Internet Advertising are set of tools for delivery of promotional messages to people worldwide, using the internet as a global marketing platform. The market is majorly driven by the rising expenditure on internet advertisement, proliferation of social media, and extensive adoption of smart phone. The Japanese advertisement market is the third largest advertisement market in the world, following United States and China. While traditionally television was the leading medium which overtook by online advertising for the first time in the year 2019 and is continuing the trend of leading the Japanese advertisement market.

However, rise in adoption of ad-blockers are expected to negatively impact the market growth. Moreover, stringent government regulations are also likely to act as a restraining factor to the market growth.

Growth Influencers:

Rising expenditure on internet advertisement

In Japan, the expenditure on internet advertisement is rising, which is driving the market growth. The country is one of the most developed advertising markets across the globe. According to SB Telecom Europe Ltd, in 2020, the total media ad spending was around USD 42.67 billion, which is the 3rd largest, after the U.S. and China. One of the factors leading to growing expenditure on internet advertisement, is increasing adoption of smartphones. Hence, the rising expenditure on internet advertisement is boosting the market growth.

Segments Overview:

The Japan Internet Advertising market is segmented into Platform, Advertising Model, Ad Format, Ad Type, Ad Format-Enterprise Size, Ad Type-Enterprise Size, Enterprise Size, and Industry Vertical.

By Platform

- Mobile

- Desktop and Laptop

The mobile segment is expected to witness the highest growth rate of around 25.8% owing to the rising adoption of smartphones. According to NewZoo, in 2020, the number of smartphone users in Japan were 83.03 million, i.e. 65.9% of smartphone penetration. The desktop and laptop segment held a market opportunity of around USD 35.6 billion from 2021 to 2027. According to Bigbeat Inc., as of 2020, more than 50% of the total revenue of digital advertising in Japan was generated through desktop.

By Advertising Model

- CPM (cost per mile/cost per thousand)

- Performance

- Hybrid

The performance advertising model segment is anticipated to account for the fastest growth rate of around 25.7% over the projected period owing to its increasing adoption as compared to the other advertising models.

By Ad Format

- Search

- Banner

- Video

- Others (Classifieds, Lead Generation, Audio)

The video segment is expected to witness the highest CAGR of about 26.6% from 2022 to 2027 owing to the growing initiatives by market players to launch innovative video platforms. The search segment is estimated to hold a market opportunity of USD 34.41 billion during 2021 to 2027.

By Ad Type

- Display Advertising

- Mobile Advertising

- Search Engine Advertising

- Social Media Advertising

- Hybrid

- Others

The mobile advertising segment is estimated to grow at the fastest CAGR of 27% during the projected period owing to the rising use of smartphones. The search engine advertising segment is expected to generate a revenue of around USD 10 billion by 2022, owing to the growth in the number of consumers who shop and search for products online.

By Ad Format, By Enterprise Size

- Small Enterprise - Ad Format

- Search

- Banner

- Video

- Others (Classifieds, Lead Generation, Audio)

- Medium Enterprise - Ad Format

- Search

- Banner

- Video

- Others (Classifieds, Lead Generation, Audio)

- Large Enterprise - Ad Format

- Search

- Banner

- Video

- Others (Classifieds, Lead Generation, Audio)

The medium enterprise - ad format segment is expected to generate a total revenue of USD 9.16 billion in 2021 owing to the increasing adoption of Google Advertising and Facebook by medium enterprises. Within the small enterprise - ad format segment, the search segment is expected to account for the highest market share of over 40% by 2027. Within the large enterprises - ad format segment, the video segment is anticipated to witness the fastest growth rate of about 22.18% over the projected period.

By Ad Type, By Enterprise Size

- Small Enterprise - Ad Type

- Display Advertising

- Mobile Advertising

- Search Engine Advertising

- Social Media Advertising

- Hybrid

- Others

- Medium Enterprise - Ad Type

- Display Advertising

- Mobile Advertising

- Search Engine Advertising

- Social Media Advertising

- Hybrid

- Others

- Large Enterprise - Ad Type

- Display Advertising

- Mobile Advertising

- Search Engine Advertising

- Social Media Advertising

- Hybrid

- Others

The large enterprise - ad type segment is estimated to witness double digit growth in all its sub segments owing to the rising demand for internet advertising in large enterprises as well. The small enterprise - ad type segment is estimated to hold an opportunity of more than USD 9 billion during 2021 to 2027. This is owing to the high adoption of internet-based services by small enterprises. Within the medium enterprise - ad type segment, the search engine advertising segment is estimated to cross the mark of USD 5 billion by 2024, owing to the emergence of many e-commerce sites.

By Enterprise Size

- Large Enterprises

- Small Enterprises

- Medium Sized Enterprises

The medium sized enterprises segment is estimated to witness the highest growth rate of about 31.2% over the projected period owing to the rising number of medium sized enterprises in Japan. The large enterprises segment is expected to surpass a market value of USD 25 billion by 2024 owing to the rising expenditure on internet-based advertising by large enterprises.

By Industry Vertical

- Automotive

- Healthcare

- Media & Entertainment

- BFSI

- Education

- Retail & Consumer Goods

- Transport & Tourism

- IT & Telecom

- Others

The retail & consumer goods segment is expected to account for the largest market share of more than 30% in 2021 owing to the presence of a large number of companies in this segment and high requirement of advertising to create a competitive edge over other players. The automotive segment is estimated to hold a market opportunity of USD 3.7 billion owing to the rising demand for internet advertising in the automotive industries owing to the emergence of innovative players in the industry.

Competitive Landscape

Key players operating in the Japan Internet Advertising market include Dentsu Group, Hakuhodo, CyberAgent, Asatsu-DK, D.A. Consortium Holdings, Adobe Systems Inc., Alibaba Group Holdings Limited, Amazon Web Services, Inc., Baidu, Inc., Facebook, Inc., Google LLC, Hulu LLC, International Business Machines Corporation, Microsoft Corporation, Twitter Inc., Verizon Communication Inc., and Other Prominent Players.

The cumulative market share of the five major players is more than 85%. These key players are involved in collaborations, new product launches, and mergers & acquisitions to strengthen their market presence. For instance, in November 2021, CyberAgent Inc. established CyberAgent Dx, Inc., a planning and development subsidiary for facilitating the corporate digital transformation and increase the profitability.

The Japan Internet Advertising market report provides insights on the below pointers:

- Market Penetration: Provides comprehensive information on the market offered by the prominent players

- Market Development: The report offers detailed information about lucrative emerging markets and analyzes penetration across mature segments of the markets

- Market Diversification: Provides in-depth information about untapped geographies, recent developments, and investments

- Competitive Landscape Assessment: Mergers & acquisitions, certifications, product launches in the Japan Internet Advertising market have been provided in this research report. In addition, the report also emphasizes the SWOT analysis of the leading players.

- Product Development & Innovation: The report provides intelligent insights on future technologies, R&D activities, and breakthrough product developments

The Japan Internet Advertising market report answers questions such as:

- What is the market size and forecast of the Japan Internet Advertising Market?

- What are the inhibiting factors and impact of COVID-19 on the Japan Internet Advertising Market during the assessment period?

- Which are the products/segments/applications/areas to invest in over the assessment period in the Japan Internet Advertising Market?

- What is the competitive strategic window for opportunities in the Japan Internet Advertising Market?

- What are the technology trends and regulatory frameworks in the Japan Internet Advertising Market?

- What is the market share of the leading players in the Japan Internet Advertising Market?

- What modes and strategic moves are considered favorable for entering the Japan Internet Advertising Market?

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Google LLC

- Baidu, Inc.

- Amazon.com, Inc.

- Facebook, Inc.

- Microsoft Corporation

- Twitter Inc.

Table Information

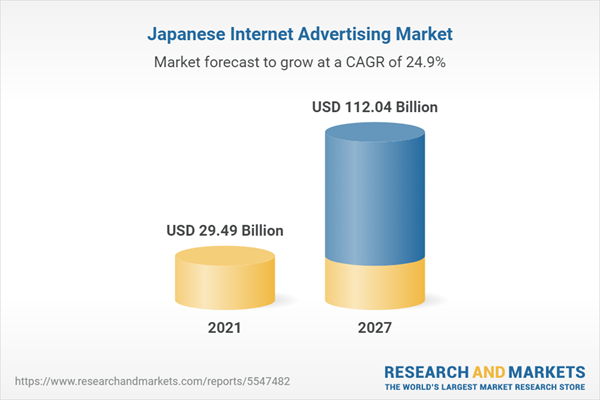

| Report Attribute | Details |

|---|---|

| No. of Pages | 45 |

| Published | January 2022 |

| Forecast Period | 2021 - 2027 |

| Estimated Market Value ( USD | $ 29.49 Billion |

| Forecasted Market Value ( USD | $ 112.04 Billion |

| Compound Annual Growth Rate | 24.9% |

| Regions Covered | Japan |