Bioplastics are a type of plastic that is made from natural resources, such as straw, corn starch, woodchips, sawdust, vegetable oils and starches. The rising inclination towards the use of environment friendly products for a sustainable society is driving the growth of this market. Moreover, government, non-government, as well as manufacturers are aiming at increasing awareness by providing policies, subsidies, and other positive strategies and perks that drive the growth of the bioplastics market across the world.

The rising dependency on renewable biomass materials also contributes heavily towards the growth rate. The biomass plastic market is growing at a substantial rate, that aids the growth of bioplastics market. On the basis of raw material, the biomass plastic market is segmented into agricultural crop residues, forestry residues, microbes, wood processing residues, recycled food waste and others. The agricultural crop residues segment is estimated to have the highest market share of around 57.2% in 2020. The Asia Pacific region held the foremost share of around 42% in the global biomass plastics market in the year 2020.

On the other hand, the high cost to end user is a restraining factor for bioplastics market. Moreover, many researchers have pointed out to the limited performance of bioplastics, which decreases the preference rate of bioplastics among stakeholders. Thus, these factors curb the growth rate of the bioplastics market.

Growth Influencers:

- Environmentally friendly properties and favorable government policy

Bio-based plastics have unique benefits over conventional plastics to decrease the dependency on limited fossil resources as well as to lessen greenhouse gas emissions. Bioplastics are considered to be carbon neutral and supports sustainable measures to the environment. Moreover, several governments all over the world are trying to develop policies of the production of bio plastics. For instance, in July 2019, the Department for Business, Energy, and Industrial Strategy (BEIS), situated in the United Kingdom publicized a drive to boost modernization in bioplastics. The GBP 60 million government investment is anticipated to immensely increase the UK’s re and development (R&D) sector and further produce GBP 149 million from businesses. Overall, such optimistic growth from several end-user industries is projected to drive the UK market in the coming years.

- High consumer acceptance and renewable raw material sources

The raw materials, such as wood, cork, bamboo, straw, linoleum, soy, and wool, among others, are renewable in nature. The sustainability factor of these materials pushes the demand, thus enhancing consumer preference. Such a factor aids significantly in increasing the growth rate of the bioplastic market.

Segments Overview:

The global bioplastic market is segmented into type and mode application.

By Type

- Biodegradable

- Starch-based

- Poly lactic Acid (PLA)

- Poly hydroxylalkanoates (PHA)

- Polyester (PBS, PBAT, and PCL)

- Other Biodegradable Plastics

- Non-biodegradable

- Bio-polyethylene Terephthalate (PET)

- Bio-Polyethylene

- Bio-Polyamides

- Bio-Polytrimethylene Terephthalate

- Other Non-Biodegradable Plastics

The biodegradable segment is anticipated to hold the largest market share of more than 70%. The non-biodegradable segment is estimated to grow at a CAGR of 8.8%. The polyester market volume is expected to hit 891.4 kilo tons in 2027. The increasing PLA, PHA and PBS product usage and benefits are fueling the growth of this segment. For instance, Nodax, Danimer’s signature PHA, and Novomer’s p(3HP) have different properties and attributes: Nodax has strong performance and biodegradability properties, making it possible to be used across varied end-use applications, while p(3HP) has enhanced barrier characteristics and is a lower cost non-fermented input.

By Mode Application

- Rigid Packaging

- Bottles & Jars

- Trays (Market Volume size will cross 400 kilo tons in 2027)

- Others

- Flexible Packaging (Largest Market Share)

- Pouches

- Shopping/Waste Bags

- Others

- Agriculture & Horticulture

- Consumer goods

- Textile

- Automotive & Transportation

- Building & Construction

- Others

The flexible packaging segment held the largest share in 2020 owing to the increase in the use of pouches and waste bags. Based on rigid packaging, the trays market volume is anticipated to cross 400 kilo tons in 2027. The consumer goods segment is anticipated to be the fastest growing segment with a CAGR of 12.4% owing to the rise in adoption of bioplastics in the manufacturing process of consumer goods.

Regional Overview

By region, the global bioplastic market is divided into Europe, North America, Asia Pacific, Middle East & Africa, and South America.

The Asia Pacific region is expected to hold the largest market share of around 43% in 2020 owing to the increasing initiatives by government and the companies. For instance, in September 2019, Green Science Alliance, a Japanese chemical company, developed a new approach to manufacturing bioplastic. The company produced a bottle made of a 100% biobased composite material.

The European region is anticipated to grow substantially owing to the increasing number of companies investing in research and development to develop cutting-edge products. The North American region is also anticipated to grow at a considerable rate. The Latin American market volume for bioplastics is anticipated to cross 300 kilo tons in 2025.

Competitive Landscape

Key players operating in the global bioplastic market include BASF SE, Biome Technologies plc, Braskem, Corbion N.V., Danimer Scientific., E. I. du Pont de Nemours and Company, Eastman Chemical Company, Futerro SA, Galactic, M& G Chemicals, Mitsubishi Chemical Holdings, NatureWorks LLC, Novamont S.p.A., Plantic, PTT Global Chemical Public Company Ltd., Showa Denko K.K., Solvay SA, Teijin Ltd., Toray Industries, Toyota Tsusho, among others.

The major six players in the market hold approximately 60% of the market share. These market players are investing in product launches, collaborations, mergers & acquisitions, and expansions to create a competitive edge in the market. For instance, in September 2020, Corbion and Total announced their intention to build a new PLA bioplastics plant in Europe through their Total Corbion PLA joint venture. The plant is expected to have a capacity of 100,000 tons per annum, and the first world-scale PLA production facility in Europe. This new plant is planned to be located in Grandpuits, France and to be operational in 2024.

The global bioplastic market report provides insights on the below pointers:

- Market Penetration: Provides comprehensive information on the market offered by the prominent players

- Market Development: The report offers detailed information about lucrative emerging markets and analyzes penetration across mature segments of the markets

- Market Diversification: Provides in-depth information about untapped geographies, recent developments, and investments

- Competitive Landscape Assessment: Mergers & acquisitions, certifications, product launches in the global bioplastic market have been provided in this research report. In addition, the report also emphasizes the SWOT analysis of the leading players.

- Product Development & Innovation: The report provides intelligent insights on future technologies, R&D activities, and breakthrough product developments

- Pricing Analysis: Pricing analysis of various types and other components used in the manufacturing of bioplastics

- Manufacturing Cost Analysis: Cost-share of various bioplastic materials, cost analysis of bioplastic materials, Unit Cost Analysis of bioplastic materials

The global bioplastic market report answers questions such as:

- What is the market size and forecast of the global bioplastic market?

- What are the inhibiting factors and impact of COVID-19 on the global bioplastic market during the assessment period?

- Which are the products/segments/applications/areas to invest in over the assessment period in the global bioplastic market?

- What is the competitive strategic window for opportunities in the global bioplastic market?

- What are the technology trends and regulatory frameworks in the global bioplastic market?

- What is the market share of the leading players in the global bioplastic market?

- What modes and strategic moves are considered favorable for entering the global bioplastic market?

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- BASF SE

- Biome Technologies plc

- Braskem

- Corbion N.V.

- Danimer Scientific.

- E. I. du Pont de Nemours and Company

- Eastman Chemical Company

- Futerro SA

- Galactic

- M& G Chemicals

- Mitsubishi Chemical Holdings

- NatureWorks LLC

- Novamont S.p.A.

- Plantic

- PTT Global Chemical Public Company Ltd.

- Showa Denko K.K.

- Solvay SA

- Teijin Ltd.

- Toray Industries

- Toyota Tsusho

Table Information

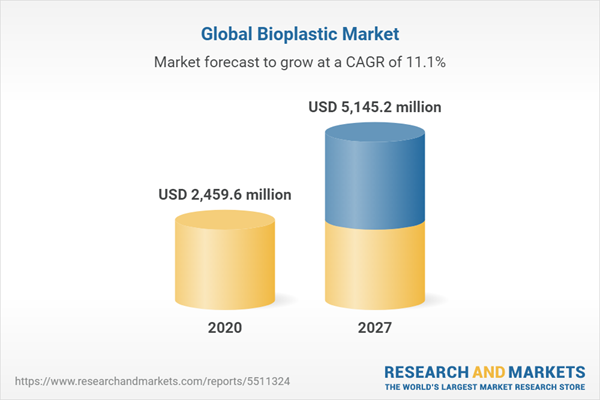

| Report Attribute | Details |

|---|---|

| No. of Pages | 238 |

| Published | October 2021 |

| Forecast Period | 2020 - 2027 |

| Estimated Market Value ( USD | $ 2459.6 million |

| Forecasted Market Value ( USD | $ 5145.2 million |

| Compound Annual Growth Rate | 11.1% |

| Regions Covered | Global |