The increasing demand for fuel-efficient and environmentally friendly tyres holds a good mass in the Japanese market. Consumers and manufacturers have shifted focus to sustainability and cost-effectiveness. Fuel-efficient tyres reduce rolling resistance and consume less fuel, which in turn saves the environment from emitting carbon into the atmosphere. All the automobile manufacturing giants in Japan, including the powerhouses of Toyota, Honda, and Nissan, have tremendous investment in climate-conscious innovation. For instance, Mazda has vowed to reduce the level of emissions by 50% below that of 2010 by the year 2030 and eventually targets a reduction of 90% by the year 2050. This involves the designing of tyres in line with manufacturing efforts to have reduced fuel efficiency while contributing towards lower overall emissions, which satisfies growing consumer requirements for eco-conscious, cost-effective products.

Stringent government regulations regarding vehicle safety and emissions also drive the tyre market in Japan. The government imposes strict standards for tyre performance, including safety features such as wet traction, braking distance, and durability. These regulations push manufacturers to develop high-performance tyres that meet or exceed these standards. Additionally, Japan's commitment to reducing greenhouse gases (GHG) emissions encourages the adoption of tyres that improve fuel efficiency and reduce environmental impact. This regulatory pressure has spurred innovation within the market, with manufacturers continuously advancing tyre technologies to comply with evolving safety and environmental regulations.

Japan Tyre Market Trends:

Shift Towards Sustainable and Green Tyres

A strong trend in the Japan tyre market is sustainable and green tyres due to the rise in environmental issues. Consumers and businesses are more inclined to adopt solutions that can help them decrease their footprint. In 2023, nearly 78 million tyres were generated from replacement alone, of which a huge quantity was recycled or reused. In efforts to become ecologically friendly and increase the number of low- GHG products used by Japanese producers, tyre makers have turned attention toward using material, like the rubber used by tyres, and manufacturing tyres specifically with improved fuel efficiency. Indeed, with continued rises in customer environmental awareness and sensitivity, innovation and usage trends continue to progress towards combining tyres' performance standards with sustainable uses.Advancements in Smart Tyre Technology

The rise of electric vehicles in Japan is accelerating smart tyre technology at a very rapid pace. For instance, with 3.45 million new electric vehicles in 2023and their representation of 7% in total vehicle registrations, the demand for advanced tyremarket solutions has surged ahead. These are advanced tyres that offer sensors that monitor such factors as the pressure of the tire, the temperature of the tire, and the tread-wearing issues of the tires. These tyres boost safety and performance through real time provision of data to the drivers and fleet operators, which allow better maintenance. Additionally, digital technology integration allows for predictive maintenance, reducing downtime. This shift towards smart tyres is fueled by Japan’s focus on automotive connectivity and innovation, with the rise of EVs further driving the adoption of these high-tech solutions.Rising Popularity of High-Performance Tyres

The demand for high-performance tyres is growing in Japan, driven by a rise in consumer preference for premium and specialized products. Japanese consumers are becoming more discerning in their tyre choices, seeking tyres that offer superior handling, durability, and ride comfort. This trend is particularly strong in the sports and luxury vehicle segments, where the need for tyres that enhance vehicle performance is critical. Additionally, manufacturers are developing high-performance tyres that cater to specific needs, such as tyres designed for wet or snowy conditions, as well as tyres optimized for electric vehicles. This trend reflects Japan's evolving automotive market, where performance and safety are top priorities.Japan Tyre Industry Segmentation:

The publisher provides an analysis of the key trends in each segment of the Japan tyre market, along with forecasts at the country and regional levels from 2025-2033. The market has been categorized based on vehicle type, OEM and replacement segment, import and export, radial and bias tyres, and tube and tubeless tyres.Analysis by Vehicle Type:

- Passenger Car Tyres

- Light Truck Tyres

- Truck and Bus Tyres

- Special Vehicle Tyres

- Motorcycle Tyres

Analysis by OEM and Replacement Segment:

- OEM Tyres

- Passenger Car Tyres

- Light Truck Tyres

- Truck and Bus Tyres

- Special Vehicle Tyres

- Motorcycle Tyres

- Replacement Tyres

- Passenger Car Tyres

- Light Truck Tyres

- Truck and Bus Tyres

- Special Vehicle Tyres

- Motorcycle Tyres

Analysis by Imports and Exports:

- Imports

- Exports

Furthermore, the country exports high-quality tyres to regions with growing automotive markets. These tyres, imported from Japan, are renowned for their technologically advanced qualities and performance and durability. In terms of geography, Japanese tyre manufacturers export a wide variety of products, including premium tyres targeting luxury vehicles and eco-friendly tyres, to globally maintain competitive market presence.

Analysis by Radial and Bias Tyres:

- Bias Tyres

- Radial Tyres

Analysis by Tube and Tubeless Tyres:

- Tube Tyres

- Tubeless Tyres

Besides this, tubeless tyres do not require an inner tube as they are designed to hold air directly within the tyre itself. They offer improved safety, as air loss from punctures is slower, reducing the risk of sudden deflation. Tubeless tyres are also more durable and require less maintenance.

Competitive Landscape:

The Japan tyre market research report features established global players and the strong presence of local manufacturers. Competition in this market happens to be based on product innovation, quality, and technology. It is evident that there is a concentration on the development of fuel-efficient, eco-friendly, and high-performance tyres in the midst of evolving consumer demands. This can be attributed to a significant investment by manufacturers in research and development (R&D) activities, thereby enabling the use of smart technologies, such as sensors for real-time monitoring and maximizing tyre longevity. Price competitiveness also plays an important role here. Companies can now offer tyres for both premium and budget-conscious segments. Furthermore, strategic partnerships and collaborations with vehicle manufacturers are key tactics for strengthening market position and expanding distribution networks. The market remains dynamic, with continuous innovation driving the competition.The report provides a comprehensive analysis of the competitive landscape in the Japan tyre market with detailed profiles of all major companies.

Key Questions Answered in This Report

1. How big is the tyre market in Japan?2. What is the forecast for the tyre market in the Japan?

3. What factors are driving the growth of the Japan tyre market?

Table of Contents

1 Preface2 Scope and Methodology

2.1 Objectives of the Study

2.2 Stakeholders

2.3 Data Sources

2.3.1 Primary Sources

2.3.2 Secondary Sources

2.4 Market Estimation

2.4.1 Bottom-Up Approach

2.4.2 Top-Down Approach

2.5 Forecasting Methodology

3 Executive Summary

4 Introduction

4.1 Overview

4.2 Key Industry Trends

5 Japan Tyre Market

5.1 Market Overview

5.2 Market Performance

5.3 Impact of COVID-19

5.4 Market Breakup by Vehicle Type

5.5 Market Breakup by OEM and Replacement Segment

5.6 Market Breakup by Radial and Bias Tyre

5.7 Market Breakup by Tube and Tubeless Tyre

5.8 Market Forecast

5.9 SWOT Analysis

5.9.1 Overview

5.9.2 Strengths

5.9.3 Weaknesses

5.9.4 Opportunities

5.9.5 Threats

5.10 Value Chain Analysis

5.10.1 Overview

5.10.2 Research and Development

5.10.3 Raw Material Procurement

5.10.4 Tyre Manufacturing

5.10.5 Marketing

5.10.6 Distribution

5.10.7 End-Users

5.10.8 Recycling

5.11 Porters Five Forces Analysis

5.11.1 Overview

5.11.2 Bargaining Power of Buyers

5.11.3 Bargaining Power of Suppliers

5.11.4 Degree of Competition

5.11.5 Threat of New Entrants

5.11.6 Threat of Substitutes

5.12 PESTEL Analysis

5.12.1 Political

5.12.2 Economic

5.12.3 Social

5.12.4 Legal

5.12.5 Environmental

5.12.6 Technological

5.13 Price Analysis

5.13.1 Price Indicators

5.13.2 Price Structure

5.13.3 Margin Analysis

6 Market Breakup by Vehicle Type

6.1 Passenger Car Tyres

6.1.1 Market Trends

6.1.2 Market Forecast

6.2 Light Truck Tyres

6.2.1 Market Trends

6.2.2 Market Forecast

6.3 Truck and Bus Tyres

6.3.1 Market Trends

6.3.2 Market Forecast

6.4 Special Vehicle Tyres

6.4.1 Market Trends

6.4.2 Market Forecast

6.5 Motorcycle Tyres

6.5.1 Market Trends

6.5.2 Market Forecast

7 Market Breakup by OEM and Replacement Segment

7.1 OEM Tyres

7.1.1 Market Trends

7.1.2 Market Breakup by Type

7.1.2.1 Passenger Car Tyres

7.1.2.1.1 Market Trends

7.1.2.1.2 Market Forecast

7.1.2.2 Light Truck Tyres

7.1.2.2.1 Market Trends

7.1.2.2.2 Market Forecast

7.1.2.3 Truck and Bus Tyres

7.1.2.3.1 Market Trends

7.1.2.3.2 Market Forecast

7.1.2.4 Special Vehicle Tyres

7.1.2.4.1 Market Trends

7.1.2.4.2 Market Forecast

7.1.2.5 Motorcycle Tyres

7.1.2.5.1 Market Trends

7.1.2.5.2 Market Forecast

7.1.3 Market Forecast

7.2 Replacement Tyres

7.2.1 Market Trends

7.2.2 Market Breakup by Type

7.2.2.1 Passenger Car Tyres

7.2.2.1.1 Market Trends

7.2.2.1.2 Market Forecast

7.2.2.2 Light Truck Tyres

7.2.2.2.1 Market Trends

7.2.2.2.2 Market Forecast

7.2.2.3 Truck and Bus Tyres

7.2.2.3.1 Market Trends

7.2.2.3.2 Market Forecast

7.2.2.4 Special Vehicle Tyres

7.2.2.4.1 Market Trends

7.2.2.4.2 Market Forecast

7.2.2.5 Motorcycle Tyres

7.2.2.5.1 Market Trends

7.2.2.5.2 Market Forecast

8 Imports and Exports

8.1 Imports

8.2 Exports

9 Market Breakup by Radial and Bias Tyres

9.1 Bias Tyres

9.1.1 Market Trends

9.1.2 Market Forecast

9.2 Radial Tyres

9.2.1 Market Trends

9.2.2 Market Forecast

10 Market Breakup by Tube and Tubeless Tyres

10.1 Tube Tyres

10.1.1 Market Trends

10.1.2 Market Forecast

10.2 Tubeless Tyres

10.2.1 Market Trends

10.2.2 Market Forecast

11 Government Regulations

12 Strategic Recommendations

13 Competitive Landscape

13.1 Market Structure

13.2 Key Players

13.3 Profiles of Key Players

List of Figures

Figure 1: Japan: Tyre Market: Major Drivers and Challenges

Figure 2: Japan: Tyre Market: Sales Volume (in Million Units), 2019-2024

Figure 3: Japan: Tyre Market: Sales Value (in Million USD), 2019-2024

Figure 4: Japan: Tyre Market: Breakup by Vehicle Type (in %), 2024

Figure 5: Japan: Tyre Market: Breakup by OEM and Replacement Segment (in %), 2024

Figure 6: Japan: Tyre Market: Breakup by Radial and Bias Tyres (in %), 2024

Figure 7: Japan: Tyre Market: Breakup by Tube and Tubeless Tyres (in %), 2024

Figure 8: Japan: Tyre Market Forecast: Sales Volume (in Million Units), 2025-2033

Figure 9: Japan: Tyre Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 10: Japan: Tyre Industry: SWOT Analysis

Figure 11: Japan: Tyre Industry: Value Chain Analysis

Figure 12: Japan: Tyre Industry: Porter’s Five Forces Analysis

Figure 13: Japan: Tyre Industry: PESTEL Analysis

Figure 14: Japan: Tyres (Passenger Car Tyres) Market: Sales Value (in Million USD), 2019 & 2024

Figure 15: Japan: Tyres (Passenger Car Tyres) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 16: Japan: Tyres (Light Truck Tyres) Market: Sales Value (in Million USD), 2019 & 2024

Figure 17: Japan: Tyres (Light Truck Tyres) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 18: Japan: Tyres (Truck and Bus Tyres) Market: Sales Value (in Million USD), 2019 & 2024

Figure 19: Japan: Tyres (Truck and Bus Tyres) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 20: Japan: Tyres (Special Vehicle Tyres) Market: Sales Value (in Million USD), 2019 & 2024

Figure 21: Japan: Tyres (Special Vehicle Tyres) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 22: Japan: Tyres (Motorcycle Tyres) Market: Sales Value (in Million USD), 2019 & 2024

Figure 23: Japan: Tyres (Motorcycle Tyres) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 24: Japan: OEM Tyres (Passenger Car Tyres) Market: Sales Value (in Million USD), 2019 & 2024

Figure 25: Japan: OEM Tyres (Passenger Car Tyres) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 26: Japan: OEM Tyres (Light Truck Tyres) Market: Sales Value (in Million USD), 2019 & 2024

Figure 27: Japan: OEM Tyres (Light Truck Tyres) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 28: Japan: OEM Tyres (Truck and Bus Tyres) Market: Sales Value (in Million USD), 2019 & 2024

Figure 29: Japan: OEM Tyres (Truck and Bus Tyres) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 30: Japan: OEM Tyres (Special Vehicle Tyres) Market: Sales Value (in Million USD), 2019 & 2024

Figure 31: Japan: OEM Tyres (Special Vehicle Tyres) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 32: Japan: OEM Tyres (Motorcycle Tyres) Market: Sales Value (in Million USD), 2019 & 2024

Figure 33: Japan: OEM Tyres (Motorcycle Tyres) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 34: Japan: Replacement Tyres (Passenger Car Tyres) Market: Sales Value (in Million USD), 2019 & 2024

Figure 35: Japan: Replacement Tyres (Passenger Car Tyres) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 36: Japan: Replacement Tyres (Light Truck Tyres) Market: Sales Value (in Million USD), 2019 & 2024

Figure 37: Japan: Replacement Tyres (Light Truck Tyres) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 38: Japan: Replacement Tyres (Truck and Bus Tyres) Market: Sales Value (in Million USD), 2019 & 2024

Figure 39: Japan: Replacement Tyres (Truck and Bus Tyres) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 40: Japan: Replacement Tyres (Special Vehicle Tyres) Market: Sales Value (in Million USD), 2019 & 2024

Figure 41: Japan: Replacement Tyres (Special Vehicle Tyres) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 42: Japan: Replacement Tyres (Motorcycle Tyres) Market: Sales Value (in Million USD), 2019 & 2024

Figure 43: Japan: Replacement Tyres (Motorcycle Tyres) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 44: Japan: Tyre Market: Import Value (in Million USD), 2019-2024

Figure 45: Japan: Tyre Market: Export Value (in Million USD), 2019-2024

Figure 46: Japan: Tyre (Bias Tyres) Market: Sales Value (in Million USD), 2019 & 2024

Figure 47: Japan: Tyre (Bias Tyres) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 48: Japan: Tyre (Radial Tyres) Market: Sales Value (in Million USD), 2019 & 2024

Figure 49: Japan: Tyre (Radial Tyres) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 50: Japan: Tyre (Tube Tyres) Market: Sales Value (in Million USD), 2019 & 2024

Figure 51: Japan: Tyre (Tube Tyres) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 52: Japan: Tyre (Tubeless Tyres) Market: Sales Value (in Million USD), 2019 & 2024

Figure 53: Japan: Tyre (Tubeless Tyres) Market Forecast: Sales Value (in Million USD), 2025-2033

List of Tables

Table 1: Japan: Tyre Market: Key Industry Highlights, 2024 and 2033

Table 2: Japan: Tyre Market Forecast: Breakup by Vehicle Type (in Million USD), 2025-2033

Table 3: Japan: Tyre Market Forecast: Breakup by OEM and Replacement Segment (in Million USD), 2025-2033

Table 4: Japan: Tyre Market Forecast: Breakup by Radial and Bias Tyres (in Million USD), 2025-2033

Table 5: Japan: Tyre Market Forecast: Breakup by Tube and Tubeless Tyres (in Million USD), 2025-2033

Table 6: Japan: Tyre Market: Import Data by Country

Table 7: Japan: Tyre Market: Export Data by Country

Table 8: Japan: Tyre Market Structure

Table 9: Japan: Tyre Market: Key Players

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 115 |

| Published | August 2025 |

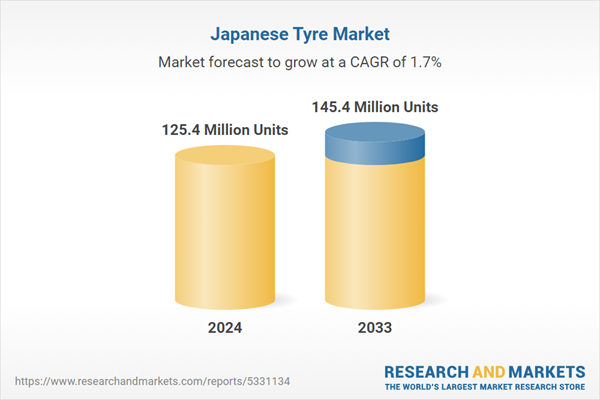

| Forecast Period | 2024 - 2033 |

| Estimated Market Value in 2024 | 125.4 Million Units |

| Forecasted Market Value by 2033 | 145.4 Million Units |

| Compound Annual Growth Rate | 1.7% |

| Regions Covered | Japan |

| No. of Companies Mentioned | 5 |