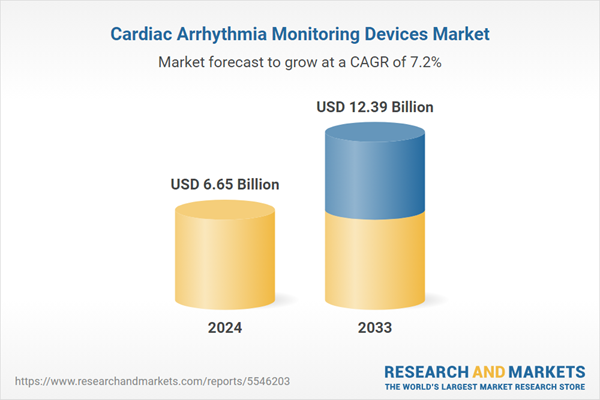

Cardiac Arrhythmia Monitoring Devices Market is expected to reach US$ 12.39 Billion in 2033 from US$ 6.65 Billion in 2024, with a CAGR of 7.16% from 2025 to 2033. Growing health consciousness, aging populations, the incidence of cardiovascular diseases, wearable monitors, and the need for remote patient monitoring solutions are some of the factors propelling the cardiac arrhythmia monitoring devices market.

Cardiac Arrhythmia Monitoring Devices Market Global Report by Type (ECG monitors, Implantable monitors, Holter monitors, Mobile cardiac telematory, Others), Application (Tachycardia, Atrial Tachycardia, Ventricular Tachycardia, Bradycardia, Premature Contraction), End User (Hospitals & Clinics, Diagnostic Centers, Others), Countries and Company Analysis 2025-2033.

Cardiac Arrhythmia Monitoring Devices Industry Overview

Medical equipment called cardiac arrhythmia monitoring devices is used to identify, monitor, and treat abnormal heartbeats. These gadgets include implantable loop recorders, smartwatches, and wearable ECG monitors. While implanted devices are utilized for long-term surveillance in patients with persistent arrhythmias, wearable devices provide continuous real-time monitoring of cardiac activity. Artificial intelligence and sophisticated algorithms improve the precision of anomaly detection, frequently allowing for early intervention. By enabling remote patient monitoring, these gadgets lower hospital visits and promote preventative treatment. All things considered, they are essential in helping patients with arrhythmias by facilitating prompt diagnosis and therapy.

A number of factors are driving the adoption of cardiac arrhythmia monitoring devices. The need for monitoring solutions is fueled by the rising prevalence of cardiovascular disorders, especially arrhythmias. More people need ongoing cardiac rhythm monitoring as the world's population ages. AI-driven algorithms, implantable loop recorders, and wearable ECG devices are examples of technological innovations that increase patient comfort and diagnostic precision. Better patient management and lower healthcare expenses are made possible by the growing popularity of telemedicine and remote patient monitoring. Further propelling market expansion are enhanced reimbursement policies and rising health consciousness.

Growth Drivers for the Cardiac Arrhythmia Monitoring Devices Market

Technological Advancements

Improvements in cardiac arrhythmia monitoring technology have greatly increased patient care and diagnostic precision. Continuous, real-time cardiac rhythm monitoring is made possible by wearable technology, such as smartwatches and ECG monitors. Even in the early phases, AI-driven systems improve arrhythmia diagnosis. Loop recorders and other implanted devices provide long-term monitoring with little disturbance to the patient. Furthermore, remote monitoring made possible by wireless and mobile health technologies lets patients take care of their diseases at home while real-time progress is tracked by medical professionals.

Morgan Stanley sponsored a USD 43 million fundraising round for Octagos Health, an AI-powered cardiac device monitoring business, in July 2024. It was anticipated that this investment will support their goal of using AI-powered improved patient monitoring to transform cardiac care.

Rising healthcare expenditure

One of the main factors driving the growth of cardiac arrhythmia monitoring devices is rising healthcare costs. More money is being spent on cutting-edge diagnostic equipment and technologies to enhance patient outcomes as healthcare budgets around the world rise. With this support, healthcare organizations can implement cutting-edge monitoring tools that provide real-time tracking and early arrhythmia diagnosis, like wearable ECG monitors, smartwatches, and implantable loop recorders. Furthermore, higher healthcare spending encourages the creation of more affordable solutions through research and development, which increases the accessibility of these devices, especially in areas where the need for cardiovascular care is expanding.

Rising prevalence of cardiovascular diseases

Heart arrhythmia monitoring technologies are seeing significant increase due to the increasing prevalence of cardiovascular diseases (CVDs). More than 130 million Americans are expected to suffer from CVDs by 2035, according to the American Heart Association. Due to their increased risk of arrhythmias, many of these individuals require ongoing monitoring in order to avoid consequences like heart failure or abrupt cardiac arrest. With more CVD cases, there is a greater need for sophisticated monitoring tools, like implanted devices and wearable ECG monitors, which allow for prompt identification and treatment, ultimately leading to better patient outcomes and quality of life.

Challenges in the Cardiac Arrhythmia Monitoring Devices Market

High cost of devices

One major obstacle is the high expense of cardiac arrhythmia monitoring equipment. The high upfront expenditures of advanced technology, notably implantable devices and sophisticated wearables, restrict access for both patients and healthcare providers, particularly in areas with low and middle incomes. The cost is further increased by continuing upkeep, replacements, and monitoring services. Even though these devices have the potential to improve patient outcomes and early detection in the management of cardiac arrhythmias, their exorbitant cost may discourage both individuals and healthcare systems from implementing them.

Limited reimbursement

Insufficient reimbursement poses a serious obstacle to the market for cardiac arrhythmia monitoring devices. For certain patients, modern monitoring technologies like implanted loop recorders or wearable ECG monitors are costly because many insurance policies do not cover their entire cost. Especially in areas with little healthcare resources, this lack of reimbursement lowers the adoption rate of these devices. As a result, patients could not have access to ongoing monitoring and prompt diagnosis, which could help those with arrhythmias and other heart disorders.

Cardiac Arrhythmia Monitoring Devices Market Overview by Regions

The market for cardiac arrhythmia monitoring devices is growing internationally, with North America dominating because of its sophisticated healthcare system and widespread use of wearable technology. Europe comes next, propelled by aging populations and growing healthcare consciousness. Due to expanding access to healthcare, a sizable patient base, and advancements in medical technology, the Asia Pacific region is expanding quickly. Due to budgetary limitations and a lack of healthcare resources, Latin America and the Middle East are expanding, albeit more slowly.

United States Cardiac Arrhythmia Monitoring Devices Market

The rising incidence of heart disorders, especially atrial fibrillation (AFib), is propelling the market for cardiac arrhythmia monitoring devices in the United States. By 2030, AFib is expected to be the most prevalent cardiac arrhythmia in the United States, affecting 12.1 million individuals, according to the Centers for Disease Control and Prevention (CDC). The market is expanding as a result of the increasing demand for continuous monitoring devices to measure cardiac rhythms brought on by this growing patient population.

Another trend that is gaining popularity is mobile cardiac outpatient telemetry (MCOT), which provides patients with ongoing, easy monitoring outside of the clinical setting. The FDA granted 510(k) clearance to Biotricity's Biotres Cardiac Monitoring Device in January 2022. With its continuous three-channel ECG recording, this wearable Holter patch device makes it possible to detect arrhythmias with greater accuracy. The clearance contributes to the innovation and expansion of the market by further broadening Biotricity's line of wireless cardiac monitoring devices in the United States. The U.S. market is expected to gain from improvements in device technology and an increased emphasis on early diagnosis and treatment of arrhythmias as demand for remote and continuous monitoring increases.

Germany Cardiac Arrhythmia Monitoring Devices Market

The market for cardiac arrhythmia monitoring devices in Germany is fueled by an aging population, a robust healthcare system, and growing heart health awareness. Because arrhythmias and cardiovascular illnesses are becoming more common, there is an increasing need for sophisticated monitoring options, such as implantable loop recorders and wearable ECG equipment. Germany's emphasis on healthcare reforms and medical innovation encourages market growth even more. The use of arrhythmia monitoring equipment is also being accelerated by government programs that support remote monitoring and early diagnosis.

India Cardiac Arrhythmia Monitoring Devices Market

The market for cardiac arrhythmia monitoring devices in India is expanding quickly as a result of the rising incidence of cardiovascular diseases (CVDs). According to August 2024 data from the Indian Institute of Public Health Gandhinagar (IIPHG), cardiovascular illnesses are a major health concern that lead to high disease burden and mortality. Heart attacks, strokes, diabetes, obesity, high blood pressure, and raised cholesterol are among the CVD risk factors that are on the rise in the nation. The need for cardiac arrhythmia monitoring technologies, such as implantable loop recorders and wearable ECG monitors, is being driven by the rise in CVDs.

The market is expected to continue rising as a result of increased access to healthcare services, technological developments, and greater health consciousness. The market is expanding as a result of remote monitoring and telemedicine solutions that make these devices more accessible, especially in underdeveloped and rural areas.

Saudi Arabia Cardiac Arrhythmia Monitoring Devices Market

Saudi Arabia's market for cardiac arrhythmia monitoring devices is growing as a result of an aging population, increased cardiovascular disease prevalence, and growing health consciousness. The need for continuous monitoring tools like implantable loop recorders and wearable ECG monitors is rising as heart disease rates rise, especially among the elderly. Access to cutting-edge medical technologies is also being improved via Saudi Arabia's healthcare modernization initiatives, which are a component of Vision 2030. By enabling patients to monitor arrhythmias outside of conventional clinical settings and enhancing overall healthcare efficiency, the increasing use of telemedicine and remote monitoring systems is also fueling market expansion.

Cardiac Arrhythmia Monitoring Devices Market Segments

Type

1. ECG monitors

2. Implantable monitors

3. Holter monitors

4. Mobile cardiac telematory

5. Others

Application

1. Atrial Fibrillation

2. Bradycardia

3. Tachycardia

4. Ventricular Fibrillation

5. Premature Contraction

6. Others

End User

1. Hospitals & Clinics

2. Diagnostic Centers

3. Others

Countries

North America

1. United States

2. Canada

Europe

1. France

2. Germany

3. Italy

4. Spain

5. United Kingdom

6. Belgium

7. Netherlands

8. Turkey

Asia Pacific

1. China

2. Japan

3. India

4. South Korea

5. Thailand

6. Malaysia

7. Indonesia

8. Australia

9. New Zealand

Latin America

1. Brazil

2. Mexico

3. Argentina

Middle East & Africa

1. Saudi Arabia

2. UAE

3. South Africa

Rest of the world

All the Key players have been covered from 5 Viewpoints:

1. Business overview

2. Key Players

3. Product Portfolio

4. Recent development & Strategies

5. Sales analysis

Key Players Analysis

1. Abott Laboratories

2. GE healthcare

3. Koninklijke Philips N.V.

4. Medtronic PLC

5. Asahi Kasei Corporation

6. Boston scientific corporation

7. iRhythm Technologies

8. Nihon kohden

Table of Contents

Companies Mentioned

- Abott Laboratories

- GE healthcare

- Koninklijke Philips N.V.

- Medtronic PLC

- Asahi Kasei Corporation

- Boston scientific corporation

- iRhythm Technologies

- Nihon kohden

Methodology

In this report, for analyzing the future trends for the studied market during the forecast period, the publisher has incorporated rigorous statistical and econometric methods, further scrutinized by secondary, primary sources and by in-house experts, supported through their extensive data intelligence repository. The market is studied holistically from both demand and supply-side perspectives. This is carried out to analyze both end-user and producer behavior patterns, in the review period, which affects price, demand and consumption trends. As the study demands to analyze the long-term nature of the market, the identification of factors influencing the market is based on the fundamentality of the study market.

Through secondary and primary researches, which largely include interviews with industry participants, reliable statistics, and regional intelligence, are identified and are transformed to quantitative data through data extraction, and further applied for inferential purposes. The publisher's in-house industry experts play an instrumental role in designing analytic tools and models, tailored to the requirements of a particular industry segment. These analytical tools and models sanitize the data & statistics and enhance the accuracy of their recommendations and advice.

Primary Research

The primary purpose of this phase is to extract qualitative information regarding the market from the key industry leaders. The primary research efforts include reaching out to participants through mail, tele-conversations, referrals, professional networks, and face-to-face interactions. The publisher also established professional corporate relations with various companies that allow us greater flexibility for reaching out to industry participants and commentators for interviews and discussions, fulfilling the following functions:

- Validates and improves the data quality and strengthens research proceeds

- Further develop the analyst team’s market understanding and expertise

- Supplies authentic information about market size, share, growth, and forecast

The researcher's primary research interview and discussion panels are typically composed of the most experienced industry members. These participants include, however, are not limited to:

- Chief executives and VPs of leading corporations specific to the industry

- Product and sales managers or country heads; channel partners and top level distributors; banking, investment, and valuation experts

- Key opinion leaders (KOLs)

Secondary Research

The publisher refers to a broad array of industry sources for their secondary research, which typically includes, however, is not limited to:

- Company SEC filings, annual reports, company websites, broker & financial reports, and investor presentations for competitive scenario and shape of the industry

- Patent and regulatory databases for understanding of technical & legal developments

- Scientific and technical writings for product information and related preemptions

- Regional government and statistical databases for macro analysis

- Authentic new articles, webcasts, and other related releases for market evaluation

- Internal and external proprietary databases, key market indicators, and relevant press releases for market estimates and forecasts

LOADING...

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 200 |

| Published | April 2025 |

| Forecast Period | 2024 - 2033 |

| Estimated Market Value ( USD | $ 6.65 Billion |

| Forecasted Market Value ( USD | $ 12.39 Billion |

| Compound Annual Growth Rate | 7.1% |

| Regions Covered | Global |

| No. of Companies Mentioned | 8 |