Among the Customer in the Car Rental Market (Business and Leisure), Leisure is globally popular because the demand to travel by own and road trips with family is growing and the rising digitalisation and internet penetration is expected to drive market in the forecast period.

Among the Application of the Car Rental Market (Airport and Off-Airport), Off-Airport holds large share and dominates Car Rental industry globally and is expected to keep growing rapidly in the forecast period. The rising demand to travel within country with family is main factor for growth. Also, the rising demand of rental cars for business purpose will be driving the demand in future.

Among the Type of the Car Rental Market (Economy, Executive, Luxury, MUV and SUV), Economy type is largely popular in Car Rental Market globally as it is widely used and is expected to keep growing rapidly in the forecast period as economy car is cost efficient, which is preferred by most of the users.

The North American market is expected to lead the global market throughout the forecast period. The rising business trips in the region with rising tourism sector expected to infuse market growth tremendously.

Scope of the Report

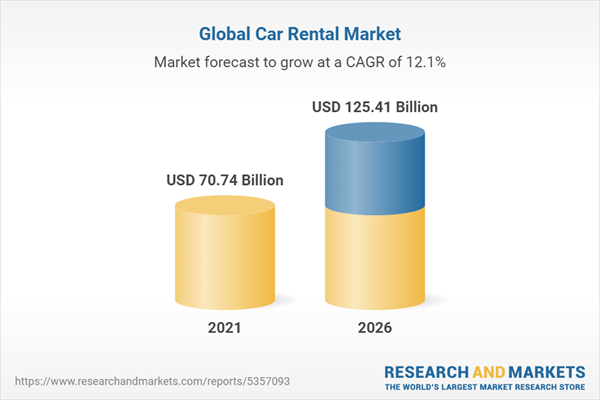

- The report presents the analysis of Car Rental Market for the historical period of 2016-2020 and the forecast period of 2021-2026.

- The report analyses the Car Rental Market by Customer (Business and Leisure).

- The report analyses the Car Rental Market by Application (Airport and Off-Airport).

- The report analyses the Car Rental Market by Type (Economy, Executive, Luxury, MUV, SUV).

- The Global Car Rental Market has been analysed By Region (North America, Europe, Asia Pacific and ROW) and By Country (U.S., Canada, Germany, France, U.K., China, India, Brazil, Saudi Arabia and UAE).

- The attractiveness of the market has been presented by region, by Customer, by Application and by Type. Also, the major opportunities, trends, drivers and challenges of the industry has been analysed in the report.

- The report tracks competitive developments, strategies, mergers and acquisitions and new product development. The companies analysed in the report include Hertz Global Holdings, Enterprise Holdings, Avis Budget Group, Europcar, Sixt SE, China Auto Rental Inc., eHi Car Services, UBER Technologies Inc., Localiza and Ola Cabs.

- The report analyses the impact of Covid-19 on Car Rental Market.

Key Target Audience

- Car Rental Vendors

- Consulting and Advisory Firms

- Government and Policy Makers

- Investment Banks and Equity Firms

- Regulatory Authorities

Table of Contents

1 Research Methodology and Executive Summary1 1 Research Methodology

1 2 Executive Summary

2 Strategic Recommendations

4 Global Car Rental Market: Sizing and Forecast

4 1 Market Size, By Value, Year 2016-2026

4 2 Impact of COVID-19 on Global Car Rental Market

4 3 Global Economic and Industrial Statistics

5 Global Car Rental Market Segmentation - By Customer, By Application, By Type

5 1 Competitive Scenario of Car Rental Market: By Customer

5 1 1 Business - Market Size and Forecast (2016-2026)

5 1 2 Leisure - Market Size and Forecast (2016-2026)

5 2 Competitive Scenario of Car Rental Market: by Application

5 2 1 Airport - Market Size and Forecast (2016-2026)

5 2 2 Off-Airport - Market Size and Forecast (2016-2026)

5 3 Competitive Scenario of Car Rental Market: by Type

5 3 1 Economy - Market Size and Forecast (2016-2026)

5 3 2 Executive - Market Size and Forecast (2016-2026)

5 3 3 Luxury - Market Size and Forecast (2016-2026)

5 3 4 MUV - Market Size and Forecast (2016-2026)

5 3 5 SUV - Market Size and Forecast (2016-2026)

6 Global Car Rental Market: Regional Analysis

6 1 Competitive Scenario of Car Rental Market: by Region

7 North America Car Rental Market An Analysis (2016-2026)

7 1 North America Car Rental Market: Size and Forecast (2016-2026)

7 2 North Americas Economic and Industrial Statistics

7 3 North Americas Car Rental Market - Prominent Companies

7 4 Market Segmentation by Customer (Business and Leisure)

7 5 Market Segmentation by Application (Airport and Off Airport)

7 6 Market Segmentation by Type (Economy, Executive, Luxury, MUV and SUV)

7 7 North America Car Rental Market: Country Analysis

7 8 Market Opportunity Chart of North America Car Rental Market - by Country, By Value, 2026

7 9 Competitive Scenario of North America Car Rental Market: by Country

7 10 United States Car Rental Market: Size and Forecast (2016-2026), By Value

7 11 United States Economic and Industrial Statistics

7 12 United States Car Rental Market Segmentation - by Customer, by Application and by Type

7 13 Canada Car Rental Market: Size and Forecast (2016-2026), By Value

7 14 Canada Economic and Industrial Statistics

7 15 Canada Car Rental Market Segmentation - by Customer, by Application and by Type

8 Europe Car Rental Market: An Analysis (2016-2026)

8 1 Europe Car Rental Market: Size and Forecast (2016-2026)

8 2 Europe Economic and Industrial Statistics

8 3 Europe Car Rental Market - Prominent Companies

8 4 Market Segmentation by Customer (Business and Leisure)

8 5 Market Segmentation by Application (Airport and Off Airport)

8 6 Market Segmentation by Type (Economy, Executive, Luxury, MUV and SUV)

8 7 Europe Car Rental Market: Country Analysis

8 8 Market Opportunity Chart of Europe Car Rental Market - By Country, By Value, 2026

8 9 Competitive Scenario of Europe Car Rental Market: By Country

8 10 Germany Car Rental Market: Size and Forecast (2016-2026), By Value

8 11 Germany Economic and Industrial Statistics

8 12 Germany Car Rental Market Segmentation - by Customer, by Application and by Type

8 13 United Kingdom Car Rental Market: Size and Forecast (2016-2026), By Value

8 14 United Kingdom Economic and Industrial Statistics

8 15 United Kingdom Car Rental Market Segmentation - by Customer, by Application and by Type

8 16 France Car Rental Market: Size and Forecast (2016-2026), By Value

8 17 France Economic and Industrial Statistics

8 18 France Car Rental Market Segmentation - by Customer, by Application and by Type

9 Asia Pacific Car Rental Market: An Analysis (2016-2026)

9 1 Asia Pacific Car Rental Market: Size and Forecast (2016-2026)

9 2 Asia Pacific Economic and Industrial Statistics

9 3 Asia Pacific Car Rental Market - Prominent Companies

9 4 Market Segmentation by Customer (Business and Leisure)

9 5 Market Segmentation by Application (Airport and Off Airport)

9 6 Market Segmentation by Type (Economy, Executive, Luxury, MUV and SUV)

9 7 Asia Pacific Car Rental Market: Country Analysis

9 8 Market Opportunity Chart of Asia Pacific Car Rental Market - by Country, By Value, 2026

9 9 Competitive Scenario of Asia Pacific Car Rental Market: by Country

9 10 China Car Rental Market: Size and Forecast (2016-2026), by Value

9 11 China Economic and Industrial Statistics

9 12 China Car Rental Market Segmentation - by Customer, by Application and by Type

9 13 India Car Rental Market: Size and Forecast (2016-2026), by Value

9 14 India Economic and Industrial Statistics

9 15 India Car Rental Market Segmentation - by Customer, by Application and by Type

10 ROW Car Rental Market: An Analysis (2016-2026)

10 1 ROW Car Rental Market: Size and Forecast (2016-2026)

10 2 ROW Economic and Industrial Statistics

10 3 ROW Car Rental Market - Prominent Companies

10 4 Market Segmentation by Customer (Business and Leisure)

10 5 Market Segmentation by Application (Airport and Off Airport)

10 6 Market Segmentation by Type (Economy, Executive, Luxury, MUV and SUV)

10 7 ROW Car Rental Market: Country Analysis

10 8 Market Opportunity Chart of ROW Car Rental Market - by Country, By Value, 2026

10 9 Competitive Scenario of ROW Car Rental Market: by Country

10 10 Brazil Car Rental Market: Size and Forecast (2016-2026), by Value

10 11 Brazil Economic and Industrial Statistics

10 12 Brazil Car Rental Market Segmentation - by Customer, by Application and by Type

10 13 Saudi Arabia Car Rental Market: Size and Forecast (2016-2026), by Value

10 14 Saudi Arabia Economic and Industrial Statistics

10 15 Saudi Arabia Car Rental Market Segmentation - by Customer, by Application and by Type

10 16 UAE Car Rental Market: Size and Forecast (2016-2026), by Value

10 17 UAE Economic and Industrial Statistics

10 18 UAE Car Rental Market Segmentation - by Customer, by Application and by Type

11 Global Car Rental Market Dynamics

11 1 Drivers

11 2 Restraints

11 3 Trends

12 Market Attractiveness

12 1 Market Attractiveness Chart of Car Rental Market - by Customer, 2026

12 2 Market Attractiveness Chart of Car Rental Market - by Application, 2026

12 3 Market Attractiveness Chart of Car Rental Market - by Type, 2026

12 4 Market Attractiveness Chart of Car Rental Market - by Region, 2026

13 Competitive Landscape

13 1 Porter Five Force Analysis

13 2 SWOT Analysis

13 3 Mergers and Acquisitions

13 4 Market Share Analysis

14 Company Analysis

14 1 Hertz Global Holdings

14 2 Enterprise Holdings

14 3 Avis Budget Group

14 4 Europcar

14 5 Sixt SE

14 6 China Auto Rental Inc

14 7 eHi Car Services

14 8 UBER Technologies Inc

14 9 Localiza

14 10 Ola Cabs

List of Figures

Figure 1: Global Car Rental Market Size, By Value, 2016-2026 (USD Billion)

Figure 2: Global spending on the Internet of Things (IOT), USD Billion. 2017-2020

Figure 3: Advanced technology expenditure, 2018 & 2025, (USD Billion)

Figure 4: Global International Tourism Arrival in 2019 compared to 2020 due to impact of COVID-19, As of January, 2021, (In%)

Figure 5: UNPRECEDENTED FALL OF INTERNATIONAL TOURISM DURING PREVIOUS CRISIS (In %)

Figure 6: World Urban Population, 2016-2020, (% of total)

Figure 7: Global Urban travel by mode of transportation, 2015-2050 (tn passenger-miles)

Figure 8: Global GDP growth, 2016-2020 (annual %)

Figure 9: Global International tourism, expenditures (% of total imports), 2015 -2019

Figure 10: Number of vehicles in the global car rental fleet from 2015 to 2025, (in Million Units)

Figure 11: Global Number of Internet Users, 2013-2018 (In % of World Population)

Figure 12: Global Smartphones Sales by region 2019-2020 (thousands of Unit)

Figure 13: Global Business Extent, 2012-2018 (As Per Disclosure Index)

Figure 14: Global Car Rental Market, By Customer, 2020, 2026

Figure 15: Global Car Rental Market - By Business, By Value (USD Billion), 2016-2026

Figure 16: Global Car Rental Market - By Leisure, By Value (USD Billion), 2016-2026

Figure 17: Global Car Rental Market, By Application, 2020, 2026

Figure 18: Global Car Rental Market - By Airport, By Value (USD Billion), 2016-2026

Figure 19: Global Car Rental Market - By Off-Airport, By Value (USD Billion), 2016-2026

Figure 20: Global Car Rental Market, By Type, 2020, 2026

Figure 21: Global Car Rental Market - By Economy, By Value (USD Billion), 2016-2026

Figure 22: Global Car Rental Market - By Executive, By Value (USD Billion), 2016-2026

Figure 23: Global Car Rental Market - By Luxury, By Value (USD Billion), 2016-2026

Figure 24: Global Car Rental Market - By MUV, By Value (USD Billion), 2016-2026

Figure 25: Global Car Rental Market - By SUV, By Value (USD Billion), 2016-2026

Figure 26: Global Car Rental Market, By Region, 2020, 2026

Figure 27: North America Car Rental Market Size, By Value, 2016-2026 (USD Billion)

Figure 28: North America GDP growth (annual %), 2015-2019

Figure 29: North America International tourism, expenditures (% of total imports), 2015 -2019

Figure 30: North America International tourism, receipts (% of total exports), 2015 -2019

Figure 31: North America Urban population (% of total population), 2015-2019

Figure 32: North America IT spending (Billion USD), 2018-2019

Figure 33: North America internet users 2020 (In Million Users)

Figure 34: North America Urban travel modes by region (bn passenger-miles), 2015-2050

Figure 35: North America Car Rental Market - By Customer, By Value, 2016-2026 (USD Billion)

Figure 36: North America Car Rental Market - By Application, By Value, 2016-2026 (USD Billion)

Figure 37: North America Car Rental Market - By Type, By Value, 2016-2026 (USD Billion)

Figure 38: Market Opportunity Chart of North America Car Rental Market - By Country, By Value, 2026

Figure 39: North America Car Rental Market, By Country, 2020 & 2026

Figure 40: United States Car Rental Market Size, By Value, 2016-2026 (USD Billion)

Figure 41: United States Car Rental Market Share, By Company, 2019 (%)

Figure 42: United States Car Rental share of total annual travel, transportation and mobility spend, 2015-2019 (in %)

Figure 43: United States GDP growth (annual %), 2015-2019

Figure 44: United States International tourism, expenditures (% of total imports), 2015 -2019

Figure 45: United States International tourism, receipts (% of total exports), 2015 -2019

Figure 46: United States Urban population (% of total population), 2015-2019

Figure 47: USA IT spending (Billion USD), 2016-2020

Figure 48: USA Internet Users (in Millions), 2015-19

Figure 49: USA annual spending in travel, transportation and mobility (in Billion USD) in 2007- 2019

Figure 50: USA Smartphone Users (In %), 2019

Figure 51: USA Most popular E-commerce purchase online, 2019 (In %)

Figure 52: USA E-commerce Payment method, 2019 (In %)

Figure 53: United States Car Rental Market - By Customer, By Value, 2016-2026 (USD Billion)

Figure 54: United States Car Rental Market - By Application, By Value, 2016-2026 (USD Billion)

Figure 55: United States Car Rental Market - By Type, By Value, 2016-2026 (USD Billion)

Figure 56: Canada Car Rental Market Size, By Value, 2016-2026 (USD Billion)

Figure 57: Canada R&D expenditure (% of GDP) 2014-2018

Figure 58: Canada Internet Users (in Millions), 2015-19

Figure 59: Canada spending in technology by sectors (in Billion USD) in 2018- 2019

Figure 60: Canada Users between18-35 Age (in % of population) in 2019

Figure 61: Canada E-commerce Payment method, 2019 (In %)

Figure 62: Canada Most popular E-commerce purchase online, 2019 (In %)

Figure 63: Canada Car Rental Market - By Customer, By Value, 2016-2026 (USD Billion)

Figure 64: Canada Car Rental Market - By Application, By Value, 2016-2026 (USD Billion)

Figure 65: Canada Car Rental Market - By Type, By Value, 2016-2026 (USD Billion)

Figure 66: Europe Car Rental Market Size, By Value, 2016-2026 (USD Billion)

Figure 67: Car rental market shares 2019 - Europe

Figure 68: Europe GDP Growth (In %), 2014-2020

Figure 69: European Union GDP growth (annual %), 2015-2019

Figure 70: European Union International tourism, expenditures (% of total imports), 2015 -2019

Figure 71: European Union International tourism, receipts (% of total exports), 2015 -2019

Figure 72: European Union Urban population (% of total population), 2015-2019

Figure 73: Europe Internet Users by Age (%), 2015-2019

Figure 74: Europe Urban travel modes by region (bn passenger-miles), 2015-2050

Figure 75: Europe Car Rental Market - By Customer, By Value, 2016-2026 (USD Billion)

Figure 76: Europe Car Rental Market - By Application, By Value, 2016-2026 (USD Billion)

Figure 77: Europe Car Rental Market - By Type, By Value, 2016-2026 (USD Billion)

Figure 78: Market Opportunity Chart of Europe Car Rental Market - By Country, By Value, 2026

Figure 79: Europe Car Rental Market, By Country, 2020 & 2026

Figure 80: Germany Car Rental Market Size, By Value, 2016-2026(USD Billion)

Figure 81: Percentage Share of leading companies of Car Rental Market in Germany, 2019

Figure 82: Germany Manufacturing value added as a proportion of GDP (%), 2015-19

Figure 83: Germany Urban population (% of total population), 2015-2019

Figure 84: Germany International tourism, expenditures (% of total imports), 2015 -2019

Figure 85: Germany International tourism, expenditures (current USD Billion), 2015 -2019

Figure 86: Germany Car Rental Market - By Customer, By Value, 2016-2026 (USD Billion)

Figure 87: Germany Car Rental Market - By Application, By Value, 2016-2026 (USD Billion)

Figure 88: Germany Car Rental Market - By Type, By Value, 2016-2026 (USD Billion)

Figure 89: United Kingdom Car Rental Market Size, By Value, 2016-2026 (USD Billion)

Figure 90: Percentage Share of leading companies of Car Rental Market in United Kingdom, 2019

Figure 91: UK Smartphone Penetration, By Age Group 2014-2018 (%)

Figure 92: UK GDP Growth (In %), 2016-2019

Figure 93: UK Urban population (% of total population), 2015-2019

Figure 94: United Kingdom Car Rental Market - By Customer, By Value, 2016-2026 (USD Billion)

Figure 95: United Kingdom Car Rental Market - By Application, By Value, 2016-2026 (USD Billion)

Figure 96: United Kingdom Car Rental Market - By Type, By Value, 2016-2026 (USD Billion)

Figure 97: France Car Rental Market Size, By Value, 2016-2026 (USD Billion)

Figure 98: Percentage Share of leading companies of Car Rental Market in France, 2019

Figure 99: France Individuals Using the Internet, 2014 - 2018 (In % of Population)

Figure 100: France Cloud computing penetration in enterprises, by industry, 2019

Figure 101: France E-commerce Payment method, 2019 (In %)

Figure 102: France Most popular E-commerce purchase online, 2020 (In %)

Figure 103: France GDP growth (%), 2015-19

Figure 104: France International tourism, expenditures (% of total imports), 2015 -2019

Figure 105: France Urban population (% of total population), 2015-2019

Figure 106: France international tourism, expenditures (current USD Billion), 2015 -2019

Figure 107: France Car Rental Market - By Customer, By Value, 2016-2026 (USD Billion)

Figure 108: France Car Rental Market - By Application, By Value, 2016-2026 (USD Billion)

Figure 109: France Car Rental Market - By Type, By Value, 2016-2026 (USD Billion)

Figure 110: Asia Pacific Car Rental Market Size, By Value, 2016-2026 (USD Billion)

Figure 111: Asia Urban travel modes by region (bn passenger-miles), 2015-2050

Figure 112: China + India Urban travel modes by region (bn passenger-miles), 2015-2050

Figure 113: Asia Pacific Manufacturing Value Added (annual % growth), 2014-18

Figure 114: East Asia & Pacific GDP Growth rate, 2014-2018 (%)

Figure 115: South Asia International tourism, expenditures (% of total imports), 2015 -2019

Figure 116: Asia Pacific Urban population (% of total population), 2015-2019

Figure 117: APAC Car Rental Market - By Customer, By Value, 2016-2026 (USD Billion)

Figure 118: APAC Car Rental Market - By Application, By Value, 2016-2026 (USD Billion)

Figure 119: APAC Car Rental Market - By Type, By Value, 2016-2026 (USD Billion)

Figure 120: Market Opportunity Chart of Asia Pacific Car Rental Market - By Country, By Value, 2026

Figure 121: Asia Pacific Car Rental Market, By Country, 2020 & 2026

Figure 122: China Car Rental Market Size, By Value, 2016-2026 (USD Billion)

Figure 123: China Car Rental Market Share, By Company, 2019 (%)

Figure 124: Chinaís Manufacturing Value added (USD T), 2013-18

Figure 125: China GDP growth (annual %), 2015-2019

Figure 126: China Average Rental Car Fleet Size, By Private-Owned Industry, 2017 (Units)

Figure 127: China Car Rental Market - By Customer, By Value, 2016-2026 (USD Billion)

Figure 128: China Car Rental Market - By Application, By Value, 2016-2026 (USD Billion)

Figure 129: China Car Rental Market - By Type, By Value, 2016-2026 (USD Billion)

Figure 130: India Car Rental Market Size, By Value, 2016-2026 (USD Billion)

Figure 131: India Car Rental Market Share, By Sector (2016 & 2022)

Figure 132: India International tourism, receipts (% of total exports), 2015 -2019

Figure 133: India Urban population (% of total population), 2015-2019

Figure 134: India GDP growth (annual %), 2015-2019

Figure 135: India International tourism, expenditures (current USD Billion), 2015 -2019

Figure 136: India E-commerce Payment method, 2019 (In %)

Figure 137: India Most popular E-commerce purchase online, 2019 (In % of total E commerce Value)

Figure 138: India Car Rental Market - By Customer, By Value, 2016-2026 (USD Billion)

Figure 139: India Car Rental Market - By Application, By Value, 2016-2026 (USD Billion)

Figure 140: India Car Rental Market - By Type, By Value, 2016-2026 (USD Billion)

Figure 141: Rest of World Car Rental Market Size, By Value, 2016-2026 (USD Billion)

Figure 142: Latin America Urban travel modes by region (bn passenger-miles), 2015-2050

Figure 143: Middle East Urban travel modes by region (bn passenger-miles), 2015-2050

Figure 144: ROW GDP growth (annual %), 2015-2019

Figure 145: ROW International tourism, expenditures (% of total imports), 2015 -2019

Figure 146: ROW International tourism, receipts (% of total exports), 2015 -2019

Figure 147: ROW Urban population (% of total population), 2015-2019

Figure 148: Saudi Arabia Individuals using the Internet (% of population), 2015-2019

Figure 149: Latin America IT spending (Billion USD), 2018-2019

Figure 150: UAE Individuals using the Internet (% of population), 2015-2019

Figure 151: Latin America internet users 2020 (In Million Users)

Figure 152: Rest of World Car Rental Market - By Customer, By Value, 2016-2026 (USD Billion)

Figure 153: Rest of World Car Rental Market - By Application, By Value, 2016-2026 (USD Billion)

Figure 154: Rest of World Car Rental Market - By Type, By Value, 2016-2026 (USD Billion)

Figure 155: Market Opportunity Chart of ROW Car Rental Market - By Country, By Value, 2026

Figure 156: ROW Car Rental Market, By Country, 2020 & 2026

Figure 157: Brazil Car Rental Market Size, By Value, 2016-2026 (USD Billion)

Figure 158: Brazil GDP growth (annual %), 2015-2019

Figure 159: Brazil International tourism, expenditures (% of total imports), 2015 -2019

Figure 160: Brazil International tourism, receipts (% of total exports), 2015 -2019

Figure 161: Brazil Urban population (% of total population), 2015-2019

Figure 162: Brazil IT Services spending (Billion USD) 2015 - 2019

Figure 163: Brazil Individuals Using the Internet, 2015 - 2019 (In % of Population)

Figure 164: Brazil E-commerce Payment method, 2019 (In %)

Figure 165: Brazil Most popular E-commerce purchase online, 2019 (In %)

Figure 166: Brazil Car Rental Market - By Customer, By Value, 2016-2026 (USD Billion)

Figure 167: Brazil Car Rental Market - By Application, By Value, 2016-2026 (USD Billion)

Figure 168: Brazil Car Rental Market - By Type, By Value, 2016-2026 (USD Billion)

Figure 169: Saudi Arabia Car Rental Market Size, By Value, 2016-2026 (USD Billion)

Figure 170: Saudi Arabia GDP growth (annual %), 2015-2019

Figure 171: Saudi Arabia International tourism, expenditures (% of total imports), 2015 -2019

Figure 172: Saudi Arabia International tourism, receipts (% of total exports), 2015 -2019

Figure 173: Saudi Arabia Urban population (% of total population), 2015-2019

Figure 174: Saudi Arabia Car Rental Market - By Customer, By Value, 2016-2026 (USD Billion)

Figure 175: Saudi Arabia Car Rental Market - By Application, By Value, 2016-2026 (USD Billion)

Figure 176: Saudi Arabia Car Rental Market - By Type, By Value, 2016-2026 (USD Billion)

Figure 177: UAE Car Rental Market Size, By Value, 2016-2026 (USD Billion)

Figure 178: UAE GDP growth (annual %), 2015-2019

Figure 179: UAE International tourism, expenditures (% of total imports), 2015 -2019

Figure 180: UAE International tourism, receipts (% of total exports), 2015 -2019

Figure 181: UAE Urban population (% of total population), 2015-2019

Figure 182: UAE Car Rental Market - By Customer, By Value, 2016-2026 (USD Billion)

Figure 183: UAE Car Rental Market - By Application, By Value, 2016-2026 (USD Billion)

Figure 184: UAE Car Rental Market - By Type, By Value, 2016-2026 (USD Billion)

Figure 185: Market Attractiveness Chart of Car Rental Market - By Customer, By Value, 2026

Figure 186: Market Attractiveness Chart of Car Rental Market - By Application, By Value, 2026

Figure 187: Market Opportunity Chart of Car Rental Market - By Type, By Value, 2026

Figure 188: Market Attractiveness Chart of Car Rental Market - By Region, By Value, 2026

Figure 189: Market Share of Leading Car Rental Companies, 2020 (In %)

Figure 190: Hertz, Net Revenue, 2016 - 2020 (USD Million)

Figure 191: Hertz Net Revenue, By Segment, 2020 (%)

Figure 192: Hertz Net Revenue, By Region, 2019 (%)

Figure 193: Enterprise Holdings, Net Revenue, 2016 - 2020 (USD Million)

Figure 194: Avis Budget Group, Net Revenue, 2016 - 2020 (USD Million)

Figure 195: Avis Budget Group, Net Income, 2016 - 2020 (USD Million)

Figure 196: Avis Budget Group, Net Revenue, By Brand, 2020 (%)

Figure 197: Avis Budget Group, Net Revenue, By Region, 2020 (%)

Figure 198: Avis Budget Group, Net Revenue, By Customer, 2020 (%)

Figure 199: Avis Budget Group, Net Revenue, By Market, 2020 (%)

Figure 200: Europcar, Net Revenue, 2016 - 2020 (EUR Million)

Figure 201: Europcar, Net Profit, 2016 - 2020 (EUR Million)

Figure 202: Europcar, Net Revenue, By Operating segments, 2020 (%)

Figure 203: Europcar, Net Revenue, By Operating segments, 2019 (%)

Figure 204: Europcar, Net Revenue, By Geographical Segment, 2020 (%)

Figure 205: Europcar, Net Revenue, By Business Units, 2020 (%)

Figure 206: 206: Sixt SE, Net Revenue, 2016 - 2020 (EURO Million)

Figure 207: Sixt SE, Net Revenue, By Business Segment, 2020(%)

Figure 208: Sixt SE, Net Revenue, By Business Segment, 2019 (%)

Figure 209: China Auto Rental Inc., Net Revenue, 2015-2018(RMB Million)

Figure 210: China Auto Rental Inc., Net Revenue, By Business Segment, 2018 (%)

Figure 211: UBER Technologies Inc., Net Revenue, 2016 - 2020 (USD Million)

Figure 212: UBER Technologies Inc., Net Income, 2016 - 2020 (USD Million)

Figure 213: UBER Technologies Inc, Net Revenue, By Business Segment, 2020(%)

Figure 214: 214: UBER Technologies Inc, Net Revenue, By Geographical Segment, 2020 (%)

Figure 215: Localiza, Net Revenue, 2016 - 2020 (USD Million)

Figure 216: Localiza, Net Income, 2016 - 2020 (USD Million)

Figure 217: Localiza, Net Revenue, By Business Type, 2020(%)

Figure 218: Localiza, Net Revenue, By Business Segment, 2020 (%)

Table A: Investment by ten biggest Car Rental start-ups, 2021

Companies Mentioned

- Hertz Global Holdings

- Enterprise Holdings

- Avis Budget Group

- Europcar

- Sixt SE

- China Auto Rental Inc.

- eHi Car Services

- UBER Technologies Inc.

- Localiza

- Ola Cabs.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 260 |

| Published | June 2021 |

| Forecast Period | 2021 - 2026 |

| Estimated Market Value ( USD | $ 70.74 Billion |

| Forecasted Market Value ( USD | $ 125.41 Billion |

| Compound Annual Growth Rate | 12.1% |

| Regions Covered | Global |

| No. of Companies Mentioned | 10 |