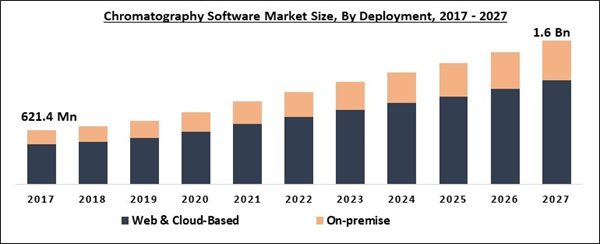

The Global Chromatography Software Market size is expected to reach $1.6 billion by 2027, rising at a market growth of 9.7% CAGR during the forecast period. Chromatography is the procedure of segregating various components of a mixture based on the relative amounts of every component or solute distributed between a moving fluid stream, known as a contiguous stationary phase, and the mobile phase. The stationary phase could be either solid or liquid while the mobile phase could be either a liquid or a gas. In addition, chromatography procedures are widely utilized in numerous applications across different industries like biotechnology, pharmaceutical, food production, genetic engineering, diagnostics, and drug discovery & water analysis.

Moreover, this technique is one of the crucial biophysical techniques, which helps in the identification, separation, and purification of the various components of a mixture for qualitative and quantitative analysis. Through this technique, proteins are purified on the basis of their characteristics like total charge, size & shape, hydrophobic groups that exist on the surface, and binding capability with the stationary phase. For protein purification, column chromatography is the widely adopted technique.

The growth of the chromatography software market is surging due to the increasing adoption of chromatography software over traditional software. Along with that, the rising demand for chromatography techniques in numerous industry segments to segregate very complicated compounds is expected to propel the growth and demand for chromatography software in the market. Although, the high equipment cost attached to this chromatography software is estimated to hamper the growth of the market.

COVID-19 Impact Analysis

The COVID-19 pandemic has impacted the workflows of the healthcare sector across the globe. Numerous industries were compelled to shut down temporarily in the pandemic. Though, the pandemic has a positive impact on the demand for different services or tools like chromatography technologies including liquid chromatography. It is because chromatography is an effective laboratory analytical method, which is used by researchers to understand the Sars-CoV-2 virus and develop vaccines, therapies, and diagnostic tools to help patients to fight against the COVID-19.

Market Growth Factors:

Growing applications of chromatography in different fields

There is an increase in the applications of chromatography techniques across numerous fields like chemical, pharmaceutical industries, environmental testing laboratories, food industry, and forensic science, which is estimated to open new growth avenues for the market in the coming years. Additionally, the high adoption of chromatography techniques in drug discovery procedures is also fueling the growth of the chromatography market.

Constant development in gas chromatography columns for petrochemical applications

Gas chromatography is among the most popular analytical techniques used in the petroleum sector. It is owing to its high sensitivity for volatile components. There is rising usage of specialized gas chromatography columns in petroleum analysis, with constant expectations from the industry for improved columns, which boost the overall analytical performance and chromatographic efficiency.

Market Restraining Factor:

Chromatography instruments are not cost-effective

Chromatography instruments have various advanced functionalities and features, due to which, the price of these instruments is high. However, the cost of these instruments differs according to the applications. These instruments are utilized across the pharmaceutical sector since they utilize capillary columns to segregate compounds such as hydrogen, oxygen, and methane. Small- & medium-sized enterprises in sectors like food & beverage, oil & gas, and biotech & pharmaceutical, and research & academic institutions are demanding more such systems for their procedures. Thus, the amount of money spent on such systems has substantially increased.

Deployment Outlook

Based on Deployment, the market is segmented into Web & Cloud-Based and On-premise. The on-premise software provides various features like data security & privacy, simple retrieval of data, and easy access to data. Along with that, the option of personalization, convenient installation, and full control of the operations and working of the software is expected to increase the adoption of this software.

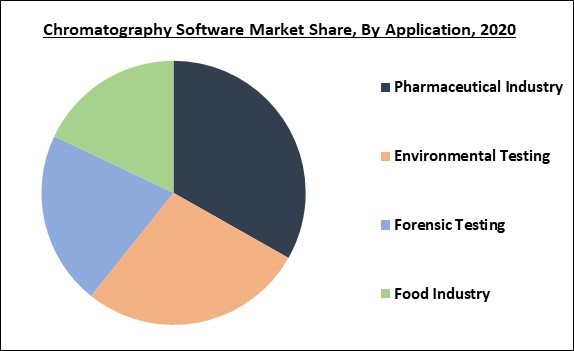

Application Outlook

Based on Application, the market is segmented into Pharmaceutical Industry, Environmental Testing, Forensic Testing, and Food Industry. The pharmaceutical industry segment procured the highest revenue share in the market in 2020. The chromatography software helps in managing operations, workflows, and instruments within a single system to coordinate the reporting, management, and processing of chromatography data. Additionally, chromatography techniques are widely utilized to evaluate the purified components for checking contaminants and to produce big quantities of highly pure materials.

Type Outlook

Based on Type, the market is segmented into Integrated and Standalone. The integrated chromatography software segment acquired the highest revenue share in the market in 2020. It is due to the increasing demand for workflow integration to simplify effective coordination and communication that leads to precise and quick outcomes.

Regional Outlook

Based on Regions, the market is segmented into North America, Europe, Asia Pacific, and Latin America, Middle East & Africa. The Asia Pacific is estimated to exhibit the fastest growth rate during the forecast period. This growth is attributed to the growing adoption of chromatography technology for numerous applications like a forensic, drug, environmental, and food testing. Additionally, supportive government initiatives regarding lab automation and increasing awareness & adoption of technology among laboratories are anticipated to contribute to the regional market growth.

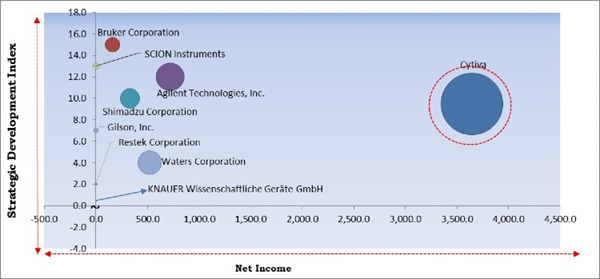

The major strategies followed by the market participants are Product Launches. Based on the Analysis presented in the Cardinal matrix; Cytiva (Danaher Corporation) is the major forerunners in the Chromatography Software Market. Companies such as Agilent Technologies, Inc., Shimadzu Corporation, Waters Corporation are some of the key innovators in the market.

The market research report covers the analysis of key stake holders of the market. Key companies profiled in the report include Agilent Technologies, Inc., Shimadzu Corporation, Cytiva (Danaher Corporation), Bruker Corporation, Waters Corporation, DataApex, Gilson, Inc., KNAUER Wissenschaftliche Geräte GmbH, Restek Corporation, and SCION Instruments (the Techcomp group).

Recent Strategies Deployed in Chromatography Software Market

Partnerships, Collaborations and Agreements:

- Aug-2021: Agilent Technologies signed an agreement with Metrohm USA and Metrohm Canada. Through this agreement, Metrohm USA and Metrohm Canada is expected to become a reseller for their single- and triple-quadrupole mass spectrometers along with ICP-MS and ICP-OES products, software and services. In addition, the companies expanded the ion chromatography (IC) capabilities of Metrohm USA and Metrohm Canada and open various additional applications, especially in the environmental and food & beverage analysis markets.

- May-2021: Waters Corporation entered into an agreement with SCIEX, a global leader in life science analytical technologies. This agreement aimed to provide customers with fully configured and interoperable Waters Ultra-Performance Liquid Chromatography instruments when they purchase and implement SCIEX mass spectrometry (MS) systems.

- Feb-2021: Waters Corporation signed an agreement with TetraScience, a cloud technology innovator powering transformational changes in life sciences R&D. This partnership aimed to enable Waters to provide its customers the Empower Data Science Link, powered by TetraScience.

- Apr-2020: Gilson partnered with QIAGEN, a German provider of sample and assay technologies for molecular diagnostics, applied testing, academic and pharmaceutical research. This partnership aimed to combine Gilson’s TRACKMAN Connected digital bench tools and QIAGEN’s manual nucleic acid extraction kits to boost confidence in their execution of extraction protocols, develop consistency among collaborators, and enhance traceability at the bench.

- Feb-2020: Cytiva entered into an agreement with GoSilico, a software company. This agreement aimed to co-market GoSilico’s ChromX chromatography modeling software and contract modeling services in the US.

Acquisitions and Mergers:

- Jun-2021: Cytiva took over GoSilico, the German scientific software maker. This acquisition aimed to strengthen the company's position of leadership in the chromatography and process development spaces.

- May-2021: SCION Instruments took over Teledyne Tekmar Headspace product Lines HT3 and Versa from Teledyne Instruments. This acquisition aimed to boost Scion Instruments and Techcomp presence in the analytical Chromatography market and enable Scion Instruments to fulfil the increasing requirement for highly complicated applications and analysis utilizing the next generation of sample introduction systems.

Product Launches and Product Expansions:

- Jun-2021: Shimadzu Corporation and HORIBA launched a new LC-Raman system. This system integrates a Shimadzu high-performance liquid chromatography with a HORIBA Raman spectrometer for the Japanese domestic market. This system helps in improving measurement accuracy and efficiency and also provides new measurement values by identifying unknown components.

- Jan-2021: Shimadzu unveiled its Advanced i-Series liquid chromatographs. This Advanced i-Series fulfil customer demands for evaluating a huge number of samples or rapidly re-processing data while working from home.

- Apr-2020: Gilson launched a new industrial-scale centrifugal partition chromatography (CPC) system, VERITY CPC Process. Through this launch, Gilson is expected to become the only end-to-end provider of CPC systems & services for lab, pilot, and process scales.

- Feb-2020: Bruker launched the B.I.QUANT-UR 1.1 module. The module quantifies up to 150 endogenous and disease-related metabolites from urine automatically, enabling the customers to obtain accurate, sensitive, and fully reproducible outcomes, even below the limit of detection (LOD).

Geographical Expansions:

- Jul-2021: Cytiva and Pall Corporation expanded their manufacturing capacity and services over geographies for global life sciences users. This investment is expected to boost the companies' expansion program to rapidly fulfil the current and future requirements of their customers and eventually, their patients.

- Feb-2021: KNAUER expanded its global footprints by opening offices in Austria and Switzerland. This expansion aimed to provide greater customer proximity and direct specialist advice on-site to the company.

Scope of the Study

Market Segments Covered in the Report:

By Deployment

- Web & Cloud-Based

- On-premise

By Application

- Pharmaceutical Industry

- Environmental Testing

- Forensic Testing

- Food Industry

By Type

- Integrated

- Standalone

By Geography

- North America

- US

- Canada

- Mexico

- Rest of North America

- Europe

- Germany

- UK

- France

- Russia

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Singapore

- Malaysia

- Rest of Asia Pacific

- LAMEA

- Brazil

- Argentina

- UAE

- Saudi Arabia

- South Africa

- Nigeria

- Rest of LAMEA

Key Market Players

List of Companies Profiled in the Report:

- Agilent Technologies, Inc.

- Shimadzu Corporation

- Cytiva (Danaher Corporation)

- Bruker Corporation

- Waters Corporation

- DataApex

- Gilson, Inc.

- KNAUER Wissenschaftliche Geräte GmbH

- Restek Corporation

- SCION Instruments (the Techcomp group)

Unique Offerings from the Publisher

- Exhaustive coverage

- The highest number of market tables and figures

- Subscription-based model available

- Guaranteed best price

- Assured post sales research support with 10% customization free

Table of Contents

Companies Mentioned

- Agilent Technologies, Inc.

- Shimadzu Corporation

- Cytiva (Danaher Corporation)

- Bruker Corporation

- Waters Corporation

- DataApex

- Gilson, Inc.

- KNAUER Wissenschaftliche Geräte GmbH

- Restek Corporation

- SCION Instruments (the Techcomp group)