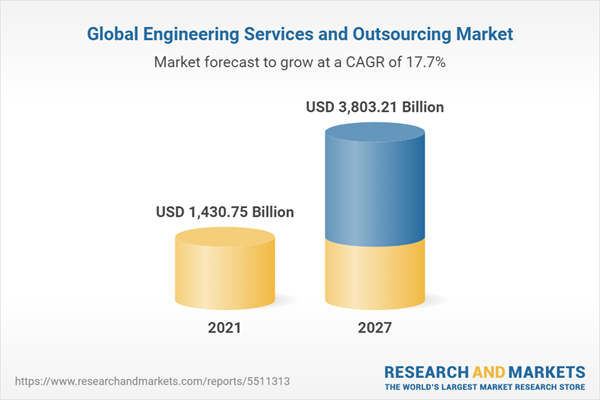

The global Engineering Services and Outsourcing market was valued at USD 1,430.75 Billion in 2021 and is forecasted to reach USD 3,803.21 Billion by the year 2027. The market is anticipated to register a CAGR of 17.7% over the projected period.

Engineering Services and Outsourcing is a process of assigning certain engineering tasks and functions to an organization or a team outside of the organization. Reduction in overhead cost is expected to boost the market growth. Furthermore, implementation of Industry 4.0 is also expected to fuel the market growth.

Despite the driving factors, loss of managerial control over connected outsourcing companies are expected to hinder the market growth during the forecast period. The market was negatively influenced during the COVID-19 pandemic, since manufacturing facilities were shut down temporarily.

Implementation of Industry 4.0

Industry 4.0 is digital transformation of production and related industries and value creation processes. Its implementation is currently encouraging smart manufacturing and fueling the demand for latest industrial solutions on the basis of artificial intelligence, machine learning, and robotics. This provides various opportunities for IT integration in the service offerings of the engineering service providers. This is expected to boost the market growth during the forecast period.

The global Engineering Services and Outsourcing market is segmented the type, location, pricing model, and industry.

The product designing segment is expected to hold the largest market share of around 22% owing to rising design complexities and need to cut costs by outsourcing designing. The plant automation and enterprise asset management segment is anticipated to witness the fastest growth rate of 19.8% during the forecast period.

The market size of Onshore segment is around 94% of Offshore market size in 2021 and will be around 91% in 2027. This market share is owing to growing demand for onshore services.

The services segment is expected to grow at the second fastest growth rate of around 20% owing to increasing adoption of services based pricing model. The fixed price projects segment is anticipated to surpass market value of USD 300 billion by 2024.

The medical devices segment is expected to grow at the fastest growth rate owing to increasing adoption of outsourcing services in the medical device industry. The computing systems segment is anticipated to surpass a market size of USD 50 billion by 2024 and USD 83.14 billion by 2027.

Based on region, the global Engineering Services and Outsourcing market is divided into Europe, North America, Asia Pacific, and the Rest of the World.

The Europe region is expected to hold the largest market share of around 30% due to presence various industrial goods manufacturing facilities and easy availability of highly skilled engineering professionals. The North America region is estimated to grow at the a CAGR of about 14.5% during the projected period.

Key players operating in the global Engineering Services and Outsourcing market include Accenture, AKKA Technologies, Altair Engineering, Inc., ALTEN SA, ASAP Holding GmbH, Assystem, AVL List GmbH, Bertrandt, Capgemini SE, Cognizant, Cyient, EDAG, ESI Group, Ferchau, Genpact, Geometric, HCL Technologies Limited, IAV, IGate, Infosys, International Business Machines Corporation, ITC Infotech, KPIT, L&T Technology Service, Neilsoft, QuEST Global, Ranal Inc., Segula Technologies, Semcon, Tata Consultancy Services, Tata Elxsi, Tata Technologies, Tech Mahindra, Wipro, and Other Prominent Players. The cumulative market share of the seven major players is close to 32%.

These market players are engaged in mergers & acquisitions, collaborations, and new product launches to strengthen their market presence. For instance, in November 2021, Altair Engineering Inc. collaborated with Origin Engineering Solutions for making it channel partner for Ireland and the UK. Origin Engineering is set to offer Altair’s manufacturing simulation software solutions through this.

Engineering Services and Outsourcing is a process of assigning certain engineering tasks and functions to an organization or a team outside of the organization. Reduction in overhead cost is expected to boost the market growth. Furthermore, implementation of Industry 4.0 is also expected to fuel the market growth.

Despite the driving factors, loss of managerial control over connected outsourcing companies are expected to hinder the market growth during the forecast period. The market was negatively influenced during the COVID-19 pandemic, since manufacturing facilities were shut down temporarily.

Growth Influencers:

Implementation of Industry 4.0

Industry 4.0 is digital transformation of production and related industries and value creation processes. Its implementation is currently encouraging smart manufacturing and fueling the demand for latest industrial solutions on the basis of artificial intelligence, machine learning, and robotics. This provides various opportunities for IT integration in the service offerings of the engineering service providers. This is expected to boost the market growth during the forecast period.

Segments Overview:

The global Engineering Services and Outsourcing market is segmented the type, location, pricing model, and industry.

By Type

- Product Designing

- Prototyping

- Process Designing

- System Integration

- Testing

- Quality Control

- Product Lifecycle Management

- Plant Automation & Enterprise Asset Management

The product designing segment is expected to hold the largest market share of around 22% owing to rising design complexities and need to cut costs by outsourcing designing. The plant automation and enterprise asset management segment is anticipated to witness the fastest growth rate of 19.8% during the forecast period.

By Location

- On-Site

- Onshore

- Offshore

The market size of Onshore segment is around 94% of Offshore market size in 2021 and will be around 91% in 2027. This market share is owing to growing demand for onshore services.

By Pricing Model

- Staff Augmentation

- Time and Materia

- Fixed Price Projects

- Services

- Risk/Rewards

The services segment is expected to grow at the second fastest growth rate of around 20% owing to increasing adoption of services based pricing model. The fixed price projects segment is anticipated to surpass market value of USD 300 billion by 2024.

By Industry

- Aerospace

- Automotive

- Computing Systems

- Construction

- Consumer Electronics

- Energy

- Heavy Machinery

- Healthcare

- Industrial

- Medical Devices

- Semiconductors

- Telecom

- Others

The medical devices segment is expected to grow at the fastest growth rate owing to increasing adoption of outsourcing services in the medical device industry. The computing systems segment is anticipated to surpass a market size of USD 50 billion by 2024 and USD 83.14 billion by 2027.

Regional Overview

Based on region, the global Engineering Services and Outsourcing market is divided into Europe, North America, Asia Pacific, and the Rest of the World.

The Europe region is expected to hold the largest market share of around 30% due to presence various industrial goods manufacturing facilities and easy availability of highly skilled engineering professionals. The North America region is estimated to grow at the a CAGR of about 14.5% during the projected period.

Competitive Landscape

Key players operating in the global Engineering Services and Outsourcing market include Accenture, AKKA Technologies, Altair Engineering, Inc., ALTEN SA, ASAP Holding GmbH, Assystem, AVL List GmbH, Bertrandt, Capgemini SE, Cognizant, Cyient, EDAG, ESI Group, Ferchau, Genpact, Geometric, HCL Technologies Limited, IAV, IGate, Infosys, International Business Machines Corporation, ITC Infotech, KPIT, L&T Technology Service, Neilsoft, QuEST Global, Ranal Inc., Segula Technologies, Semcon, Tata Consultancy Services, Tata Elxsi, Tata Technologies, Tech Mahindra, Wipro, and Other Prominent Players. The cumulative market share of the seven major players is close to 32%.

These market players are engaged in mergers & acquisitions, collaborations, and new product launches to strengthen their market presence. For instance, in November 2021, Altair Engineering Inc. collaborated with Origin Engineering Solutions for making it channel partner for Ireland and the UK. Origin Engineering is set to offer Altair’s manufacturing simulation software solutions through this.

The global Engineering Services and Outsourcing market report provides insights on the below pointers:

- Market Penetration: Provides comprehensive information on the market offered by the prominent players

- Market Development: The report offers detailed information about lucrative emerging markets and analyzes penetration across mature segments of the markets

- Market Diversification: Provides in-depth information about untapped geographies, recent developments, and investments

- Competitive Landscape Assessment: Mergers & acquisitions, certifications, product launches in the global Engineering Services and Outsourcing market have been provided in this research report. In addition, the report also emphasizes the SWOT analysis of the leading players.

- Product Development & Innovation: The report provides intelligent insights on future technologies, R&D activities, and breakthrough product developments

- Top Component/Resource Provider Companies; Top Service Provider Companies

- Pricing Comparison Between Insource and Outsource Product Development

The global Engineering Services and Outsourcing market report answers questions such as:

- What is the market size and forecast of the Global Engineering Services and Outsourcing Market?

- What are the inhibiting factors and impact of COVID-19 on the Global Engineering Services and Outsourcing Market during the assessment period?

- Which are the products/segments/applications/areas to invest in over the assessment period in the Global Engineering Services and Outsourcing Market?

- What is the competitive strategic window for opportunities in the Global Engineering Services and Outsourcing Market?

- What are the technology trends and regulatory frameworks in the Global Engineering Services and Outsourcing Market?

- What is the market share of the leading players in the Global Engineering Services and Outsourcing Market?

- What modes and strategic moves are considered favorable for entering the Global Engineering Services and Outsourcing Market?

Table of Contents

Chapter 1. Research Framework

Chapter 2. Research Methodology

Chapter 4. Global Engineering Services Outsourcing (ESO) Market Overview

Chapter 5. Engineering Services Outsourcing (ESO) Market Analysis, By Type

Chapter 6. Engineering Services Outsourcing (ESO) Market Analysis, By Location

Chapter 7. Engineering Services Outsourcing (ESO) Market Analysis, By Pricing Model

Chapter 8. Engineering Services Outsourcing (ESO) Market Analysis, By Industry

Chapter 9. Engineering Services Outsourcing (ESO) Market Analysis, By Region/ Country

Chapter 10. North America Engineering Services Outsourcing (ESO) Market Analysis

Chapter 11. Europe Engineering Services Outsourcing (ESO) Market Analysis

Chapter 12. Asia Pacific Engineering Services Outsourcing (ESO) Market Analysis

Chapter 13. Company Profile (Company Overview, Financial Matrix, Key Product landscape, Key Personnel, Key Competitors, Contact Address, and Business Strategy Outlook)

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Accenture

- AKKA Technologies

- Altair Engineering, Inc.

- ALTEN SA

- ASAP Holding GmbH

- Assystem

- AVL List GmbH

- Bertrandt

- Capgemini SE

- Cognizant

- Cyient

- EDAG

- ESI Group

- Ferchau

- Genpact

- Geometric

- HCL Technologies Limited

- IAV

- IGate

- Infosys

- International Business Machines Corporation

- ITC Infotech

- KPIT

- L&T Technology Service

- Neilsoft

- QuEST Global

- Ranal Inc.

- Segula Technologies

- Semcon

- Tata Consultancy Services

- Tata Elxsi

- Tata Technologies

- Tech Mahindra

- Wipro

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 190 |

| Published | October 2021 |

| Forecast Period | 2021 - 2027 |

| Estimated Market Value ( USD | $ 1430.75 Billion |

| Forecasted Market Value ( USD | $ 3803.21 Billion |

| Compound Annual Growth Rate | 17.7% |

| Regions Covered | Global |