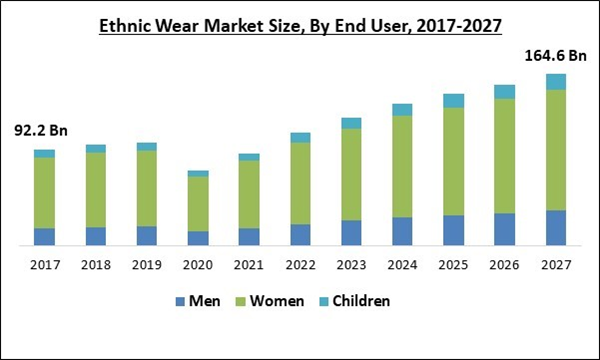

The Global Ethnic Wear Market size is expected to reach $164.67 billion by 2027, rising at a market growth of 10.82% CAGR during the forecast period.

Ethnic wear is a term used to define a type of clothing that belongs to a specific nation or group of people. This type of clothing showcases the tradition of a nation as well as the rich diversified sense of dressing of the people. One of the most popular ethnic wear across the globe is Indian ethnic wear, which is accompanied by Singapore, Australia, Cambodia, Indonesia, Thailand, Japan, and the Philippines.

Globalization has played a vital role in spreading a country’s culture and clothing to the world. It has created a huge demand for ethnic clothing of numerous nations around the world. Additionally, the movement of culture and tradition along with people visiting and staying in different nations is expected to augment the demand for ethnic wear in the world.

COVID-19 Impact Analysis

The outbreak of the COVID-19 pandemic has affected various verticals of the business world. It is due to the imposition of various regulatory norms like lockdowns, social distancing, and travel ban across borders. The disruption caused across various sales channels along with the significant changes in the customers’ preferences and habits has also affected the overall ethnic wear market.

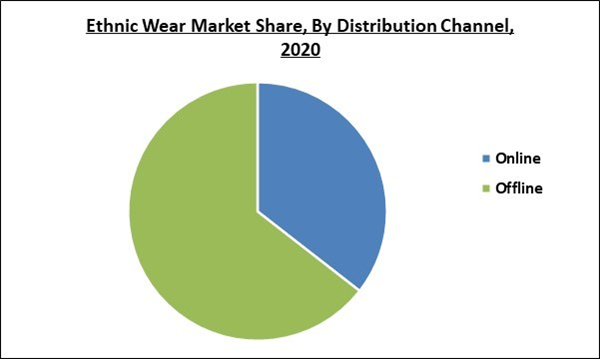

Owing to the unavailability of raw materials and the shutdown of manufacturing units to curb the spread of the virus, the demand for ethnic wear has declined drastically. The shifting preference of the customers towards online shopping platforms due to the pandemic is expected to support the demand and growth of the ethnic wear market in the upcoming years.

Market Growth Factors:

The increasing popularity of Indian ethnic wear across the globe

Indian ethnic wear is witnessing a huge demand from various parts of the world owing to the wide range of options available in Indian ethnic clothing. There are several fashion freak people from various countries who have begun wearing Indian ethnic wear, which is contributing to the increasing hype of wearing saree in parties and festivals across the world and thus, the demand and growth of the ethnic wear market is expected to witness a surge in the coming years.

The rapid pace of globalization

With the rapid pace of globalization, the penetration of different cultures and clothing has increased across various parts of the world, which is expected to create lucrative opportunities for many apparel companies to expand their business. The global fashion industry has contributed to the constantly changing fashion trends across the world, which is followed by numerous people in order to try out new fashion wear. The supportive government policies of the emerging nations to attract global companies to enter their regional market is expected to further create opportunities for the regional ethnic wear companies.

Marketing Restraining Factor:

Less acceptance of ethnic wear in the corporate world

There is less acceptance of ethnic wear in the corporate sector, which is expected to restrict the demand for ethnic wear in the world. Vibrant colors, heavy designs, and patterns are not allowed in the corporate sector as they are considered to be informal, which is expected to restrict people from adopting ethnic wear for their offices. In addition, the growing population of working women across the world is expected to further hinder the demand for ethnic wear among working women, which is anticipated to hamper the growth of the ethnic wear market over the forecast period.

End User Outlook

Based on End Users, the ethnic wear market is classified into men, women, and children. Men end-user segment procured a substantial revenue share in 2020 and is anticipated to witness a considerable growth rate during the forecast period. The rise in the number of aspiring fashion designers, the increasing popularity of fashion wear among millennials, and the advent of mass & digital marketing strategies by numerous fashion brands have significantly transformed the dynamics of the ethnic wear market for men across the world. Ethnic wear is one of the essential apparel in any person’s wardrobe during festivals and weddings.

Distribution Outlook

Based on Distribution Channel, the ethnic wear market is bifurcated into online and offline. The online store segment is anticipated to exhibit a prominent growth rate during the forecast period. The COVID-19 pandemic has motivated consumers to reconsider their life priorities, which is expected to lead to new values and spending norms.

Regional Outlook

Based on Regions, the market is segmented into North America, Europe, Asia Pacific, and Latin America, Middle East & Africa. In 2020, the Asia Pacific emerged as the leading region in the ethnic wear market with the highest revenue share and is estimated to witness a notable growth rate during the forecast period.

The market research report covers the analysis of key stake holders of the market. Key companies profiled in the report include Vedant Fashions Limited (Manyawar), Ochre and Black Private Limited (Global Desi), BIBA Apparels Private Limited, Elie Saab, Modanisa, Fabindia, and Shanghai Tang.

Recent Strategies Deployed in Ethnic Wear Market

Partnerships, Collaborations and Agreements:

- Nov-2021: Biba expanded its geographical footprint by opening new stores in Gurgaon and Bengaluru. These stores is expected to support the company's expansion plan in India.

- Aug-2021: Fabindia introduced FabNu, a new style womenwear line. Through the launch, the company aimed to serve young customers with a global perspective. This line includes four collections: Indie Dreams, Flashback, Conversation Starter, Folkadelic.

- Jul-2021: Biba entered into a partnership with Liva Fluid Fashion, Aditya Birla Group’s sustainable textile brand. Under this partnership, the companies aimed to launch a line of kurtas and sets made to be environment friendly and simple to wear.

- Feb-2021: Fabindia and Highdesign expanded their footprints in Chennai's commercial hub, via opening the first joint location store at Pondy Bazaar, T Nagar. The store is expected to offer a range of sarees, duppatas, and also western wear.

- Dec-2020: Elie Saab came into collaboration with Amazon’s Luxury Stores. The collaboration aimed to strengthen Elie Saab's presence in the U.S. market via a new widespread e-commerce presence and also reaching luxury shoppers' new generation.

- Sep-2020: Elie Saab released an exclusive haute couture collection. The collection is dedicated to Elie Saab's native city and entitled Beirut, The Sacred Source, as the couturier responds aesthetically to the new crisis in Lebanon.

- Oct-2019: Biba joined hands with Anju Modi, a fashion label. Under this collaboration, Biba launched an exquisite festive collection, which is a perfect combination of Anju Modi’s signature design sensibility and Biba’s ethnic brand lineage that is ideal for the festive season.

- Oct-2018: Global Desi introduced a line in festive wear. This line is developed to recall a classic image of the holiday season with a boho twist, the brand's signature.

- Aug-2017: Vedant Fashions took over Hyderabad-based rival Mebaz, ethnic fashion brand house. Through the acquisition, the company aimed to expand the Indian wedding and party wear clothing section and supply products for men, women, and kids.

- Jun-2017: Global Desi collaborated with AND, a clothing brand. Under this collaboration, the companies aimed to expand their geographical footprints by establishing a new store in Allahabad.

Scope of the Study

Market Segments Covered in the Report:

By End Users

- Men

- Women

- Children

By Distribution Channel

- Online

- Offline

By Geography

- North America

- US

- Canada

- Mexico

- Rest of North America

- Germany

- UK

- France

- Russia

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Singapore

- Australia

- Rest of Asia Pacific

- LAMEA

- Brazil

- Argentina

- UAE

- Saudi Arabia

- South Africa

- Nigeria

- Rest of LAMEA

Key Market Players

List of Companies Profiled in the Report:

- Vedant Fashions Limited (Manyawar)

- Ochre and Black Private Limited (Global Desi)

- BIBA Apparels Private Limited

- Elie Saab

- Modanisa

- Fabindia

- Shanghai Tang

Unique Offerings from the Publisher

- Exhaustive coverage

- The highest number of market tables and figures

- Subscription-based model available

- Guaranteed best price

- Assured post sales research support with 10% customization free

Table of Contents

Companies Mentioned

- Vedant Fashions Limited (Manyawar)

- Ochre and Black Private Limited (Global Desi)

- BIBA Apparels Private Limited

- Elie Saab

- Modanisa

- Fabindia

- Shanghai Tang