Global A/B Testing Software Market - Key Trends & Growth Drivers Explored

Why Is A/B Testing Software Transforming Marketing and Product Optimization Strategies?

A/B testing software has become an indispensable tool for modern businesses, enabling marketers, product managers, and developers to make data-driven decisions that optimize user experiences and increase conversion rates. But what exactly makes A/B testing software so vital for today's digital operations? A/B testing, also known as split testing, is a method of comparing two versions of a webpage, email, application feature, or other digital asset to determine which one performs better based on specific user behaviors or metrics, such as click-through rates, bounce rates, or conversion rates. A/B testing software facilitates this process by providing tools to create variations, distribute traffic evenly, and collect and analyze data on user interactions. This allows organizations to experiment with different design elements, content, layouts, and features, making it possible to identify the best-performing options and implement them confidently.The demand for A/B testing software has surged as businesses seek to improve customer experiences, optimize digital content, and achieve higher returns on marketing investments. As consumer expectations for personalized and seamless digital interactions rise, businesses need to ensure that their websites, mobile apps, and marketing campaigns deliver the best possible user experience. A/B testing helps organizations achieve this by enabling them to test different hypotheses and understand how specific changes impact user behavior. By leveraging A/B testing software, companies can reduce guesswork and minimize the risks associated with implementing changes, ensuring that every update is backed by empirical evidence. As a result, A/B testing has become a cornerstone of digital optimization strategies, supporting data-driven decision-making across marketing, product development, and user experience (UX) design.

How Are Technological Advancements Elevating the Capabilities of A/B Testing Software?

The A/B testing software market has witnessed significant technological advancements that have enhanced the functionality, scalability, and analytical power of these tools. But what are the key innovations driving these developments? One of the most impactful advancements is the integration of machine learning (ML) and artificial intelligence (AI) into A/B testing platforms. AI-powered algorithms can analyze large datasets in real time, identify trends, and optimize traffic allocation to maximize test efficiency. This enables businesses to run multi-armed bandit experiments, where traffic is dynamically allocated to the best-performing variations, reducing the time required to reach statistically significant results. Additionally, AI can uncover hidden patterns and interactions between variables that traditional A/B tests might overlook, providing deeper insights into user behavior and preferences.Another critical innovation is the development of advanced testing methodologies, such as multivariate testing and personalization testing. While traditional A/B testing compares only two variations at a time, multivariate testing allows businesses to test multiple elements simultaneously, providing insights into how different combinations of changes impact user behavior. This enables companies to optimize more complex elements, such as entire page layouts or multi-step processes, in a single test. Personalization testing, on the other hand, leverages user segmentation and behavior data to deliver personalized experiences for different audience segments. By integrating personalization engines into A/B testing software, businesses can run tests that target specific user groups based on demographics, behavioral data, or past interactions, ensuring that optimizations are tailored to the needs and preferences of each segment.

The adoption of cloud-based and cross-platform testing capabilities has also transformed the A/B testing landscape. Cloud-based A/B testing platforms offer greater scalability, flexibility, and ease of integration with other digital tools, such as analytics, customer relationship management (CRM) systems, and marketing automation platforms. This allows businesses to conduct tests across multiple devices, channels, and touchpoints, providing a unified view of how changes impact user behavior in different contexts. Cross-platform testing capabilities are particularly valuable in today's multi-device world, where users frequently switch between desktops, tablets, and smartphones. By ensuring that A/B tests are consistent and accurate across platforms, businesses can optimize user experiences holistically, rather than in isolated silos. These technological advancements have collectively elevated the capabilities of A/B testing software, making it a powerful tool for driving data-driven innovation and optimization.

What Market Trends Are Driving the Adoption of A/B Testing Software Across Various Industries?

Several key market trends are shaping the adoption of A/B testing software across various industries, reflecting the evolving needs of businesses and the increasing emphasis on customer experience optimization. One of the most prominent trends is the growing focus on conversion rate optimization (CRO). As competition intensifies in the digital marketplace, businesses are seeking ways to improve the efficiency of their marketing efforts and maximize the value of their web traffic. A/B testing plays a critical role in CRO by helping organizations identify and implement changes that lead to higher conversion rates, whether it's through optimizing landing pages, refining calls-to-action (CTAs), or improving checkout processes. This trend is particularly strong in e-commerce, where even small improvements in conversion rates can lead to significant increases in revenue and profitability.Another key trend driving the adoption of A/B testing software is the increasing use of personalization and targeted marketing. Consumers today expect personalized experiences that cater to their unique needs and preferences. A/B testing software that supports personalization testing enables businesses to create, test, and optimize personalized experiences for different user segments. This includes testing personalized product recommendations, dynamic content, and customized messaging. The ability to deliver and test personalized experiences has become a competitive advantage, particularly in industries such as retail, travel, and financial services, where customer engagement and satisfaction are critical to success. As more businesses invest in personalization strategies, the demand for A/B testing software that can support and validate these efforts is expected to grow.

The adoption of A/B testing software is also being influenced by the rise of agile and data-driven business practices. Companies are increasingly adopting agile methodologies that prioritize continuous improvement and rapid iteration. A/B testing aligns with these methodologies by enabling teams to quickly test hypotheses, gather data, and make informed decisions in real time. This has led to the widespread use of A/B testing in product development, where teams use it to optimize features, improve usability, and enhance user engagement. Additionally, the growing reliance on data-driven decision-making has increased the use of A/B testing across various business functions, including marketing, product management, and UX design. These trends underscore the increasing recognition of A/B testing software as a strategic tool for driving business growth and achieving operational excellence.

What Factors Are Driving the Growth of the Global A/B Testing Software Market?

The growth in the global A/B testing software market is driven by several factors, including the increasing demand for data-driven optimization, advancements in digital marketing technologies, and the rising focus on customer experience. One of the primary growth drivers is the expanding adoption of digital marketing strategies across industries. As more businesses invest in digital channels to reach and engage their target audiences, there is a growing need for tools that can optimize content, design, and functionality to maximize engagement and conversions. A/B testing software enables marketers to test different variations of their campaigns and identify the most effective elements, driving higher return on investment (ROI) and reducing customer acquisition costs.Another key growth driver is the increasing emphasis on user experience (UX) design and usability testing. Businesses recognize that delivering a positive user experience is essential to building brand loyalty and retaining customers. A/B testing software provides UX designers and product managers with the ability to experiment with different interface designs, navigation structures, and interaction flows to determine which ones lead to the best user outcomes. This has made A/B testing a critical component of UX optimization, supporting the continuous improvement of websites, applications, and digital products. The rise of mobile and responsive design has further increased the importance of A/B testing, as businesses seek to ensure that their digital assets perform optimally across different devices and screen sizes.

The global A/B testing software market is also benefiting from the increasing adoption of artificial intelligence (AI) and machine learning (ML) in analytics and optimization. AI-powered testing solutions offer advanced capabilities, such as automated traffic allocation, predictive analytics, and real-time optimization, which enhance the efficiency and effectiveness of A/B testing. These technologies enable businesses to conduct more sophisticated tests, gain deeper insights into user behavior, and achieve faster results. The use of AI and ML is expected to drive further innovation in the A/B testing market, making these solutions more accessible and valuable to a broader range of businesses.

With ongoing advancements in testing methodologies, the growing need for digital optimization, and the expanding scope of data-driven decision-making, the global A/B testing software market is poised for sustained growth. The dynamic interplay of technological innovation, business demand, and evolving digital strategies is set to shape the future of the market, offering businesses new opportunities to enhance their digital experiences, improve conversion rates, and achieve competitive advantage. As companies continue to invest in customer experience and optimization, A/B testing software will remain a critical tool for driving innovation and achieving success in the digital age.

Report Scope

The report analyzes the A/B Testing Software market, presented in terms of market value (US$ Thousand). The analysis covers the key segments and geographic regions outlined below.- Segments: Type (Web-based, Mobile-based, Full-Stack); Organization Type (Large Enterprises, SMEs).

- Geographic Regions/Countries:World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Web-based Software segment, which is expected to reach US$582.8 Million by 2030 with a CAGR of a 10.2%. The Mobile-based Software segment is also set to grow at 10.7% CAGR over the analysis period.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global A/B Testing Software Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global A/B Testing Software Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global A/B Testing Software Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Crazy Egg, Inc., Dynamic Yield Ltd., Evergage, Inc., Instapage, Kameleoon, simplified joint stock company and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 12 companies featured in this A/B Testing Software market report include:

- Crazy Egg, Inc.

- Dynamic Yield Ltd.

- Evergage, Inc.

- Instapage

- Kameleoon, simplified joint stock company

- Landingi

- NotifyVisitors

- Omniconvert

- Optimizely, Inc.

- Qubit Digital Limited

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Crazy Egg, Inc.

- Dynamic Yield Ltd.

- Evergage, Inc.

- Instapage

- Kameleoon, simplified joint stock company

- Landingi

- NotifyVisitors

- Omniconvert

- Optimizely, Inc.

- Qubit Digital Limited

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 158 |

| Published | January 2026 |

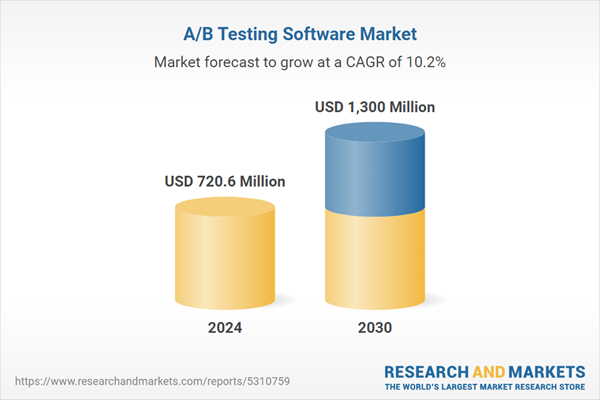

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 720.6 Million |

| Forecasted Market Value ( USD | $ 1300 Million |

| Compound Annual Growth Rate | 10.2% |

| Regions Covered | Global |