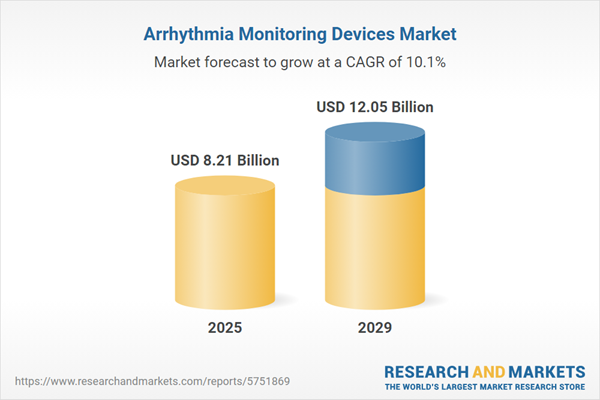

The arrhythmia monitoring devices market size has grown strongly in recent years. It will grow from $7.5 billion in 2024 to $8.21 billion in 2025 at a compound annual growth rate (CAGR) of 9.5%. The growth in the historic period can be attributed to aging population, healthcare infrastructure growth, rise in personalized medicine, rise in home healthcare, increased funding.

The arrhythmia monitoring devices market size is expected to see rapid growth in the next few years. It will grow to $12.05 billion in 2029 at a compound annual growth rate (CAGR) of 10.1%. The growth in the forecast period can be attributed to rising cardiovascular diseases, telemedicine growth, regulatory approvals, rise in remote patient monitoring, economic growth. Major trends in the forecast period include wearable technology advancements, use of artificial intelligence and machine learning, patient-centric solutions, iot integration, preventive healthcare and health tracking.

The growth of the arrhythmia monitoring devices market is being fueled by the increasing incidence of cardiovascular diseases. These diseases, which affect the heart and blood vessels, require monitoring devices to detect irregular heart rates, a primary symptom in most cases. In August 2022, the American College of Cardiology forecasted a significant increase in cardiovascular risk factors and disease rates in the United States by 2060, with heart failure anticipated to rise by 33.4% and ischemic heart disease by 30.7%. This uptrend in cardiovascular diseases is expected to drive the demand for arrhythmia monitoring devices.

The market is set to be influenced by the aging population, leading to increased demand for arrhythmia monitoring devices. The elderly often face irregular heart rhythms such as atrial fibrillation, making monitoring devices crucial for early detection and management. Reports by the World Health Organization in October 2022 projected that by 2030, 1 in 6 people worldwide will be aged 60 years or over. The global population of people aged 60 years and older is predicted to double by 2050 to reach 2.1 billion, and individuals aged 80 years or older will triple to 426 million by 2050. This demographic shift will significantly boost the need for arrhythmia monitoring devices.

Technological advancements represent a significant trend in the arrhythmia monitoring devices market. Leading companies in this sector are incorporating innovative technologies such as AI and detection systems to enhance accuracy and efficiently manage data. For example, in September 2024, iRhythm Technologies, a US-based digital healthcare company, announced that the Zio ECG Monitoring System received Japanese Regulatory Approval. The Zio system signifies a substantial improvement in cardiac arrhythmia diagnostics compared to traditional Holter monitoring, providing greater clinical accuracy to aid physicians in making precise diagnoses from the outset. iRhythm's deep learning technology can accurately classify a broad spectrum of distinct arrhythmias, achieving diagnostic performance comparable to that of cardiologists. In clinical settings, this service has the potential to decrease the occurrence of misdiagnosed computerized ECG interpretations and improve overall clinical efficiency.

The arrhythmia monitoring devices market is witnessing innovation from major companies, introducing wearable and mobile products like medical-grade smartwatches to enhance their market position. A notable example is the medical-grade smartwatch - a continuous monitoring device in the form of a watch, launched through a collaboration between Xplore Lifestyle Solutions Pvt. Ltd., an India-based wellness solutions company, and Cardiac Sense, an Israel-based wearable technology provider. This groundbreaking smartwatch is the world’s first continuous monitoring device capable of distinguishing between normal and abnormal/irregular heart rhythms. Its objective is to increase awareness among individuals regarding silent and life-threatening arrhythmias, such as Atrial Fibrillation and other chronic illnesses.

In May 2024, WearLinq, a US-based digital healthcare solutions provider, acquired AMI Cardiac Monitoring for an undisclosed sum. This acquisition enables the company to offer comprehensive clinical services across the nation, thereby increasing access to its eWave six-lead wearable ECG monitor, which has recently obtained 510(k) clearance from the U.S. Food and Drug Administration (FDA). AMI Cardiac Monitoring is a US-based manufacturer of ECG devices.

Major companies operating in the arrhythmia monitoring devices market include Abbott Laboratories, Medtronic plc, Biotronik Inc., Hill-Rom Services Inc., iRhythm Technologies Inc., GE HealthCare Technologies Inc., Koninklijke Philips NV, ACS Diagnostics Inc., AliveCor Inc., Medi-Lynx Cardiac Monitoring LLC, Welch Allyn Inc., Spacelabs Healthcare Inc., Fukuda Denshi Co. Ltd., Applied Cardiac Systems Inc., BIOTRONIK SE & Co. KG, Hill-Rom Holdings Inc., Nihon Kohden Corporation, CardioNet LLC, Bardy Diagnostics Inc., BioTelemetry Inc., Boston Scientific Corporation, CardioComm Solutions Inc., Cardiac Insight Inc., Cardiac Science Corporation, Johnson & Johnson, Preventice Solutions Inc., Qardio Inc., ZOLL Medical Corporation, Stryker Corporation, Drägerwerk AG & Co. KGaA, Mindray Medical International Limited, Cardinal Health Inc., Physio-Control Corporation.

Arrhythmia monitoring devices play a crucial role in identifying and determining the type and cause of abnormal heart rhythms. These devices are utilized for tracking and monitoring irregular heart rhythms associated with arrhythmia, a heart condition that disrupts the pace or rhythm of the heartbeat.

The primary types of arrhythmia monitoring devices include ECG (Electrocardiogram), implantable monitors, holter monitors, and mobile cardiac telemetry. ECG is particularly effective in detecting electrical impulses generated by the heart, providing valuable insights for diagnosing various cardiac issues. Arrhythmia monitoring devices find applications in diverse cardiac conditions, including bradycardia, tachycardia, atrial fibrillation, ventricular fibrillation, premature contraction, and other related applications. These devices cater to various end-users, including hospitals and diagnostic centers, ambulatory centers, and other healthcare facilities, playing a crucial role in monitoring and managing heart-related conditions.

The arrhythmia monitoring devices market research report is one of a series of new reports that provides arrhythmia monitoring devices market statistics, including arrhythmia monitoring devices industry global market size, regional shares, competitors with an arrhythmia monitoring devices market share, detailed arrhythmia monitoring devices market segments, market trends and opportunities, and any further data you may need to thrive in the arrhythmia monitoring devices industry. This arrhythmia monitoring devices market research report delivers a complete perspective of everything you need, with an in-depth analysis of the current and future scenarios of the industry.

North America was the largest region in the arrhythmia monitoring devices market in 2024. Asia-Pacific is expected to be the fastest-growing region in the forecast period. The regions covered in the arrhythmia monitoring devices market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East and Africa.

The countries covered in the arrhythmia monitoring devices market report are Australia, Brazil, China, France, Germany, India, Indonesia, Japan, Russia, South Korea, UK and USA.

The arrhythmia monitoring devices market consists of sales of cardiac event monitors, loop memory monitor, patch recorder, and symptom event monitor. Values in this market are ‘factory gate’ values, that is the value of goods sold by the manufacturers or creators of the goods, whether to other entities (including downstream manufacturers, wholesalers, distributors and retailers) or directly to end customers. The value of goods in this market includes related services sold by the creators of the goods.

The market value is defined as the revenues that enterprises gain from the sale of goods and/or services within the specified market and geography through sales, grants, or donations in terms of the currency (in USD unless otherwise specified).

The revenues for a specified geography are consumption values that are revenues generated by organizations in the specified geography within the market, irrespective of where they are produced. It does not include revenues from resales along the supply chain, either further along the supply chain or as part of other products.

This product will be delivered within 3-5 business days.

Table of Contents

Executive Summary

Arrhythmia Monitoring Devices Global Market Report 2025 provides strategists, marketers and senior management with the critical information they need to assess the market.This report focuses on arrhythmia monitoring devices market which is experiencing strong growth. The report gives a guide to the trends which will be shaping the market over the next ten years and beyond.

Reasons to Purchase:

- Gain a truly global perspective with the most comprehensive report available on this market covering 15 geographies.

- Assess the impact of key macro factors such as conflict, pandemic and recovery, inflation and interest rate environment and the 2nd Trump presidency.

- Create regional and country strategies on the basis of local data and analysis.

- Identify growth segments for investment.

- Outperform competitors using forecast data and the drivers and trends shaping the market.

- Understand customers based on the latest market shares.

- Benchmark performance against key competitors.

- Suitable for supporting your internal and external presentations with reliable high quality data and analysis

- Report will be updated with the latest data and delivered to you along with an Excel data sheet for easy data extraction and analysis.

- All data from the report will also be delivered in an excel dashboard format.

Description

Where is the largest and fastest growing market for arrhythmia monitoring devices? How does the market relate to the overall economy, demography and other similar markets? What forces will shape the market going forward? The arrhythmia monitoring devices market global report answers all these questions and many more.The report covers market characteristics, size and growth, segmentation, regional and country breakdowns, competitive landscape, market shares, trends and strategies for this market. It traces the market’s historic and forecast market growth by geography.

- The market characteristics section of the report defines and explains the market.

- The market size section gives the market size ($b) covering both the historic growth of the market, and forecasting its development.

- The forecasts are made after considering the major factors currently impacting the market. These include:

- The forecasts are made after considering the major factors currently impacting the market. These include the Russia-Ukraine war, rising inflation, higher interest rates, and the legacy of the COVID-19 pandemic.

- Market segmentations break down the market into sub markets.

- The regional and country breakdowns section gives an analysis of the market in each geography and the size of the market by geography and compares their historic and forecast growth. It covers the growth trajectory of COVID-19 for all regions, key developed countries and major emerging markets.

- The competitive landscape chapter gives a description of the competitive nature of the market, market shares, and a description of the leading companies. Key financial deals which have shaped the market in recent years are identified.

- The trends and strategies section analyses the shape of the market as it emerges from the crisis and suggests how companies can grow as the market recovers.

Scope

Markets Covered:

1) By Type: ECG; Implantable Monitors; Holter Monitors; Mobile Cardiac Telemetry2) By Application: Bradycardia; Tachycardia; Atrial Fibrillation; Ventricular Fibrillation; Premature Contraction; Other Applications

3) By End-User: Hospitals And Diagnostic Centers; Ambulatory Centers; Other End Users

Subsegments:

1) By ECG (Electrocardiogram): Resting ECG Machines; Stress ECG Machines; 12-Lead ECG Systems2) By Implantable Monitors: Implantable Loop Recorders (ILRs); Subcutaneous Implantable Cardioverter Defibrillators (S-ICDs)

3) By Holter Monitors: 24-Hour Holter Monitors; 48-Hour Holter Monitors; 7-Day Holter Monitors

4) By Mobile Cardiac Telemetry: Wireless Telemetry Devices; Smartphone-Integrated Telemetry Systems

Key Companies Mentioned: Abbott Laboratories; Medtronic plc; Biotronik Inc.; Hill-Rom Services Inc.; iRhythm Technologies Inc.

Countries: Australia; Brazil; China; France; Germany; India; Indonesia; Japan; Russia; South Korea; UK; USA; Canada; Italy; Spain

Regions: Asia-Pacific; Western Europe; Eastern Europe; North America; South America; Middle East; Africa

Time Series: Five years historic and ten years forecast.

Data: Ratios of market size and growth to related markets, GDP proportions, expenditure per capita.

Data Segmentation: Country and regional historic and forecast data, market share of competitors, market segments.

Sourcing and Referencing: Data and analysis throughout the report is sourced using end notes.

Delivery Format: PDF, Word and Excel Data Dashboard.

Companies Mentioned

The major companies featured in this Arrhythmia Monitoring Devices market report include:- Abbott Laboratories

- Medtronic plc

- Biotronik Inc.

- Hill-Rom Services Inc.

- iRhythm Technologies Inc.

- GE HealthCare Technologies Inc.

- Koninklijke Philips NV

- ACS Diagnostics Inc.

- AliveCor Inc.

- Medi-Lynx Cardiac Monitoring LLC

- Welch Allyn Inc.

- Spacelabs Healthcare Inc.

- Fukuda Denshi Co. Ltd.

- Applied Cardiac Systems Inc.

- BIOTRONIK SE & Co. KG

- Hill-Rom Holdings Inc.

- Nihon Kohden Corporation

- CardioNet LLC

- Bardy Diagnostics Inc.

- BioTelemetry Inc.

- Boston Scientific Corporation

- CardioComm Solutions Inc.

- Cardiac Insight Inc.

- Cardiac Science Corporation

- Johnson & Johnson

- Preventice Solutions Inc.

- Qardio Inc.

- ZOLL Medical Corporation

- Stryker Corporation

- Drägerwerk AG & Co. KGaA

- Mindray Medical International Limited

- Cardinal Health Inc.

- Physio-Control Corporation

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 200 |

| Published | January 2025 |

| Forecast Period | 2025 - 2029 |

| Estimated Market Value ( USD | $ 8.21 Billion |

| Forecasted Market Value ( USD | $ 12.05 Billion |

| Compound Annual Growth Rate | 10.1% |

| Regions Covered | Global |

| No. of Companies Mentioned | 34 |