Global Plant-Based Beverages Market - Key Trends & Drivers Summarized

Why Are Plant-Based Beverages Gaining So Much Attention in the Global Market?

Plant-based beverages have experienced an exponential rise in popularity over the last decade, driven by a fundamental shift in consumer preferences toward healthier, sustainable, and ethical food choices. These beverages, derived from various plant sources such as almonds, soy, oats, rice, and coconut, offer consumers dairy-free alternatives that cater to those seeking vegan, lactose-free, or environmentally friendly options. The surge in plant-based beverages reflects a broader trend of consumers moving away from animal-based products, particularly in the face of growing concerns about the environmental impact of dairy farming, animal welfare, and the rising prevalence of lactose intolerance globally.Moreover, plant-based beverages are seen as a healthier alternative to traditional dairy products. Many consumers associate these drinks with lower cholesterol, reduced fat content, and the potential to avoid allergens commonly found in milk. This has been particularly appealing to millennials and Generation Z, who are more likely to embrace plant-based diets and are deeply concerned about their dietary choices' impact on personal health and the planet. In addition to health-conscious consumers, the popularity of plant-based beverages is also soaring in regions with a high incidence of lactose intolerance, such as Asia-Pacific, where consumers are shifting to these alternatives for both nutritional and practical reasons.

How Are Technological Innovations Enhancing the Plant-Based Beverage Market?

The rise of plant-based beverages has been heavily supported by advancements in food technology, which have significantly improved the taste, texture, and nutritional profile of these products. Early iterations of plant-based milks, for example, often struggled to replicate the creamy texture and flavor of dairy milk, limiting their appeal beyond vegan or lactose-intolerant consumers. However, innovations in processing techniques, including ultra-filtration, emulsification, and the use of advanced stabilizers, have enhanced the sensory attributes of plant-based beverages, making them more palatable to mainstream consumers.Moreover, companies are continuously exploring novel ingredients to enhance the nutritional value of plant-based beverages. Fortification with essential vitamins and minerals, such as calcium, vitamin D, and B12, has been a common strategy to position these beverages as nutritionally comparable to dairy milk. Recent technological advancements have also enabled manufacturers to extract proteins more efficiently from plant sources like peas, soy, and oats, resulting in beverages with higher protein content that cater to consumers seeking functional, protein-rich alternatives. These innovations are critical for expanding the market reach of plant-based beverages, allowing them to compete with dairy products not just as substitutes but as superior options for health-conscious consumers.

What Is Driving Consumer Behavior and Market Adoption of Plant-Based Beverages?

Consumer behavior plays a pivotal role in the explosive growth of the plant-based beverage market. One of the most significant drivers is the global shift toward plant-based diets. According to various surveys, more consumers are identifying as flexitarians - individuals who primarily eat plant-based foods but occasionally consume animal products. This group has emerged as a substantial market for plant-based beverages, seeking a balance between environmental sustainability and personal health without fully committing to a vegan diet. As consumers become more informed about the environmental footprint of dairy production - especially regarding water usage, methane emissions, and deforestation - they are increasingly choosing plant-based beverages to minimize their impact on the planet.Additionally, consumer demand for transparency and clean-label products has propelled the market forward. Shoppers are now more inclined to scrutinize product labels for natural ingredients, free from artificial additives, preservatives, or genetically modified organisms (GMOs). Plant-based beverage manufacturers are capitalizing on this trend by offering clean-label products that highlight their simplicity and health benefits. In tandem with this, the rise of functional beverages - those offering added health benefits such as gut health, immune support, and energy-boosting properties - has aligned with plant-based beverages' growing appeal. Products infused with probiotics, antioxidants, and adaptogens are seeing strong demand, further expanding the reach of plant-based beverages beyond just dairy alternatives.

Growth in the Plant-Based Beverages Market Is Driven by Several Factors…

The growth in the plant-based beverages market is driven by several factors, all contributing to the sector's rapid expansion. Technological advancements in processing techniques and ingredient innovation have been crucial in enhancing the taste, texture, and nutritional content of plant-based drinks, making them more appealing to a broader audience. The development of protein-rich formulations, advanced flavoring technologies, and better fortification has allowed manufacturers to create superior products that closely mimic dairy's creaminess and nutritional profile, thereby attracting health-conscious and mainstream consumers alike.Consumer behavior is another significant driver, particularly the increasing adoption of plant-based diets, even among non-vegans. The rise of flexitarianism, combined with growing environmental concerns, is fueling demand for plant-based beverages as consumers seek to reduce their carbon footprint and opt for more sustainable food choices. Furthermore, the clean-label movement, which prioritizes transparency and the use of natural, simple ingredients, aligns perfectly with the values of consumers purchasing plant-based beverages. Functional benefits also play a key role, with consumers gravitating towards beverages that offer added health perks like enhanced protein, probiotics, or antioxidants. Finally, the global rise in lactose intolerance, particularly in regions like Asia-Pacific, has expanded the market for plant-based alternatives, ensuring strong and sustained demand for these products in both established and emerging markets.

Report Scope

The report analyzes the Plant-based Beverages market, presented in terms of market value (US$ Thousand). The analysis covers the key segments and geographic regions outlined below.- Segments: Source (Almond, Soy, Coconut, Rice, Other Sources); Type (Milk, Other Types).

- Geographic Regions/Countries:World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Almond Source segment, which is expected to reach US$19.2 Billion by 2030 with a CAGR of a 12.1%. The Soy Source segment is also set to grow at 9.8% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $6.5 Billion in 2024, and China, forecasted to grow at an impressive 14.5% CAGR to reach $11.1 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Plant-based Beverages Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Plant-based Beverages Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Plant-based Beverages Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Blue Diamond Growers, Borges International Group S.L., Califia Farms, Csc Brands L.P., Danone SA and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 48 companies featured in this Plant-based Beverages market report include:

- Blue Diamond Growers

- Borges International Group S.L.

- Califia Farms

- Csc Brands L.P.

- Danone SA

- Hain Celestial

- Kikkoman Corporation

- Pepsi Co.

- Pulmuone Foods USA, Inc.

- Pureharvest

- Ripple Foods

- Sunopta

- The Coca Cola Company

- Troll Bridge Creek

- Want Want China Holdings Limited

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Blue Diamond Growers

- Borges International Group S.L.

- Califia Farms

- Csc Brands L.P.

- Danone SA

- Hain Celestial

- Kikkoman Corporation

- Pepsi Co.

- Pulmuone Foods USA, Inc.

- Pureharvest

- Ripple Foods

- Sunopta

- The Coca Cola Company

- Troll Bridge Creek

- Want Want China Holdings Limited

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 288 |

| Published | January 2026 |

| Forecast Period | 2024 - 2030 |

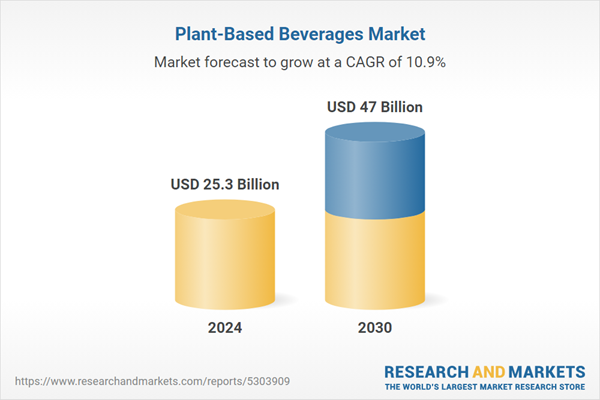

| Estimated Market Value ( USD | $ 25.3 Billion |

| Forecasted Market Value ( USD | $ 47 Billion |

| Compound Annual Growth Rate | 10.9% |

| Regions Covered | Global |