Global Plasma Protease C1-Inhibitor Treatment Market - Key Trends & Drivers Summarized

Why Is the Plasma Protease C1-Inhibitor Treatment Market Gaining Prominence as a Critical Segment in Rare Disease Therapeutics?

The plasma protease C1-inhibitor treatment market is gaining prominence as a critical segment in rare disease therapeutics due to its role in managing hereditary angioedema (HAE) and other conditions associated with C1-inhibitor deficiency. C1-inhibitor is a crucial regulatory protein in the complement, coagulation, and kallikrein-kinin systems, and its deficiency can lead to uncontrolled activation of these pathways, resulting in recurrent episodes of severe swelling in various parts of the body, including the extremities, face, gastrointestinal tract, and airways. These unpredictable and potentially life-threatening attacks, especially those involving the airway, can cause significant morbidity and require prompt medical intervention. Plasma-derived and recombinant C1-inhibitor therapies provide targeted treatment for both acute attacks and long-term prophylaxis, helping to manage the symptoms and reduce the frequency and severity of HAE episodes.The growing recognition of hereditary angioedema as a distinct and serious medical condition has driven increased awareness, diagnosis, and treatment adoption, contributing to the expansion of the C1-inhibitor treatment market. Until recently, HAE and related C1-inhibitor deficiency conditions were underdiagnosed and often misdiagnosed due to their rarity and non-specific symptoms. However, advances in diagnostic capabilities and a better understanding of the disease's genetic basis have improved the identification and management of HAE, leading to earlier intervention and better outcomes for patients. As healthcare providers and patients become more knowledgeable about the condition and the benefits of targeted C1-inhibitor therapies, the demand for these treatments is expected to rise significantly, making it a vital area of focus in rare disease therapeutics.

How Are Technological Advancements and Emerging Therapies Transforming the Plasma Protease C1-Inhibitor Treatment Market?

Technological advancements and emerging therapies are transforming the plasma protease C1-inhibitor treatment market by offering patients more effective, convenient, and personalized treatment options. One of the most significant innovations in this space is the development of recombinant C1-inhibitor therapies that do not rely on human plasma as a source. Recombinant C1-inhibitor products, such as Ruconest®, are produced using transgenic animals or cell-based expression systems, providing a high-purity alternative that reduces the risk of blood-borne pathogens and immunogenic reactions. These recombinant products are gaining traction in the market due to their safety profile, consistent supply, and potential for subcutaneous or intravenous administration, making them suitable for both acute attack management and long-term prophylaxis.Another transformative trend is the introduction of new administration routes and formulations that enhance patient convenience and adherence to therapy. Traditional C1-inhibitor therapies are often administered intravenously, which can be challenging for patients to self-administer, particularly during acute attacks. The development of subcutaneous formulations, such as Haegarda®, which offers long-term prophylaxis with a more straightforward subcutaneous injection, is providing patients with more flexibility and control over their treatment. These advancements are improving patient compliance, reducing the burden of therapy, and supporting better quality of life for individuals with HAE. The use of pre-filled syringes, auto-injectors, and on-demand home infusion services is further enhancing the accessibility and ease of use of C1-inhibitor therapies.

The growing focus on personalized medicine and targeted therapies is also influencing the development of novel C1-inhibitor treatments. Precision medicine approaches that consider the genetic, biochemical, and clinical characteristics of individual patients are enabling more tailored treatment regimens. Genetic testing and biomarker identification are being used to predict disease severity, optimize dosing, and monitor treatment response, leading to more personalized and effective management of C1-inhibitor deficiency disorders. The use of monoclonal antibodies and small molecule inhibitors targeting specific pathways involved in HAE pathogenesis, such as kallikrein inhibitors (e.g., lanadelumab) and bradykinin receptor antagonists (e.g., icatibant), is expanding the therapeutic landscape and providing new options for patients who may not respond adequately to conventional C1-inhibitor therapies.

Moreover, the development of gene therapies and RNA-based treatments is emerging as a promising avenue for the long-term management of C1-inhibitor deficiency. Gene therapies aim to provide a permanent solution by delivering functional copies of the SERPING1 gene, which encodes the C1-inhibitor protein, to patients with hereditary angioedema. These therapies have the potential to restore normal C1-inhibitor levels and prevent attacks without the need for frequent infusions or injections. RNA-based therapies, such as small interfering RNA (siRNA) and antisense oligonucleotides, are being explored to downregulate specific genes involved in the overproduction of bradykinin and other mediators of angioedema. These cutting-edge therapies are still in the experimental stages but represent a significant shift towards more effective and durable treatment options for C1-inhibitor deficiency disorders.

The integration of digital health technologies is further transforming the plasma protease C1-inhibitor treatment market. Mobile health applications, telemedicine platforms, and digital monitoring tools are being used to track symptoms, schedule treatments, and monitor adherence in real-time. These technologies provide valuable data that can be used to optimize treatment plans, detect early signs of an impending attack, and support patient education and engagement. The use of digital health solutions is improving the overall management of C1-inhibitor deficiency, supporting better communication between patients and healthcare providers, and enhancing treatment outcomes. As these technological advancements and emerging therapies continue to evolve, they are making C1-inhibitor treatments more accessible, effective, and tailored to the needs of individual patients.

What Role Do Market Dynamics and Regulatory Approvals Play in Shaping the Adoption of Plasma Protease C1-Inhibitor Treatments?

Market dynamics and regulatory approvals play a pivotal role in shaping the adoption of plasma protease C1-inhibitor treatments as healthcare providers, patients, and industry stakeholders navigate the complexities of rare disease management and treatment access. The growing recognition of hereditary angioedema as a serious and debilitating condition is driving increased investment in research and development (R&D), resulting in the introduction of new therapies and improved treatment options. Pharmaceutical companies are focusing on expanding their C1-inhibitor product portfolios, conducting clinical trials for new indications, and developing next-generation therapies to address the unmet needs of HAE patients. The increasing number of clinical trials and product approvals is expanding the range of available treatment options, providing patients with more choices for managing their condition.Regulatory approvals are crucial for the commercialization and adoption of C1-inhibitor therapies, as they ensure that these treatments meet stringent safety, efficacy, and quality standards. The U.S. Food and Drug Administration (FDA), the European Medicines Agency (EMA), and other regulatory bodies have established specific guidelines for the approval of C1-inhibitor therapies, including the evaluation of clinical trial data, manufacturing processes, and post-marketing surveillance. The approval of new C1-inhibitor therapies for both acute treatment and prophylaxis, such as Haegarda®, Berinert®, and Cinryze®, has set a benchmark for the safety and efficacy of these products, supporting their adoption in clinical practice. The expansion of approved indications, such as the use of C1-inhibitors in pediatric patients or in patients with acquired angioedema, is further increasing access to these therapies.

The role of health insurance and reimbursement policies is also influencing the adoption of C1-inhibitor treatments. Given the high cost of plasma-derived and recombinant therapies, reimbursement coverage is essential for ensuring that patients can access these life-saving treatments. Many countries have established reimbursement policies and insurance coverage for C1-inhibitor therapies, particularly for rare and orphan conditions like HAE. The inclusion of these treatments in national formularies and insurance plans is reducing the financial burden on patients and healthcare providers, encouraging greater use of C1-inhibitor therapies. The availability of patient assistance programs, co-pay support, and specialty pharmacy services is further supporting patient access and adherence to treatment.

The increasing collaboration between pharmaceutical companies, patient advocacy groups, and healthcare providers is also shaping the adoption of C1-inhibitor therapies. Patient advocacy organizations, such as the Hereditary Angioedema Association (HAEA) and the International Hereditary Angioedema Patient Organization (HAEi), play a critical role in raising awareness, providing education, and advocating for better access to treatment. These organizations work closely with industry stakeholders to support research initiatives, provide input on clinical trial design, and facilitate the inclusion of patient perspectives in regulatory decisions. The collaboration between patient groups and pharmaceutical companies is driving the development of patient-centric therapies, improving the quality of care, and supporting the adoption of C1-inhibitor treatments in the global healthcare community.

What Factors Are Driving the Growth of the Global Plasma Protease C1-Inhibitor Treatment Market?

The growth in the global plasma protease C1-inhibitor treatment market is driven by several factors, including the rising prevalence of hereditary angioedema (HAE), increasing awareness of rare disease management, and ongoing advancements in treatment technologies. One of the primary growth drivers is the rising prevalence of hereditary angioedema and other conditions associated with C1-inhibitor deficiency. Although HAE is a rare genetic disorder, its impact on patients' quality of life is significant, with recurrent and unpredictable attacks causing pain, disability, and even life-threatening airway obstruction. The growing awareness of HAE among healthcare providers, coupled with improved diagnostic capabilities, is leading to earlier diagnosis and more timely treatment, supporting the demand for C1-inhibitor therapies.The increasing awareness of rare disease management and the focus on improving patient outcomes are also key factors contributing to market growth. Governments, healthcare organizations, and pharmaceutical companies are investing in research and initiatives aimed at improving the diagnosis and treatment of rare diseases, including HAE. Public health campaigns, patient advocacy efforts, and educational programs are raising awareness of the symptoms and treatment options for HAE, encouraging patients to seek medical help and adhere to prescribed therapies. The recognition of HAE as a serious and debilitating condition is driving demand for effective treatment options that can prevent attacks, reduce symptoms, and improve quality of life.

Ongoing advancements in treatment technologies are further supporting the growth of the plasma protease C1-inhibitor treatment market. The development of recombinant therapies, subcutaneous formulations, and novel therapeutic approaches is expanding the range of available options for HAE patients. These advancements are making treatment more accessible, reducing the burden of therapy, and supporting better patient adherence and outcomes. The introduction of self-administration kits, portable infusion devices, and home-based therapy options is enhancing the convenience of treatment, making it easier for patients to manage their condition independently. The increasing adoption of these advanced treatment technologies is driving demand for C1-inhibitor therapies across various healthcare settings.

Moreover, the growing focus on research and development (R&D) and the introduction of new therapeutic agents are creating new opportunities for market growth. Pharmaceutical companies are investing in the development of innovative therapies, such as gene therapies and monoclonal antibodies, to provide more effective and long-lasting solutions for HAE patients. Clinical trials for novel agents targeting specific pathways involved in HAE pathogenesis are providing new insights into the disease and expanding the therapeutic landscape. The approval and commercialization of new therapies are increasing competition in the market and providing patients with more options for managing their condition.

Additionally, the expansion of treatment indications and the inclusion of pediatric and adolescent populations in clinical trials are contributing to market growth. The approval of C1-inhibitor therapies for use in younger patients is providing new treatment options for pediatric patients with HAE, addressing an unmet need in this population. The focus on expanding access to treatment across different age groups and patient populations is supporting the growth of the C1-inhibitor treatment market.

Furthermore, the impact of the COVID-19 pandemic has highlighted the importance of ensuring access to essential medications for rare disease patients. The pandemic has underscored the need for home-based therapies, telehealth services, and remote monitoring solutions to support continuity of care for HAE patients. The increased focus on patient-centric care and the adoption of digital health solutions are expected to influence the future development and adoption of C1-inhibitor therapies. As these factors converge, the global plasma protease C1-inhibitor treatment market is poised for robust growth, driven by technological advancements, expanding treatment options, and the increasing emphasis on improving patient outcomes and quality of life for individuals with rare diseases.

Report Scope

The report analyzes the Plasma Protease C1-inhibitor Treatment market, presented in terms of market value (US$ Thousand). The analysis covers the key segments and geographic regions outlined below.- Segments: Distribution Channel (Hospital Pharmacies, Independent Pharmacies); Dosage Type (Lyophilized, Liquid/Injectable); Drug Class (C1-Inhibitor, Kallikrein Inhibitor (Kalbitor), Selective Bradykinin B2 Receptor Antagonist (Firazyr))).

- Geographic Regions/Countries:World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; and Rest of Europe); Asia-Pacific; Rest of World.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the C1-Inhibitor segment, which is expected to reach US$8.8 Billion by 2030 with a CAGR of a 18.3%. The Kallikrein Inhibitor (Kalbitor) segment is also set to grow at 20.2% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $1.7 Billion in 2024, and China, forecasted to grow at an impressive 19.1% CAGR to reach $2.7 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Plasma Protease C1-inhibitor Treatment Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Plasma Protease C1-inhibitor Treatment Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Plasma Protease C1-inhibitor Treatment Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as AbbVie, Alexion, Argenx, Bluebird Bio, Bristol-Myers Squibb/Celgene and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 46 companies featured in this Plasma Protease C1-inhibitor Treatment market report include:

- AbbVie

- Alexion

- Argenx

- Bluebird Bio

- Bristol-Myers Squibb/Celgene

- CSL Limited

- FibroGen

- Gilead

- GlaxoSmithKline

- Novartis

- Pharming Group N.V.

- Sanquin

- Shire plc

- Vertex

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- AbbVie

- Alexion

- Argenx

- Bluebird Bio

- Bristol-Myers Squibb/Celgene

- CSL Limited

- FibroGen

- Gilead

- GlaxoSmithKline

- Novartis

- Pharming Group N.V.

- Sanquin

- Shire plc

- Vertex

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 196 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

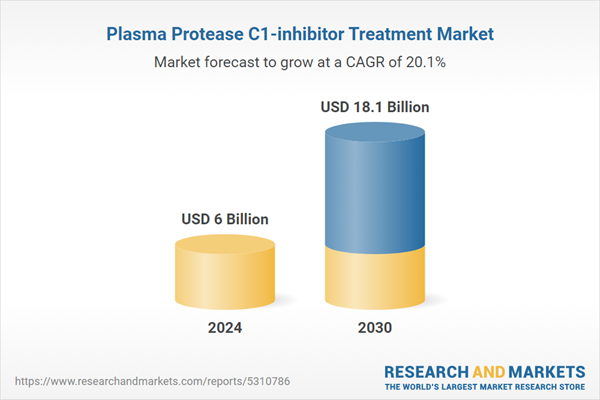

| Estimated Market Value ( USD | $ 6 Billion |

| Forecasted Market Value ( USD | $ 18.1 Billion |

| Compound Annual Growth Rate | 20.1% |

| Regions Covered | Global |