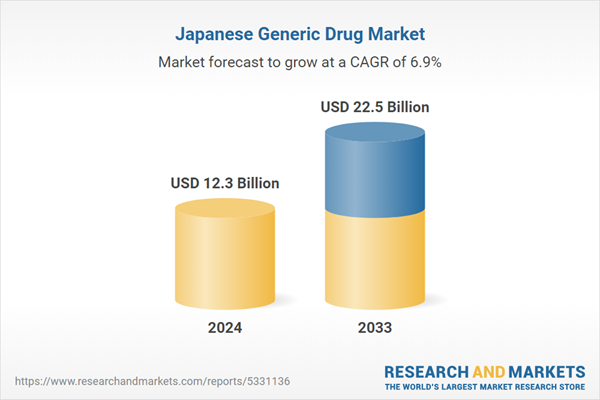

Japan Generic Drug Market Analysis:

- Major Market Drivers: The rising government policies aimed at reducing healthcare costs represent the major drivers of the market. the government actively promotes the use of generic drugs through incentives and favorable, regulations, making them a cost-effective alternative to branded medications. The rising healthcare expenditures further propel the market in Japan.

- Key Market Trends: The increasing collaboration between domestic and international pharmaceutical companies represents the key Japan generic drug market trends. These partnerships aim to enhance the development and distribution of generic medications, leveraging global expertise and resources. Another notable trend is the technological advancement in generic drug manufacturing.

- Competitive Landscape: The report has also provided a comprehensive analysis of the competitive landscape in the market. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

- Challenges and Opportunities: The market faces several challenges including strict regulatory requirements, which can delay the approval and launch of generic medications. However, the market also faces various opportunities including an aging population and rising healthcare costs driving demand for affordable medications.

Japan Generic Drug Market Trends:

Growing Government Policies and Initiatives

The Japanese government actively promotes the use of generic drugs to reduce healthcare costs. Incentives, favorable regulations, and public awareness campaigns encourage the adoption of generics, making them a key component of the national healthcare strategy. According to an article published by the Japan Times in 2024, a health ministry panel is urging small drugmakers to merge with their bigger counterparts to ensure a stable supply of generic drugs in Japan amid an ongoing shortage. At present, around a quarter of the companies in the industry that primarily manufacture generic drugs, each produce more than 51 products. This is boosting the Japan generic drug market growth significantly.Increasing Aging Population

Japan's rapidly aging population increases the demand for affordable medications. Elderly patients often require long-term treatment for chronic conditions, driving the need for cost-effective generic drugs to manage the financial burden on the healthcare system. According to the industry report, Japan has one of the lowest birth rates in the world and has long struggled with how to provide for its aging population. It has the world's oldest population, measured by the proportion of people aged 65 or up, as per the United Nations report. In Japan, those aged over 65 years are expected to account for 34.8% of the population by 2040, according to the National Institute of Population and Social Security Research. This is likely to fuel the Japan generic drug market forecast over the coming years.Rising Healthcare Costs

As healthcare expenditures continue to rise, both patients and healthcare providers seek more economical treatment options. According to Ubie Health, Japan’s healthcare expenses have been on a steady rise since the past 30 years with the government estimates predicting healthcare expenses to be approximately 445 billion dollars in the year 2040. Since generic drugs offer a cost-effective alternative to branded medications without compromising efficacy, they are increasing gaining traction among both the patients and healthcare providers, making them an attractive choice in managing healthcare budgets. According to an article published by Meiji, at present, about 80% of the prescribed drugs available at pharmacies in Japan are generic drugs, which is expected to only witness a rise to cope with the increasing healthcare costs in the country.Report Coverage:

The market report provides extensive coverage of the performance of the generic drug market in Japan. The study provides in-depth information about the value and volume trends, COVID-19 impact, and market forecast from 2025-2033.Competitive Landscape:

Key players in the Japan generic drug market are driven by factors such as government incentives promoting the use of generics to reduce healthcare costs and providing a favorable regulatory environment. The aging population in Japan significantly boosts demand for affordable, long-term medication options, encouraging pharmaceutical companies to expand their generic drug portfolios. Additionally, rising healthcare costs push both providers and patients towards more economical treatment alternatives, increasing the adoption of generic drugs. Technological advancements in drug manufacturing and formulation also enable key players to produce high-quality generics, ensuring market competitiveness and compliance with stringent regulatory standards.Key Questions Answered in This Report:

- How has the Japan generic drug market performed so far, and how will it perform in the coming years?

- What has been the impact of COVID-19 on the Japan generic drug market?

- What are the various stages in the value chain of the Japan generic drug market?

- What are the key driving factors and challenges in the Japan generic drug market?

- What is the structure of the Japan generic drug market, and who are the key players?

- What is the competitive structure of the market?

- Who are the key players/companies in the Japan generic drug market?

Table of Contents

1 Preface2 Scope and Methodology

2.1 Objectives of the Study

2.2 Stakeholders

2.3 Data Sources

2.3.1 Primary Sources

2.3.2 Secondary Sources

2.4 Market Estimation

2.4.1 Bottom-Up Approach

2.4.2 Top-Down Approach

2.5 Forecasting Methodology

3 Executive Summary

4 Japan Generic Drug Market - Introduction

4.1 What are Generic Drugs?

4.2 Unbranded and Branded Generic Drugs

4.3 Authorized Generic Drugs

5 Why is the Japanese Generic Drug Market So Lucrative

5.1 Blockbuster Drugs Going Off-Patent

5.2 Rising Healthcare Costs Coupled with an Increasing Ageing Population

5.3 Japan Has One of the Lowest Penetration of Generics

5.4 Incentives for Dispensing Generics

5.5 Significant Savings for Payers and Providers

5.6 Biosimilars

6 Global Generic Drug Market

6.1 Market Performance

6.1.1 Value Trends

6.1.2 Volume Trends

6.2 Market Breakup by Country

6.2.1 Market Breakup by Volume

6.2.2 Market Breakup by Value

6.3 Market Forecast

6.4 Most Prescribed Generic and Branded Drugs

7 Japan Generic Drug Market

7.1 Japan Pharmaceutical Market Performance

7.1.1 Value Trends

7.1.2 Volume Trends

7.1.3 Market Breakup by Type

7.1.4 Market Forecast

7.2 Japan Generic Drug Market Performance

7.2.1 Value Trends

7.2.2 Volume Trends

7.2.3 Impact of COVID-19

7.2.4 Market Forecast

8 SWOT Analysis

8.1 Overview

8.2 Strength

8.3 Weakness

8.4 Opportunities

8.5 Threats

9 Pricing Mechanism and Profit Margins at Various Levels of Supply Chain

10 Porter’s Five Forces Analysis

10.1 Overview

10.2 Bargaining Power of Buyers

10.3 Bargaining Power of Suppliers

10.4 Degree of Competition

10.5 Threat of New Entrants

10.6 Threat of Substitutes

11 Japan Generic Drug Market- Competitive Landscape

11.1 Japan Generic Drug Market - Competitive Structure

11.2 Japan Generic Drug Market - Breakup by Key Players

11.3 Japan Generic Drug Market - Breakup by Distribution Channel

12 Japan Generic Drug Market- Value Chain Analysis

12.1 Research and Development

12.2 Manufacturing

12.3 Marketing

12.4 Distribution

13 Regulations in Japan Generics Industry

13.1 Approval Pathway of a Generic Drug in Japan

13.1.1 Master File Scheme for Active Ingredients

13.1.2 Equivalency Review

13.1.3 Conformity Audit

13.2 Certifications

13.2.1 MAH (Market Authorization Holder) License for Product Approval

13.2.2 FMA (Foreign Manufacturer Accredited) Certification for Product Approval

13.2.3 DMF (Drug Master File) Registration

13.2.4 GMP (Good Manufacturing Practices) Certification

13.2.5 Manufacturer’s License

14 Japan Generic Drug Market: Key Success Factors

15 Japan Generic Drug Market: Road Blocks

16 Requirements for Setting up a Generic Drug Manufacturing Plant

16.1 Manufacturing Process

16.2 Raw Material Requirements

16.3 Raw Material Pictures

16.4 Land and Construction Requirements

16.5 Machinery and Infrastructure Requirements

16.6 Machinery Pictures

16.7 Plant Layout

16.8 Packaging Requirements

16.9 Utility Requirements

16.10 Manpower Requirements

17 Japan Generic Drug Market - Key Company Profiles

List of Figures

Figure 1: Structure of the Pharmaceutical Industry

Figure 2: Classification of Generic Drugs

Figure 3: Penetration of Generic Drugs Across Various Developed Markets

Figure 4: Global: Generic Drug Market: Sales Value (in Billion USD), 2019-2024

Figure 5: Global: Generic Drug Market: Sales Volume (in Billion Units), 2019-2024

Figure 6: Global: Generic Drug Market: Sales Value Breakup by Country (in %), 2024

Figure 7: Global: Generic Drug Market: Sales Volume Breakup by Country (in %), 2024

Figure 8: Global: Generic Drug Market Forecast: Sales Value (in Billion USD), 2025-2033

Figure 9: Global: Generic Drug Market Forecast: Sales Volume (in Billion Units), 2025-2033

Figure 10: Japan: Pharmaceutical Market: Sales Value (in Billion JPY), 2019-2024

Figure 11: Japan: Pharmaceutical Market: Sales Volume (in Billion Units), 2019-2024

Figure 12: Japan: Pharmaceutical Market Forecast: Sales Value (in Billion JPY), 2025-2033

Figure 13: Japan: Pharmaceutical Market Forecast: Sales Volume (in Billion Units), 2025-2033

Figure 14: Japan: Pharmaceutical Market: Sales Volume Breakup of Branded and Generic Drugs (in %), 2019 and 2024

Figure 15: Japan: Pharmaceutical Market: Sales Value Breakup of Branded and Generic Drugs (in %), 2019 and 2024

Figure 16: Japan: Generic Drug Market: Sales Value (in Billion USD), 2019-2024

Figure 17: Japan: Generic Drug Market Forecast: Sales Value (in Billion USD), 2025-2033

Figure 18: Japan: Generic Drug Market: Sales Volume (in Billion Units), 2019-2024

Figure 19: Japan: Generic Drug Market Forecast: Sales Volume (in Billion Units), 2025-2033

Figure 20: Japan: Generic Drug Market: Breakup by Key Players (in %)

Figure 21: Japan: Generic Drug Market: Breakup by Distribution Channel (in %)

Figure 22: Japan: Generic Drug Industry: SWOT Analysis

Figure 23: Pricing Mechanism and Profit Margins at Various Levels of the Supply Chain

Figure 24: Japan: Generic Drug Industry: Porter’s Five Forces Analysis

Figure 25: Japan: Generic Drug Industry: Value Chain Analysis

Figure 26: Japan: Generic Drug Manufacturing: Detailed Process Flow

Figure 27: Japan: Generic Drug Manufacturing: Raw Material Requirements

Figure 28: Japan: Generic Drug Manufacturing Plant: Proposed Plant Layout

Figure 29: Japan: Generic Drug Manufacturing: Packaging Requirements

Figure 30: Japan: Approval Pathway for a Generic Drug

List of Tables

Table 1: Japan: Sales (in Billion USD) and Patent Expiry of Major Drugs Expected to Lose Patent Protection (in Billion USD)

Table 2: Japan: History of Major Policies to Encourage the Use of Generic Drugs

Table 3: Japan: Expenses of Generic and Branded Drug Manufacturers (in %)

Table 4: Major Biosimilar Product Under Development as of March 2023

Table 5: Japan: Generic Drug Market: Key Industry Highlights, 2024 and 2033

Table 6: Global: Generics Market: Volume Performance of Top Molecules (in Million Prescriptions)

Table 7: Global: Branded Drug market: Volume Performance of Top Branded Drugs (in Million Prescriptions)

Table 8: Japan: Generic Drug Industry: Market Structure

Table 9: Generic Drug Manufacturing Plant: Machinery Costs (in USD)

Table 10: Generic Oncology Drug Manufacturing Plant: Costs Related to Salaries and Wages (in USD)

Table 11: Japan: Data Requirements for a New Generic Drug Application

Table 12: Japan: Various Bioequivalence Guidelines for Generic Drugs

Table 13: Japan: Timeline for New Generic Drug Approval

Table 14: Japan: Review Time of the Application for Partial Change Approval

Table 15: Nichi-Iko Pharmaceutical Co., Ltd: Key Financials (in USD Million)

Table 16: Sawai Pharmaceutical Co., Ltd: Key Financials (in USD Million)

Table 17: Towa Pharmaceutical: Key Financials (in USD Million)

Table 18: Teva Pharmaceutical Ltd: Key Financials (in USD Million)

Table 19: Fuji Pharma Co Ltd: Key Financials (in USD Million)

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 118 |

| Published | August 2025 |

| Forecast Period | 2024 - 2033 |

| Estimated Market Value ( USD | $ 12.3 Billion |

| Forecasted Market Value ( USD | $ 22.5 Billion |

| Compound Annual Growth Rate | 6.9% |

| Regions Covered | Japan |