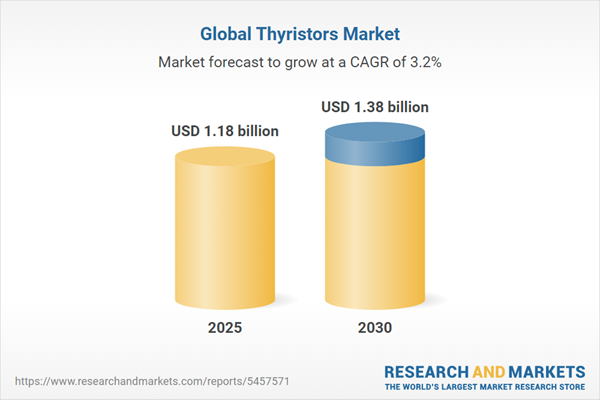

The global thyristors market is projected to experience robust growth from 2025 to 2030, driven by increasing energy demand, industrial automation, and the rising adoption of electric vehicles (EVs) and renewable energy systems. Thyristors, solid-state switching devices used in power electronics like inverters, controllers, and power supplies, are critical for efficient energy management and high-voltage applications. The market is propelled by the need to modernize aging infrastructure, particularly in developed regions, and the growing use of high-voltage direct current (HVDC) systems. North America is expected to hold a significant share, while Asia-Pacific, particularly India, shows strong growth potential. Challenges include high development costs and competition from alternative semiconductor technologies.

Market Drivers

Increasing Energy Demand

Global electricity demand is rising, driven by population growth and industrialization, necessitating efficient power management solutions. According to the International Energy Agency, electricity demand is expected to grow at 3% annually through 2025, outpacing previous years. Thyristors, with their fast switching times and low losses, are essential in power electronics for applications like voltage regulation and energy transmission. Their use in HVDC systems, which enable low-loss electricity transmission over long distances, is growing, particularly in countries like India, where HVDC adoption is expanding, boosting market demand.Industrial Automation

The rise of industrial automation is a key driver, with thyristors playing a critical role in motor control, lighting systems, and heating elements. The increasing use of industrial robots and automation technologies in manufacturing enhances the demand for thyristors, which provide precise control and reliability in high-power applications. The robust growth of the manufacturing sector, particularly in the United States, supports market expansion, as thyristors are integral to automating processes and improving operational efficiency.Growth in Electric Vehicle Adoption

The surge in battery electric vehicle (BEV) sales is driving demand for thyristors in power electronics for motor control and battery charging systems. Thyristors ensure efficient energy management in EVs, supporting their growing adoption globally. As governments and industries prioritize sustainable transportation, the need for reliable, high-performance thyristors in EV infrastructure is increasing, further fueling market growth.Market Restraints

The thyristors market faces challenges due to high development and production costs, which can limit adoption in cost-sensitive regions or smaller applications. Competition from alternative technologies, such as insulated-gate bipolar transistors (IGBTs) and metal-oxide-semiconductor field-effect transistors (MOSFETs), which offer improved efficiency in certain applications, poses a threat. Additionally, the complexity of integrating thyristors into advanced systems requires skilled expertise, potentially hindering growth in emerging markets. Addressing these challenges through cost-effective designs and simplified integration will be critical for sustained expansion.Market Segmentation

By Application

The market is segmented into power electronics, industrial automation, automotive, and others. Power electronics, including HVDC and inverters, dominate due to rising energy demands. Automotive applications, particularly EVs, are a fast-growing segment, while industrial automation is expanding with increased robot adoption.By End-User

The market includes power and energy, automotive, manufacturing, and others. Power and energy lead due to HVDC and renewable energy applications, while automotive is driven by EV growth. Manufacturing is a significant segment, supported by automation trends.By Geography

The market is segmented into North America, Asia-Pacific, Europe, South America, and the Middle East and Africa. North America holds a significant share, driven by investments in renewable energy and EV infrastructure, with key players like Infineon Technologies and Littelfuse leading innovation. Asia-Pacific, particularly India, is expected to grow rapidly due to HVDC adoption and industrial expansion. Europe, South America, and the Middle East and Africa are emerging markets.The thyristors market is set for robust growth from 2025 to 2030, driven by rising energy demand, industrial automation, and EV adoption. Despite challenges like high costs and competition from alternative technologies, the market's outlook is positive, particularly in North America and Asia-Pacific. Industry players must focus on innovative, cost-effective thyristor solutions and seamless integration to capitalize on the growing demand in power electronics, automotive, and automation applications.

Key Benefits of this Report:

- Insightful Analysis: Gain detailed market insights covering major as well as emerging geographical regions, focusing on customer segments, government policies and socio-economic factors, consumer preferences, industry verticals, and other sub-segments.

- Competitive Landscape: Understand the strategic maneuvers employed by key players globally to understand possible market penetration with the correct strategy.

- Market Drivers & Future Trends: Explore the dynamic factors and pivotal market trends and how they will shape future market developments.

- Actionable Recommendations: Utilize the insights to exercise strategic decisions to uncover new business streams and revenues in a dynamic environment.

- Caters to a Wide Audience: Beneficial and cost-effective for startups, research institutions, consultants, SMEs, and large enterprises.

What do businesses use our reports for?

Industry and Market Insights, Opportunity Assessment, Product Demand Forecasting, Market Entry Strategy, Geographical Expansion, Capital Investment Decisions, Regulatory Framework & Implications, New Product Development, Competitive Intelligence.Report Coverage:

- Historical data from 2020 to 2024 & forecast data from 2025 to 2030

- Growth Opportunities, Challenges, Supply Chain Outlook, Regulatory Framework, and Trend Analysis

- Competitive Positioning, Strategies, and Market Share Analysis

- Revenue Growth and Forecast Assessment of segments and regions including countries

- Company Profiling: Strategies, Products, Financial Information, and Key Developments among others

Segmentation:

By Type

- Silicon Controller Thyristor

- Gate Turn Off Thyristor

- Emitter Turn Off Thyristor

- Reverse Conducting Thyristor

- Others

By Power Rating

- Below 500 MW

- 500-900 MW

- Above 999 MW

By End-User Industry

- Consumer Electronics

- Telecommunications

- Automotive

- Industrial

- Others

By Geography

- North America

- USA

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Others

- Europe

- Germany

- France

- United Kingdom

- Spain

- Others

- Middle East and Africa

- Saudi Arabia

- UAE

- Others

- Asia Pacific

- China

- Japan

- India

- South Korea

- Indonesia

- Thailand

- Others

Table of Contents

Companies Mentioned

- Honeywell International Inc.

- Fuji Electric Co., Ltd.

- Infineon Technologies AG

- STMicroelectronics

- Toshiba Corporation

- Diodes Incorporated

- Renesas Electronics Corporation

- Mitsubishi Electric Corporation

- ABB Ltd.

- ON Semiconductor

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 146 |

| Published | August 2025 |

| Forecast Period | 2025 - 2030 |

| Estimated Market Value ( USD | $ 1.18 billion |

| Forecasted Market Value ( USD | $ 1.38 billion |

| Compound Annual Growth Rate | 3.2% |

| Regions Covered | Global |

| No. of Companies Mentioned | 10 |