Global Demand Side Platforms (DSP) Market - Key Trends & Growth Drivers Explored

Why Are Demand Side Platforms (DSPs) Transforming Digital Advertising and Media Buying?

Demand Side Platforms (DSPs) have become essential tools in the digital advertising ecosystem, enabling advertisers to efficiently manage, optimize, and automate media buying across a vast array of digital channels. But what exactly makes DSPs so critical for modern marketing strategies? A DSP is a software platform that allows advertisers to purchase digital ad inventory through real-time bidding (RTB) across multiple sources - such as websites, mobile apps, video platforms, and social media - within a single interface. DSPs enable advertisers to target specific audiences, track campaign performance, and optimize ad placements based on data-driven insights. This technology allows marketers to buy advertising impressions in real-time, reaching the right audience at the right time with highly relevant ads, while maximizing return on investment (ROI) and minimizing ad spend inefficiencies.The demand for DSPs has surged as digital advertising has evolved from manual processes to highly automated and data-driven strategies. With the proliferation of digital channels and platforms, managing ad placements manually has become increasingly complex and resource-intensive. DSPs streamline the process by providing a centralized platform for managing programmatic ad campaigns, making it easier to optimize bids, track key performance indicators (KPIs), and achieve greater transparency in media buying. DSPs are widely used by digital agencies, brands, and marketers across industries seeking to leverage programmatic advertising for brand awareness, customer acquisition, and retargeting efforts. As data-driven marketing continues to gain traction, DSPs are becoming a cornerstone of modern advertising technology stacks, enabling businesses to achieve greater precision, efficiency, and scale in their digital marketing efforts.

How Are Technological Advancements Elevating the Capabilities of Demand Side Platforms?

The demand side platform market has witnessed significant technological advancements that have enhanced the efficiency, targeting capabilities, and analytical power of these solutions. But what are the key innovations driving these developments? One of the most impactful advancements is the integration of artificial intelligence (AI) and machine learning (ML) into DSPs. AI-powered DSPs can analyze vast datasets in real time to identify patterns, predict campaign outcomes, and optimize bidding strategies automatically. Machine learning algorithms continuously learn from past performance and market trends, enabling DSPs to make more informed decisions about which impressions to bid on and at what price. For example, ML models can adjust bids dynamically based on factors such as time of day, device type, or user behavior, ensuring that ads are served to the most relevant audience segments. This intelligent optimization helps advertisers achieve better campaign performance, reduce wasteful ad spend, and increase overall ROI.Another critical innovation is the enhanced ability to leverage first-party data and audience segmentation within DSPs. As third-party cookies are phased out and data privacy regulations become more stringent, advertisers are shifting their focus to leveraging first-party data for targeting and personalization. Modern DSPs allow advertisers to integrate their own customer data - such as CRM information, website activity, and purchase history - into programmatic campaigns, creating more accurate audience segments and personalized experiences. This shift is driving demand for DSPs that support robust data management capabilities, enable lookalike modeling, and provide deeper audience insights. Additionally, DSPs are offering advanced targeting options, such as contextual targeting and sentiment analysis, which allow advertisers to target audiences based on the content they are consuming or their emotional response to it. These innovations are enhancing the precision and relevance of digital advertising, making DSPs more effective tools for driving engagement and conversions.

The emergence of cross-channel and omnichannel capabilities has also transformed the functionality of DSPs. Traditional DSPs were primarily focused on display and video ads, but modern platforms are now enabling programmatic buying across multiple channels, including connected TV (CTV), audio streaming, native ads, and digital out-of-home (DOOH). This integration allows advertisers to manage and optimize campaigns holistically across diverse media formats and devices, ensuring a consistent and cohesive brand experience for consumers. The ability to execute and measure campaigns across multiple channels within a single DSP platform simplifies media planning and provides a unified view of performance. These cross-channel capabilities are particularly valuable for advertisers looking to implement sophisticated, multi-touchpoint strategies that drive customer engagement and conversion throughout the buyer's journey. These technological advancements have collectively elevated the capabilities of DSPs, making them powerful tools for executing data-driven, omnichannel marketing strategies at scale.

What Market Trends Are Driving the Adoption of Demand Side Platforms Across Various Sectors?

Several key market trends are shaping the adoption of demand side platforms across various sectors, reflecting the evolving needs of advertisers and the increasing complexity of the digital advertising landscape. One of the most prominent trends is the growing focus on programmatic advertising and real-time bidding (RTB). Programmatic advertising, which automates the process of buying and selling ad inventory through DSPs and supply-side platforms (SSPs), has become the preferred method for digital media buying due to its efficiency, scalability, and ability to optimize ad placements in real-time. The adoption of programmatic advertising is being driven by its ability to reach specific audience segments at scale, deliver personalized experiences, and maximize ad performance. This trend is particularly strong in industries such as retail, automotive, and technology, where businesses are leveraging DSPs to implement programmatic campaigns that target niche audiences and drive higher engagement.Another key trend driving the adoption of DSPs is the increasing use of data-driven marketing and audience targeting. As businesses prioritize data-driven strategies to enhance customer engagement and achieve better campaign outcomes, the demand for DSPs that support sophisticated targeting and segmentation capabilities is rising. DSPs provide advertisers with granular control over audience targeting, enabling them to define custom segments based on demographics, interests, behavior, and other attributes. The ability to use first-party data for targeting is also gaining importance as businesses navigate the changing landscape of data privacy and the decline of third-party cookies. This trend is driving the adoption of DSPs that offer strong data management capabilities, integrate with data management platforms (DMPs) and customer data platforms (CDPs), and support advanced analytics for measuring campaign performance and audience insights.

The adoption of DSPs is also being influenced by the increasing demand for transparency and accountability in digital advertising. Advertisers are seeking greater visibility into where their ads are placed, who sees them, and how they perform. DSPs that offer transparency features - such as viewability metrics, fraud detection, and brand safety controls - are becoming more attractive to advertisers who want to ensure that their media spend is being used effectively and that their ads are being shown in safe and suitable environments. The rise of programmatic direct and private marketplaces (PMPs) is also contributing to this trend, as these models offer greater control and transparency compared to open auction RTB. The focus on transparency is particularly relevant for industries such as finance, healthcare, and CPG (consumer packaged goods), where brand reputation and regulatory compliance are critical considerations. As transparency and accountability continue to shape advertiser expectations, the adoption of DSPs that offer robust transparency features and reporting capabilities is expected to grow.

What Factors Are Driving the Growth of the Global Demand Side Platforms Market?

The growth in the global demand side platforms market is driven by several factors, including the increasing adoption of programmatic advertising, advancements in data and analytics technology, and the rising demand for personalized and targeted advertising. One of the primary growth drivers is the expanding use of programmatic advertising across digital channels. As advertisers seek to reach audiences at scale and optimize their ad spend, programmatic advertising has become the go-to method for buying digital media. DSPs enable advertisers to execute programmatic campaigns efficiently by providing access to a vast pool of inventory and automating the bidding process. The ability to target specific audience segments, optimize bids in real-time, and measure performance through a single platform is driving demand for DSPs among businesses of all sizes. This growth is further supported by the increasing adoption of programmatic buying in emerging markets, where digital advertising is gaining traction as internet and mobile penetration rise.Another key growth driver is the rising emphasis on personalization and dynamic ad delivery. As consumers become more selective about the ads they engage with, advertisers are turning to DSPs to deliver personalized and contextually relevant ads that resonate with their audience. DSPs enable advertisers to use dynamic creative optimization (DCO) to tailor ad content based on factors such as user behavior, location, and device type. This capability allows businesses to create a more engaging and personalized ad experience, increasing the likelihood of conversion. The growing demand for personalized advertising is particularly strong in industries such as e-commerce, travel, and entertainment, where businesses seek to capture consumer attention and influence purchase decisions through targeted and relevant messaging. The ability of DSPs to support dynamic ad delivery and personalization is driving their adoption among advertisers looking to differentiate themselves in a crowded digital landscape.

The global demand side platforms market is also benefiting from the increasing use of data and analytics in marketing strategies. As businesses adopt data-driven approaches to optimize their marketing efforts, the need for DSPs that provide advanced analytics and reporting capabilities is growing. Modern DSPs offer a wealth of data and insights, allowing advertisers to measure the performance of their campaigns, track key metrics such as click-through rates (CTR) and conversion rates, and make data-informed decisions to improve campaign outcomes. The integration of DSPs with other data and analytics tools, such as CRM systems, CDPs, and attribution platforms, is further enhancing the ability of businesses to track and analyze customer journeys, optimize ad spend, and achieve a higher ROI. As data and analytics become integral to marketing success, the demand for DSPs that offer strong analytical capabilities and integration options is expected to rise.

With ongoing advancements in programmatic technology, the growing complexity of digital media buying, and the increasing focus on data-driven and personalized advertising strategies, the global demand side platforms market is poised for sustained growth. The dynamic interplay of technological innovation, market demand, and evolving advertising strategies is set to shape the future of the market, offering businesses new opportunities to optimize their media buying, engage with target audiences, and achieve greater transparency and efficiency in their advertising efforts. As companies continue to prioritize data-driven marketing and personalized engagement, demand side platforms will remain a critical tool for driving success in the evolving digital advertising landscape.

Report Scope

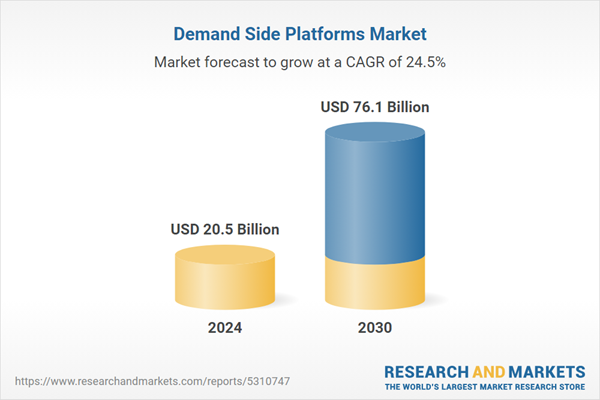

The report analyzes the Demand Side Platforms market, presented in terms of market value (US$ Thousand). The analysis covers the key segments and geographic regions outlined below.- Segments: Type (Programmatic Premium Buying, Real Time Bidding).

- Geographic Regions/Countries:World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Programmatic Premium Buying segment, which is expected to reach US$62.4 Billion by 2030 with a CAGR of a 25%. The Real Time Bidding segment is also set to grow at 22.4% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $5.2 Billion in 2024, and China, forecasted to grow at an impressive 32.8% CAGR to reach $22.7 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Demand Side Platforms Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Demand Side Platforms Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Demand Side Platforms Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Adform, Amazon.com, Inc., Amobee, Inc., Centro Incorporated, Criteo and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 12 companies featured in this Demand Side Platforms market report include:

- Adform

- Amazon.com, Inc.

- Amobee, Inc.

- Centro Incorporated

- Criteo

- Double Click

- MediaMath, Inc.

- Sizmek, Inc.

- Trade Desk

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Adform

- Amazon.com, Inc.

- Amobee, Inc.

- Centro Incorporated

- Criteo

- Double Click

- MediaMath, Inc.

- Sizmek, Inc.

- Trade Desk

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 158 |

| Published | January 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 20.5 Billion |

| Forecasted Market Value ( USD | $ 76.1 Billion |

| Compound Annual Growth Rate | 24.5% |

| Regions Covered | Global |