Global Immune Checkpoint Inhibitors Market - Key Trends and Drivers Summarized

How Do Immune Checkpoint Inhibitors Work to Revolutionize Cancer Therapy?

Immune checkpoint inhibitors (ICIs) represent one of the most revolutionary advances in cancer treatment, offering hope for patients with various types of malignancies. But what exactly makes these drugs so groundbreaking? The human immune system has built-in checkpoints - molecules that act as brakes to prevent the immune system from attacking the body's own cells. However, cancer cells often hijack these checkpoints, using them to hide from the immune system and evade destruction. Immune checkpoint inhibitors work by blocking these checkpoints, essentially releasing the brakes and allowing immune cells, particularly T-cells, to recognize and attack cancer cells.The most well-known immune checkpoints targeted by these therapies are PD-1 (programmed death-1) and CTLA-4 (cytotoxic T-lymphocyte-associated protein 4). Inhibitors targeting these molecules have shown remarkable efficacy in treating cancers such as melanoma, lung cancer, kidney cancer, and even certain types of lymphoma. Drugs like pembrolizumab (Keytruda) and nivolumab (Opdivo) have become household names in oncology, transforming previously fatal cancers into manageable, chronic conditions for some patients. While not all patients respond to these therapies, ICIs have shown the potential to provide long-lasting remission in cases where traditional treatments such as chemotherapy and radiation have failed. By harnessing the power of the immune system, these drugs have opened a new frontier in cancer treatment, shifting the paradigm from a focus on directly killing cancer cells to empowering the body's natural defenses to do the work.

What Makes Immune Checkpoint Inhibitors Different From Traditional Cancer Therapies?

Unlike conventional cancer treatments such as chemotherapy and radiation, which attack both healthy and cancerous cells indiscriminately, immune checkpoint inhibitors offer a more targeted approach. By specifically focusing on the immune system's regulatory checkpoints, these therapies boost the body's natural ability to detect and eliminate cancer cells without the widespread collateral damage associated with traditional treatments. Chemotherapy, for example, can often weaken a patient's immune system, leaving them vulnerable to infections and other complications. In contrast, ICIs strengthen immune responses, allowing the body to better fend off both cancer and external threats.Moreover, immune checkpoint inhibitors have a unique advantage in terms of durability. While the effects of chemotherapy and radiation often wane over time, requiring repeated rounds of treatment, ICIs can sometimes lead to long-lasting immune responses. In some cases, patients who have responded to checkpoint inhibitors continue to remain cancer-free for years after treatment has ended. This durability is attributed to the immune system's 'memory,' which can retain the ability to recognize and attack cancer cells long after the initial treatment. While this class of drugs is not without its side effects - ranging from fatigue and skin reactions to more severe immune-related adverse events like colitis or hepatitis - its ability to provide a more sustained and less toxic alternative makes it a compelling option for both patients and oncologists. As research continues to fine-tune these therapies, immune checkpoint inhibitors are quickly emerging as a vital component in the arsenal against cancer.

How Are Immune Checkpoint Inhibitors Expanding Beyond Oncology?

While immune checkpoint inhibitors have primarily been associated with cancer treatment, researchers are now exploring their potential beyond oncology, investigating their applications in autoimmune diseases and chronic viral infections. The same immune-modulating mechanisms that make ICIs effective against cancer could be harnessed to rebalance overactive immune responses in diseases like lupus, rheumatoid arthritis, and multiple sclerosis. By blocking specific checkpoints, scientists hope to prevent the immune system from attacking healthy tissues, offering new therapeutic avenues for these often debilitating conditions.In addition to autoimmune disorders, checkpoint inhibitors are being studied for their role in treating chronic viral infections, such as HIV and hepatitis B. In these cases, the immune system becomes exhausted after years of fighting the virus, leading to diminished immune responses. By reactivating these exhausted T-cells through checkpoint inhibition, there's hope that the immune system can better control or even eliminate the viral infection. The potential applications of ICIs in these areas are still in the early stages of research, but the preliminary data is promising. If successful, checkpoint inhibitors could play a role in rethinking how we approach the treatment of chronic immune-related conditions, significantly expanding their scope beyond cancer. The ongoing exploration of these drugs in other therapeutic areas highlights the immense potential of immune modulation as a broader healthcare strategy.

What's Driving the Growth in the Immune Checkpoint Inhibitors Market?

The growth in the immune checkpoint inhibitors market is driven by several factors, each contributing to the rapid expansion of these therapies in healthcare. One of the primary drivers is the rising incidence of cancer worldwide, leading to an increasing demand for novel, effective treatments. Immune checkpoint inhibitors have demonstrated remarkable efficacy in treating some of the most aggressive and previously untreatable cancers, which has led to their widespread adoption by oncologists. Another factor fueling market growth is the expanding list of FDA-approved ICIs. As clinical trials continue to show positive results, the indications for these drugs are broadening to include various types of solid tumors and hematologic cancers, thereby increasing their market penetration.Advances in biomarker research are also playing a critical role in the growth of the ICI market. By identifying patients who are most likely to respond to these treatments based on specific biomarkers, such as PD-L1 expression or tumor mutational burden, healthcare providers can offer more personalized and effective care. Additionally, pharmaceutical companies are heavily investing in combination therapies, where immune checkpoint inhibitors are used alongside other treatments such as chemotherapy, radiation, or targeted therapies. These combinations have shown promise in enhancing treatment efficacy, further driving market expansion.

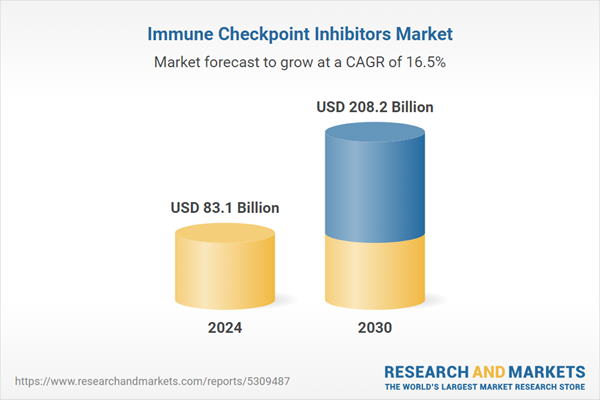

Finally, growing awareness among both patients and healthcare providers about the benefits of immunotherapy has led to increased demand. Patients are actively seeking out these treatments, which are often perceived as more tolerable than traditional cancer therapies. As consumer behavior shifts towards more personalized and less invasive treatment options, the demand for immune checkpoint inhibitors continues to rise. This combination of technological advancement, clinical success, and evolving consumer preferences is ensuring that immune checkpoint inhibitors remain at the forefront of cancer treatment innovation, with the market expected to grow significantly in the coming years.

Report Scope

The report analyzes the Immune Checkpoint Inhibitors market, presented in terms of market value (USD). The analysis covers the key segments and geographic regions outlined below.- Segments: Type (PD-1, PD-L1, CLTA-4); Application (Lung Cancer, Bladder Cancer, Melanoma, Hodgkin Lymphoma, Other Applications).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; and Rest of Europe); Asia-Pacific; Rest of World.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the PD-1 segment, which is expected to reach US$109 Billion by 2030 with a CAGR of 16.2%. The PD-L1 segment is also set to grow at 17.1% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $23.2 Billion in 2024, and China, forecasted to grow at an impressive 15.5% CAGR to reach $31.3 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Immune Checkpoint Inhibitors Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Immune Checkpoint Inhibitors Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Immune Checkpoint Inhibitors Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as AstraZeneca PLC, Bristol-Myers Squibb Company, Eli Lilly and Company, F. Hoffmann-La Roche AG, Fortress Biotech, Inc. and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 42 companies featured in this Immune Checkpoint Inhibitors market report include:

- AstraZeneca PLC

- Bristol-Myers Squibb Company

- Eli Lilly and Company

- F. Hoffmann-La Roche AG

- Fortress Biotech, Inc.

- Immutep Ltd.

- Merck & Co., Inc.

- Merck KGaA

- Novartis International AG

- Pfizer, Inc.

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- AstraZeneca PLC

- Bristol-Myers Squibb Company

- Eli Lilly and Company

- F. Hoffmann-La Roche AG

- Fortress Biotech, Inc.

- Immutep Ltd.

- Merck & Co., Inc.

- Merck KGaA

- Novartis International AG

- Pfizer, Inc.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 194 |

| Published | January 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 83.1 Billion |

| Forecasted Market Value ( USD | $ 208.2 Billion |

| Compound Annual Growth Rate | 16.5% |

| Regions Covered | Global |