Global Robotic Refueling Systems Market - Key Trends and Drivers Summarized

How Are Robotic Refueling Systems Transforming the Fueling Process?

Robotic refueling systems (RFS) are automated solutions designed to refuel vehicles without human intervention. These systems are particularly valuable in industries such as mining, transportation, and aviation, where efficiency and safety are critical. RFS technology utilizes robotic arms, sensors, and advanced control systems to carry out the fueling process in a controlled and precise manner. In mining, for example, RFS helps eliminate the need for manual refueling in hazardous environments, reducing the risk of accidents. As the demand for automation in fuel handling grows, robotic refueling systems are becoming a vital tool for operations requiring quick turnaround and minimal downtime.What Are the Key Segments in the Robotic Refueling Systems Market?

Fuel types include diesel, gasoline, and natural gas, with diesel refueling systems holding a significant share due to their application in mining and heavy-duty vehicles. Components of RFS include robotic arms, sensors, control software, and safety mechanisms. Robotic arms and sensors form the core of these systems, enabling accurate positioning and movement during the refueling process. Control software ensures precision, adapting to different vehicles and refueling requirements based on the configuration. End-user industries for RFS include mining, transportation, automotive, and aviation. Mining is a dominant segment as RFS technology enables efficient refueling of heavy machinery in remote locations without compromising safety. In the transportation industry, RFS provides quick refueling for buses, trucks, and fleets, enhancing operational efficiency. In aviation, robotic refueling is emerging as an efficient alternative for handling large volumes of fuel safely, ensuring faster turnaround times for aircraft. The automotive sector is also exploring robotic refueling solutions for fuel stations, potentially transforming the traditional gas station experience into an automated, self-service model.How Are Robotic Refueling Systems Applied Across Different Sectors?

In the mining industry, robotic refueling systems are used to fuel large machinery, such as haul trucks and loaders, in remote and hazardous locations. This eliminates the need for workers to be present in risky areas and reduces the risk of fuel spillage, enhancing safety and environmental compliance. In the transportation sector, RFS is implemented in large-scale fleets to provide quick and efficient refueling, reducing downtime and optimizing fleet availability. In aviation, robotic systems allow for precise and safe refueling of aircraft, reducing the turnaround time in busy airports. Additionally, RFS is gaining interest from fuel stations in the automotive sector, where it promises a convenient, automated fueling solution for drivers.What Factors Are Driving the Growth in the Robotic Refueling Systems Market?

The growth in the Robotic Refueling Systems market is driven by several factors, including the need for operational efficiency, advancements in automation, and heightened safety requirements. Innovations in sensor technology, control systems, and automation software have enhanced the functionality of RFS, making them more reliable and adaptable across industries. The focus on reducing manual labor, enhancing safety, and minimizing fuel wastage has further fueled demand, as robotic refueling systems provide an efficient and controlled refueling solution. Additionally, the expansion of heavy industries, growing vehicle fleets, and the adoption of automation in hazardous environments have contributed to market growth, encouraging wider adoption of RFS technology.Report Scope

The report analyzes the Robotic Refueling Systems market, presented in terms of market value (US$ Thousand). The analysis covers the key segments and geographic regions outlined below.- Segments: Fuel Type (Gasoline, Natural Gas, Petrochemical, Other Fuel Types); Vertical (Mining, Aerospace & Defense, Automotive, Oil & Gas, Construction, Other Verticals).

- Geographic Regions/Countries:World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; and Rest of Europe); Asia-Pacific; Rest of World.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Gasoline Fuel segment, which is expected to reach US$1.4 Billion by 2030 with a CAGR of a 39.1%. The Natural Gas Fuel segment is also set to grow at 37% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $94.5 Million in 2024, and China, forecasted to grow at an impressive 35.7% CAGR to reach $287.7 Million by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Robotic Refueling Systems Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Robotic Refueling Systems Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Robotic Refueling Systems Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as ABB, Aerobotix, Aral, Daihen Corporation, Fanuc Corporation and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 33 companies featured in this Robotic Refueling Systems market report include:

- ABB

- Aerobotix

- Aral

- Daihen Corporation

- Fanuc Corporation

- Fuelmatics

- Gazpromneft-Aero

- Green Fueling Technologies

- KUKA AG

- Mine Energy Solution

- Neste

- Plug Power Inc.

- Rotec Engineering

- Royal Dutch Shell PLC

- Scott

- Shaw Development LLC

- Simon Group Holdings

- Stäubli International AG

- Tatsuno Corporation

- Yaskawa Electric Corporation

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- ABB

- Aerobotix

- Aral

- Daihen Corporation

- Fanuc Corporation

- Fuelmatics

- Gazpromneft-Aero

- Green Fueling Technologies

- KUKA AG

- Mine Energy Solution

- Neste

- Plug Power Inc.

- Rotec Engineering

- Royal Dutch Shell PLC

- Scott

- Shaw Development LLC

- Simon Group Holdings

- Stäubli International AG

- Tatsuno Corporation

- Yaskawa Electric Corporation

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 141 |

| Published | January 2026 |

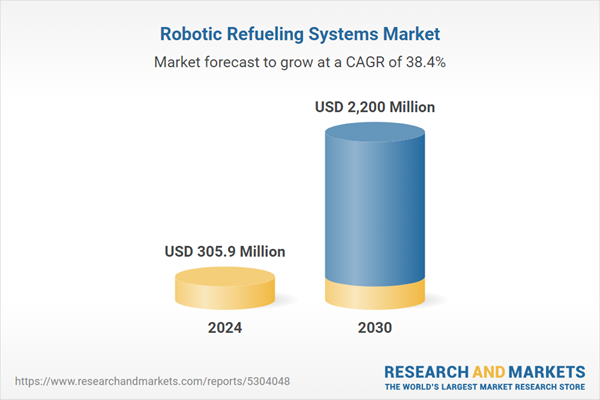

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 305.9 Million |

| Forecasted Market Value ( USD | $ 2200 Million |

| Compound Annual Growth Rate | 38.4% |

| Regions Covered | Global |