon Organic

- Nature’s Gate

- Pacifica

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Arbonne

- Bare Blossom

- Beauty Without Cruelty (BWC)

- Billy Jealousy

- Ecco Bella

- Emma Jean Cosmetics

- Modern Minerals Makeup

- MuLondon Organic

- Nature’s Gate

- Pacifica

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 288 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 21.4 Billion |

| Forecasted Market Value ( USD | $ 29.3 Billion |

| Compound Annual Growth Rate | 5.4% |

| Regions Covered | Global |