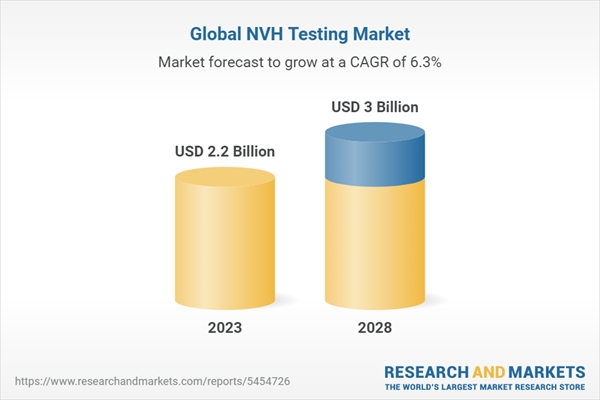

The NVH testing market is projected to reach USD 3.0 billion by 2028 from USD 2.2 billion in 2023, at a CAGR of 6.3% from 2023 to 2028. The major factors driving the market growth of the NVH testing market include stringent government regulations to reduce noise pollution, the growing need for NVH testing in the automotive vertical, and the growing adoption of automated condition monitoring solutions for smart factories. Moreover, the emergence of new application areas for NVH testing solutions, the development of advanced sensor technologies, and the shift toward electric vehicles are expected to provide ample growth opportunities for market players in the NVH testing market.

Data Acquisition Systems is expected to account for the largest market share in NVH testing hardware market during the forecast period

Data acquisition systems are used in NVH testing to gather data from different sensors and equipment, such as microphones, accelerometers, tachometers, and other devices that measure noise, vibration, and other factors.

Signal Analysis Software is expected to account for the largest market share in software segment during the forecast period

Signal analysis software is used to analyze and interpret data collected during NVH testing, including vibration signals, acoustics signals, and other data. The software offers tools to analyze signals in both the time and frequency domains, including spectral analysis and signal filtering. Moreover, the software provides visualization options in graphs, charts, and 3D animations, enabling users to easily identify trends and patterns in the data.

North America is expected to account for the largest market share during the forecast period

The region is witnessing an increasing adoption of autonomous and electric vehicles, which in turn is driving the NVH testing market. Furthermore, the increasing focus on renewable energy and the presence of established aerospace & defense companies in the region are expected to provide growth opportunities for players in the NVH testing market.

Asia Pacific is expected to account for the highest CAGR during the forecast period

The Asia Pacific region is the world's largest automotive production hub, with China, Japan, India, and South Korea among the top ten global producers. The Asia Pacific region is also a leader in electric vehicle (EV) production and adoption. Increased vehicle production is a major factor driving the demand for NVH testing in Asia Pacific.

The break-up of profile of primary participants in the NVH testing market:

- By Company Type: Tier 1 - 50%, Tier 2 - 30%, Tier 3 - 20%

- By Designation Type: C Level - 35%, Director Level - 30%, Others - 35%

- By Region Type: North America - 40%, Europe - 25%, Asia Pacific - 20%, Rest of the World - 15%

The major players of NVH testing market are National Instruments Corporation (US), Siemens Digital Industries Software (US), Brüel & Kjær (Denmark), Axiometrix Solutions (US), and HEAD acoustics GmbH (Germany) among others.

Research Coverage

The report segments the NVH testing market and forecasts its size based on type, application, vertical, and region. The report also provides a comprehensive review of drivers, restraints, opportunities, and challenges influencing the market growth. The report also covers qualitative aspects in addition to the quantitative aspects of the market.

Reasons to buy the report:

The report will help the market leaders/new entrants in this market with information on the closest approximate revenues for the overall NVH testing market and related segments. This report will help stakeholders understand the competitive landscape and gain more insights to strengthen their position in the market and plan suitable go-to-market strategies. The report also helps stakeholders understand the pulse of the market and provides them with information on key market drivers, restraints, opportunities, and challenges.

The report provides insights on the following pointers:

- Analysis of key drivers (stringent government regulations to reduce noise pollution, growing need for NVH testing in automotive vertical, growing adoption of automated condition monitoring for smart factories), restraints (availability of rental NVH testing equipment, reliability issues in prediction capabilities of NVH solutions, lack of skilled workforce), opportunities (emergence of new applications for NVH testing, development of advanced sensor technologies, shift toward electric vehicles), and challenges (difficulty in selecting NVH testing equipment, integration of NVH systems with other systems, high retrofitting costs for incorporating NVH solutions) influencing the growth of the NVH testing market)

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and new product launches in the NVH testing market

- Market Development: Comprehensive information about lucrative markets - the report analyses the NVH testing market across varied regions

- Market Diversification: Exhaustive information about new products, untapped geographies, recent developments, and investments in the NVH testing market

- Competitive Assessment: In-depth assessment of market shares, growth strategies and product offerings of leading players like National Instruments Corporation (US), Siemens Digital Industries Software (US), Brüel & Kjær (Denmark), Axiometrix Solutions (US), HEAD acoustics GmbH (Germany).

Table of Contents

1 Introduction

1.1 Study Objectives

1.2 Market Definition

1.2.1 Inclusions and Exclusions at Company Level

1.2.2 Inclusions and Exclusions at Type Level

1.2.3 Inclusions and Exclusions at Application Level

1.2.4 Inclusions and Exclusions at Vertical Level

1.2.5 Inclusions and Exclusions at Regional Level

1.3 Study Scope

Figure 1 Nvh Testing Market: Segmentation

1.3.1 Nvh Testing Market: Regional Scope

1.3.2 Years Considered

1.4 Currency Considered

1.5 Study Limitations

1.6 Units Considered

1.7 Stakeholders

1.8 Summary of Changes

1.8.1 Impact of Recession

2 Research Methodology

2.1 Research Approach

Figure 2 Nvh Testing Market: Research Design

2.1.1 Secondary Data

2.1.1.1 Major Secondary Sources

2.1.1.2 Key Data from Secondary Sources

2.1.2 Primary Data

2.1.2.1 Primary Interviews with Experts

2.1.2.2 Breakdown of Primaries

2.1.2.3 Key Data from Primary Sources

2.1.3 Secondary and Primary Research

2.1.3.1 Key Industry Insights

2.2 Market Size Estimation

2.2.1 Bottom-Up Approach

Figure 3 Bottom-Up Approach

2.2.2 Top-Down Approach

Figure 4 Top-Down Approach

2.3 Factor Analysis

2.3.1 Supply-Side Analysis

Figure 5 Market Size Estimation: Supply-Side Analysis (Approach 1)

Figure 6 Market Size Estimation: Supply-Side Analysis (Approach 2)

2.3.2 Growth Forecast Assumptions

Table 1 Market Growth Assumptions

2.3.3 Recession Impact

2.4 Market Breakdown and Data Triangulation

Figure 7 Data Triangulation

2.5 Research Assumptions

2.6 Risk Assessment

Table 2 Risk Assessment: Nvh Testing Market

3 Executive Summary

Figure 8 Nvh Testing Market: Global Snapshot

3.1 Pre-Recession Scenario

3.2 Post-Recession Scenario

Figure 9 Hardware to Account for Largest Share of Nvh Testing Market During Forecast Period

Figure 10 Sound Intensity Measurement and Sound Quality Testing to Register Highest CAGR During Forecast Period

Figure 11 Automotive & Transportation Vertical to Dominate Nvh Testing Market During Forecast Period

Figure 12 Asia-Pacific to Register Highest CAGR from 2023 to 2028

4 Premium Insights

4.1 Attractive Growth Opportunities for Players in Nvh Testing Market

Figure 13 Rising Vehicle Production Globally to Offer Growth Opportunities for Market Players

4.2 Nvh Testing Market, by Type

Figure 14 Hardware to Account for Largest Market Share During Forecast Period

4.3 Nvh Testing Market, by Application

Figure 15 Sound Intensity Measurement and Sound Quality Testing to Register Highest CAGR During Forecast Period

4.4 Nvh Testing Market, by Vertical

Figure 16 Automotive & Transportation to Dominate Nvh Testing Market from 2023 to 2028

4.5 Nvh Testing Market, by Region

Figure 17 Us and Hardware Segment Held Largest Shares of Nvh Testing Market in North America in 2022

5 Market Overview

5.1 Introduction

5.2 Market Dynamics

Figure 18 Market Dynamics: Nvh Testing Market

5.2.1 Drivers

5.2.1.1 Stringent Government Regulations to Reduce Noise Pollution

Table 3 Top 10 Cities Worldwide with Average Age of Hearing Loss of Residents

5.2.1.2 Growing Need for Nvh Testing in Automotive Vertical

Figure 19 Vehicle Production, by Vehicle Type, 2015-2021 (Million Units)

5.2.1.3 Growing Adoption of Automated Condition Monitoring for Smart Factories

Figure 20 Impact Analysis of Drivers on Nvh Testing Market

5.2.2 Restraints

5.2.2.1 Availability of Rental Nvh Testing Equipment

5.2.2.2 Reliability Issues in Prediction Capabilities of Nvh Solutions

5.2.2.3 Lack of Skilled Workforce

Figure 21 Impact Analysis of Restraints on Nvh Testing Market

5.2.3 Opportunities

5.2.3.1 Emergence of New Applications for Nvh Testing Solutions

5.2.3.2 Development of Advanced Sensor Technologies

5.2.3.3 Shift Toward Electric Vehicles

Figure 22 Impact Analysis of Opportunities on Nvh Testing Market

5.2.4 Challenges

5.2.4.1 Difficulty in Selecting Nvh Testing Equipment

5.2.4.2 Integration of Nvh Systems with Other Systems

5.2.4.3 High Retrofitting Cost for Incorporating Nvh Solutions

Figure 23 Impact Analysis of Challenges on Nvh Testing Market

5.3 Value Chain Analysis

Figure 24 Nvh Testing Market: Value Chain Analysis

5.4 Nvh Testing Market Ecosystem

Figure 25 Nvh Testing Market Ecosystem

Figure 26 Nvh Testing Market Player Ecosystem

Table 4 Nvh Testing Market: Supply Chain

5.5 Key Technology Trends

5.5.1 Road-Noise Active Noise Control System

5.5.2 Flexible Polyurethane Foam

5.5.3 Nonwoven Fiber Felts

5.5.4 Direct-To-Metal (Dtm) Technology

5.5.5 Scanning Laser Doppler Vibrometer (Sldv)

5.5.6 Torsional Vibration Damping

5.6 Pricing Analysis

5.6.1 Average Selling Price Trend

Figure 27 Average Selling Price Trend of Nvh Testing Market, by Type

Table 5 Average Selling Price of Nvh Testing Market, by Type

5.7 Patent Analysis

Table 6 Patents Filed During Review Period

Figure 28 Number of Patents Granted for Nvh Testing

Figure 29 Top 10 Companies with Highest Number of Patent Applications During Review Period

Table 7 Top 20 Patent Owners During Review Period

Table 8 Key Patents Related to Nvh Testing

5.8 Porter's Five Forces Analysis

Figure 30 Nvh Testing Market: Porter's Five Forces Analysis, 2022

Figure 31 Impact of Porter's Five Forces on Nvh Testing Market, 2022

Table 9 Nvh Testing Market: Porter's Five Forces Analysis - 2022

5.8.1 Threat of New Entrants

5.8.2 Threat of Substitutes

5.8.3 Bargaining Power of Suppliers

5.8.4 Bargaining Power of Buyers

5.8.5 Intensity of Competitive Rivalry

5.9 Key Stakeholders & Buying Criteria

5.9.1 Key Stakeholders in Buying Process

Figure 32 Influence of Stakeholders on Buying Process for Top 3 Applications of Nvh Testing

Table 10 Influence of Stakeholders on Buying Process for Top 3 Applications of Nvh Testing (%)

5.9.2 Buying Criteria

Figure 33 Key Buying Criteria for Top 3 Applications of Nvh Testing

Table 11 Key Buying Criteria for Top 3 Applications of Nvh Testing

5.10 Case Studies

5.10.1 Measuring Uncertain Sound Field Inside Airbus A320 Aircraft (Germany)

Table 12 Brüel & Kjær: Multi-Field Microphone Measured Uncertain Sound Field Inside Aircraft Cabin

5.10.2 Reducing Cost of Automotive Sensor Test Systems in Continental Automotive (Us)

Table 13 National Instruments: Ni Labview System Design Software and Pxi Modular Instrumentation Reduced Cost of Automotive Sensor Systems

5.10.3 Increasing Percentage of Completed Transmissions Passing End-Of-Line Testing in Volkswagen (Australia)

Table 14 Brüel & Kjær: Discom Systems Increased Percentage of Completed Transmissions Successfully Passing End-Of-Line Testing

5.10.4 Creation of Infrastructure for Test Data Management in Jaguar Land Rover

Table 15 National Instrument: Diadem Software and Datafinder Server Edition Created an Infrastructure for Test Data Management in Jaguar Land Rover

5.10.5 Improving Nvh Performance in Subaru

Table 16 Brüel & Kjær: Nvh Simulator Helps Subaru Fine-Tune Sound Packages and Improve Nvh Performance

5.11 Trade Data

Table 17 Hs Code: 903180, Export Values for Major Countries, 2017-2021 (USD Million)

Figure 34 Hs Code: 903180, Export Values for Major Countries, 2017-2021

Table 18 Hs Code: 903180, Import Values for Major Countries, 2017-2021 (USD Million)

Figure 35 Hs Code: 903180, Import Values for Major Countries, 2017-2021

5.12 Tariff and Regulations

5.12.1 Tariffs

Table 19 Mfn Tariffs for Products Included Under Hs Code: 903180 Exported by Germany

5.12.2 Standards

5.12.2.1 Global

5.12.2.2 Europe

5.12.2.3 Asia-Pacific

5.12.2.4 North America

5.12.3 Noise Regulations

5.12.3.1 America

5.12.3.1.1 US

5.12.3.1.2 Canada

5.12.3.1.3 Mexico

5.12.3.2 Europe

5.12.3.2.1 Germany

5.12.3.2.2 UK

5.12.3.2.3 Italy

5.12.3.3 Asia-Pacific

5.12.3.3.1 China

5.12.3.3.2 India

5.12.3.3.3 Japan

5.12.3.3.4 South Korea

5.12.3.4 Rest of the World

5.12.3.4.1 Middle East and Africa

5.12.3.4.2 South America

5.13 Trends/Disruptions Impacting Customer Business

Figure 36 Revenue Shift for Nvh Testing Market

5.14 Key Conferences & Events, 2022-2023

Table 20 Nvh Testing Market: Detailed List of Conferences and Events, 2022-2023

6 Nvh Testing Market, by Type

6.1 Introduction

Table 21 Nvh Testing Market, by Type, 2019-2022 (USD Million)

Figure 37 Hardware to Account for Largest Share of Nvh Testing Market from 2023 to 2028

Table 22 Nvh Testing Market, by Type, 2023-2028 (USD Million)

6.2 Hardware

Table 23 Hardware: Nvh Testing Market, by Vertical, 2019-2022 (USD Million)

Figure 38 Automotive & Transportation Vertical to Account for Largest Hardware Market Share of Nvh Testing Market from 2023 to 2028

Table 24 Hardware: Nvh Testing Market, by Vertical, 2023-2028 (USD Million)

Table 25 Hardware: Nvh Testing Market, by Type, 2019-2022 (USD Million)

Table 26 Hardware: Nvh Testing Market, by Type, 2023-2028 (USD Million)

Table 27 Hardware: Nvh Testing Market, by Type, 2019-2022 (Thousand Units)

Table 28 Hardware: Nvh Testing Market, by Type, 2023-2028 (Thousand Units)

Table 29 Hardware: Nvh Testing Market, by Region, 2019-2022 (USD Million)

Table 30 Hardware: Nvh Testing Market, by Region, 2023-2028 (USD Million)

Table 31 Hardware: Nvh Testing Market in North America, by Country, 2019-2022 (USD Million)

Table 32 Hardware: Nvh Testing Market in North America, by Country, 2023-2028 (USD Million)

Table 33 Hardware: Nvh Testing Market in Europe, by Country, 2019-2022 (USD Million)

Table 34 Hardware: Nvh Testing Market in Europe, by Country, 2023-2028 (USD Million)

Table 35 Hardware: Nvh Testing Market in Asia-Pacific, by Country, 2019-2022 (USD Million)

Table 36 Hardware: Nvh Testing Market in Asia-Pacific, by Country, 2023-2028 (USD Million)

Table 37 Hardware: Nvh Testing Market in Rest of the World, by Country, 2019-2022 (USD Million)

Table 38 Hardware: Nvh Testing Market in Rest of the World, by Country, 2023-2028 (USD Million)

6.2.1 Sensors & Transducers

6.2.1.1 Growing Need to Detect and Quantify Noise and Vibration to Drive Demand for Sensors and Transducers

Table 39 Sensors & Transducers: Nvh Testing Market, by Region, 2019-2022 (USD Million)

Table 40 Sensors & Transducers: Nvh Testing Market, by Region, 2023-2028 (USD Million)

6.2.2 Analyzers

6.2.2.1 Need to Measure Noise and Vibration to Drive Demand for Analyzers

Table 41 Analyzers: Nvh Testing Market, by Region, 2019-2022 (USD Million)

Table 42 Analyzers: Nvh Testing Market, by Region, 2023-2028 (USD Million)

6.2.3 Meters

6.2.3.1 Increasing Use of Meters for Nvh Testing to Create Opportunities for Market Players

Table 43 Meters: Nvh Testing Market, by Region, 2019-2022 (USD Million)

Table 44 Meters: Nvh Testing Market, by Region, 2023-2028 (USD Million)

6.2.4 Data Acquisition Systems

6.2.4.1 Need to Acquire Data and Store It for Further Analysis to Drive Market

Table 45 Data Acquisition Systems: Nvh Testing Market, by Region, 2019-2022 (USD Million)

Figure 39 North America to Hold Largest Share of Nvh Testing Hardware Market from 2023 to 2028

Table 46 Data Acquisition Systems: Nvh Testing Market, by Region, 2023-2028 (USD Million)

6.2.5 Signal Conditioners

6.2.5.1 Signal Conditioners Help Modify Signals for Processing During Nvh Testing

Table 47 Signal Conditioners: Nvh Testing Market, by Region, 2019-2022 (USD Million)

Table 48 Signal Conditioners: Nvh Testing Market, by Region, 2023-2028 (USD Million)

6.2.6 Shakers & Controllers

6.2.6.1 Need for Vibration Testing and Modal Analysis to Drive Demand for Shakers and Controllers

Table 49 Shakers & Controllers: Nvh Testing Market, by Region, 2019-2022 (USD Million)

Table 50 Shakers & Controllers: Nvh Testing Market, by Region, 2023-2028 (USD Million)

6.3 Software

Table 51 Software: Nvh Testing Market, by Vertical, 2019-2022 (USD Million)

Figure 40 Automotive & Transportation Vertical to Account for Largest Share in Software Market for Nvh Testing from 2023 to 2028

Table 52 Software: Nvh Testing Market, by Vertical, 2023-2028 (USD Million)

Table 53 Software: Nvh Testing Market, by Type, 2019-2022 (USD Million)

Table 54 Software: Nvh Testing Market, by Type, 2023-2028 (USD Million)

Table 55 Software: Nvh Testing Market, by Region, 2019-2022 (USD Million)

Table 56 Software: Nvh Testing Market, by Region, 2023-2028 (USD Million)

Table 57 Software: Nvh Testing Market in North America, by Country, 2019-2022 (USD Million)

Table 58 Software: Nvh Testing Market in North America, by Country, 2023-2028 (USD Million)

Table 59 Software: Nvh Testing Market in Europe, by Country, 2019-2022 (USD Million)

Table 60 Software: Nvh Testing Market in Europe, by Country, 2023-2028 (USD Million)

Table 61 Software: Nvh Testing Market in Asia-Pacific, by Country, 2019-2022 (USD Million)

Table 62 Software: Nvh Testing Market in Asia-Pacific, by Country, 2023-2028 (USD Million)

Table 63 Software: Nvh Testing Market in Rest of the World, by Country, 2019-2022 (USD Million)

Table 64 Software: Nvh Testing Market in Rest of the World, by Country, 2023-2028 (USD Million)

6.3.1 Data Acquisition Software

6.3.1.1 Growing Adoption of Data Acquisition Systems to Drive Demand for Data Acquisition Software

Table 65 Data Acquisition Software: Nvh Testing Market, by Region, 2019-2022 (USD Million)

Table 66 Data Acquisition Software: Nvh Testing Market, by Region, 2023-2028 (USD Million)

6.3.2 Acoustic Software

6.3.2.1 Acoustic Software Facilitates Precise Measurement and Evaluation of Sound Levels During Nvh Testing

Table 67 Acoustic Software: Nvh Testing Market, by Region, 2019-2022 (USD Million)

Table 68 Acoustic Software: Nvh Testing Market, by Region, 2023-2028 (USD Million)

6.3.3 Vibration Measurement & Analysis Software

6.3.3.1 Vibration Measurement and Analysis Software Help Evaluate Shock and Vibration Data Acquired for Nvh Testing

Table 69 Vibration Measurement and Analysis Software: Nvh Testing, by Region, 2019-2022 (USD Million)

Table 70 Vibration Measurement and Analysis Software: Nvh Testing, by Region, 2023-2028 (USD Million)

6.3.4 Signal Analysis Software

6.3.4.1 Signal Analysis Software Used for Analysis of Vibration and Acoustic Signals Captured and Stored in Database

Table 71 Signal Analysis Software: Nvh Testing Market, by Region, 2019-2022 (USD Million)

Figure 41 North America to Account for Largest Share of Signal Analysis Software in Nvh Testing Market

Table 72 Signal Analysis Software: Nvh Testing Market, by Region, 2023-2028 (USD Million)

6.3.5 Calibration Software

6.3.5.1 Calibration Software Used to Improve Quality of Results, Reduce Errors, and Standardize Testing Methods

Table 73 Calibration Software: Nvh Testing Market, by Region, 2019-2022 (USD Million)

Table 74 Calibration Software: Nvh Testing Market, by Region, 2023-2028 (USD Million)

7 Nvh Testing Market, by Application

7.1 Introduction

Table 75 Nvh Testing Market, by Application, 2019-2022 (USD Million)

Figure 42 Sound Intensity Measurement and Sound Quality Testing to Register Highest CAGR During Forecast Period

Table 76 Nvh Testing Market, by Application, 2023-2028 (USD Million)

7.2 Impact Hammer Testing and Powertrain Nvh Testing

7.2.1 Growing Need to Reduce Unwanted Noise and Vibration in Automotive Industry to Drive Market Growth

7.3 Environmental Noise Measurement

7.3.1 Need to Address Impact of Noise on Human Health and Environment to Provide Opportunities

7.4 Pass-By Noise Testing

7.4.1 Increasing Mandates for Regulating Effect of External Noise on Vehicles to Drive Market

7.5 Noise Source Mapping

7.5.1 Need to Identify Noise Sources in Difficult-To-Access Areas to Fuel Market

7.6 Sound Intensity Measurement and Sound Quality Testing

7.6.1 Growing Demand for Consumer Appliances Globally to Propel Market Growth

7.7 Product Vibration Testing

7.7.1 Increasing Focus on Quality Control and Improving Lifespan of Products to Drive Market

7.8 Mechanical Vibration Testing

7.8.1 Need to Minimize Vibration to Increase User Comfort to Fuel Market Growth

7.9 Building Acoustics

7.9.1 Growing Need to Address Noise Concerns in Buildings to Drive Market

8 Nvh Testing Market, by Vertical

8.1 Introduction

Table 77 Nvh Testing Market, by Vertical, 2019-2022 (USD Million)

Figure 43 Automotive & Transportation to Account for Largest Share of Nvh Testing Market from 2023 to 2028

Table 78 Nvh Testing Market, by Vertical, 2023-2028 (USD Million)

8.2 Automotive & Transportation

8.2.1 Growing Need to Meet Regulations and Quality Expectations of Customers to Drive Market

Table 79 Automotive & Transportation: Nvh Testing Market, by Type, 2019-2022 (USD Million)

Figure 44 Hardware to Dominate Nvh Testing Market for Automotive & Transportation Vertical During Forecast Period

Table 80 Automotive & Transportation: Nvh Testing Market, by Type, 2023-2028 (USD Million)

8.2.2 Aerospace & Defense

8.2.3 Need for Noise Control and Development of Durable Aircraft Components to Drive Market

Table 81 Aerospace & Defense: Nvh Testing Market, by Type, 2019-2022 (USD Million)

Figure 45 Software to Register Highest CAGR for Aerospace & Defense Vertical During Forecast Period

Table 82 Aerospace & Defense: Nvh Testing Market, by Type, 2023-2028 (USD Million)

8.3 Power & Energy

8.3.1 Need to Identify Noise and Vibration Sources to Drive Demand for Nvh Testing Solutions

Table 83 Power & Energy: Nvh Testing Market, by Type, 2019-2022 (USD Million)

Figure 46 Hardware Market to Dominate Power & Energy Vertical During Forecast Period

Table 84 Power & Energy: Nvh Testing Market, by Type, 2023-2028 (USD Million)

8.4 Consumer Appliances

8.4.1 Increasing Use of Consumer Appliances to Create Opportunities for Adoption of Nvh Testing

Table 85 Consumer Appliances: Nvh Testing Market, by Type, 2019-2022 (USD Million)

Table 86 Consumer Appliances: Nvh Testing Market, by Type, 2023-2028 (USD Million)

8.5 Construction

8.5.1 Increasing Need to Enhance Occupant Comfort to Push Nvh Testing Market Further

Table 87 Construction: Nvh Testing Market, by Type, 2019-2022 (USD Million)

Table 88 Construction: Nvh Testing Market, by Type, 2023-2028 (USD Million)

8.6 Industrial Equipment

8.6.1 Increasing Need to Test Noise and Vibration Levels of Industrial Equipment to Drive Market Growth

Table 89 Industrial Equipment: Nvh Testing Market, by Type, 2019-2022 (USD Million)

Table 90 Industrial Equipment: Nvh Testing Market, by Type, 2023-2028 (USD Million)

8.7 Mining & Metallurgy

8.7.1 Growing Need to Reduce Noise Levels Generated from Mining & Metallurgy Equipment to Drive Nvh Testing Market

Table 91 Mining & Metallurgy: Nvh Testing Market, by Type, 2019-2022 (USD Million)

Table 92 Mining & Metallurgy: Nvh Testing Market, by Type, 2023-2028 (USD Million)

8.8 Others

Table 93 Others: Nvh Testing Market, by Type, 2019-2022 (USD Million)

Table 94 Others: Nvh Testing Market, by Type, 2023-2028 (USD Million)

9 Nvh Testing Market, by Region

9.1 Introduction

Figure 47 China to Register Highest CAGR During Forecast Period

Table 95 Nvh Testing Market, by Region, 2019-2022 (USD Million)

Figure 48 North America to Account for Largest Market Share in Nvh Testing Market

Table 96 Nvh Testing Market, by Region, 2023-2028 (USD Million)

9.2 North America

Figure 49 North America: Nvh Testing Market Snapshot

Table 97 North America: Nvh Testing Market, by Type, 2019-2022 (USD Million)

Table 98 North America: Nvh Testing Market, by Type, 2023-2028 (USD Million)

Table 99 North America: Nvh Testing Market, by Hardware Type, 2019-2022 (USD Million)

Table 100 North America: Nvh Testing Market, by Hardware Type, 2023-2028 (USD Million)

Table 101 North America: Nvh Testing Market, by Software Type, 2019-2022 (USD Million)

Table 102 North America: Nvh Testing Market, by Software Type, 2023-2028 (USD Million)

Table 103 North America: Nvh Testing Market, by Country, 2019-2022 (USD Million)

Table 104 North America: Nvh Testing Market, by Country, 2023-2028 (USD Million)

9.2.1 Recession Impact on North America

9.2.2 US

9.2.2.1 Growing Adoption of Electric Vehicles to Drive Nvh Testing Market in US

Table 105 US: Nvh Testing Market, by Type, 2019-2022 (USD Million)

Table 106 US: Nvh Testing Market, by Type, 2023-2028 (USD Million)

9.2.3 Canada

9.2.3.1 Presence of Aerospace and Automotive Manufacturing Giants to Drive Market Growth

Table 107 Canada: Nvh Testing Market, by Type, 2019-2022 (USD Million)

Table 108 Canada: Nvh Testing Market, by Type, 2023-2028 (USD Million)

9.2.4 Mexico

9.2.4.1 Increasing Automotive Exports to Drive Nvh Testing Market

Table 109 Mexico: Nvh Testing Market, by Type, 2019-2022 (USD Million)

Table 110 Mexico: Nvh Testing Market, by Type, 2023-2028 (USD Million)

9.3 Europe

Figure 50 Europe: Nvh Testing Market Snapshot

Table 111 Europe: Nvh Testing Market, by Type, 2019-2022 (USD Million)

Table 112 Europe: Nvh Testing Market, by Type, 2023-2028 (USD Million)

Table 113 Europe: Nvh Testing Market, by Hardware Type, 2019-2022 (USD Million)

Table 114 Europe: Nvh Testing Market, by Hardware Type, 2023-2028 (USD Million)

Table 115 Europe: Nvh Testing Market, by Software Type, 2019-2022 (USD Million)

Table 116 Europe: Nvh Testing Market, by Software Type, 2023-2028 (USD Million)

Table 117 Europe: Nvh Testing Market, by Country, 2019-2022 (USD Million)

Table 118 Europe: Nvh Testing Market, by Country, 2023-2028 (USD Million)

9.3.1 Recession Impact on Europe

9.3.2 Germany

9.3.2.1 Government Funding and Policies to Support Industrial Transformation and Create Opportunities for Nvh Testing

Table 119 Germany: Nvh Testing Market, by Type, 2019-2022 (USD Million)

Table 120 Germany: Nvh Testing Market, by Type, 2023-2028 (USD Million)

9.3.3 UK

9.3.3.1 Strict Regulations for Noise Control and R&D Investments in Automotive Industry to Drive Nvh Testing Market

Table 121 UK: Nvh Testing Market, by Type, 2019-2022 (USD Million)

Table 122 UK: Nvh Testing Market, by Type, 2023-2028 (USD Million)

9.3.4 France

9.3.4.1 Rising Adoption of Smart Factories to Automate Manufacturing Processes to Create Demand for Nvh Testing Solutions

Table 123 France: Nvh Testing Market, by Type, 2019-2022 (USD Million)

Table 124 France: Nvh Testing Market, by Type, 2023-2028 (USD Million)

9.3.5 Italy

9.3.5.1 Government Support Toward Electric Vehicle Adoption to Drive Growth of Nvh Testing Market

Table 125 Italy: Nvh Testing Market, by Type, 2019-2022 (USD Million)

Table 126 Italy: Nvh Testing Market, by Type, 2023-2028 (USD Million)

9.3.6 Spain

9.3.6.1 Presence of Multinational Brands and Manufacturing Plants in Automotive Sector to Drive Demand for Nvh Testing Solutions

Table 127 Spain: Nvh Testing Market, by Type, 2019-2022 (USD Million)

Table 128 Spain: Nvh Testing Market, by Type, 2023-2028 (USD Million)

9.3.7 Rest of Europe

Table 129 Rest of Europe: Nvh Testing Market, by Type, 2019-2022 (USD Million)

Table 130 Rest of Europe: Nvh Testing Market, by Type, 2023-2028 (USD Million)

9.4 Asia-Pacific

Figure 51 Asia-Pacific: Nvh Testing Market Snapshot

Table 131 Asia-Pacific: Nvh Testing Market, by Type, 2019-2022 (USD Million)

Table 132 Asia-Pacific: Nvh Testing Market, by Type, 2023-2028 (USD Million)

Table 133 Asia-Pacific: Nvh Testing Market, by Hardware Type, 2019-2022 (USD Million)

Table 134 Asia-Pacific: Nvh Testing Market, by Hardware Type, 2023-2028 (USD Million)

Table 135 Asia-Pacific: Nvh Testing Market, by Software Type, 2019-2022 (USD Million)

Table 136 Asia-Pacific: Nvh Testing Market, by Software Type, 2023-2028 (USD Million)

Table 137 Asia-Pacific: Nvh Testing Market, by Country, 2019-2022 (USD Million)

Table 138 Asia-Pacific: Nvh Testing Market, by Country, 2023-2028 (USD Million)

9.4.1 Recession Impact on Asia-Pacific

9.4.2 China

9.4.2.1 Increasing Government Focus on Adoption of Electric Vehicles to Drive Market Growth

Table 139 China: Nvh Testing Market, by Type, 2019-2022 (USD Million)

Table 140 China: Nvh Testing Market, by Type, 2023-2028 (USD Million)

9.4.3 India

9.4.3.1 Presence of Large Automotive Industry to Drive Market

Table 141 India: Nvh Testing Market, by Type, 2019-2022 (USD Million)

Table 142 India: Nvh Testing Market, by Type, 2023-2028 (USD Million)

9.4.4 Japan

9.4.4.1 Designing and Developing Hybrid and Electric Vehicles to Drive Market

Table 143 Japan: Nvh Testing Market, by Type, 2019-2022 (USD Million)

Table 144 Japan: Nvh Testing Market, by Type, 2023-2028 (USD Million)

9.4.5 South Korea

9.4.5.1 Growing Automotive, Industrial, and Telecom Markets to Provide Growth Opportunities for Nvh Testing

Table 145 South Korea: Nvh Testing Market, by Type, 2019-2022 (USD Million)

Table 146 South Korea: Nvh Testing Market, by Type, 2023-2028 (USD Million)

9.4.6 Australia

9.4.6.1 Growing Adoption of Electric Vehicles to Drive Demand for Nvh Testing Solutions

Table 147 Australia: Nvh Testing Market, by Type, 2019-2022 (USD Million)

Table 148 Australia: Nvh Testing Market, by Type, 2023-2028 (USD Million)

9.4.7 Rest of Asia-Pacific

Table 149 Rest of Asia-Pacific: Nvh Testing Market, by Type, 2019-2022 (USD Million)

Table 150 Rest of Asia-Pacific: Nvh Testing Market, by Type, 2023-2028 (USD Million)

9.5 Rest of the World

Table 151 Rest of the World: Nvh Testing Market, by Type, 2019-2022 (USD Million)

Table 152 Rest of the World: Nvh Testing Market, by Type, 2023-2028 (USD Million)

Table 153 Rest of the World: Nvh Testing Market, by Hardware Type, 2019-2022 (USD Million)

Table 154 Rest of the World: Nvh Testing Market, by Hardware Type, 2023-2028 (USD Million)

Table 155 Rest of the World: Nvh Testing Market, by Software Type, 2019-2022 (USD Million)

Table 156 Rest of the World: Nvh Testing Market, by Software Type, 2023-2028 (USD Million)

Table 157 Rest of the World: Nvh Testing Market, by Region, 2019-2022 (USD Million)

Table 158 Rest of the World: Nvh Testing Market, by Region, 2023-2028 (USD Million)

9.5.1 Recession Impact on Row

9.5.2 South America

9.5.2.1 Mining & Metallurgy Vertical to Fuel Nvh Testing

Table 159 South America: Nvh Testing Market, by Type, 2019-2022 (USD Million)

Table 160 South America: Nvh Testing Market, by Type, 2023-2028 (USD Million)

9.5.3 Middle East & Africa

9.5.3.1 Increasing Motor Vehicles and Stringent Regulations to Boost Demand

Table 161 Middle East & Africa: Nvh Testing Market, by Type, 2019-2022 (USD Million)

Table 162 Middle East & Africa: Nvh Testing Market, by Type, 2023-2028 (USD Million)

10 Competitive Landscape

10.1 Introduction

10.2 Strategies Adopted by Key Players

Table 163 Overview of Strategies Adopted by Key Players in Nvh Testing Market

Figure 52 Key Players Used Product Launches as Key Growth Strategy from 2019-2023

10.2.1 Organic/Inorganic Growth Strategies

10.2.2 Product Portfolio

10.2.3 Geographic Presence

10.2.4 Manufacturing Footprint

10.3 Market Share Analysis, 2022

Table 164 Market Share Analysis of Key Companies in Nvh Testing Market, 2022

10.4 Historical Revenue Analysis, 2018-2022

Figure 53 Historical Revenue Analysis for Top 5 Players in Nvh Testing Market, 2018-2022 (USD Million)

10.5 Company Evaluation Quadrant

10.5.1 Stars

10.5.2 Emerging Leaders

10.5.3 Pervasive Players

10.5.4 Participants

Figure 54 Nvh Testing Market: Key Company Evaluation Quadrant, 2022

10.6 Startup/Sme Evaluation Quadrant

10.6.1 Competitive Benchmarking

Table 165 Nvh Testing Market: Detailed List of Key Startups/Smes

Table 166 Competitive Benchmarking for Startups/Smes: Type

Table 167 Competitive Benchmarking for Startups/Smes: Vertical

Table 168 Competitive Benchmarking for Startups/Smes: Region

10.6.2 Progressive Companies

10.6.3 Responsive Companies

10.6.4 Dynamic Companies

10.6.5 Starting Blocks

Figure 55 Nvh Testing Market: Startup/Sme Evaluation Quadrant, 2022

10.7 Company Footprint

Table 169 Company Footprint

Table 170 Offering Footprint

Table 171 Company Vertical Footprint

Table 172 Company Region Footprint

10.8 Competitive Scenario

10.8.1 Product Launches and Developments

Table 173 Product Launches and Developments, 2019-2023

10.8.2 Deals

Table 174 Deals, 2019-2022

10.8.3 Others

Table 175 Others, 2020-2022

11 Company Profiles

(Business Overview, Products Offered, Recent Developments, Analyst's View Right to Win, Strategic Choices Made, Weaknesses and Competitive Threats) *

11.1 Introduction

11.2 Key Players

11.2.1 National Instruments Corporation

Table 176 National Instruments Corporation: Business Overview

Figure 56 National Instruments Corporation: Company Snapshot

Table 177 National Instruments Corporation: Product Launches

Table 178 National Instruments Corporation: Deals

Table 179 National Instruments Corporation: Others

11.2.2 Siemens Digital Industries Software

Table 180 Siemens Digital Industries Software: Business Overview

Table 181 Siemens Digital Industries Software: Product Launches

Table 182 Siemens Digital Industries Software: Deals

11.2.3 Brüel & Kjær (Subsidiary of Spectris)

Table 183 Brüel & Kjær: Business Overview

Table 184 Brüel & Kjær: Product Launches

Table 185 Brüel & Kjær: Deals

11.2.4 Axiometrix Solutions

Table 186 Axiometrix Solutions: Company Overview

Table 187 Axiometrix Solutions: Product Launches

Table 188 Axiometrix Solutions: Deals

Table 189 Axiometrix Solutions: Others

11.2.5 Head Acoustics GmbH

Table 190 Head Acoustics GmbH: Business Overview

Table 191 Head Acoustics GmbH: Product Launches

Table 192 Head Acoustics GmbH: Deals

11.2.6 Dewesoft D.O.O

Table 193 Dewesoft D.O.O: Business Overview

Table 194 Dewesoft D.O.O Solutions Laiteres Inc.: Product Launches

Table 195 Dewesoft D.O.O: Deals

Table 196 Dewesoft D.O.O: Others

11.2.7 Prosig Ltd

Table 197 Prosig Ltd

Table 198 Prosig Ltd: Product Launches

Table 199 Prosig Ltd: Deals

Table 200 Prosig Ltd: Others

11.2.8 Signal.X Technologies LLC

Table 201 Signal.X Technologies LLC: Business Overview

Table 202 Signal.X Technologies LLC: Product Launches

Table 203 Signal.X Technologies LLC: Deals

11.2.9 M+P International Mess- Und Rechnertechnik GmbH

Table 204 M+P International Mess- Und Rechnertechnik GmbH: Business Overview

Table 205 M+P International Mess- Und Rechnertechnik GmbH: Product Launches

Table 206 M+P International Mess- Und Rechnertechnik GmbH: Deals

Table 207 M+P International Mess- Und Rechnertechnik GmbH: Others

11.2.10 Norsonic As

Table 208 Norsonic As: Company Overview

Table 209 Norsonic As: Product Launches

Table 210 Deals: Norsonic As

11.3 Other Players

11.3.1 Ab Dynamics

11.3.2 Benstone Instruments

11.3.3 Nvt Group

11.3.4 Econ Technologies Co., Ltd

11.3.5 Esi Group

11.3.6 Erbessd Instruments

11.3.7 Atesteo GmbH & Co. Kg

11.3.8 Thp Systems

11.3.9 Honeywell International Inc.

11.3.10 King Design Industrial Co. Ltd

11.3.11 Kistler Group

11.3.12 Müller-Bbm Vibroakustik Systeme

11.3.13 Oros

11.3.14 Pcb Piezotronics, Inc.

11.3.15 Polytec GmbH

*Details on Business Overview, Products Offered, Recent Developments, Analyst's View, Right to Win, Strategic Choices Made, Weaknesses and Competitive Threats Might Not be Captured in Case of Unlisted Companies.

12 Appendix

12.1 Insights from Industry Experts

12.2 Discussion Guide

12.3 Knowledgestore: The Subscription Portal

12.4 Customization Options

Companies Mentioned

- Ab Dynamics

- Atesteo GmbH & Co. Kg

- Axiometrix Solutions

- Benstone Instruments

- Brüel & Kjær (Subsidiary of Spectris)

- Dewesoft D.O.O

- Econ Technologies Co., Ltd

- Erbessd Instruments

- Esi Group

- Head Acoustics GmbH

- Honeywell International Inc.

- King Design Industrial Co. Ltd

- Kistler Group

- M+P International Mess- Und Rechnertechnik GmbH

- Müller-Bbm Vibroakustik Systeme

- National Instruments Corporation

- Norsonic As

- Nvt Group

- Oros

- Pcb Piezotronics, Inc.

- Polytec GmbH

- Prosig Ltd

- Siemens Digital Industries Software

- Signal.X Technologies LLC

- Thp Systems

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 286 |

| Published | April 2023 |

| Forecast Period | 2023 - 2028 |

| Estimated Market Value ( USD | $ 2.2 Billion |

| Forecasted Market Value ( USD | $ 3 Billion |

| Compound Annual Growth Rate | 6.3% |

| Regions Covered | Global |

| No. of Companies Mentioned | 26 |