Key Players are Draftkings, Flutter Entertainment (FanDuel Group), Caesars Entertainment, and Scientific Games

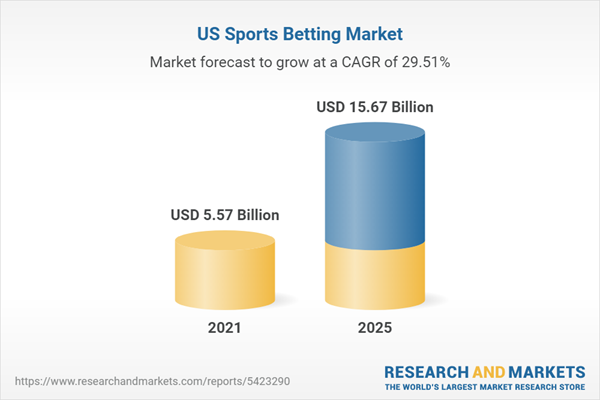

The US sports betting market has increased significantly during the year 2020, and projections are made that the market would rise in the next four years i.e. 2021-2025, tremendously.

The sports betting market is expected to increase due to increasing use of mobile phones for sports betting, easier access to online betting, rising millennial population, growing popularity of e-sports betting, mergers & acquisitions, etc. Yet the market faces some challenges such as declining disposable income, stringent regulations, etc.

The market is trending towards a more concentrated status with various market players operating in different states. The key players of the sports betting market are DraftKings, Flutter Entertainment plc (FanDuel Group), Caesars Entertainment Corporation, and Scientific Games Corporation, are also profiled with their financial information and respective business strategies.

Scope of the Report

This report provides an in depth analysis of the US sports betting market by value, by channel, by type, by region, etc. The report provides a regional analysis of the US sports betting market, including the following regions: Nevada, New Jersey, Pennsylvania, Mississippi, Indiana, West Virginia, Iowa, Rhode Island, Delaware, New York, Oregon, Arkansas, New Hampshire, Michigan, Montana, Colorado, Washington DC, Illinois, Tennessee, and Virginia. The report also provides a detailed analysis of the COVID-19 impact on the sports betting market in the US.

The report also assesses the key opportunities in the market and outlines the factors that are and will be driving the growth of the industry. Growth of the US sports betting market has also been forecasted for the period 2021-2025, taking into consideration the previous growth patterns, the growth drivers and the current and future trends.

Company Coverage

- DraftKings

- Flutter Entertainment plc (FanDuel Group)

- Caesars Entertainment Corporation

- Scientific Games Corporation

Table of Contents

1. Executive Summary

2. Introduction

2.1 Sports Betting: An Overview

2.1.1 Pros and Cons of Sports Betting

2.1.2 History of Sports Betting

2.2 Sports Betting Segmentation: An Overview

2.2.1 Sports Betting Segmentation by Type

2.2.2 Sports Betting Segmentation by Channel

2.2.3 Sports Betting Segmentation by Sports Type

3. The US Market Analysis

3.1 The US Sports Betting Market: An Analysis

3.1.1 The US Sports Betting Market by Value

3.1.2 The US Sports Betting Market by Channel (On-ground and Online)

3.1.3 The US Sports Betting Market by Type (In-play Betting and Others)

3.1.4 The US Sports Betting Market by Region (Nevada, New Jersey, Pennsylvania, Mississippi, Indiana, Illinois, Colorado, West Virginia, Iowa, Tennessee, Rhode Island, New Hampshire, Michigan, Delaware, New York, Arkansas, Washington DC, Oregon and Montana)

3.2 The US Sports Betting Market: Channel Analysis

3.2.1 The US Online Sports Betting Market by Value

3.2.2 The US On-ground Sports Betting Market by Value

3.3 The US Sports Betting Market: Type Analysis

3.3.1 The US In-play Sports Betting Market by Value

3.3.2 The US Others Sports Betting Market by Value

4. Regional Market Analysis

4.1 New Jersey Sports Betting Market: An Analysis

4.1.1 New Jersey Sports Betting Market by Value

4.2 Pennsylvania Sports Betting Market: An Analysis

4.2.1 Pennsylvania Sports Betting Market by Value

4.3 Delaware Sports Betting Market: An Analysis

4.3.1 Delaware Sports Betting Market by Value

4.4 Mississippi Sports Betting Market: An Analysis

4.4.1 Mississippi Sports Betting Market by Value

4.5 Nevada Sports Betting Market: An Analysis

4.5.1 Nevada Sports Betting Market by Value

4.6 Rhode Island Sports Betting Market: An Analysis

4.6.1 Rhode Island Sports Betting Market by Value

4.7 West Virginia Sports Betting Market: An Analysis

4.7.1 West Virginia Sports Betting Market by Value

4.8 New York Sports Betting Market: An Analysis

4.8.1 New York Sports Betting Market by Value

4.9 Iowa Sports Betting Market: An Analysis

4.9.1 Iowa Sports Betting Market by Value

4.10 Indiana Sports Betting Market: An Analysis

4.10.1 Indiana Sports Betting Market by Value

4.11 Oregon Sports Betting Market: An Analysis

4.11.1 Oregon Sports Betting Market by Value

4.12 Arkansas Sports Betting Market: An Analysis

4.12.1 Arkansas Sports Betting Market by Value

4.13 New Hampshire Sports Betting Market: An Analysis

4.13.1 New Hampshire Sports Betting Market by Value

4.14 Michigan Sports Betting Market: An Analysis

4.14.1 Michigan Sports Betting Market by Value

4.15 Montana Sports Betting Market: An Analysis

4.15.1 Montana Sports Betting Market by Value

4.16 Colorado Sports Betting Market: An Analysis

4.16.1 Colorado Sports Betting Market by Value

4.17 Washington DC Sports Betting Market: An Analysis

4.17.1 Washington DC Sports Betting Market by Value

4.18 Illinois Sports Betting Market: An Analysis

4.18.1 Illinois Sports Betting Market by Value

4.19 Tennessee Sports Betting Market: An Analysis

4.19.1 Tennessee Sports Betting Market by Value

4.20 Virginia Sports Betting Market: An Analysis

4.20.1 Virginia Sports Betting Market by Value

5. Impact of COVID-19

5.1 Impact of COVID-19

5.1.1 The Economic Effects of COVID-19

5.1.2 Impact of COVID-19 on Sports Betting

6. Market Dynamics

6.1 Growth Driver

6.1.1 Increasing Use of Mobile Phones for Sports Betting

6.1.2 Easier Access to Online Betting

6.1.3 Rising Millennial Population

6.1.4 Growing Popularity of E-Sports Betting

6.1.5 Mergers & Acquisitions

6.2 Challenges

6.2.1 Declining Disposable Income

6.2.2 Stringent Regulations

6.3 Market Trends

6.3.1 Growing Popularity of In-play/Live Betting

6.3.2 Introduction of Daily Fantasy Sports Betting

6.3.3 Technological Advancements

6.3.4 Escalating Trend of Virtual Sports Betting

6.3.5 Rising Trend of Player Tracking

6.3.6 Introduction of Free-Bets

6.3.7 5G Possibilities around Sports Events

6.3.8 Back of Big Events

6.3.9 Expanding Legislation of Sports Betting in Other States of the US

7. Competitive Landscape

7.1 The US Sports Betting Market Players: Key Comparison

7.2 The US Sports Betting Players by Market Share

8. Company Profiles

8.1 DraftKings

8.1.1 Business Overview

8.1.2 Financial Overview

8.1.3 Business Strategy

8.2 Flutter Entertainment plc (FanDuel Group)

8.2.1 Business Overview

8.2.2 Financial Overview

8.2.3 Business Strategy

8.3 Caesars Entertainment Corporation

8.3.1 Business Overview

8.3.2 Financial Overview

8.3.3 Business Strategy

8.4 Scientific Games Corporation

8.4.1 Business Overview

8.4.2 Financial Overview

8.4.3 Business Strategy

List of Tables & Figures

Table 1: Current Legal Status of Sports Betting in the US

Table 2: The US Sports Betting Market Players: Key Comparison

Table 3: The US Sports Betting Players by Market Share; 2019-2025 (Percentage, %)

Figure 1: Pros and Cons of Sports Betting

Figure 2: History of Sports Betting in the US During the 19th and 20th Century

Figure 3: History of Modern Sports Betting in the US

Figure 4: Sports Betting Segmentation by Type

Figure 5: Sports Betting Segmentation by Channel

Figure 6: Sports Betting Segmentation by Sports Type

Figure 7: The US Sports Betting Market by Value; 2019-2020 (US$ Billion)

Figure 8: The US Sports Betting Market by Value; 2021-2025 (US$ Billion)

Figure 9: The US Sports Betting Market by Channel; 2020 & 2025 (percentage, %)

Figure 10: The US Sports Betting Market by Type; 2020 & 2025 (Percentage, %)

Figure 11: The US Sports Betting Market by Region; 2020 (Percentage, %)

Figure 12: The US Online Sports Betting Market by Value; 2019-2020 (US$ Billion)

Figure 13: The US Online Sports Betting Market by Value; 2021-2025 (US$ Billion)

Figure 14: The US On-ground Sports Betting Market by Value; 2019-2020 (US$ Billion)

Figure 15: The US On-ground Sports Betting Market by Value; 2021-2025 (US$ Billion)

Figure 16: The US In-play Sports Betting Market by Value; 2019-2020 (US$ Billion)

Figure 17: The US In-play Sports Betting Market by Value; 2021-2025 (US$ Billion)

Figure 18: The US Others Sports Betting Market by Value; 2019-2020 (US$ Billion)

Figure 19: The US Others Sports Betting Market by Value; 2021-2025 (US$ Billion)

Figure 20: New Jersey Sports Betting Market by Value; 2020-2021 (US$ Million)

Figure 21: Pennsylvania Sports Betting Market by Value; 2020-2021 (US$ Million)

Figure 22: Delaware Sports Betting Market by Value; 2020-2021 (US$ Million)

Figure 23: Mississippi Sports Betting Market by Value; 2020-2021 (US$ Million)

Figure 24: Nevada Sports Betting Market by Value; 2020-2021 (US$ Million)

Figure 25: Rhode Island Sports Betting Market by Value; 2020-2021 (US$ Million)

Figure 26: West Virginia Sports Betting Market by Value; 2020-2021 (US$ Million)

Figure 27: New York Sports Betting Market by Value; 2020-2021 (US$ Million)

Figure 28: Iowa Sports Betting Market by Value; 2020-2021 (US$ Million)

Figure 29: Indiana Sports Betting Market by Value; 2020-2021 (US$ Million)

Figure 30: Oregon Sports Betting Market by Value; 2020-2021 (US$ Million)

Figure 31: Arkansas Sports Betting Market by Value; 2020-2021 (US$ Thousand)

Figure 32: New Hampshire Sports Betting Market by Value; 2020-2021 (US$ Million)

Figure 33: Michigan Sports Betting Market by Value; 2020-2021 (US$ Million)

Figure 34: Montana Sports Betting Market by Value; 2020-2021 (US$ Thousand)

Figure 35: Colorado Sports Betting Market by Value; 2020-2021 (US$ Million)

Figure 36: Washington DC Sports Betting Market by Value; 2020-2021 (US$ Thousand)

Figure 37: Illinois Sports Betting Market by Value; 2020-2021 (US$ Million)

Figure 38: Tennessee Sports Betting Market by Value; 2020-2021 (US$ Million)

Figure 39: Virginia Sports Betting Market by Value; 2021 (US$ Million)

Figure 40: The US Number of Unemployed Persons; August 2020-June 2021 (Thousand)

Figure 41: The US Sports Industry Revenue Loss due to COVID-19 Pandemic as of May 2020 (US$ Billion)

Figure 42: The US Smartphone Users; 2018-2024 (Million)

Figure 43: The US Internet Users; 2017-2023 (Million)

Figure 44: The US Millennial Population; 2016-2036 (Million)

Figure 45: The US Disposable Personal Income; January 2021-July 2021 (US$ Billion)

Figure 46: DraftKings Revenue; 2017-2020 (US$ Million)

Figure 47: DraftKings Revenue by Segments; 2020 (Percentage, %)

Figure 48: DraftKings Revenue by Region; 2020 (Percentage, %)

Figure 49: Flutter Entertainment plc Revenue; 2016-2020 (US$ Billion)

Figure 50: Flutter Entertainment plc Revenue by Segments; 2020 (Percentage, %)

Figure 51: Flutter Entertainment plc Revenue by Product Line; 2020 (Percentage, %)

Figure 52: Flutter Entertainment plc Revenue by Region; 2020 (Percentage, %)

Figure 53: Caesars Entertainment Corporation Net Revenues; 2015-2019 (US$ Billion)

Figure 54: Caesars Entertainment Corporation Net Revenues by Segments; 2019 (Percentage, %)

Figure 55: Caesars Entertainment Corporation Net Revenues by Region; 2019 (Percentage, %)

Figure 56: Scientific Games Corporation Total Revenue; 2016-2020 (US$ Billion)

Figure 57: Scientific Games Corporation Total Revenue by Segments; 2020 (Percentage, %)

Figure 58: Scientific Games Corporation Total Revenue by Region; 2020 (Percentage, %)

Executive Summary

Sports betting is one of the most popular and widely-spread forms of gambling. Sports betting can be defined as an activity, that includes placing a wager on the outcome of a particular sports event. This is considered an entertainment activity for the sports lover. Sports betting offers all the popular sports, including basketball, football, golf, hockey, tennis, horse racing, etc.

Sports betting have a long history with continuous introduction of laws to establish regulations in the sports betting industry. In May 2018, the Supreme Court in the US paved way to legalize sports betting by declaring that the federal ban on sports betting was unconditional. The sports betting market can be segmented on the basis of channel, type, and sports type.

Companies Mentioned

- Caesars Entertainment Corporation

- DraftKings

- Flutter Entertainment plc (FanDuel Group)

- Scientific Games Corporation

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 100 |

| Published | September 2021 |

| Forecast Period | 2021 - 2025 |

| Estimated Market Value ( USD | $ 5.57 Billion |

| Forecasted Market Value ( USD | $ 15.67 Billion |

| Compound Annual Growth Rate | 29.5% |

| Regions Covered | United States |

| No. of Companies Mentioned | 4 |