Packaging robots are automated machines currently revolutionizing the supply chain and manufacturing industries. They are specialized in handling a wide range of tasks such as sorting, filling, sealing, and labeling products in a highly efficient manner. Leveraging advanced technologies like artificial intelligence (AI), machine learning (ML), and computer vision, these robots adapt to varying product dimensions and packaging materials with ease. They help reduce the time, labor, and error rate associated with traditional human-led packaging processes. Companies are increasingly integrating packaging robots into their operations to benefit from their high-speed precision, lower overhead costs, and enhanced scalability. These systems operate in a controlled environment, adhering to strict quality and safety standards, thereby ensuring product integrity throughout the packaging lifecycle. As a result, packaging robots find extensive applications in modern production lines, offering businesses a competitive edge through streamlined operations and cost-effectiveness.

The rising consumer preferences for sustainable and well-packaged products are prompting companies to invest in advanced, eco-friendly packaging solutions. This, coupled with the heightened emphasis on operational efficiency and cost savings, will stimulate market growth during the forecast period. Packaging robots are highly precise, meaning they utilize materials efficiently, thus contributing to waste reduction and sustainability goals. Moreover, stringent regulatory standards and guidelines regarding hygiene, quality control, and safety in packaging has accelerated the adoption of these robots for compliance. Additionally, the escalating demand for customized packaging solutions, especially in sectors like e-commerce and pharmaceuticals, is positively influencing the market growth. Robots, armed with software that allows easy reprogramming, can adapt to these custom requirements faster than traditional machinery. Furthermore, the advent of IoT-enabled packaging robots that offer enhanced monitoring and data collection capabilities, allowing businesses to make informed decisions and optimize workflows, is propelling the market growth. Other factors, including the expanding manufacturing sectors, rapid economic growth in emerging countries, and the rising need for automation due to the increasingly global nature of supply chains, are also anticipated to catalyze the market growth.

Packaging Robots Market Trends/Drivers:

Increase in Operational Efficiency and Cost Reduction

The incessant drive for higher operational efficiency is a major force propelling the packaging robots market. Companies are continually seeking ways to optimize production lines, reduce overhead costs, and streamline operations. Packaging robots, known for their speed, accuracy, and consistency, offer an effective solution to these challenges. They can operate around the clock without fatigue, significantly boosting productivity. Additionally, their precision in tasks like sorting, filling, and sealing minimizes waste and rework, further cutting down costs. As businesses operate in increasingly competitive environments, the ability to produce more with fewer resources has become imperative. This focus on efficiency and cost-effectiveness is making the adoption of packaging robots an increasingly attractive option for companies worldwide.Rise in Labor Shortages and Labor Costs

Labor shortages, especially in developed countries, are a pressing concern for many industries. In addition to this, rising labor costs are making human-led operations increasingly expensive. Packaging robots offer a viable solution to both issues. They can efficiently perform repetitive and time-consuming tasks, thus freeing human workers to focus on more complex and value-added activities. As labor-related challenges continue to escalate worldwide, the emerging role of packaging robots as a strategic asset for maintaining productivity and controlling costs across a wide range of sectors is becoming more prominent, providing a positive thrust to the market growth.Continuous Technological Advancements by Key Players

Technological progress in robotics, particularly the integration of artificial intelligence (AI) and machine learning (ML), is another crucial factor fueling the expansion of the packaging robots market. These technologies enable robots to perform complex tasks, adapt to new situations, and even learn from experience, thus expanding their applicability. For instance, AI-powered computer vision allows robots to recognize and sort items based on size, shape, and color, making them suitable for a wider array of packaging tasks. This adaptability and versatility, made possible through technological advancements, are encouraging more industries to integrate packaging robots into their operations, thereby augmenting market growth.Packaging Robots Industry Segmentation:

This report provides an analysis of the key trends in each segment of the global packaging robots market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on gripper type, application, and end user.Breakup by Gripper Type:

- Clamp

- Claw

- Vacuum

- Others

Clamp grippers are predominantly used for handling rigid objects with defined shapes, such as boxes, cartons, and plastic containers. These grippers are highly reliable and can manage heavy payloads. Industries like food and beverages, pharmaceuticals, and consumer goods often prefer clamp grippers due to their ability to securely hold objects without causing damage, thereby ensuring the integrity of packaged products.

Claw grippers, also known as finger grippers, are versatile and capable of handling a variety of object shapes and sizes. They are particularly useful in industries requiring delicate handling, such as electronics or cosmetics. The multi-fingered design of claw grippers allows for more nuanced control over the items being packaged, making them ideal for tasks requiring greater precision.

Vacuum grippers are widely used for handling objects with flat surfaces or those that require gentle handling, such as glass panels, papers, and plastic films. They rely on suction to hold items and are highly preferred in industries, including automotive, electronics, and food packaging. These grippers are especially useful for high-speed applications and for handling fragile or sensitive items, as they reduce the chance of damaging the product during the packaging process.

Breakup by Application:

- Picking and Placing

- Packing

- Tray Packing

- Case Packing

- Filling

- Others

- Palletizing

- Case Palletizing

- Bag Palletizing

- De-Palletizing

Picking and placing holds the largest share in the market

A detailed breakup and analysis of the market based on the application has also been provided in the report. This includes picking and placing, packing (tray packing, case packing, filling, and others), and palletizing (case palletizing, bag palletizing, and de-palletizing). According to the report, picking and placing accounted for the largest market share.Picking and placing tasks are fundamental to any packaging operation, encompassing activities such as sorting items from conveyor belts and placing them into containers, boxes, or onto other conveyors. Since these tasks are repetitive, time-sensitive, and labor-intensive, packaging robots excel at performing them more efficiently and accurately than human workers.

The integration of advanced technologies like machine vision and artificial intelligence has further improved the effectiveness of robots in these applications, facilitating real-time adjustments and highly accurate operations. Such advancements make robots ideal for environments where speed, consistency, and high throughput are critical, such as in the food and beverage, pharmaceutical, and e-commerce industries. Additionally, automated picking and placing reduces the chances of manual errors and contamination, which is particularly important in sectors where stringent quality control and hygiene standards are in place. Owing to these factors, companies view investment in robots for picking and placing tasks as a strategic avenue to achieve operational excellence, thereby fueling the segment growth.

Breakup by End User:

- Food and Beverage

- Pharmaceutical

- Consumer Products

- Logistics

- Others

In the food and beverages sector, packaging robots are crucial for performing tasks like sorting, filling, and sealing perishable items at high speeds. They meet stringent hygiene and safety regulations, ensuring that the packaged products comply with strict quality standards. The need for rapid, yet accurate, packaging to preserve the shelf life of food products makes robots highly preferred in this industry.

In pharmaceuticals, precision and compliance with regulatory standards are paramount. Packaging robots handle tasks ranging from filling vials and blister packs to labeling and capping with extreme accuracy. Their ability to maintain a sterile environment and adhere to Good Manufacturing Practices (GMP) makes them invaluable for pharmaceutical packaging.

Consumer products, such as cosmetics, cleaning supplies, and personal care items, often require intricate and customized packaging. Robots in this industry are adept at handling different packaging formats and materials, thus meeting the diverse needs of consumers. Their flexibility and speed contribute to higher throughput, meeting the large-scale production demands common in this industry.

In the logistics segment, packaging robots are primarily employed for picking and placing items and for sorting and labeling. The exponential growth in online shopping has heightened the need for fast, efficient, and error-free packaging solutions. Robots help enhance the speed of operations while reducing the error rate, making them essential for handling the high volumes of products being shipped daily.

Breakup by Region:

- North America

- United States

- Canada

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

Asia-Pacific exhibits a clear dominance in the market

The market research report has also provided a comprehensive analysis of all the major regional markets, which include North America (the United States and Canada); Asia-Pacific (China, Japan, India, South Korea, Australia, Indonesia, and others); Europe (Germany, France, the United Kingdom, Italy, Spain, Russia, and others); Latin America (Brazil, Mexico, and others); and the Middle East and Africa. According to the report, Asia-Pacific accounted for the largest market share.Asia-Pacific held the biggest share in the market since the region is witnessing rapid industrialization in countries, such as China, India, and Japan, where manufacturing sectors are expanding at an exponential rate. This industrial growth creates a heightened demand for efficient, automated packaging solutions. Another major contributing aspect is the availability of skilled labor in automation technologies within the region. Countries like Japan are pioneers in robotics and automation, producing the machinery as well as the technical expertise required to integrate and maintain these systems.

Additionally, the Asia Pacific region boasts the presence of some of the world's busiest ports and logistics hubs, necessitating high-speed and high-volume packaging solutions to manage the massive inflow and outflow of goods. Packaging robots fulfill this need by optimizing the supply chain and reducing bottlenecks, thus making operations more efficient. Labor cost advantages also come into play. Although Asia has been known for its relatively low labor costs, increasing wage rates and labor shortages are pushing companies to seek automated solutions, and packaging robots offer an effective alternative.

Moreover, governments in the region are increasingly supportive of automation and Industry 4.0 initiatives, providing subsidies and favorable policies for companies adopting automated technologies, which in turn solidifies the position of Asia-Pacific as the leading regional market for packaging robots.

Competitive Landscape:

The market is experiencing steady growth as numerous key players are engaging in a variety of strategic activities to maintain and grow their market share. They are heavily investing in research and development (R&D) to innovate and improve robot capabilities, often incorporating advanced technologies such as artificial intelligence and machine learning to enhance precision and adaptability. Mergers and acquisitions are also common, as these industry leaders aim to diversify their product portfolios and extend their global reach. Partnerships with end-user industries are being formed to better understand client needs and tailor solutions accordingly. Furthermore, these players are increasingly focusing on sustainability, developing energy-efficient models that appeal to environmentally conscious customers. Through these multifaceted approaches, key players are solidifying their competitive edge and driving the industry forward.The market research report has provided a comprehensive analysis of the competitive landscape in the market. Detailed profiles of all major companies have also been provided. Some of the key players in the market include:

- ABB Ltd.

- Fanuc Corporation

- FIPA GmbH

- KRONES AG

- KUKA AG

- MIP Robotics

- Mitsubishi Electric Corporation

- ProMach Inc.

- Remtec Automation LLC

- Schneider Electric SE

- Syntegon Holding GmbH

- Yaskawa America Inc. (Yaskawa Electric Corporation)

Key Questions Answered in This Report

1. How big is the packaging robots market?2. What is the future outlook of the packaging robots market?

3. What are the key factors driving the packaging robots market?

4. Which region accounts for the largest packaging robots market share?

5. Which are the leading companies in the global packaging robots market?

Table of Contents

Companies Mentioned

- ABB Ltd.

- Fanuc Corporation

- FIPA GmbH

- KRONES AG

- KUKA AG

- MIP Robotics

- Mitsubishi Electric Corporation

- ProMach Inc.

- Remtec Automation LLC

- Schneider Electric SE

- Syntegon Holding GmbH

- Yaskawa America Inc. (Yaskawa Electric Corporation)

Table Information

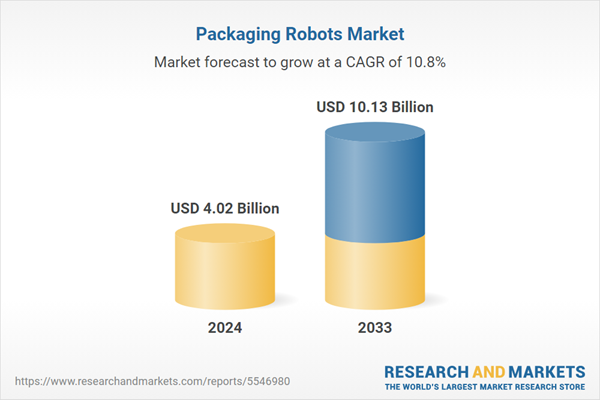

| Report Attribute | Details |

|---|---|

| No. of Pages | 140 |

| Published | May 2025 |

| Forecast Period | 2024 - 2033 |

| Estimated Market Value ( USD | $ 4.02 Billion |

| Forecasted Market Value ( USD | $ 10.13 Billion |

| Compound Annual Growth Rate | 10.8% |

| Regions Covered | Global |

| No. of Companies Mentioned | 12 |